2023 Roundup: SMB Financing Gets a Makeover with Embedded Finance

- Risav Chakraborty and Sanjeev Kumar

- 3 mins read

- Embedded Finance, Insights

Table of Contents

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional financial institutions may feel like trying to convince a cat to take a bath—challenging, frustrating, and often ending in scratches. Despite being the unsung heroes of the global economy, SMBs have been stuck in a quagmire, dealing with paperwork mountains, collateral hurdles, and credit history-perfectionist gatekeepers. A survey by EY highlights that 48% of SMBs yearn for swift credit access, as they find themselves grappling with loan processes so intricate they make a Rubik’s cube look like child’s play. Traditional credit models applied by incumbent financial institutions fall short in catering to SMBs’ diverse and rapid needs, leading to low approval rates and high costs of capital. The focus on larger loan sizes, reliance on credit bureau data, and an asset-centric approach contribute to the financial exclusion of SMBs with limited credit history from formal credit channels. This exclusion creates a cyclical dilemma for SMBs, as rejected loan applications prevent them from building a credit history, perpetuating their exclusion. Enter the world of embedded lending, which addresses several challenges that previously hindered market players from becoming lenders, such as the high […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

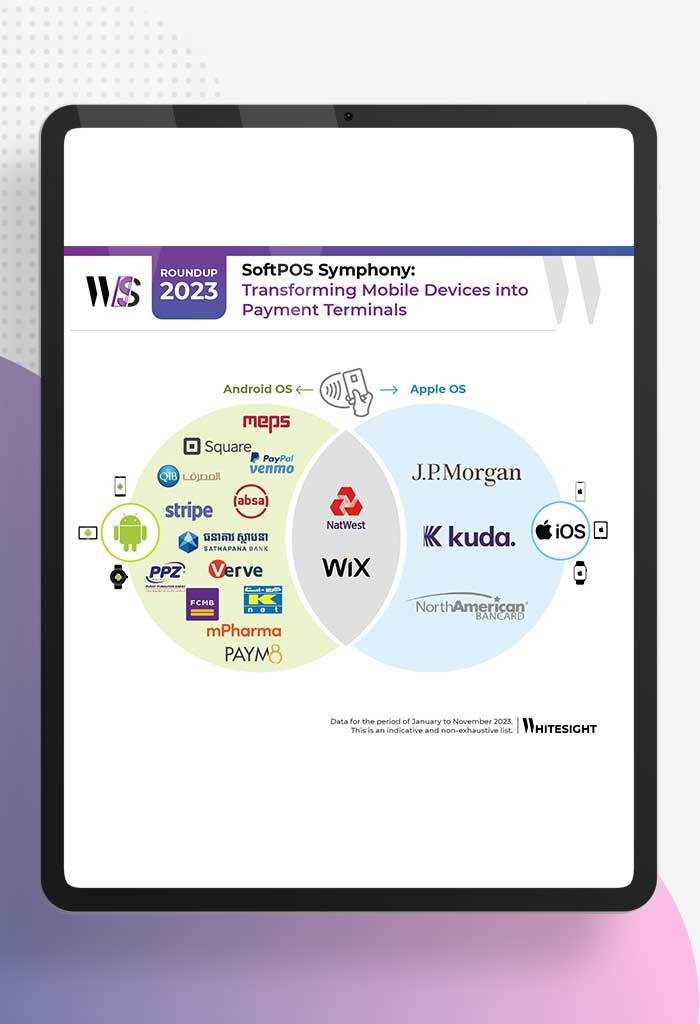

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

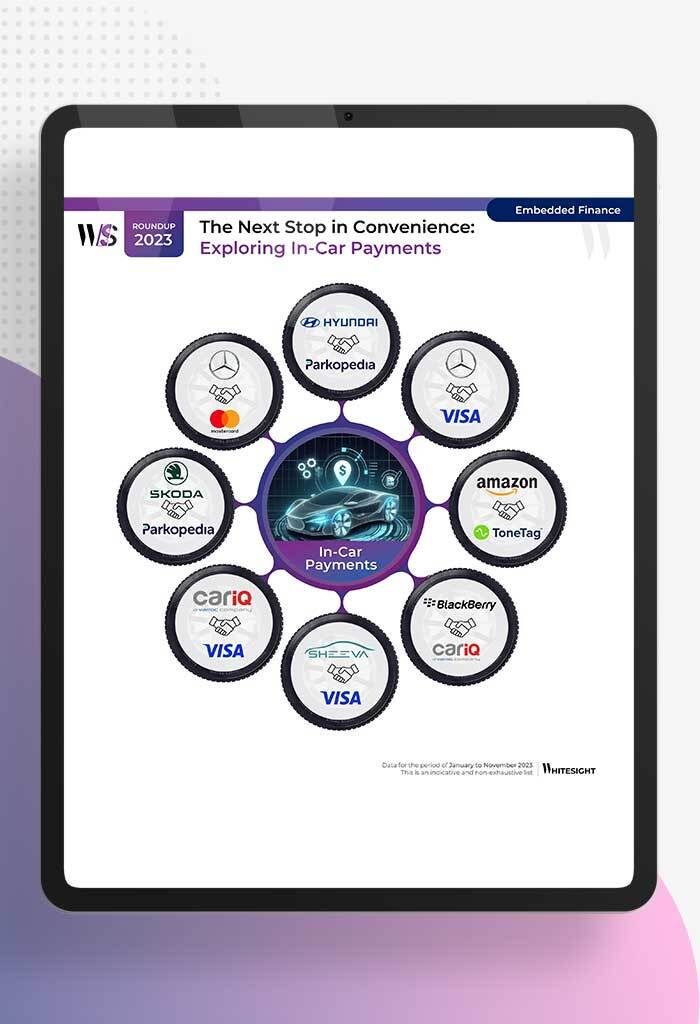

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

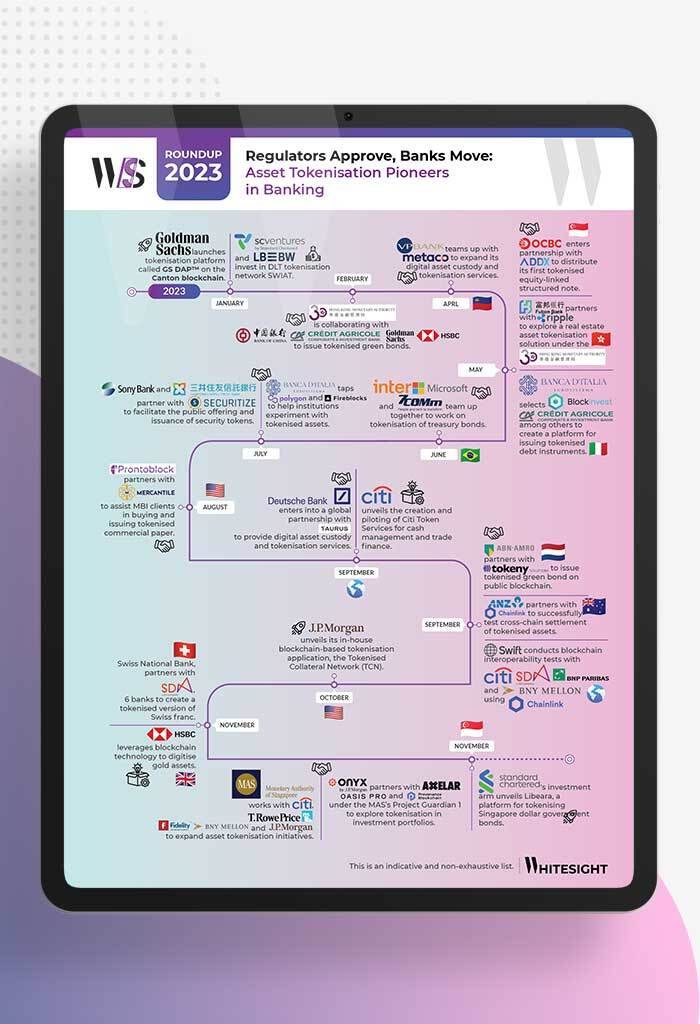

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

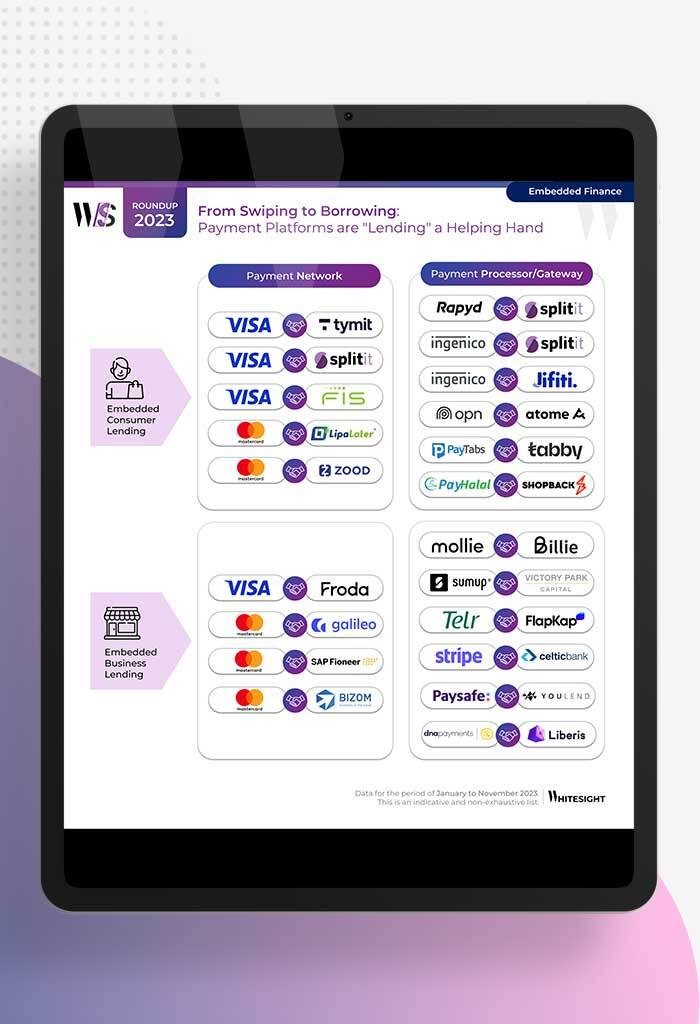

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Samridhi Singh and Kshitija Kaur

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...