Open Banking in Canada: Better Late Than Never?

- Kshitija Kaur and Sanjeev Kumar

- 7 mins read

- Insights, Open Finance

Table of Contents

Canada Open Banking: Glacial Pace or Strategic Patience? Canada, a nation renowned for its politeness and measured approach, has finally entered the open banking arena. While other developed countries like the UK, EU, Singapore, and Australia have embraced open banking with the zeal of an Olympic sprint, Canada has taken a more “politely patient” route. Much like the gradual melting of Canadian snow in the spring, the nation’s open banking journey has been characterised by deliberation and cautious optimism. This so-called “made-in-Canada” approach, often described as slow and methodical, has sparked debate – is it a case of better late than never, or a missed opportunity for innovation and competition?In 2023, regulators in North America made significant strides in implementing open banking, with key developments occurring in the United States and Canada. In October 2023, the United States laid the foundation for open banking when the Consumer Financial Protection Bureau (CFPB) introduced the Personal Financial Data Rights rule. Following this, on 21 November 2023, the Canadian Government announced its plans to create an open banking framework in its 2023 Fall Economic Statement. Just as Europe uses the term “PSD2” and Australia calls it “Consumer Data Rights,” Canada employs the term […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

- Risav Chakraborty, Kshitija Kaur, Samridhi Singh and Chinmayee Kadam

- Ananya Shetty and Kshitija Kaur

Cash Flow Lifeline: Embedded Finance for SMEs Imagine a burgeoning entrepreneur, their independent bookstore teeming with life. The latest bestsellers...

- Kshitija Kaur and Chinmayee Kadam

How the UAE is Unlocking the Potential of Crypto In recent years, the United Arab Emirates (UAE) has emerged as...

- Sanjeev Kumar

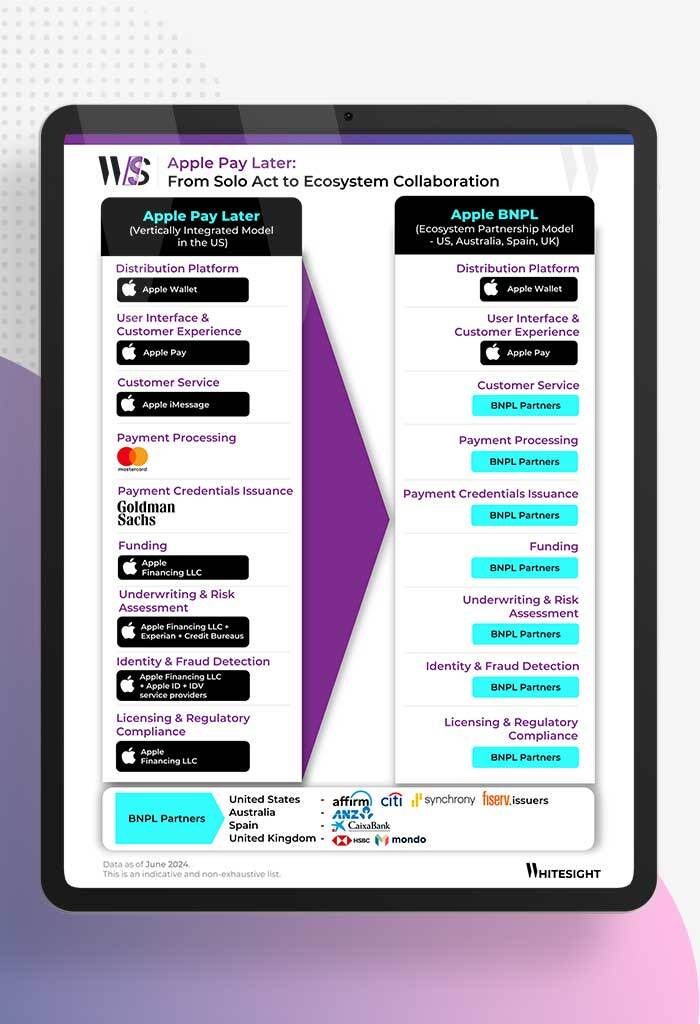

Apple’s Strategic Shift in BNPL This is a quick look at Apple’s strategic shift from building its own BNPL solution...

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...