2021 FinTech Roundup: Top 20 Independent Digital Banks

- Afshan Dadan and Kshitija Kaur

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

2021—the year the Digital Banking space said, “hold my beer, and watch this”… Only to quite literally make giant leaps towards the top that successfully made heads turn thanks to its various ingenious breakthroughs.From an initial unbundling proposition of focusing on one product and niche customer segments, independent digital banks have matured and are now challenging incumbents across multiple financial products, customer cohorts, and borders. Continuing on our observance from 2020’s Top 20 Neobanks, this year’s roundup puts the spotlight on the Top 20 Independent Digital Banks through the lens of the shifts, growth hacks, and exit strategies embraced by these unique-orns: Sailing Through A Steady BreezeThe unwavering spirit of the top 5 decacorns bore a striking resemblance to last year’s ranking – with the minor swapping of Nubank stealing Chime’s thunder by taking the first rank this year. This can be attributed to the Latin American fintech raking in about 50 million customers over the last three years, out of which 72% are active users. Nu, presently valued at $45B, began as a simple credit card provider and is now stepping up the ante towards becoming a super-app after its recent IPO. By launching an e-commerce platform, as well […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

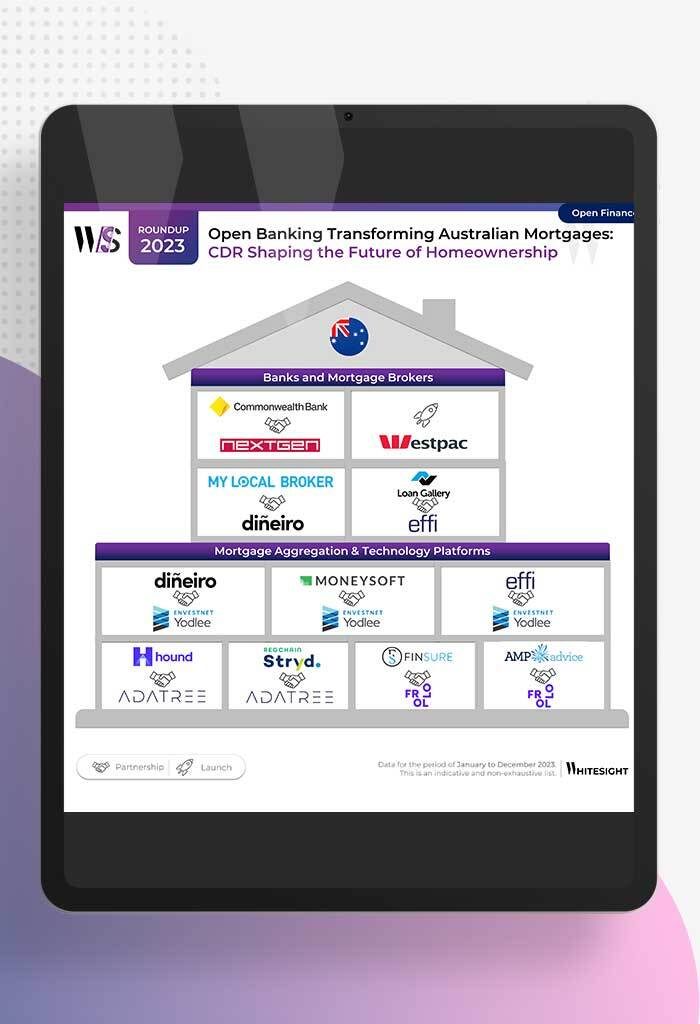

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

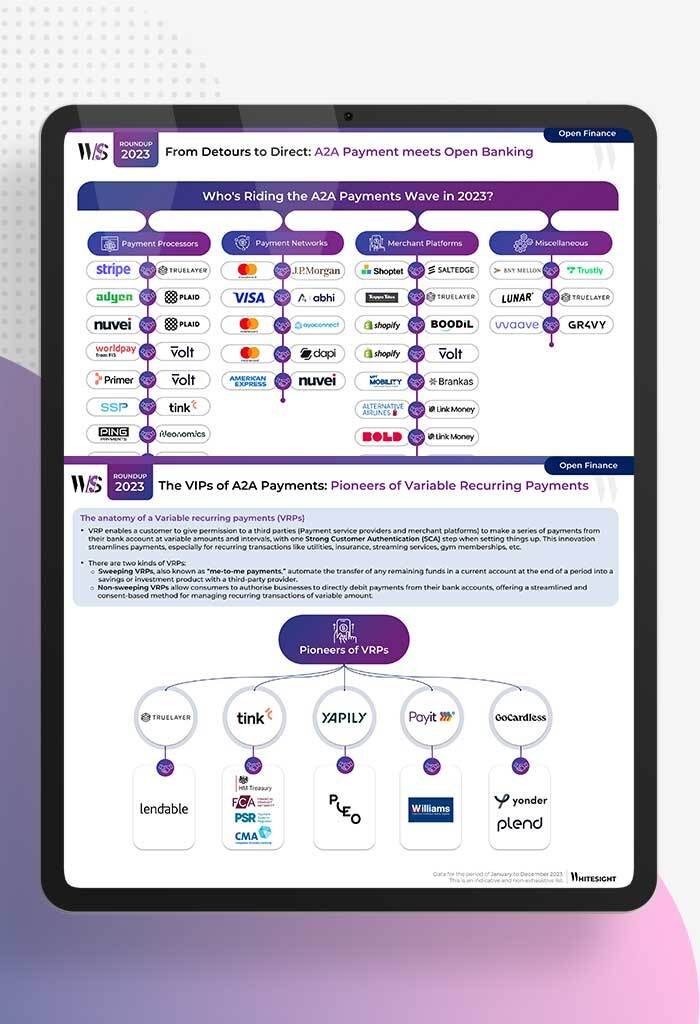

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

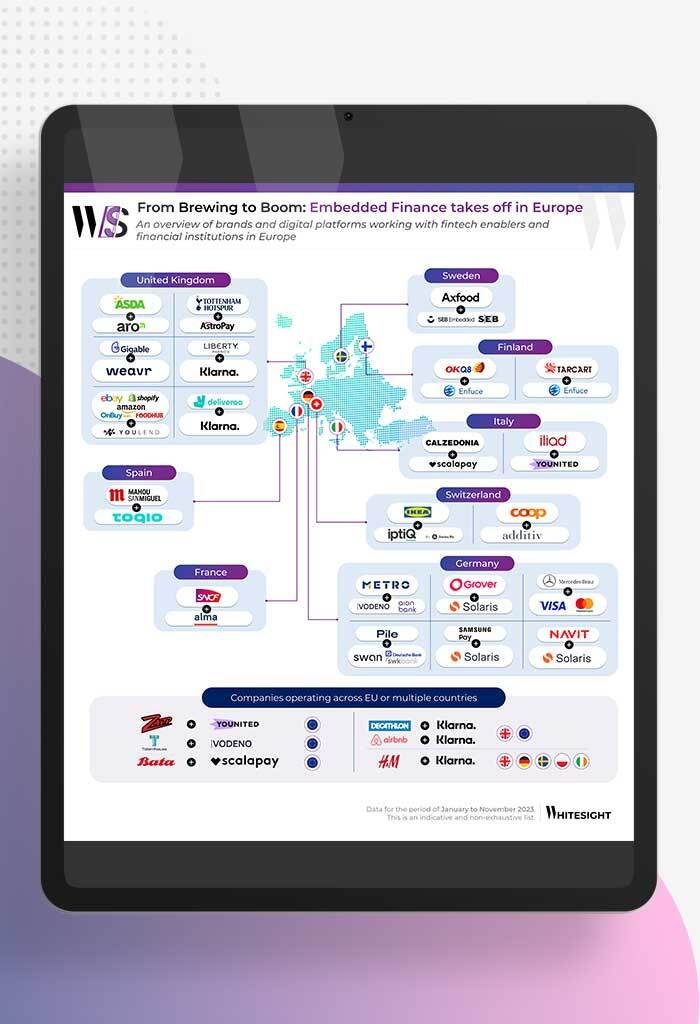

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

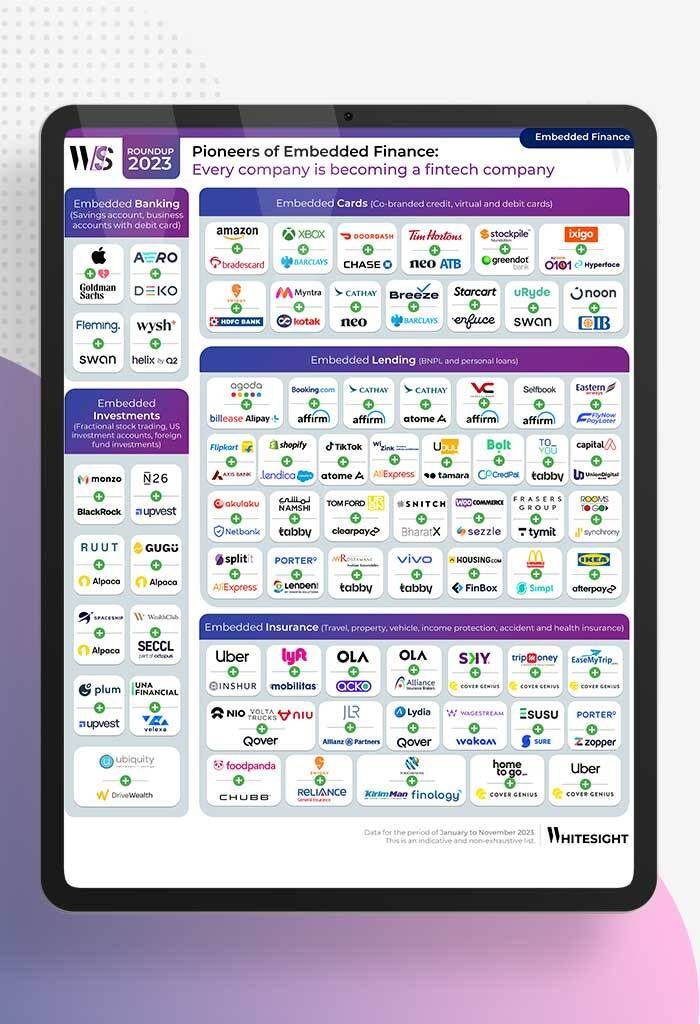

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...