2023 Roundup: Embedded Insurance as the Gig Economy’s Safety Harness

- Kshitija Kaur and Risav Chakraborty

- 3 mins read

- Embedded Finance, Insights

Table of Contents

Insurtechs: The New Guardians of the Gigaxy? Life in the gig lane is a rollercoaster, isn’t it? You’ve got the freedom to choose your gigs, working in your PJs from the comfy corners of your home, car, or bike, and being the boss of your own destiny. But let’s be real, it’s not all high-fives and victory dances. Without the safety net of sick days, health benefits, or the cosy cushion of job security, it’s like walking a tightrope without a net. And with gig workers making up ~12% of workers worldwide, that’s a lot of folks walking that line, especially women and the younger crowd.Most gig workers wouldn’t trade this freedom for a desk job, not even for a fatter paycheck. But, as they say, with great freedom comes great… risk. So, how are fintechs and insurtechs looking out for these maverick earners? For gig workers, the traditional insurance menu won’t cut it; they need a whole new recipe. Insurance needs to be tailor-made to fit the unpredictable nature of gig work and served up exactly when and where these hustlers clock in. Enter Embedded Insurance, swooping in to mix a dash of security into the gig economy cocktail.In […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

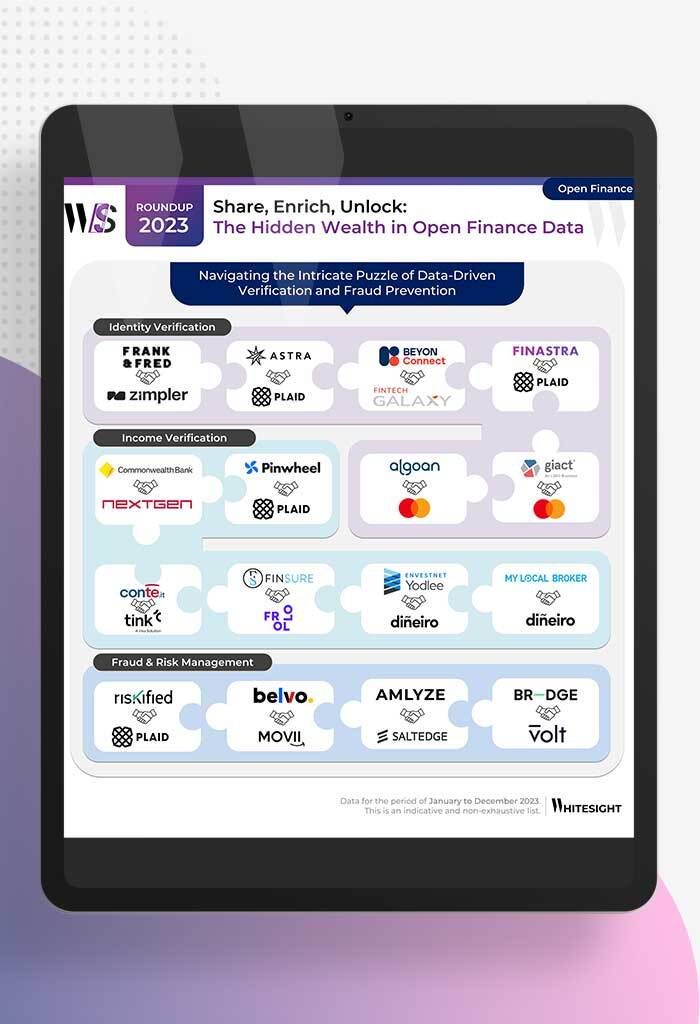

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

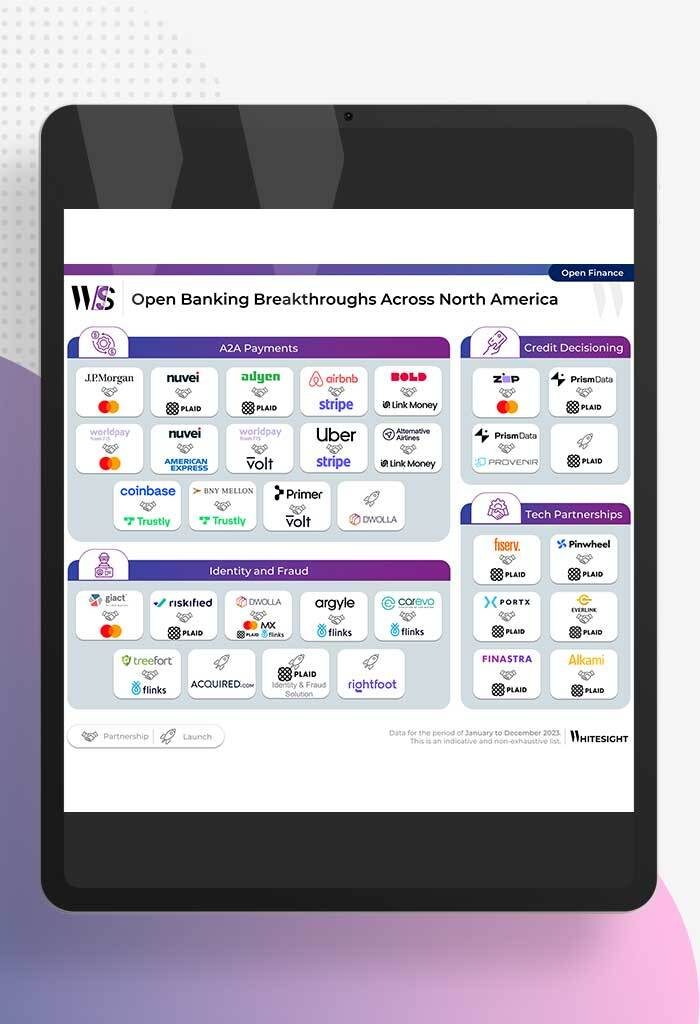

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

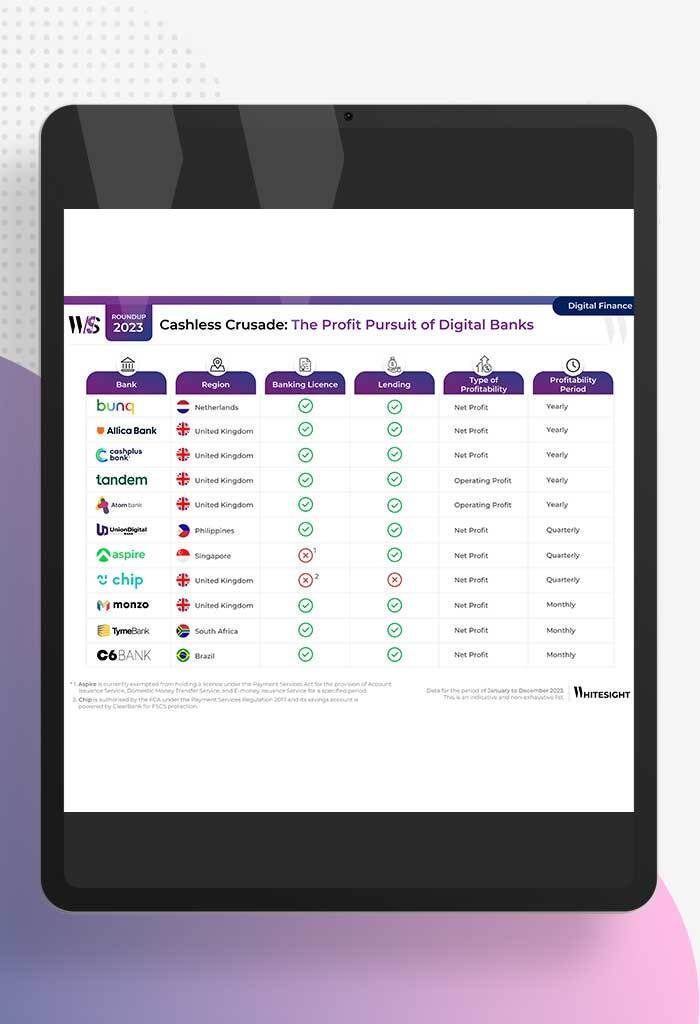

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

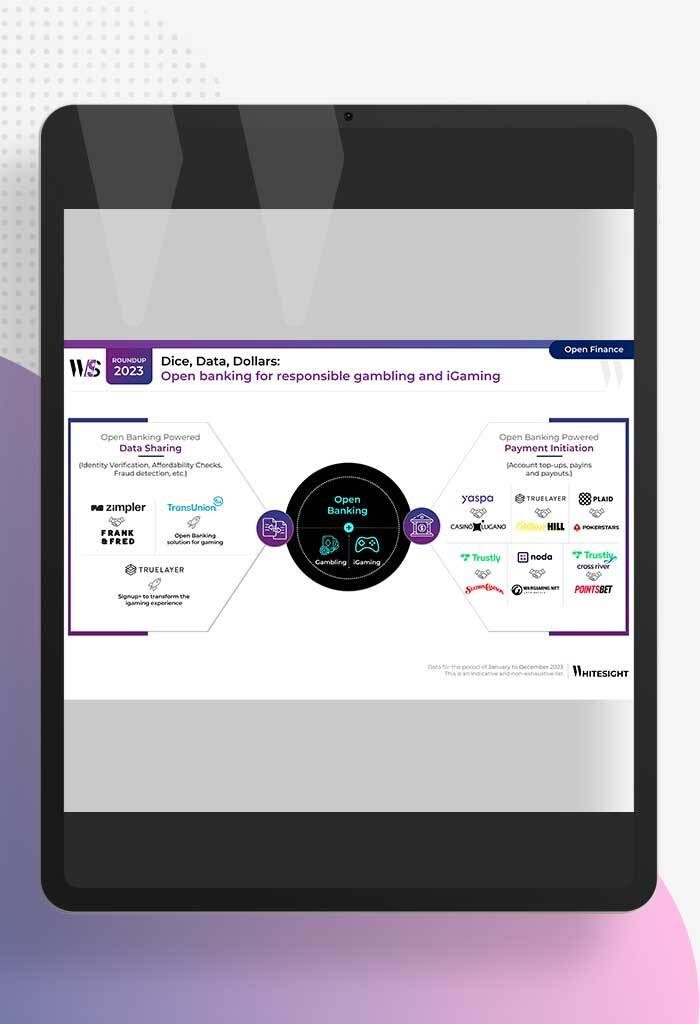

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

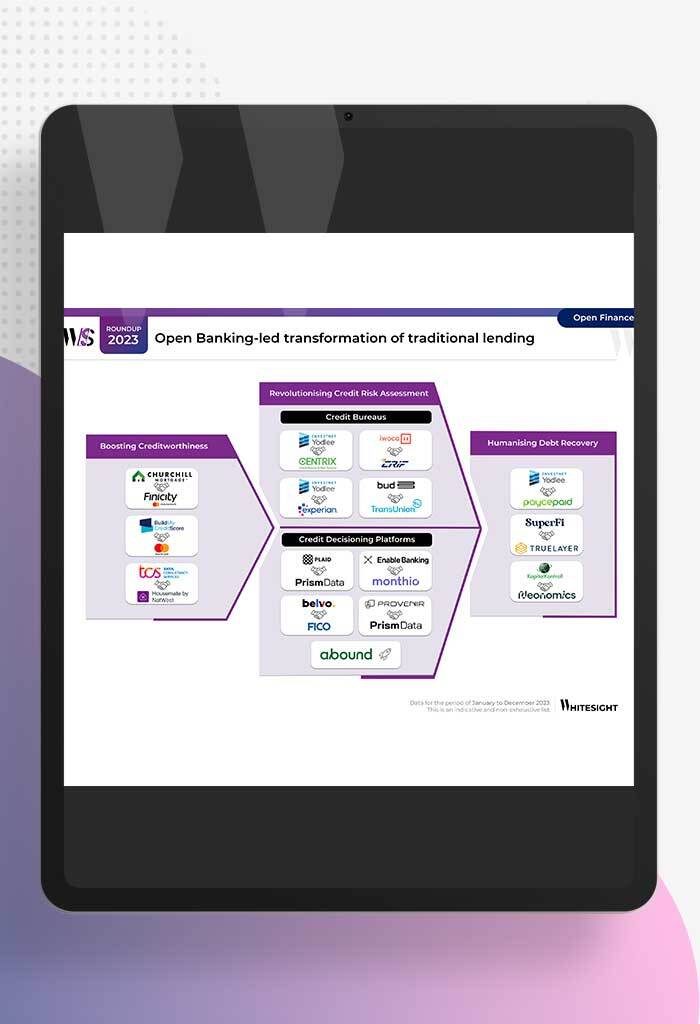

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

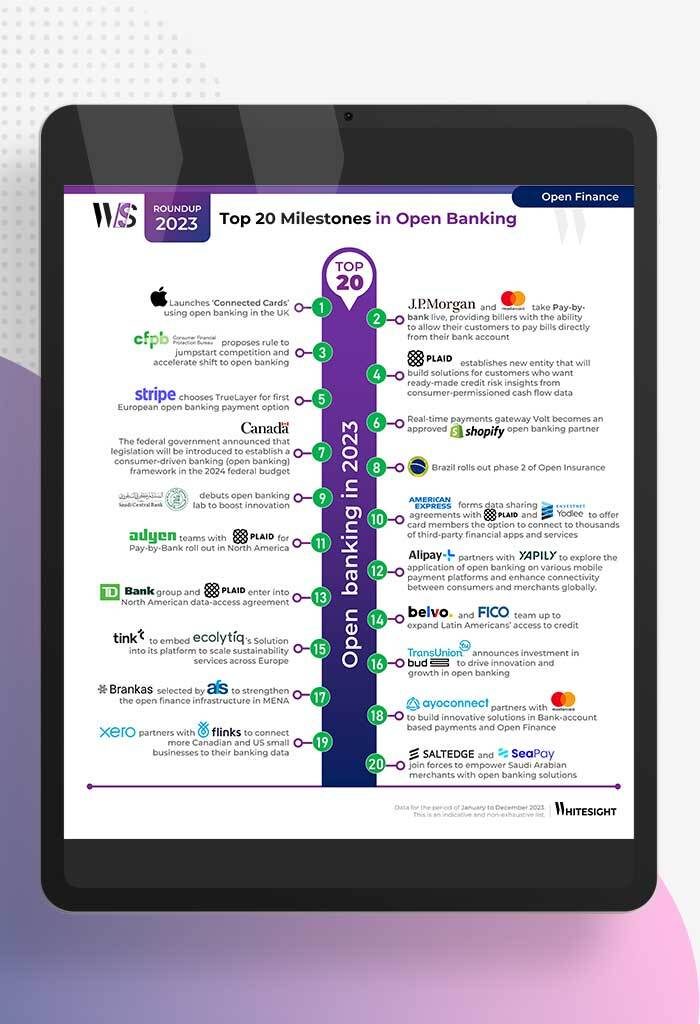

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...