2023 Roundup: The Surge of Card Issuing Innovations by Payment Processors

- Risav Chakraborty and Sanjeev Kumar

- 3 mins read

- Embedded Finance, Insights

Table of Contents

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank? It’s like asking your GPS for directions and ending up in Narnia—confusing, time-consuming, and being unsure on how you got there. Merchants, big and small, have found themselves in a similar situation, desperately wanting a simple way to provide cards to their employees, suppliers, and consumers without navigating through the labyrinthine bureaucracy of conventional banks. In 2023, payment service providers (PSPs) donned the cape of card issuance superheroes, giving businesses the power to issue customised virtual and physical cards. In the ongoing evolution of the payment and banking sector, the payment card has emerged as the crucial connection to the ultimate consumer. Inflexible legacy technology has meant that various integrations, extensive regulatory compliance demands, and operational inefficiencies have hindered businesses from getting a share of the interchange fees. According to Allied Market Research, the global cards market was valued at $524.9B in 2022 and is projected to reach $1.2T by 2032, growing at a CAGR of 8.8% from 2023 to 2032. Swipe into the Future: PSPs’ Cardistry Mastery In 2023, PSPs played a pivotal role in transforming the landscape by providing […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

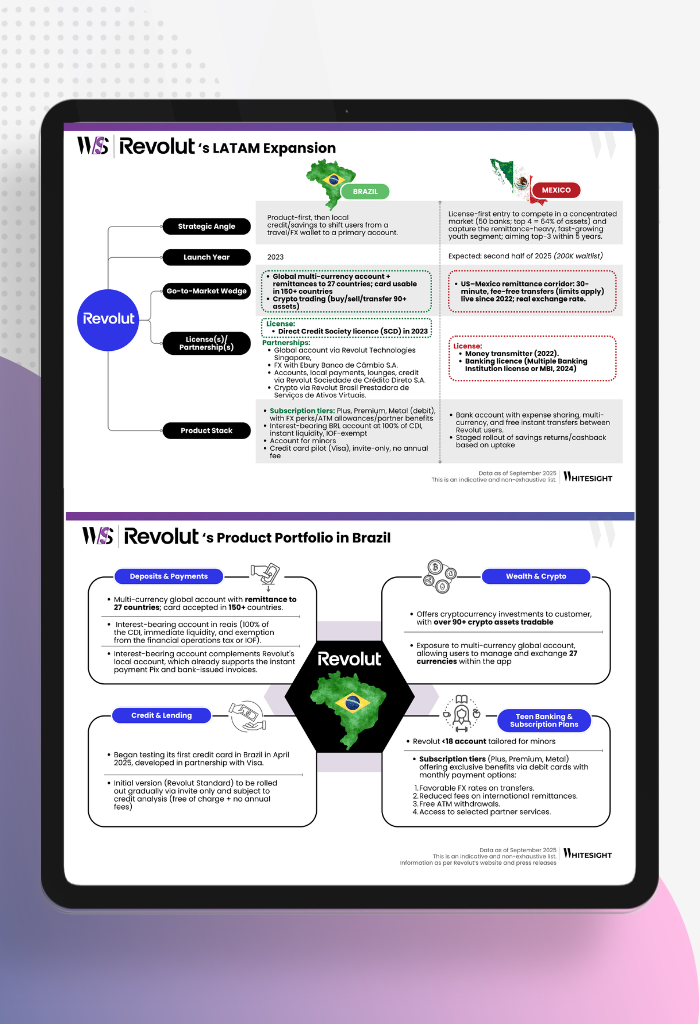

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

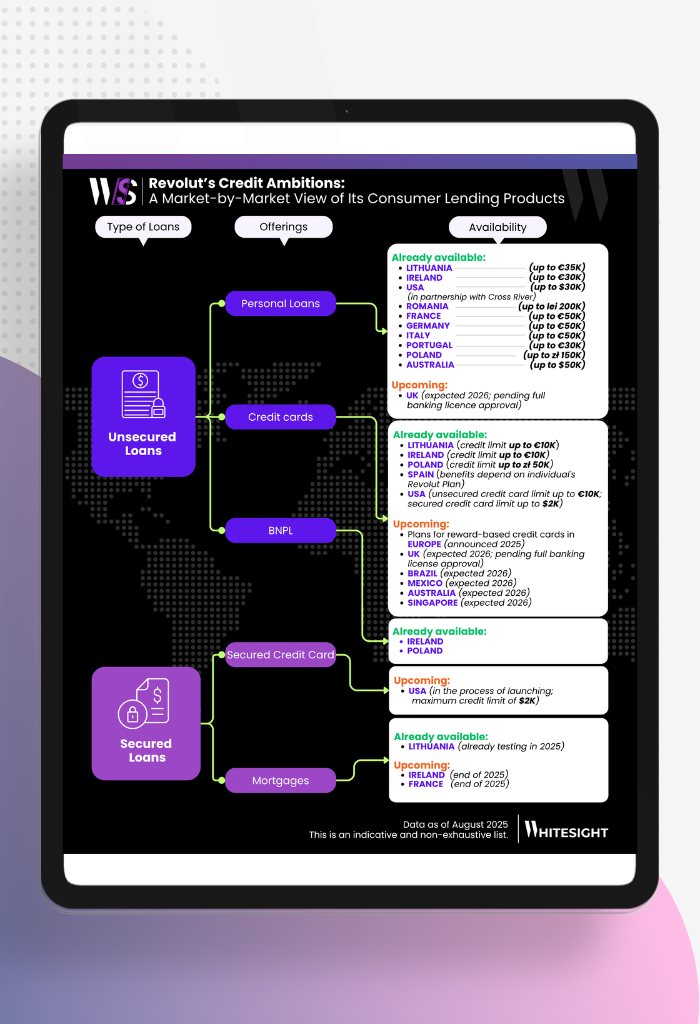

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

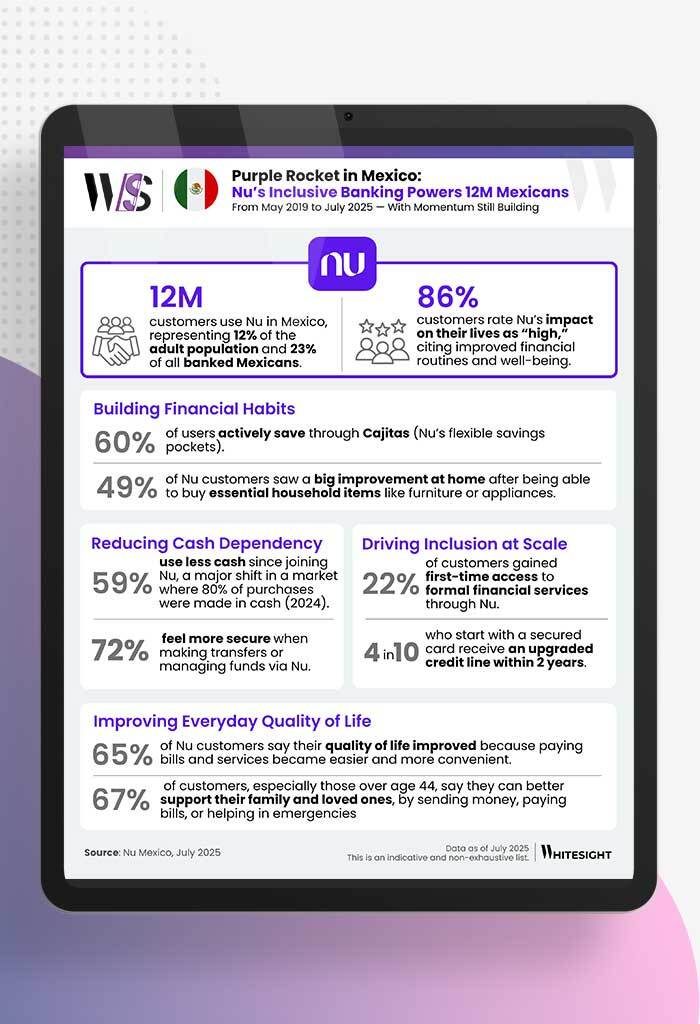

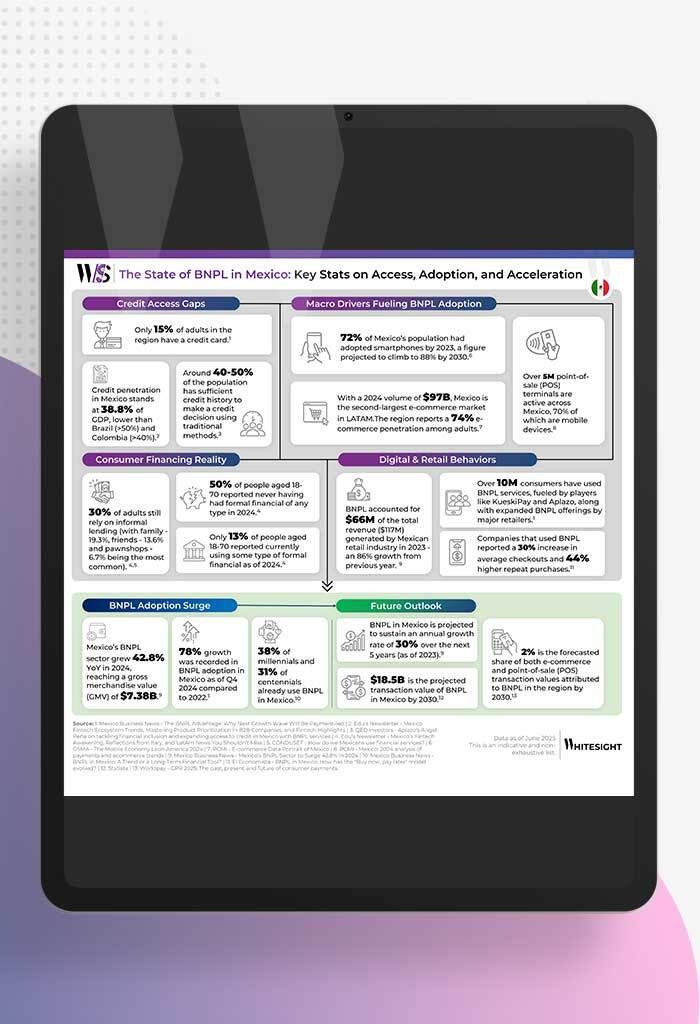

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar