Revolut’s Family Strategy: Building Loyalty Across Generations

Anchoring financial habits early to drive engagement and brand stickiness

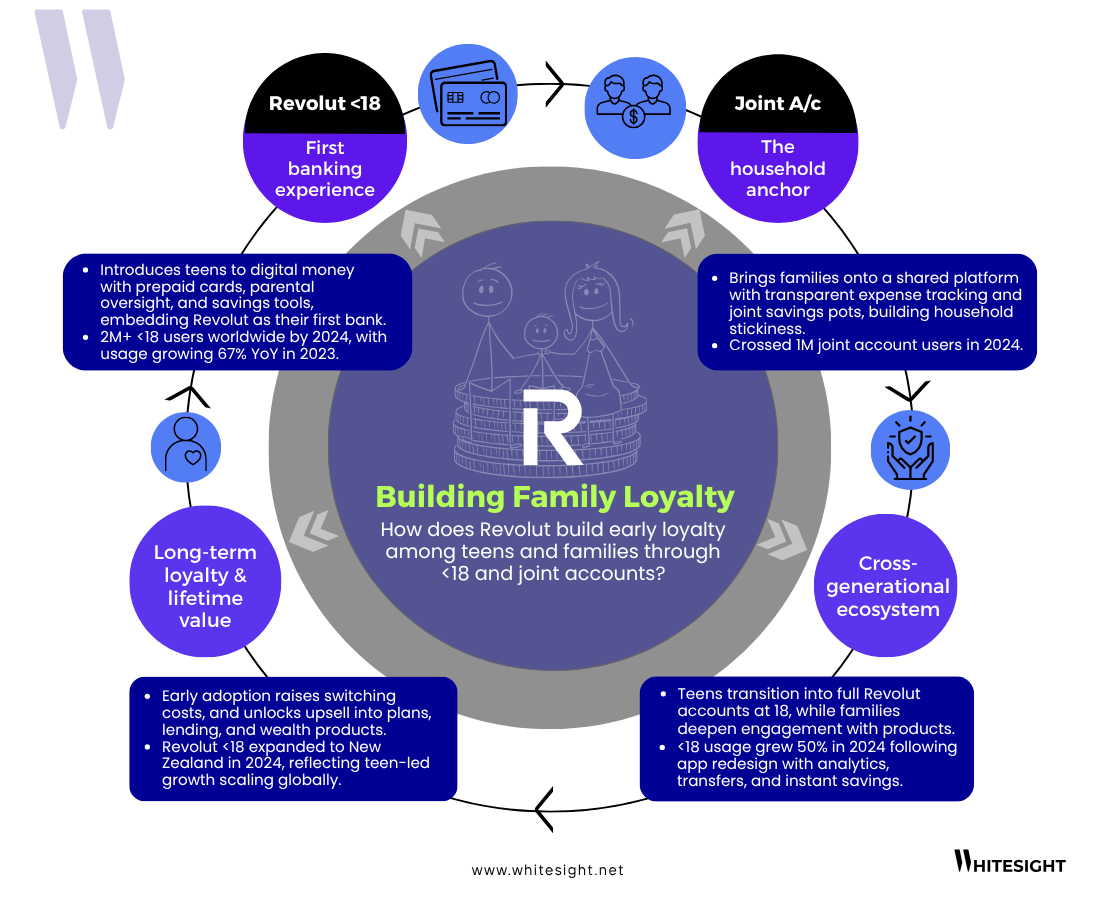

Revolut is laying the groundwork for long-term loyalty by anchoring families and teens early in its ecosystem. With Revolut <18, the company introduces teenagers to prepaid cards, parental oversight, and savings tools, embedding itself as their first banking experience.

By 2024, Revolut had surpassed 2M under-18 users, with usage growing 67% YoY, and expanded the product to New Zealand to scale teen-led adoption globally.

The strategy extends to households with Joint Accounts, which provide transparent expense tracking and shared savings pots, turning Revolut into a household anchor. The product crossed 1M joint account users in 2024, creating a powerful network effect that ties families into the platform.

The impact compounds over time: early adoption raises switching costs, unlocks upsell into plans, lending, and wealth, and positions Revolut as the lifetime financial partner for entire households. More than just customer acquisition, Revolut’s family playbook is a long-term loyalty engine, converting first banking experiences into lifelong relationships.

Revolut's Deep Dive Report 📔

Revolut’s journey to 60 million customers hasn’t been just about fast growth. It’s also about how it adapted its model in each market, tweaking product features, go-to-market strategies, and regulatory plays depending on local norms and gaps.

From the UK’s broad product suite to the EU’s carefully localized banking expansion, the Revolut model reveals tested moves for scaling and monetizing fintech.

So how exactly did it pull this off, without breaking unit economics, losing brand consistency, or stretching itself too thin?

WhiteSight’s latest report explores the licences, product bets, and revenue levers that powered Revolut’s transformation from a UK challenger into a truly global digital bank.

Report

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts