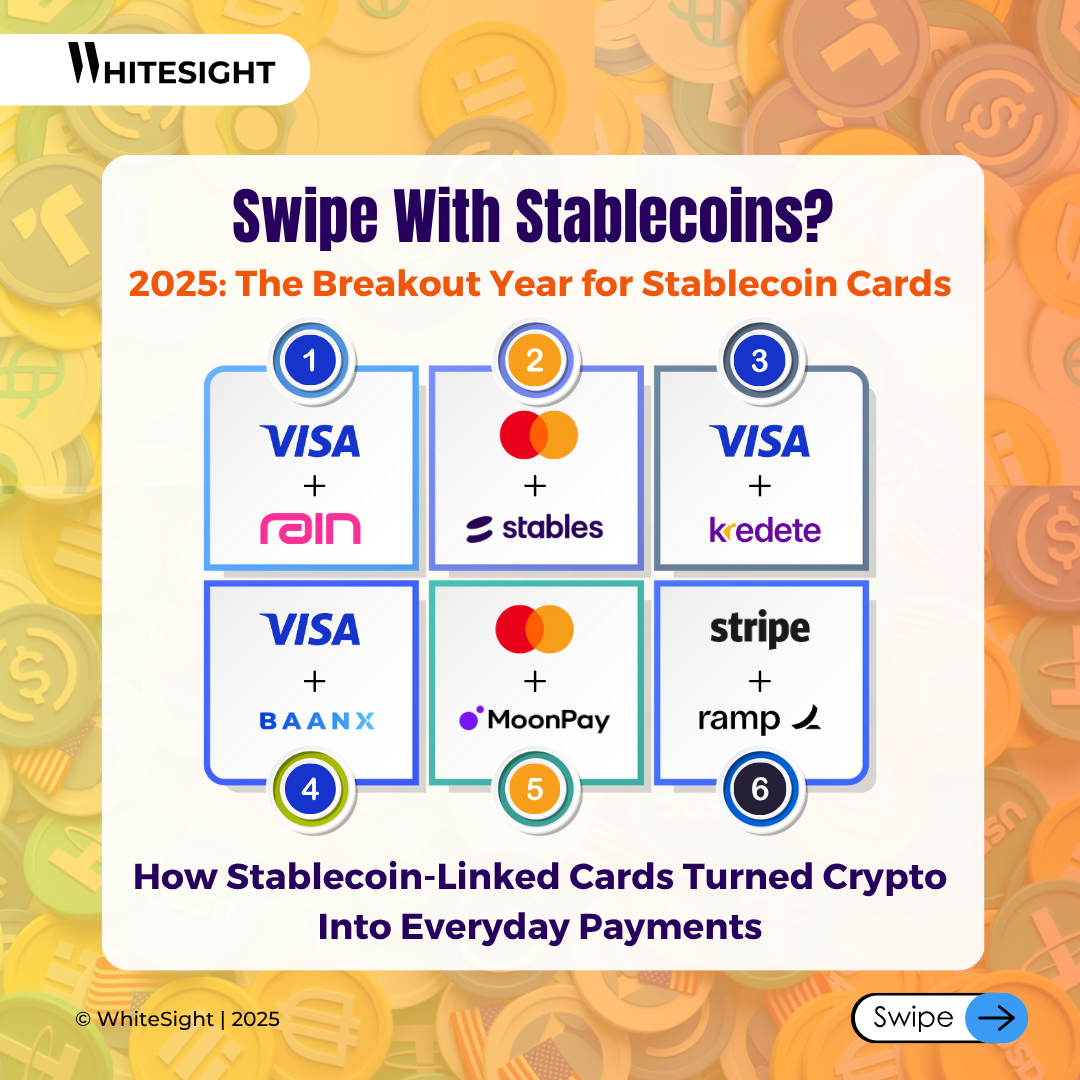

Stablecoin-Linked Cards Turn Crypto Into Everyday Payments

From Financial Access to On-Demand Spend, a Turning Point in Crypto Utility

2025 has emerged as the inflection point where stablecoins transitioned from speculative instruments to core infrastructure enabling real-world utility. The proliferation of stablecoin-linked cards by major networks and fintech players reflects a structural shift in financial infrastructure, towards wallet-native, programmable, and globally interoperable payment systems.

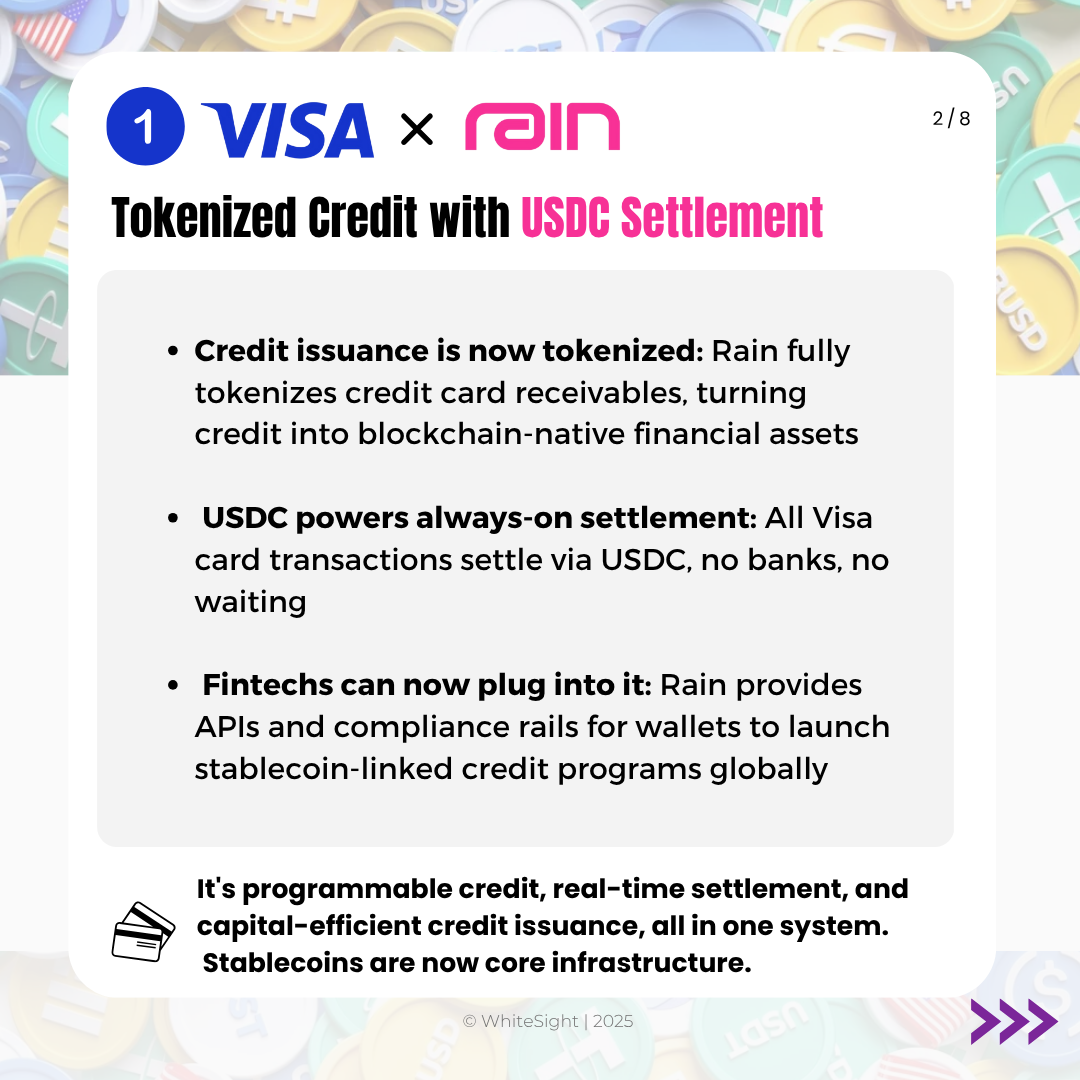

- Infrastructure as a Product: Rain’s full-stack credit issuance model with Visa tokenizes receivables, making credit programmable and universally distributable via APIs. By settling entirely in USDC without banking intermediaries, it redefines credit as an on-chain financial primitive, one that fintechs can embed natively into consumer-facing wallets and apps.

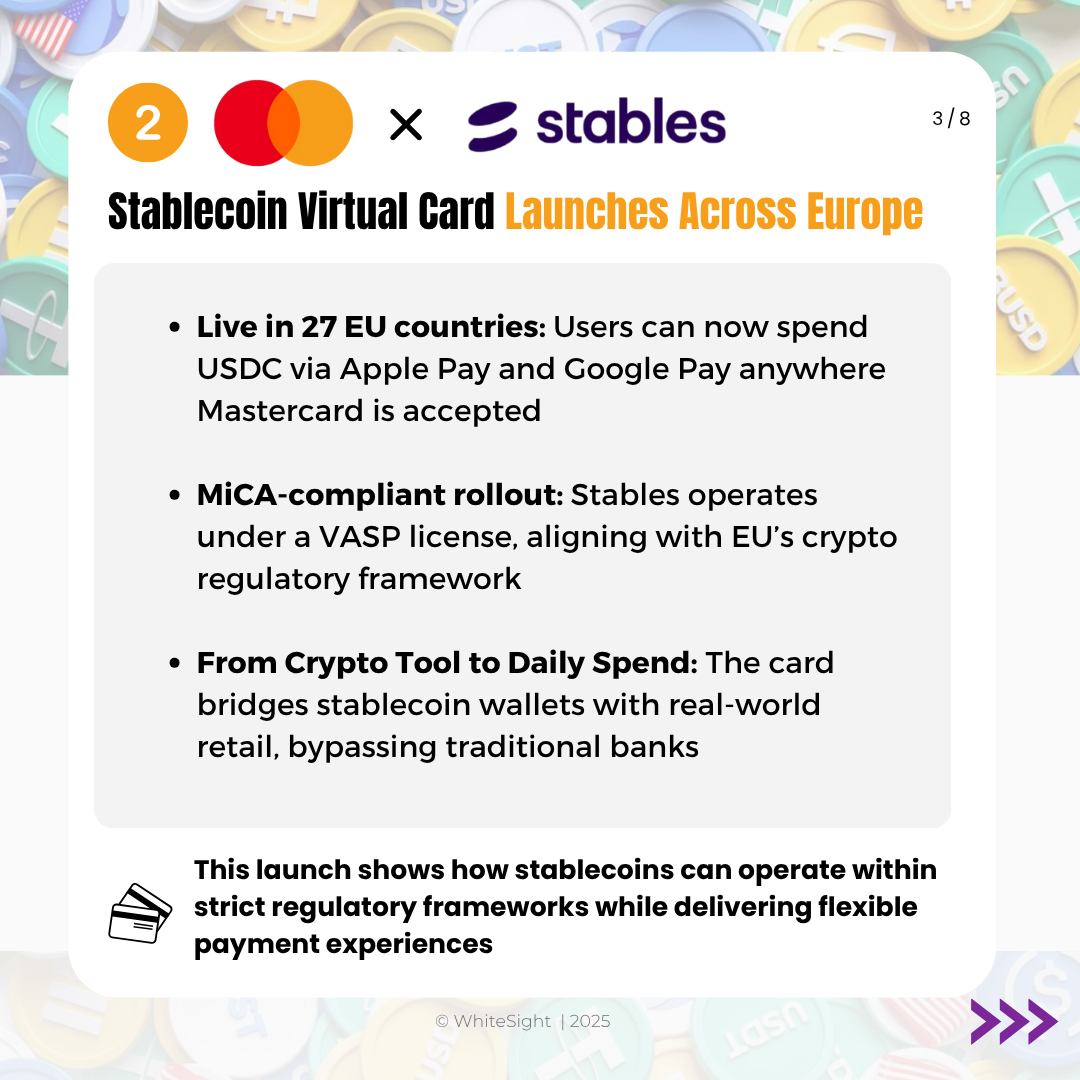

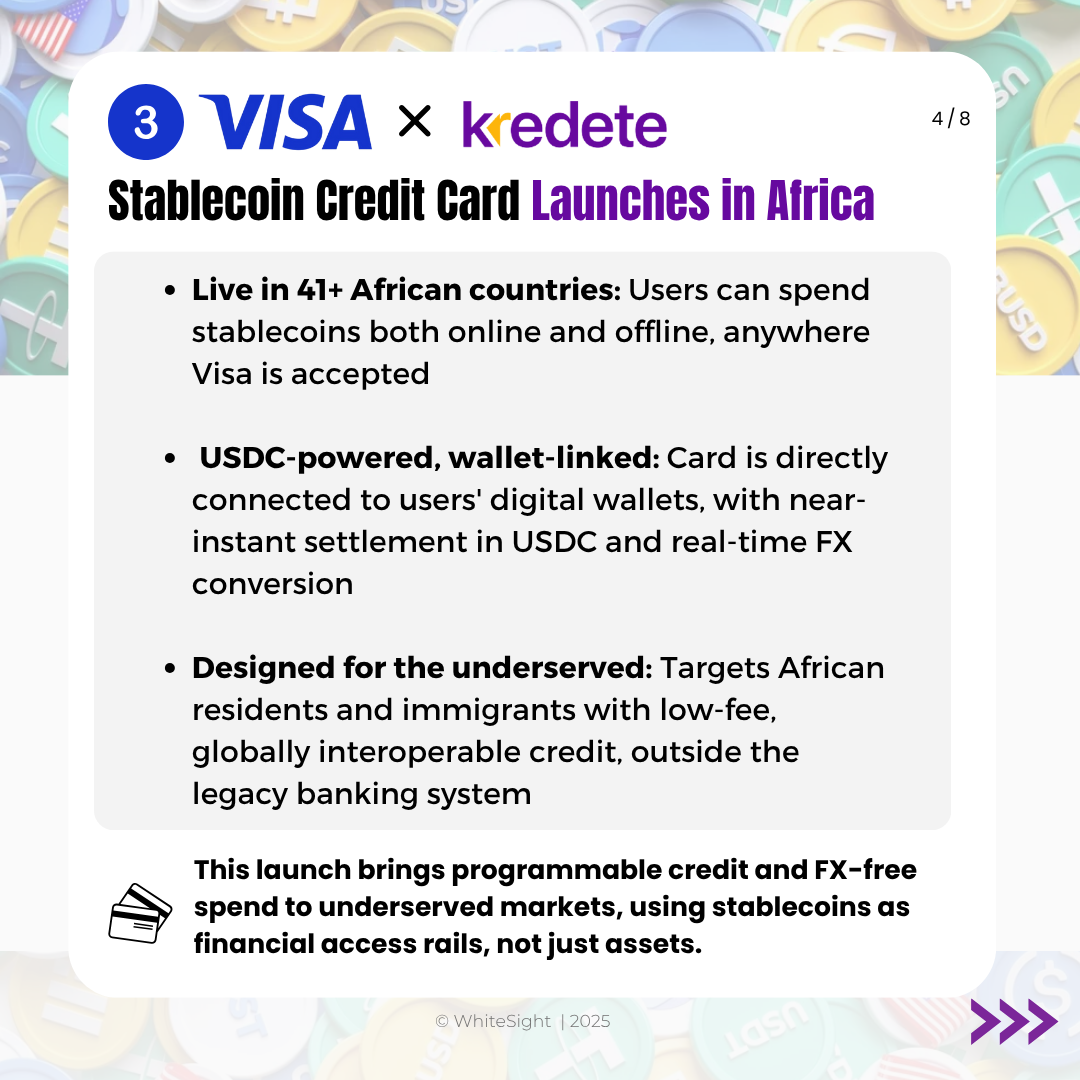

- Consumer Utility at Scale: Partnerships like Mastercard and Stables in the EU, and Visa and Kredite in 41 African countries, are pushing stablecoins from niche to norm. Consumers can now spend USDC via Apple Pay, Google Pay, or directly from wallet-linked cards – online, offline, and across borders without engaging with banks. This is particularly transformative for populations underserved by traditional financial institutions.

- Enterprise Adoption and Wallet-Layer Distribution: Ramp and Stripe’s stablecoin-powered corporate cards introduce real-time global expense infrastructure for businesses. Meanwhile, MoonPay’s API model allows any wallet or fintech to issue Mastercard-compatible stablecoin cards, reducing the gap between asset custody and retail usability. This creates a horizontal layer where stablecoins are spent, managed, and circulated at scale.

For consumers, this unlocks faster access to credit, global purchasing power, and lower transaction costs, all without a traditional bank account. For businesses and fintechs, it provides programmable liquidity, efficient operations, and a path to build compliant, modular financial services atop stablecoin rails.

Don’t want to miss the next big thing in digital assets? 🪙

Our monthly Digital Assets newsletter unpacks the latest across stablecoins, tokenization, crypto trading, and global regulations—all in one punchy read. Perfect for staying ahead of the curve without the scroll fatigue.

Read the latest issue and subscribe to catch the next drop this week!

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts