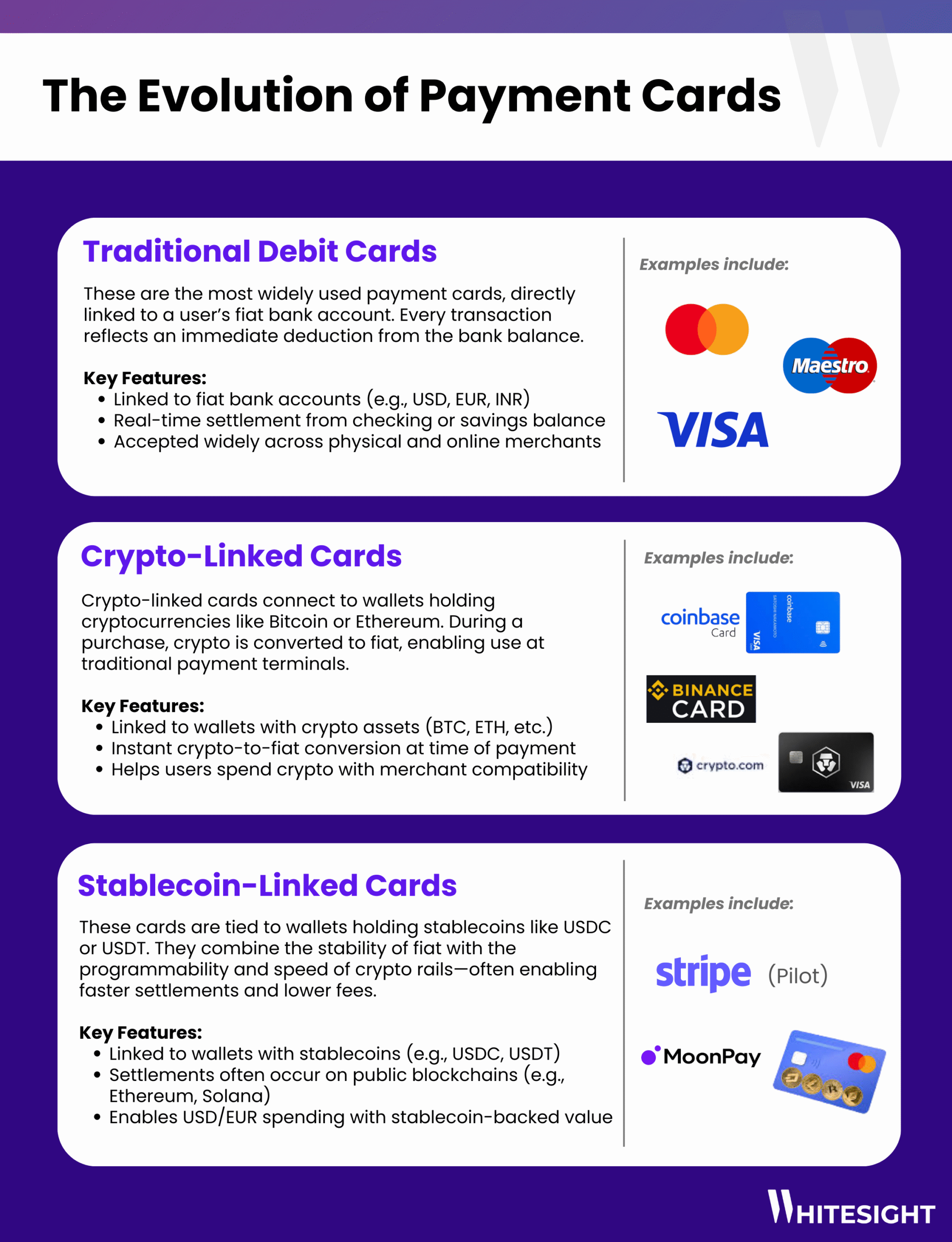

The Evolution of Payment Cards

The Next Frontier of Payments Linking Cards to Crypto and Stablecoins

What started as a simple link to checking accounts has now become a modular tool for programmable money. As cards tap into crypto assets and stablecoins, they unlock new utilities – from faster settlements to borderless spending – reshaping how businesses monetize financial access.

At the base, traditional debit cards represent a legacy infrastructure, directly tethered to fiat accounts, offering stability and ubiquity but little flexibility. What’s transformative here is the emergence of crypto-linked and stablecoin-linked cards:

- Crypto-linked cards serve as fiat bridges for volatile assets like Bitcoin and Ethereum, highlighting user demand to spend digital wealth in real-time. These cards signal growing comfort with crypto as a spendable asset class. At the same time, this not only expands crypto’s transactional utility but also unlocks a new monetization vector for exchanges and wallet providers through interchange fees and user retention.

- Meanwhile, stablecoin-linked cards like those piloted by Stripe and MoonPay are redefining settlement logic. Operating on blockchains like Ethereum and Solana, they offer near-instant, low-fee settlements and programmability, ideal for cross-border commerce and programmable payouts. For businesses, this means an emerging opportunity to embed financial infrastructure that is borderless, cost-effective, and compliant-ready.

For fintechs and digital players, this opens a playbook to innovate beyond account-linked cards, positioning wallets, tokenized assets, and programmable compliance as the new battlegrounds in everyday payments.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts