2023 Roundup – The State of Embedded Finance

- Sanjeev Kumar and Samridhi Singh

- 4 mins read

- Embedded Finance, Insights

Table of Contents

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would be the trendsetter in 2023. Last year, we saw an unprecedented acceleration in the game-changing trend where companies outside the traditional banking sector jumped into the financial services pool. They’re not just dipping their toes either – they’re diving in headfirst through innovative partnerships to offer financial services such as wallets, bank accounts, debit and credit cards, credit, and insurance. These savvy collaborations are their golden ticket to accessing essential financial licences and heaps of valuable data. It’s a whole new playground where tech meets finance, and the possibilities? Your go-to shopping app has become a fashion-forward financial hub, allowing you to purchase your latest winter essentials or holiday gifts on credit. Even ride-hailing and online travel booking platforms have taken on a dual role, functioning as covert banks offering on-the-go insurance and convenient access to credit within the app.We’ve already delved into the deep trends of embedded finance for 2023, highlighting specific trends throughout the year. Excited to dive in? Take the plunge right here!Navigating the Rise of In-Car Payments, Payment Titans Go All-In on the Embedded Lending RevolutionSMB Financing […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

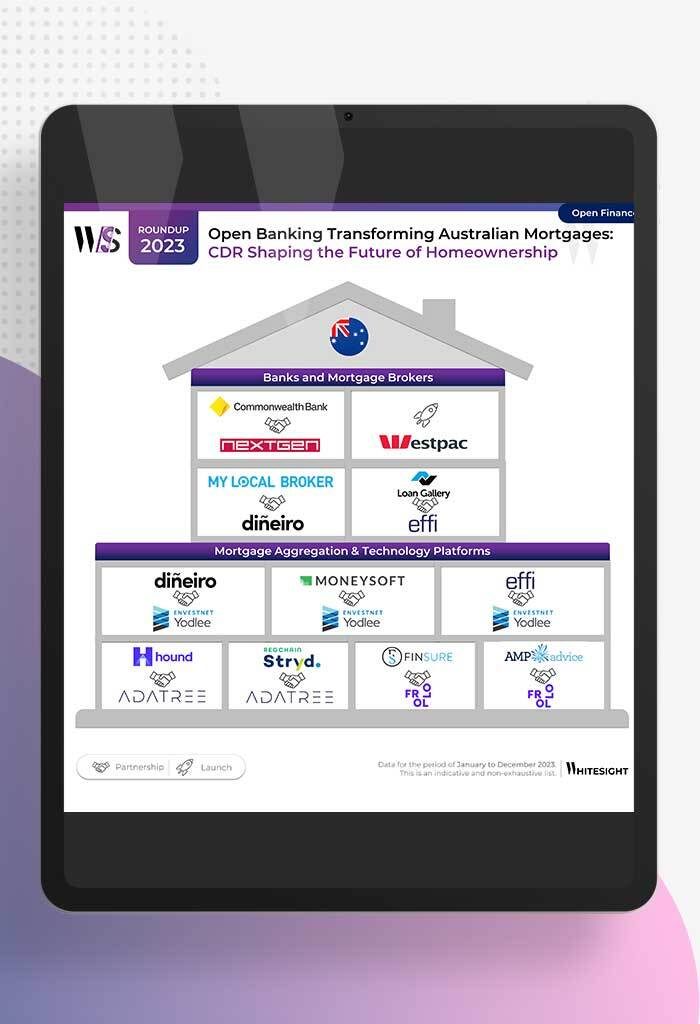

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

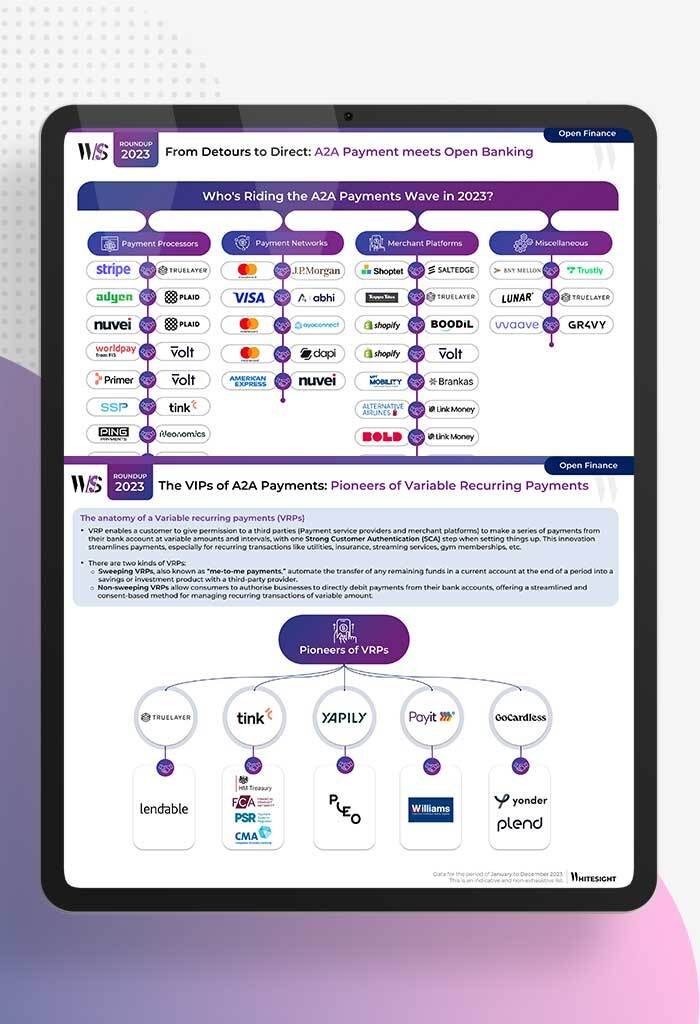

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

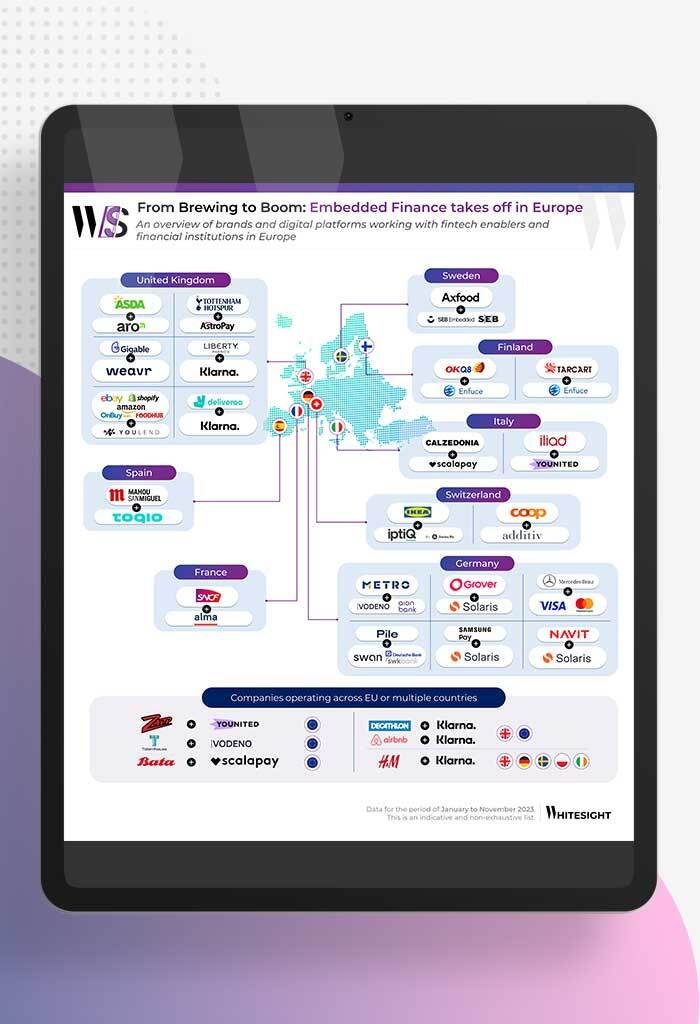

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...