Unearthing The Bustle In Green Finance: Earth Day 2022

- Afshan Dadan and Kshitija Kaur

- 4 mins read

- Insights, Sustainable Finance

Table of Contents

All investment strategies and investments involve the risk of loss—all except perhaps one: Investing in future-proofing our planet. A recently published report from Intergovernmental Panel on Climate Change (IPCC) paints a grim picture of how we are doing as a species. The report provides one of the most comprehensive analyses of the intensifying impacts of climate change and future risks for the world. The IPCC estimates that in the next decade alone, climate change will drive 32-132 million more people into extreme poverty. Global warming will jeopardize food security, increase mortality rates, and will result in irreversible effects causing stronger storms, longer heatwaves, droughts, extreme precipitation, rapid sea-level rise, loss of Arctic sea ice and ice sheets, thawing permafrost, and more.At WhiteSight, we keenly follow the reinvigorated responses from the FinTech ecosystem towards the climate change imperatives. This has branched out in the emergence of the Green Finance phenomenon, where the FinTech ecosystem stakeholders are aligning their green thumbs to keep up with the effects of climate change. This Earth Day, we reflect upon some of the moves by these participants in various activities across the span of January-April as they guide the Future of Finance towards net-zero. Banking On […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

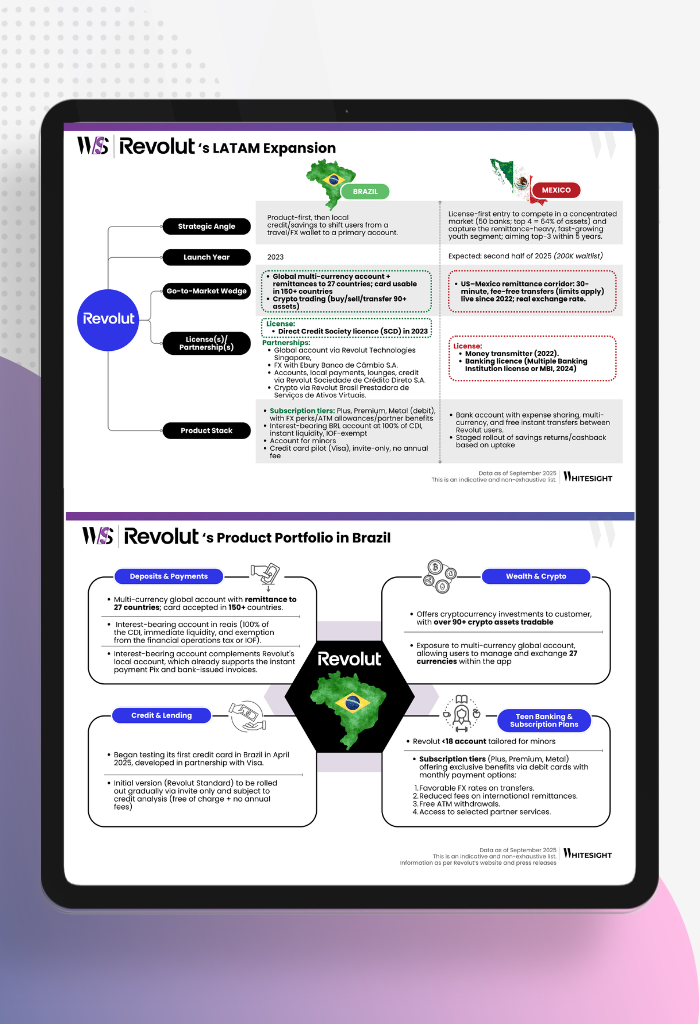

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

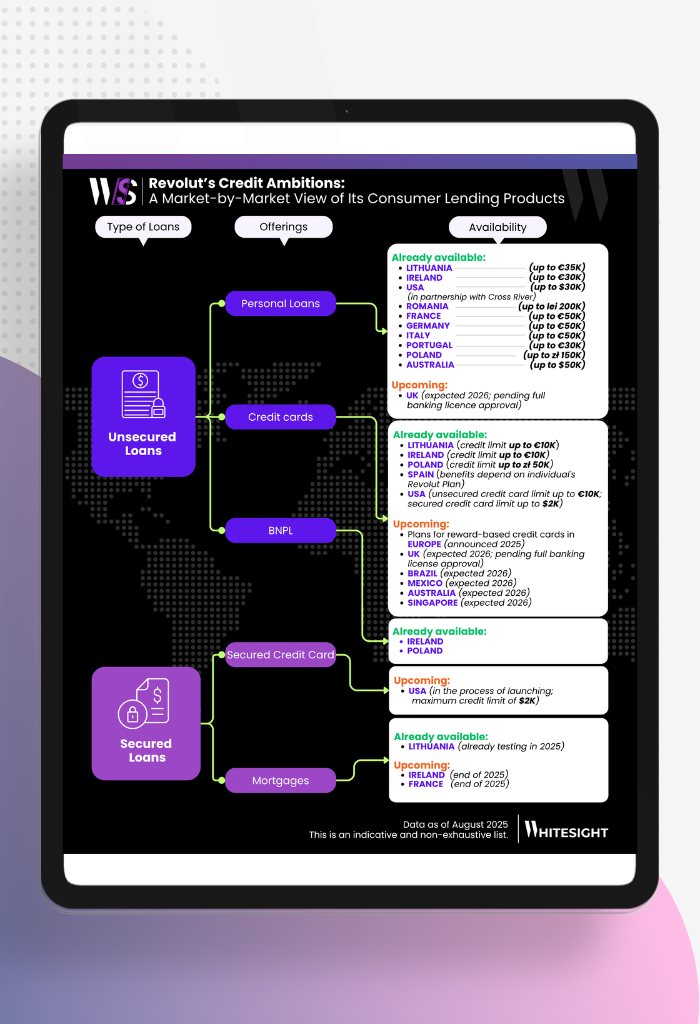

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

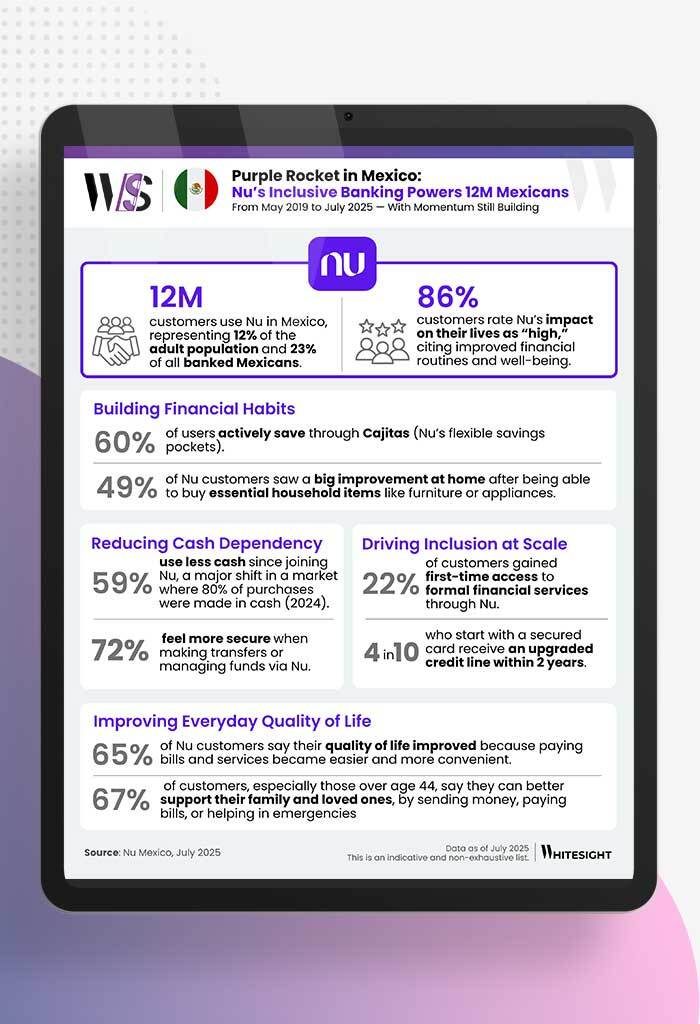

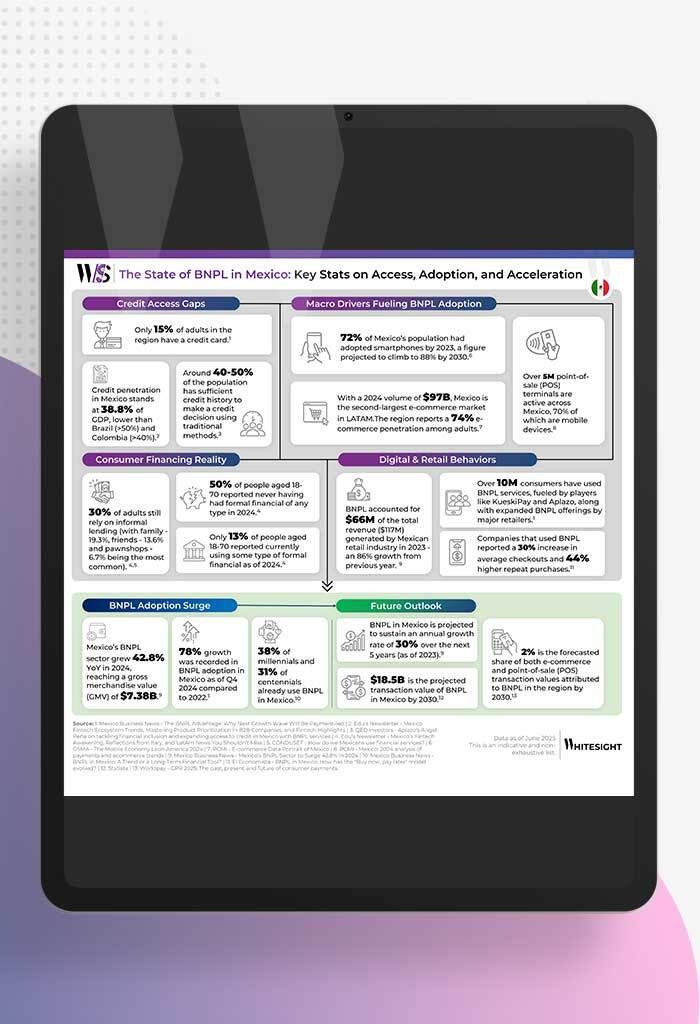

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar