Mexico’s Digital Banking Surge: A Market in Motion

- Kshitija Kaur and Sanjeev Kumar

- 9 mins read

- Digital Finance, Insights

Table of Contents

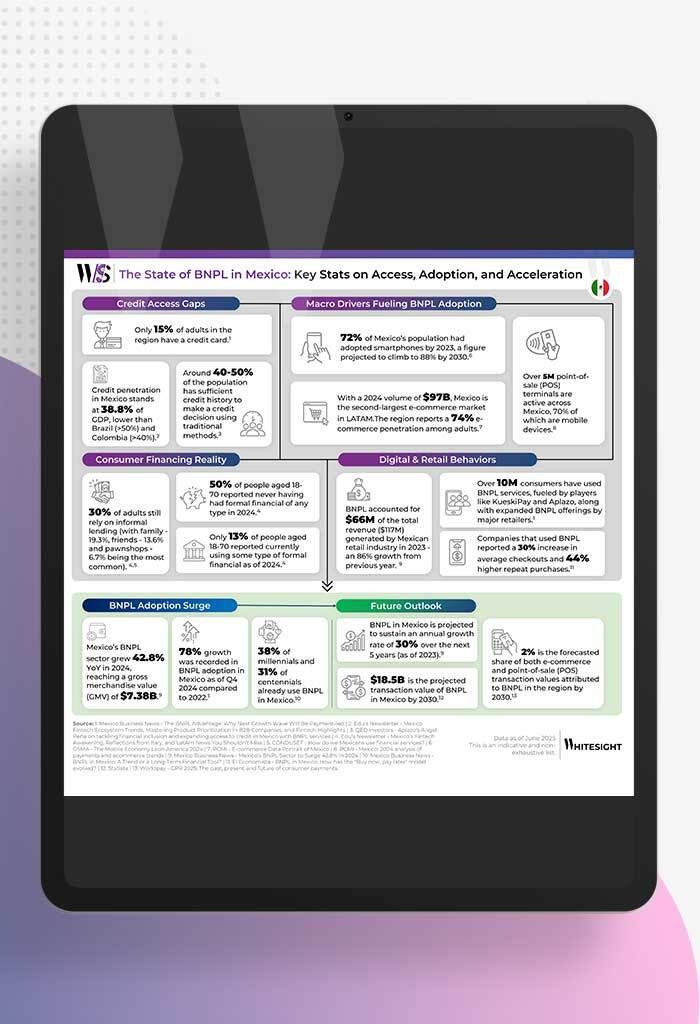

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second largest in Latin America. Yet it presents a paradox in financial services: highly digitized in behavior, yet still largely underbanked. With over two million new adults entering the market each year, Mexico represents both a formidable challenge and an immense opportunity for digital financial players focused on inclusion, simplicity, and scale. A Highly Concentrated Market Dominated by Incumbents Mexico’s banking sector remains highly concentrated and deeply traditional. As of March 2025, just six banks control 66.2% of the country’s total banking assets, which underscores limited competition and the opportunity for disruption. These top institutions include BBVA ($162B), Santander ($96.5B), Banorte ($93.5B), Banamex ($52.8B), HSBC ($44.6B), and Scotiabank ($43.6B), collectively holding over $492 billion in assets. Notably, five of these six are subsidiaries of global financial conglomerates, with Spanish banks BBVA and Santander alone accounting for nearly 35% of total market assets. Banorte stands as the lone domestic heavyweight, and the only major bank not under foreign control.While fintechs have made rapid inroads by leveraging mobile-first strategies and intuitive UX, with players like Klar offering fee-free credit cards and Stori approving… […]

This post is only available to members.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

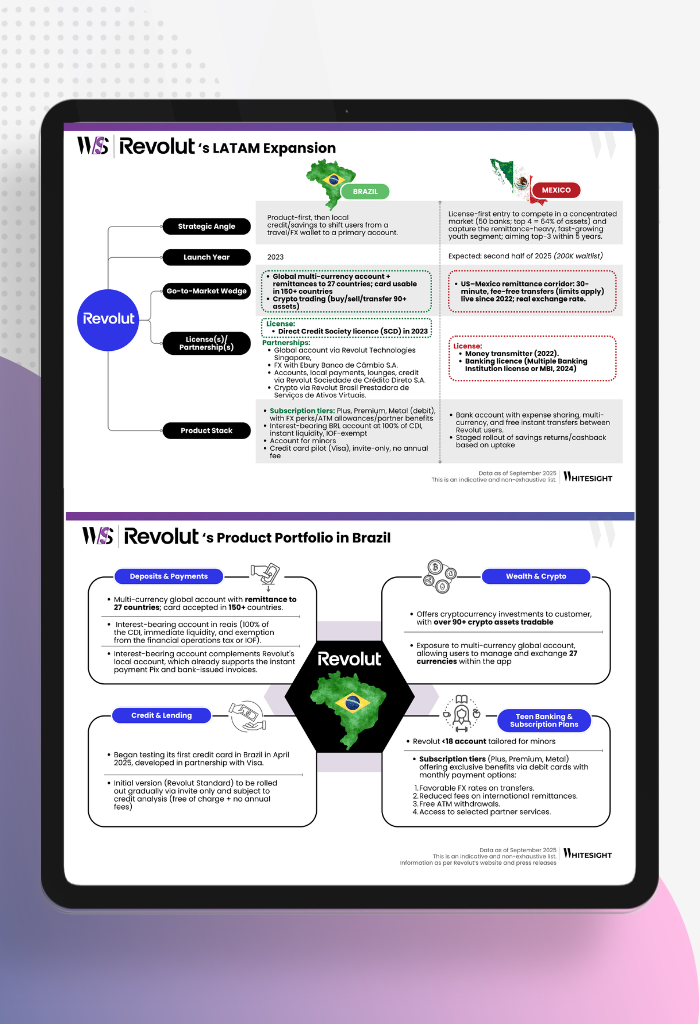

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

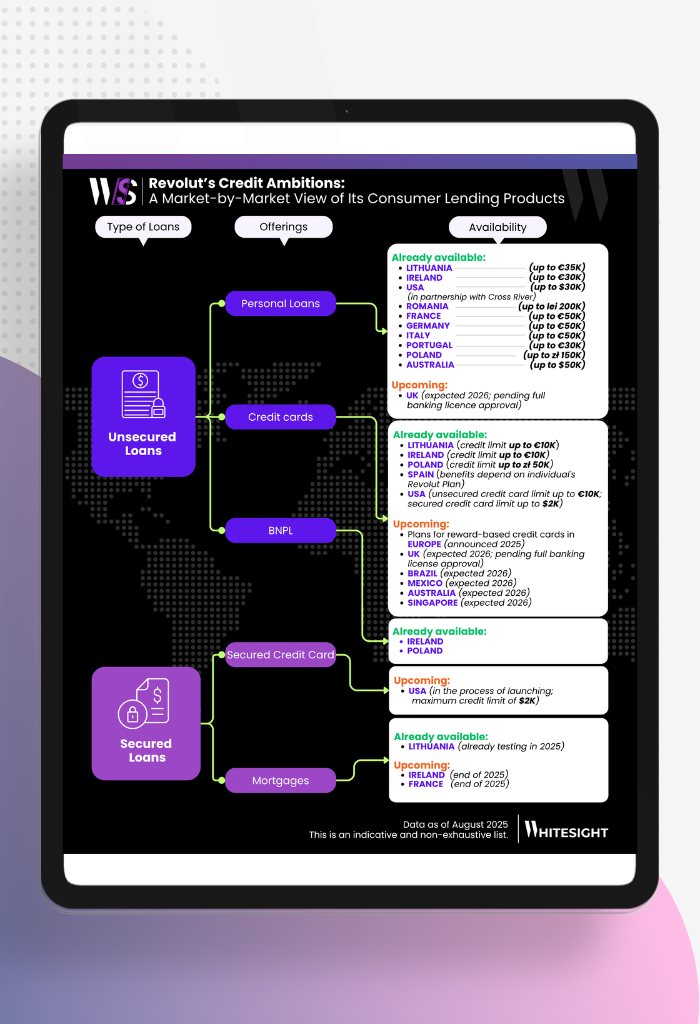

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar