Unearthing The Bustle In Green Finance: Earth Day 2022

- Afshan Dadan and Kshitija Kaur

- 4 mins read

- Insights, Sustainable Finance

Table of Contents

All investment strategies and investments involve the risk of loss—all except perhaps one: Investing in future-proofing our planet. A recently published report from Intergovernmental Panel on Climate Change (IPCC) paints a grim picture of how we are doing as a species. The report provides one of the most comprehensive analyses of the intensifying impacts of climate change and future risks for the world. The IPCC estimates that in the next decade alone, climate change will drive 32-132 million more people into extreme poverty. Global warming will jeopardize food security, increase mortality rates, and will result in irreversible effects causing stronger storms, longer heatwaves, droughts, extreme precipitation, rapid sea-level rise, loss of Arctic sea ice and ice sheets, thawing permafrost, and more.At WhiteSight, we keenly follow the reinvigorated responses from the FinTech ecosystem towards the climate change imperatives. This has branched out in the emergence of the Green Finance phenomenon, where the FinTech ecosystem stakeholders are aligning their green thumbs to keep up with the effects of climate change. This Earth Day, we reflect upon some of the moves by these participants in various activities across the span of January-April as they guide the Future of Finance towards net-zero. Banking On […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

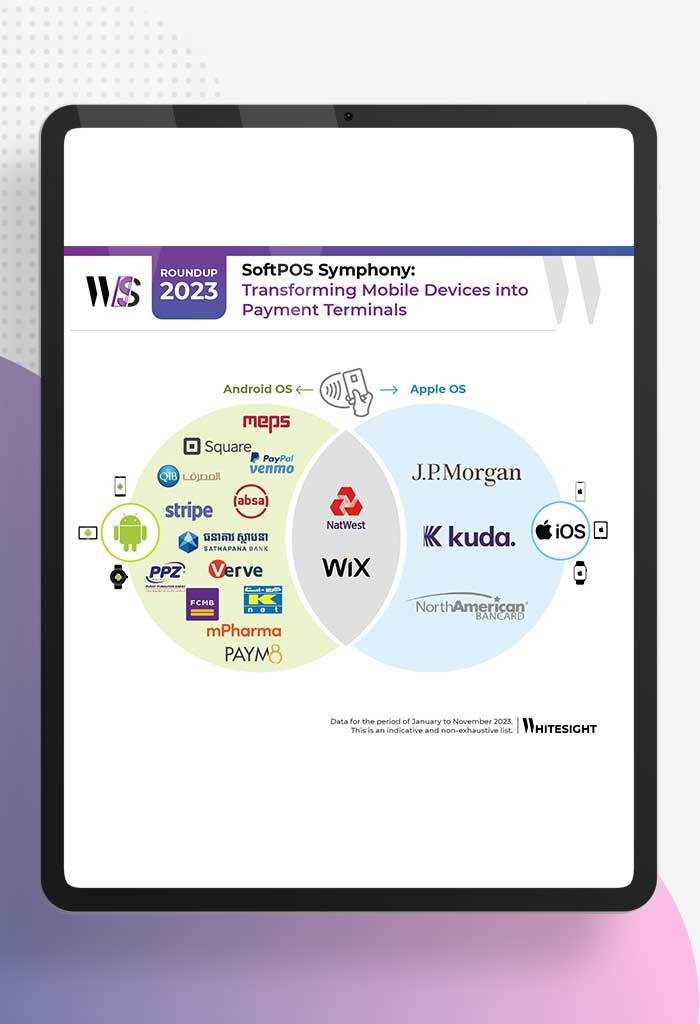

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

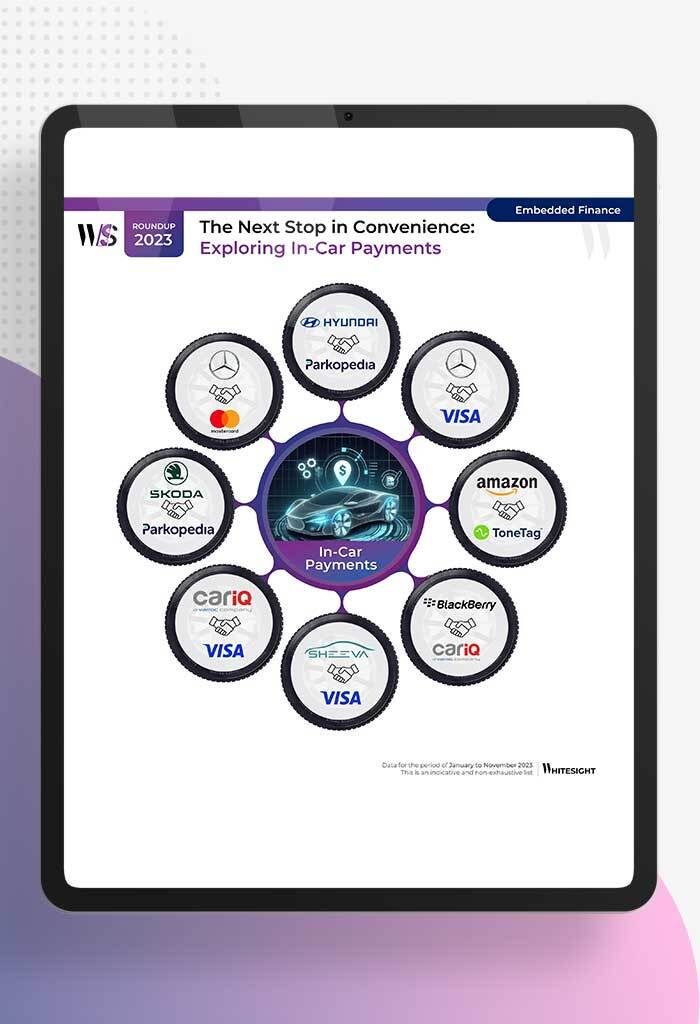

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

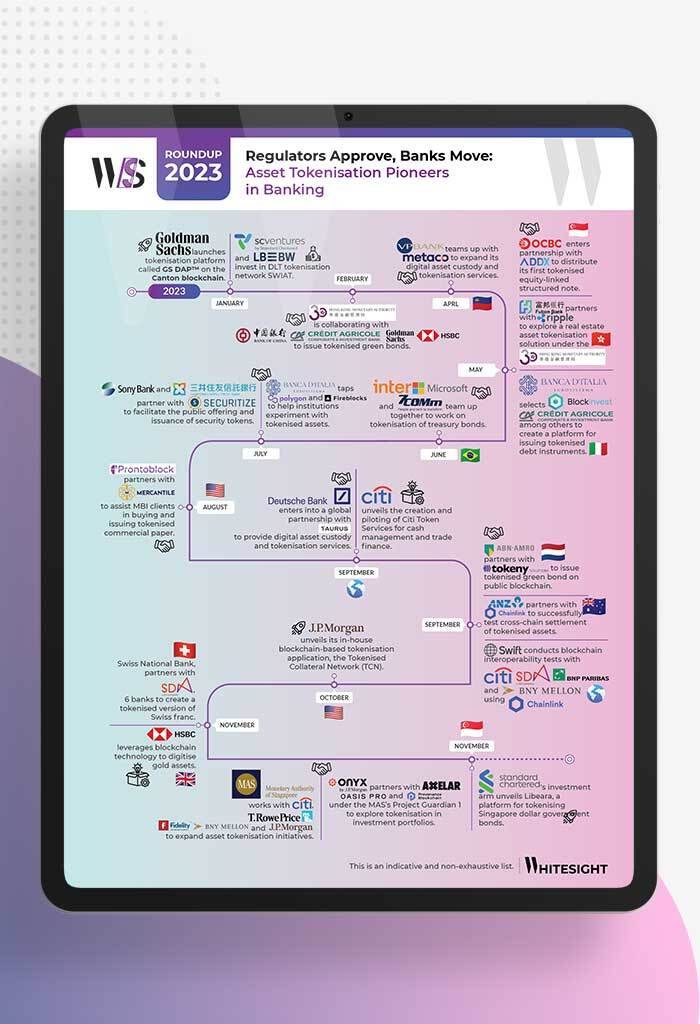

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

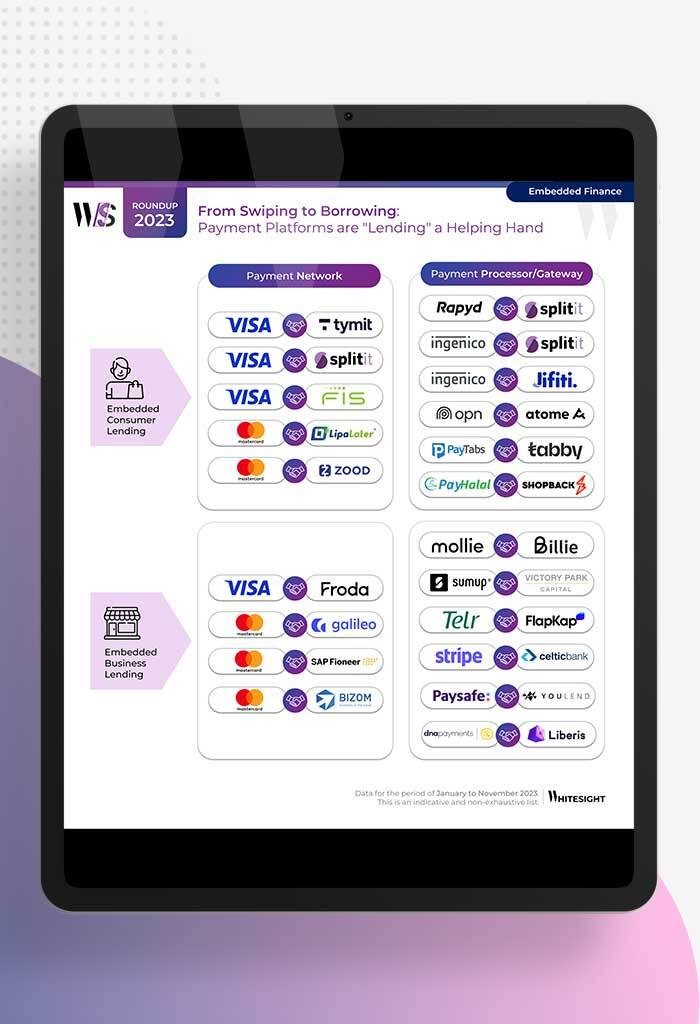

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...