Revolut’s Subscription Plans: A Strategic Lever for Sustainable Growth

Blending financial tools with lifestyle perks to secure predictable income

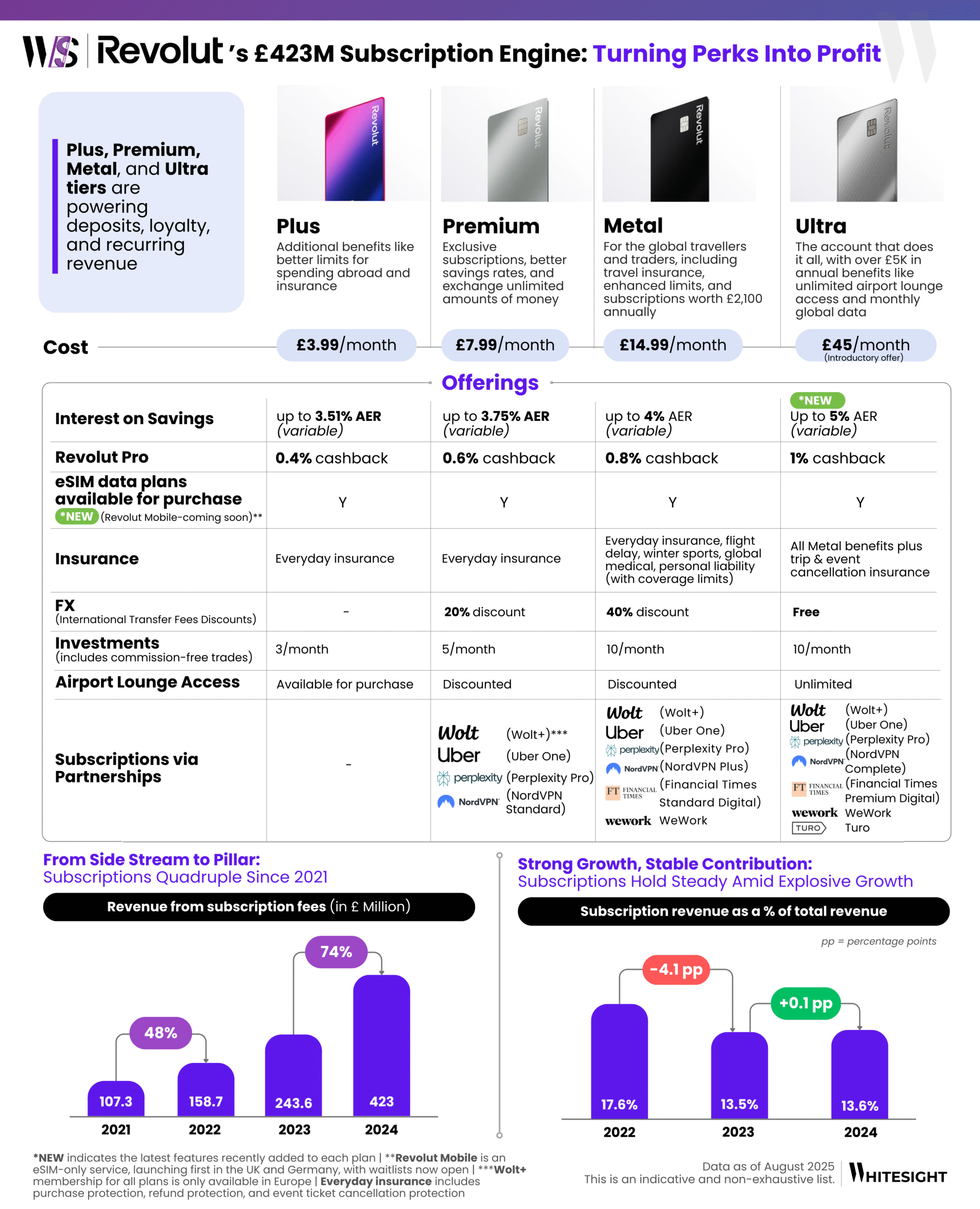

Revolut’s subscription business is less about shiny perks and more about its push toward profitability and loyalty. By layering financial utility (higher savings rates, cashback, wealth tools) with lifestyle stickiness (insurance, global eSIM data, airport lounge access), Revolut has created bundles that keep customers engaged daily while generating predictable, recurring income. Subscriptions brought in £423M in 2024, a 74% YoY increase and nearly 4x growth since 2021, making them a powerful revenue pillar.

Each tier pushes customers deeper into Revolut’s ecosystem in ways that strengthen profitable behavior. Plus is the entry point, setting spending and savings habits within the app. Premium and Metal unlock lifestyle and financial perks, from insurance to enhanced FX and affinity tie-ups with brands like Uber, Wolt, and Perplexity, that expand use cases and embed Revolut into daily routines. At the top end, Ultra combines the highest-yield savings (5% AER) with global travel and insurance benefits, accelerating deposit growth while positioning Revolut as more than a payments app.

The impact shows in the numbers: fee income accounted for 72% of the company’s £3.1B in 2024 revenue, with subscriptions emerging as a key driver.

Taken together, this strategy transforms Revolut from a fee-light, FX disruptor into a subscription-led financial platform with diversified monetization. Subscriptions are a loyalty engine, a margin booster, and a cornerstone of Revolut’s ambition to position itself as a truly global digital bank.

Revolut's Deep Dive Report 📔

Revolut’s journey to 60 million customers hasn’t been just about fast growth. It’s also about how it adapted its model in each market, tweaking product features, go-to-market strategies, and regulatory plays depending on local norms and gaps.

From the UK’s broad product suite to the EU’s carefully localized banking expansion, the Revolut model reveals tested moves for scaling and monetizing fintech.

So how exactly did it pull this off, without breaking unit economics, losing brand consistency, or stretching itself too thin?

WhiteSight’s latest report explores the licences, product bets, and revenue levers that powered Revolut’s transformation from a UK challenger into a truly global digital bank.

Report

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts