To C or Not To C: G20’s Regulatory Stance on Crypto

- Sanjeev Kumar and Kshitija Kaur

- 4 mins read

- Digital Assets, Insights

Table of Contents

To C or Not To C: G20’s Regulatory Stance on CryptoThe idea of decentralized currency has grasped everyone’s curiosity ever since its inception. A groundbreaker in the making, these digital currencies have started to shift the gears of how transactions, asset-classes, and investments are viewed through a never-done-before lens. Albeit there are a sea of possibilities to set sail on, the underlying apprehensions around anonymous transactions and the prospect of such a transformation falling into the wrong hands are equally brewing in the background.Bitcoin’s illicit ties with transactions on the dark web and facilitating payoffs for ransomware attacks, mixed with the concerns about cryptocurrencies affecting the monetary sovereignty of governments, have elicited polarized responses from authorities across the globe. This comes with its fair share of governments imposing certain regulations and laws in order to maintain a fundamental long-term result for the industry as a whole. The foundation of the current regulatory stance for crypto rides on four pillars:1. Central Bank Digital Currencies (CBDCs), a digital form of a country’s official currency.2. Transactional Use of Crypto, that signifies the everyday use-cases of crypto for transactions.3. Asset Exchanges, where crypto is traded and held for investments and speculation purposes.4. Initial Coin […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

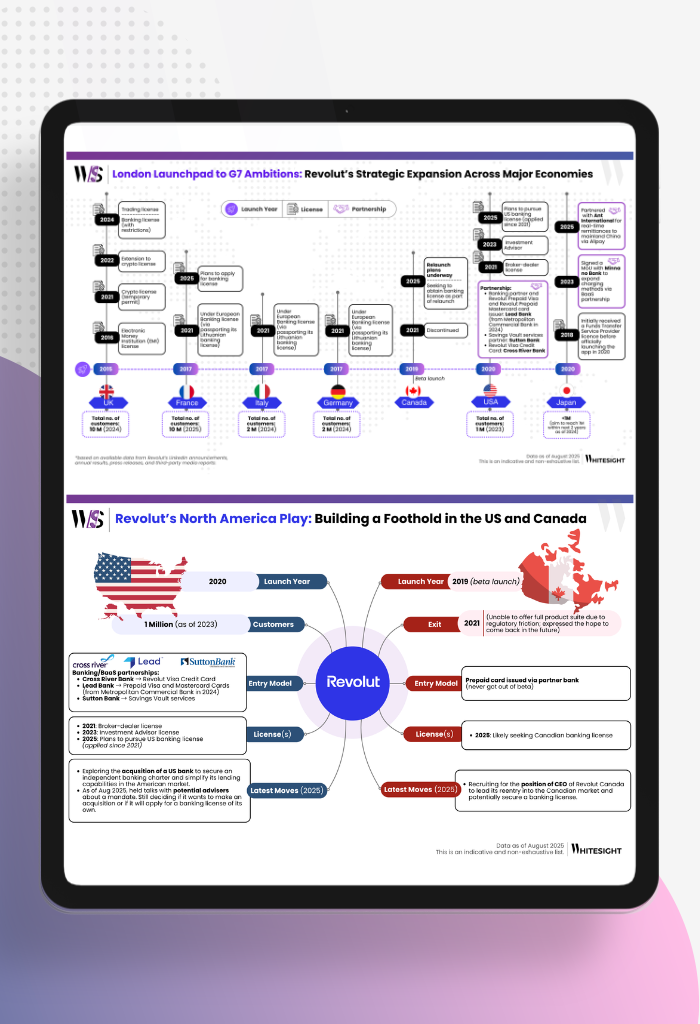

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

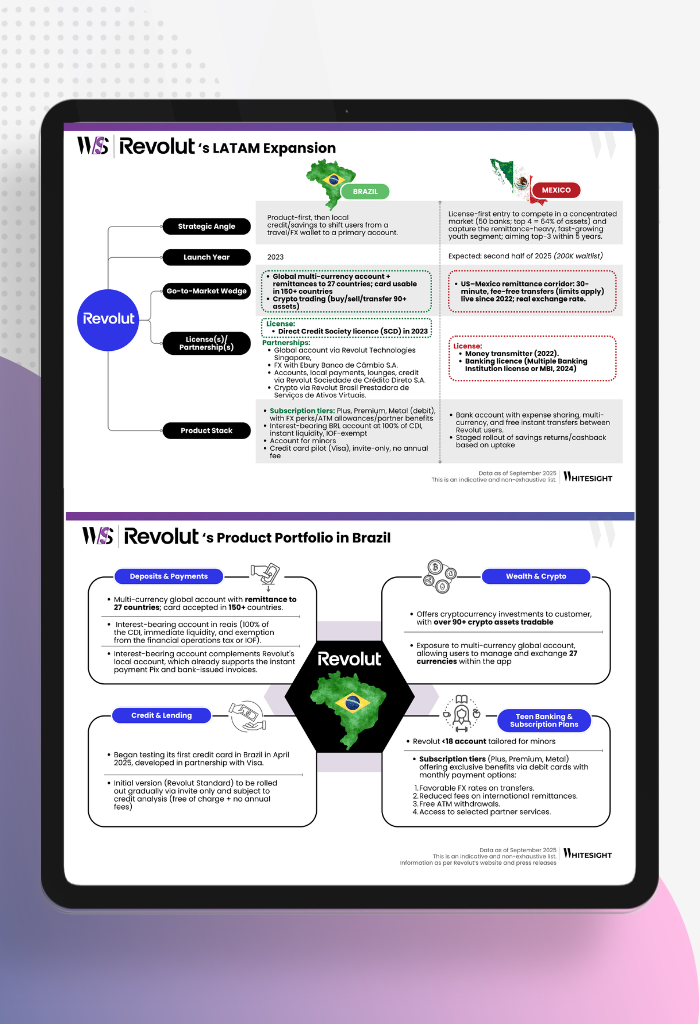

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...