2023 Roundup: Embedded Insurance as the Gig Economy’s Safety Harness

- Kshitija Kaur and Risav Chakraborty

- 3 mins read

- Embedded Finance, Insights

Table of Contents

Insurtechs: The New Guardians of the Gigaxy? Life in the gig lane is a rollercoaster, isn’t it? You’ve got the freedom to choose your gigs, working in your PJs from the comfy corners of your home, car, or bike, and being the boss of your own destiny. But let’s be real, it’s not all high-fives and victory dances. Without the safety net of sick days, health benefits, or the cosy cushion of job security, it’s like walking a tightrope without a net. And with gig workers making up ~12% of workers worldwide, that’s a lot of folks walking that line, especially women and the younger crowd.Most gig workers wouldn’t trade this freedom for a desk job, not even for a fatter paycheck. But, as they say, with great freedom comes great… risk. So, how are fintechs and insurtechs looking out for these maverick earners? For gig workers, the traditional insurance menu won’t cut it; they need a whole new recipe. Insurance needs to be tailor-made to fit the unpredictable nature of gig work and served up exactly when and where these hustlers clock in. Enter Embedded Insurance, swooping in to mix a dash of security into the gig economy cocktail.In […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

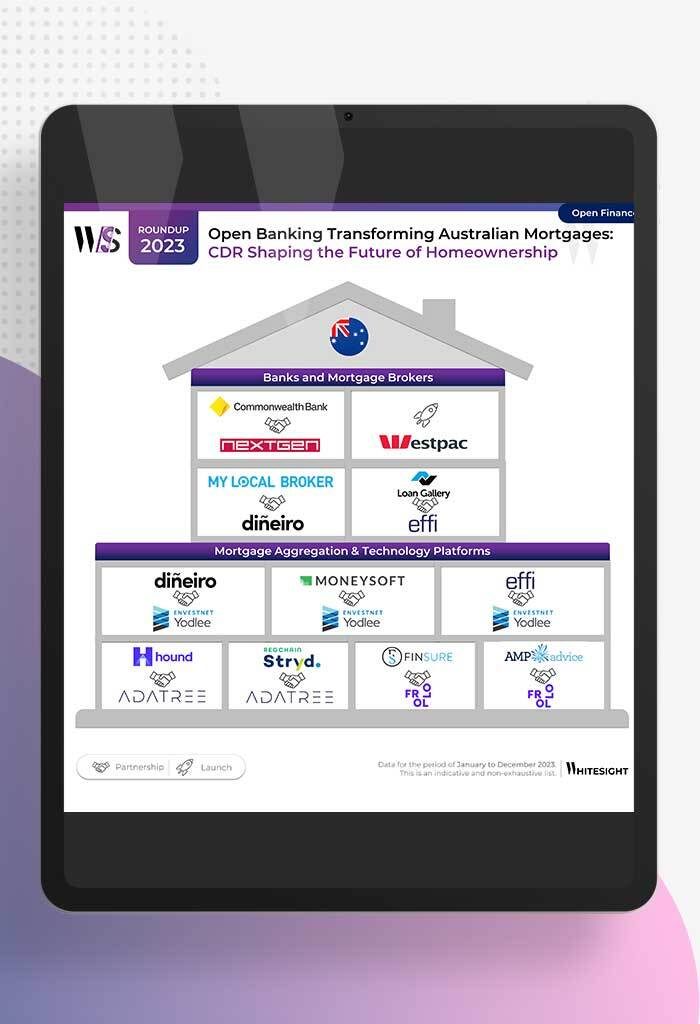

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

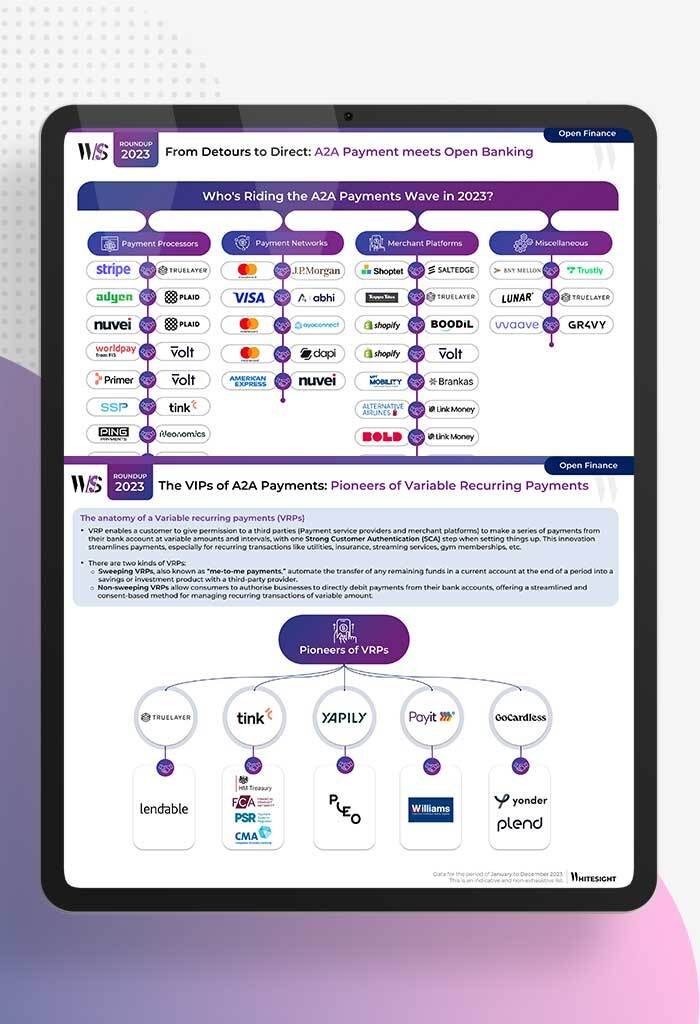

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

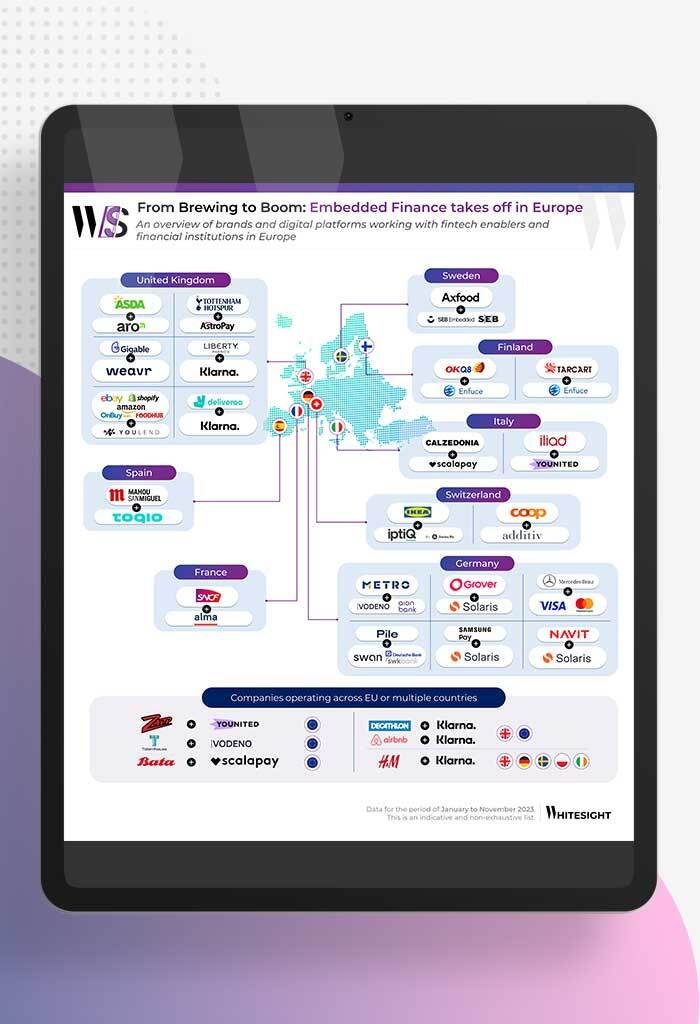

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

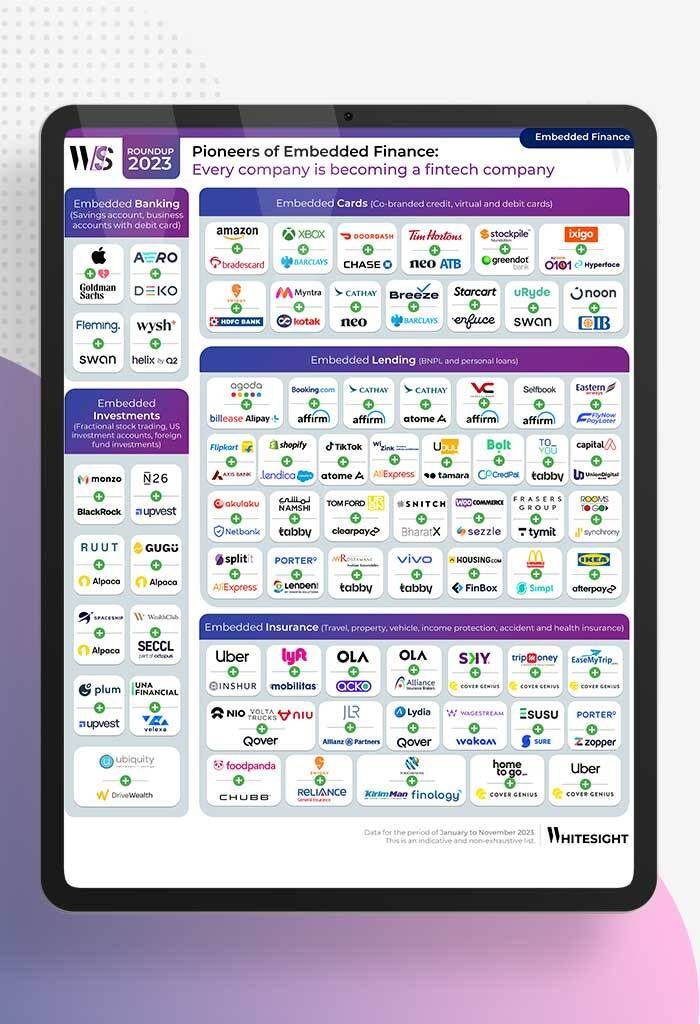

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...