2023 Roundup: Transforming Transactions with A2A Payments

- Kshitija Kaur and Sanjeev Kumar

- 5 mins read

- Insights, Open Finance

Table of Contents

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect you to an available executive”.“It looks like your query is handled by another department at our firm. Please wait while we transfer your call to the concerned department”.“Sorry, it looks like we’re going to have to transfer your call to our supervisor so that they can resolve your issue”.Yeah, we’ve all been there – having felt the frustration of calling customer service, only to be shuffled around like a deck of cards between support teams before reaching the desired person. Now imagine the same thing happening with your transactions, where multiple intermediaries like payment gateways, orchestrators, processors, and networks are involved each time you swipe your card at a merchant outlet, website, or app. Although these intermediaries ensure the process is seamless and instant for consumers, they not only charge merchants a fee for their services but also often cause a delay in funds settlements. This is where account-to-account (A2A) payments come in, enabling a financial world where your money doesn’t have to endure such bureaucratic back-and-forth. Simply put, A2A payments (or bank-to-bank payments) are used to directly transfer money from […]

This post is only available to members.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

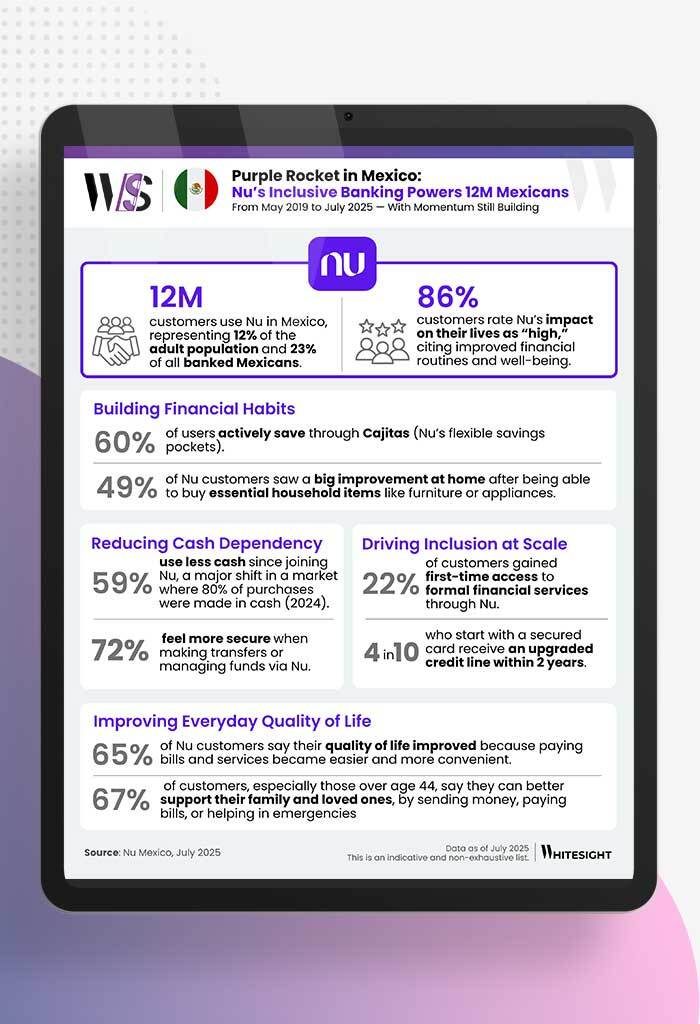

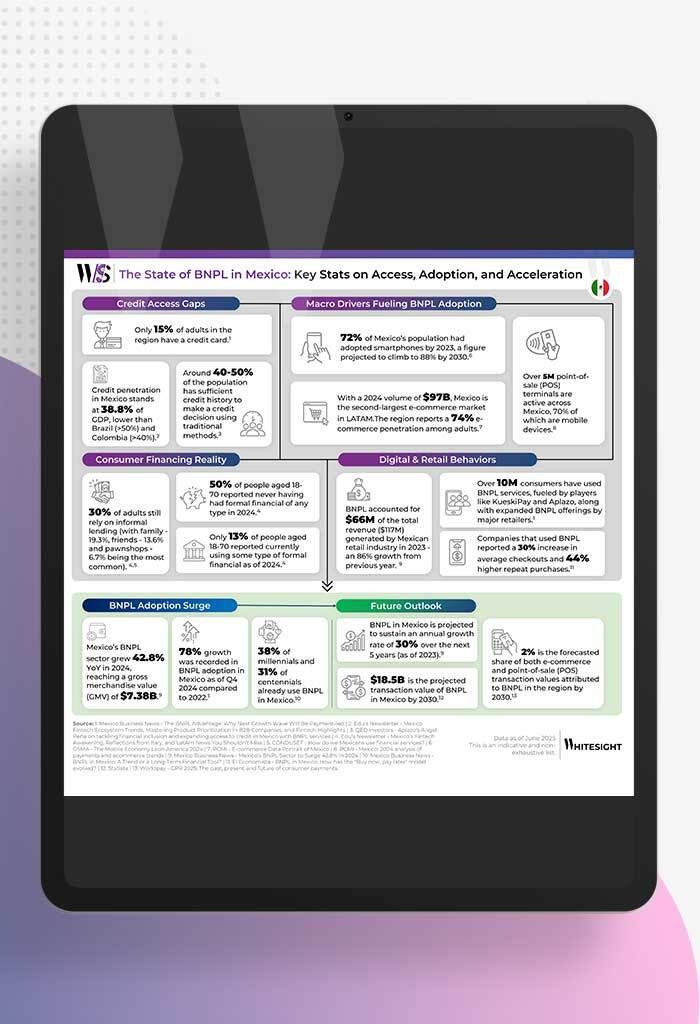

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar