Digital Bank Subsidiaries: What’s Cooking?

- Team WhiteSight

- 3 mins read

- Fintech Strategy, Insights

Table of Contents

The post-pandemic world is well-versed with astounding and demanding developments, met across unrealistic time frames, universally. The Digital Banking sphere is one such guest that managed to knock at the door towards revising its legacy-bound ways, so as to adapt to consumer shifts in an attempt to sustain its dominance in the race for the future.To initiate the foundation for the same, traditional banks took the path of innovation and agility to establish Digital Bank Subsidiaries, which are separate organizations of said larger, traditional banks, with emphasis on providing a more modular and streamlined end-to-end consumer experience as opposed to the current rigid structures.In fact, the observable trend this year is the upsurge of digital banks, the advent of which began in the West, and in recent years banks in Eastern geographies across the Asia Pacific, Middle East, and Africa are also spinning off digital banking arms at a rapid pace. This is already piquing the curiosity of many customers in the US, Europe, and Latin America as well. Why the urgency for such a swift transformation, you ask?The First Layer: Bittersweet BackgroundIn the wake of the debased reputation caused by factors of increased regulation, low interest rates, and a […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

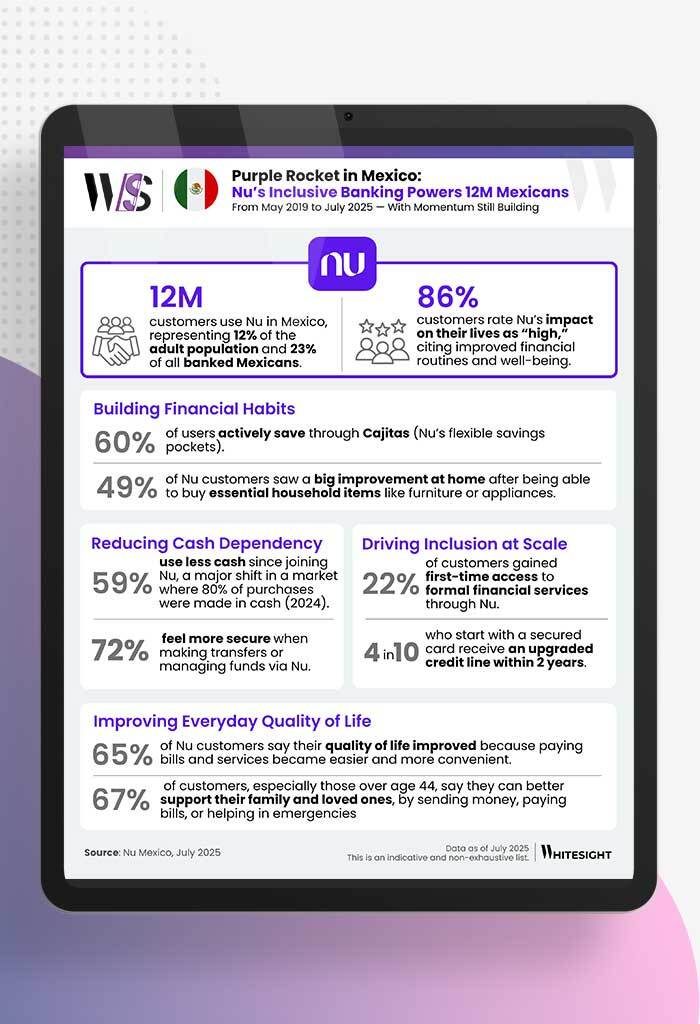

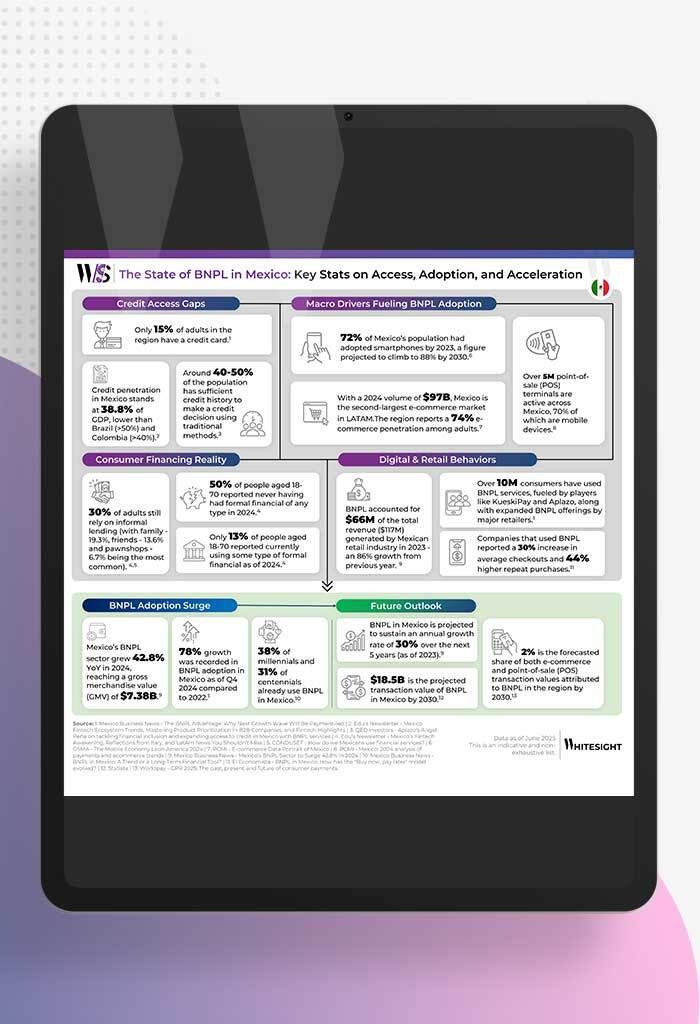

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar