Revolut’s LATAM Gambit: Testing Global Playbooks in Brazil and Mexico

- Sanjeev Kumar and Risav Chakraborty

- 6 mins read

- Digital Finance, Insights

Table of Contents

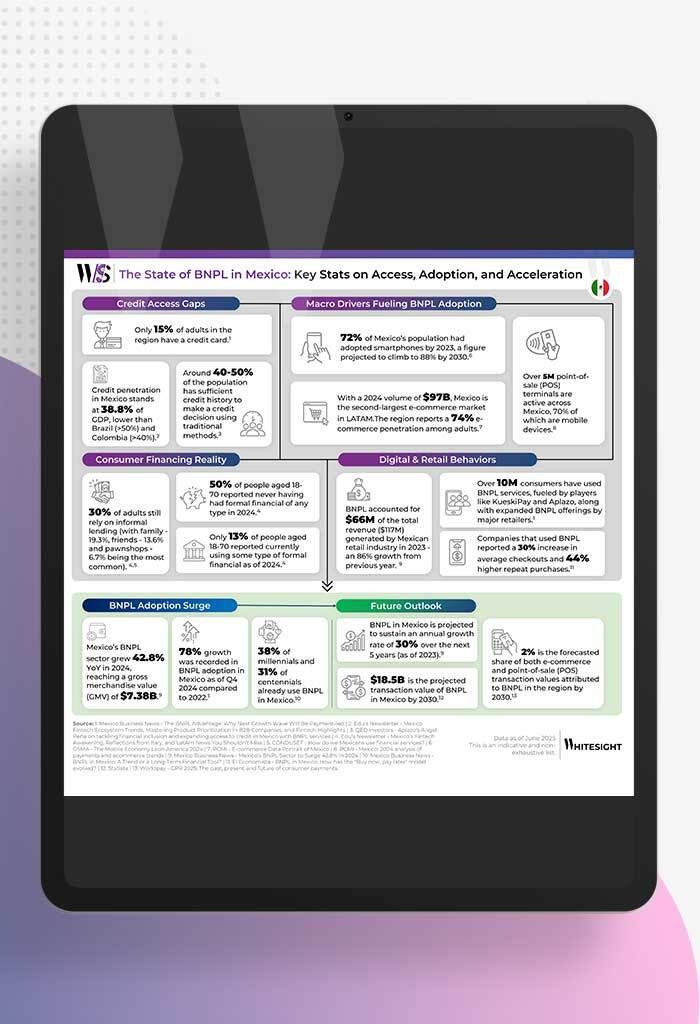

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in contradiction: a region brimming with economic potential yet shackled by concentrated banking systems, sky-high interest rates, and millions left outside the gates of formal credit. That friction has since become the fuel for one of the world’s most dramatic digital banking revolutions. Over the past years, the number of fintechs in the region has more than quadrupled to 3,000+ players. By 2025, digital banks in LATAM are expected to generate $95.6B in net interest income, on track to cross $111B by 2028. Far from being marginal players, digital-first challengers are becoming systemically important, with Brazil’s central bank noting that neobanks’ return on equity outpaced incumbents at 19.1% in 2024.The drivers run deeper than technology alone: a smartphone-native youth cohort demanding easier access to credit; policy-led innovations like Pix in Brazil and Sistema de Pagos Electrónicos Interbancarios (SPEI) in Mexico embedding instant payments into daily life; and an enduring mistrust of legacy banks that overcharged and underserved. Together, these forces have turned LATAM into the epicenter of digital banking’s future, a stage now set for both local champions and ambitious global […]

This post is only available to members.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

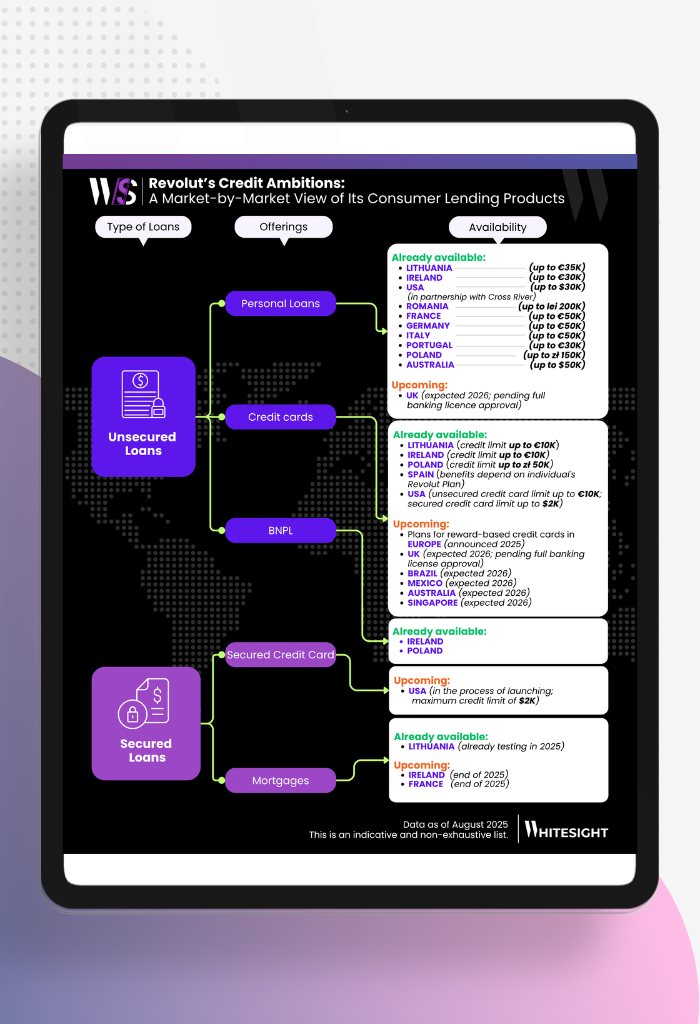

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

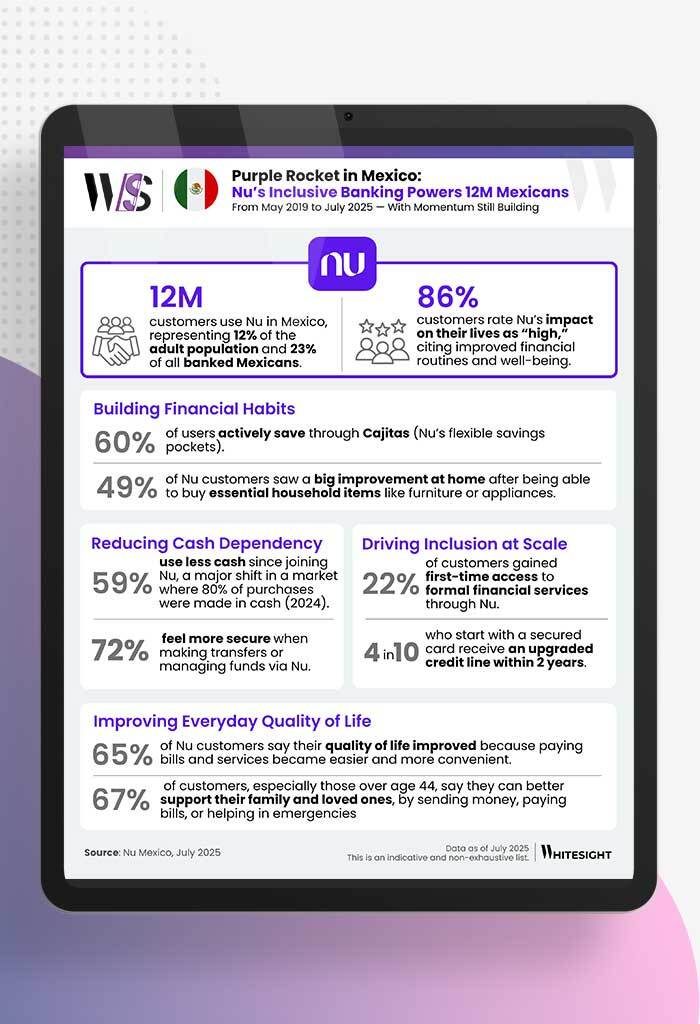

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar