African Neobanking: A Stellar And Steady Rise

- Kshitija Kaur

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

The banking sphere around the world has evolved tremendously in response to the consumers’ tastes shifting to more digital-first offerings. Be it digital banking, open banking, digital payments, the many delicate threads of such innovations have come together to collectively sew the fabric of neobanking.The first-generation neobanks have grown leaps and bounds in markets such as the UK, the US, and Brazil, gaining multi-billion dollar valuations and serving hundreds of millions of customers. The neobanking wave is now sweeping other emerging markets such as the Middle East, Southeast Asia, and Africa.In this post, we look at the intriguing landscape of African neobanks. Africa holds over 20% of the Earth’s land area more than China, Canada, and the US combined, and is home to about 16% of the world’s population. A majority of the African population is still unbanked and underbanked presenting a breeding ground for neobanks to emerge and flourish. Emerging Embroidery: The PreambleAs an emerging contender in the game of rising economies and financial breakthroughs, Africa has gained steady momentum despite its historical past. With challenges such as limited economic resources and an overall inadequacy in the region’s infrastructure, the gap between insubstantial capital and financial inclusion seems to […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

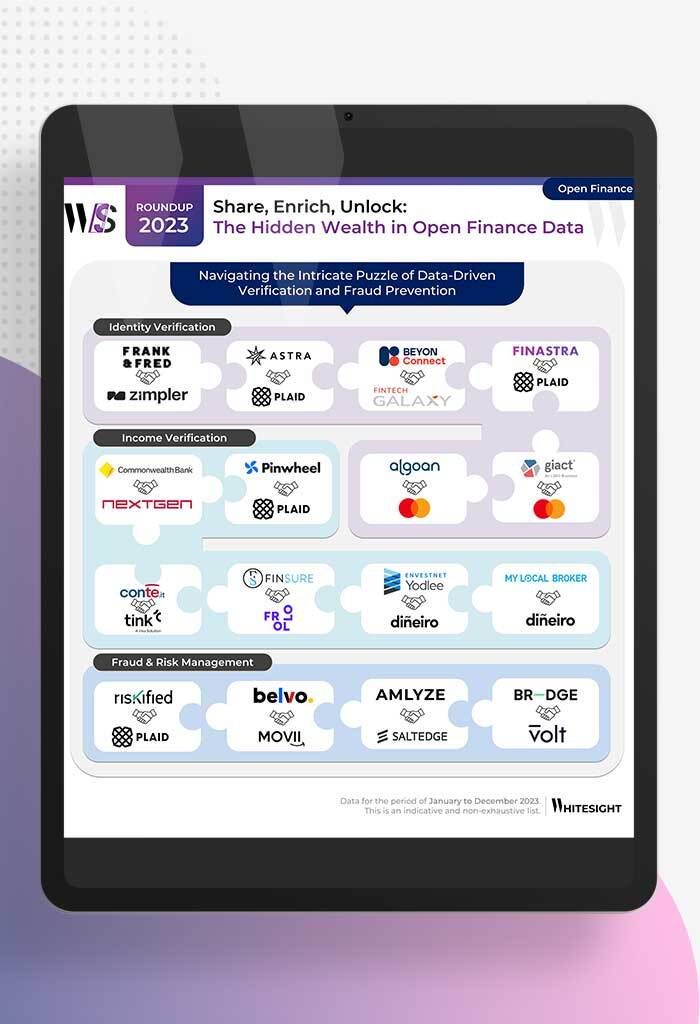

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

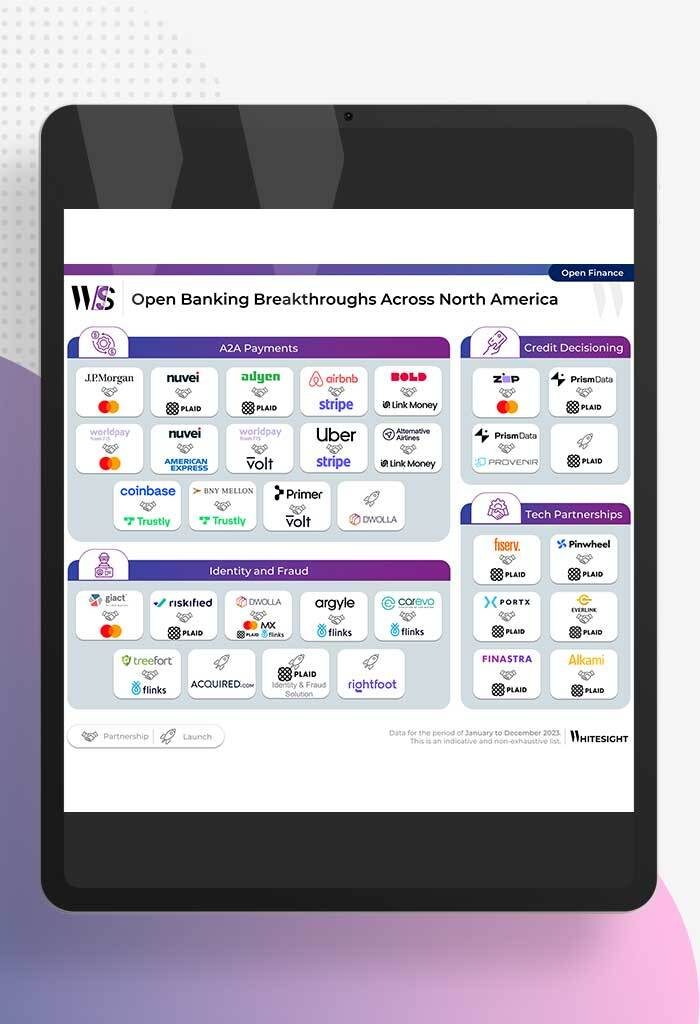

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

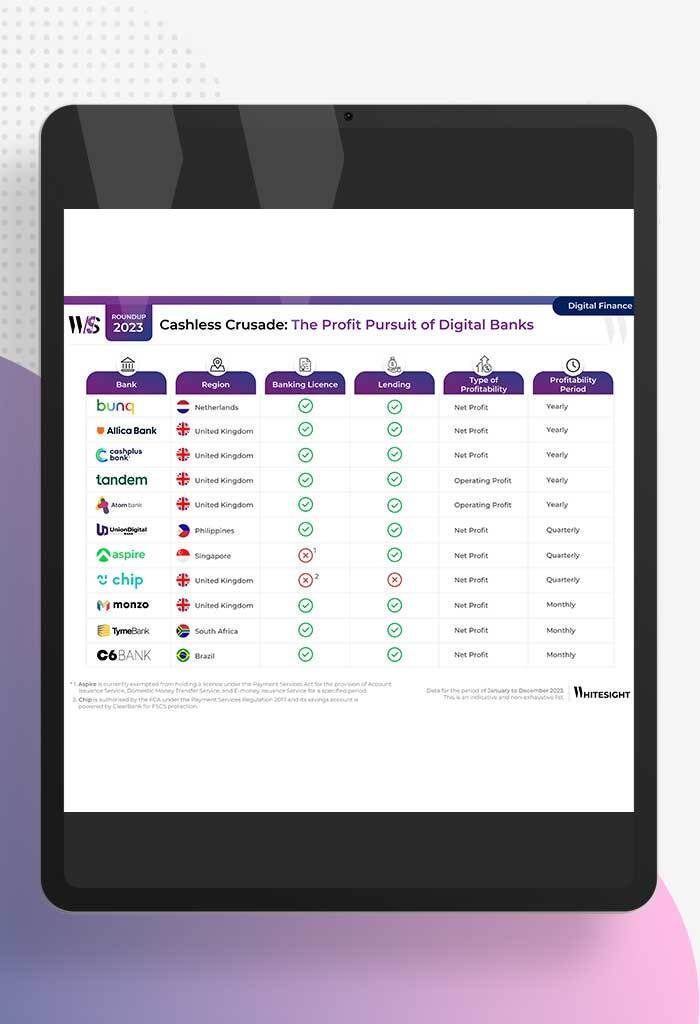

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

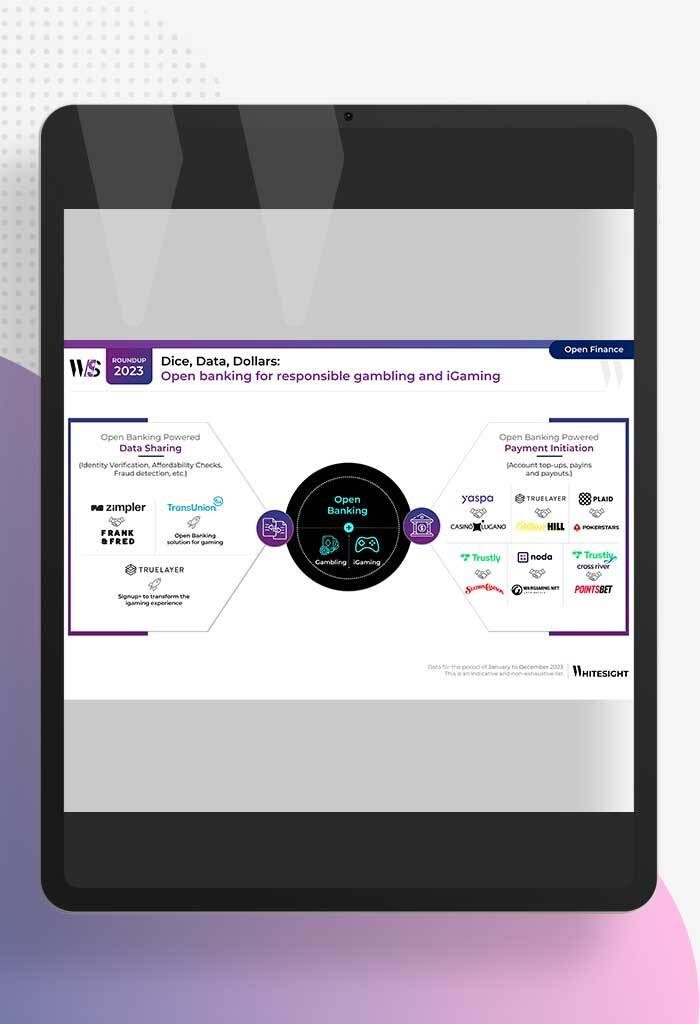

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

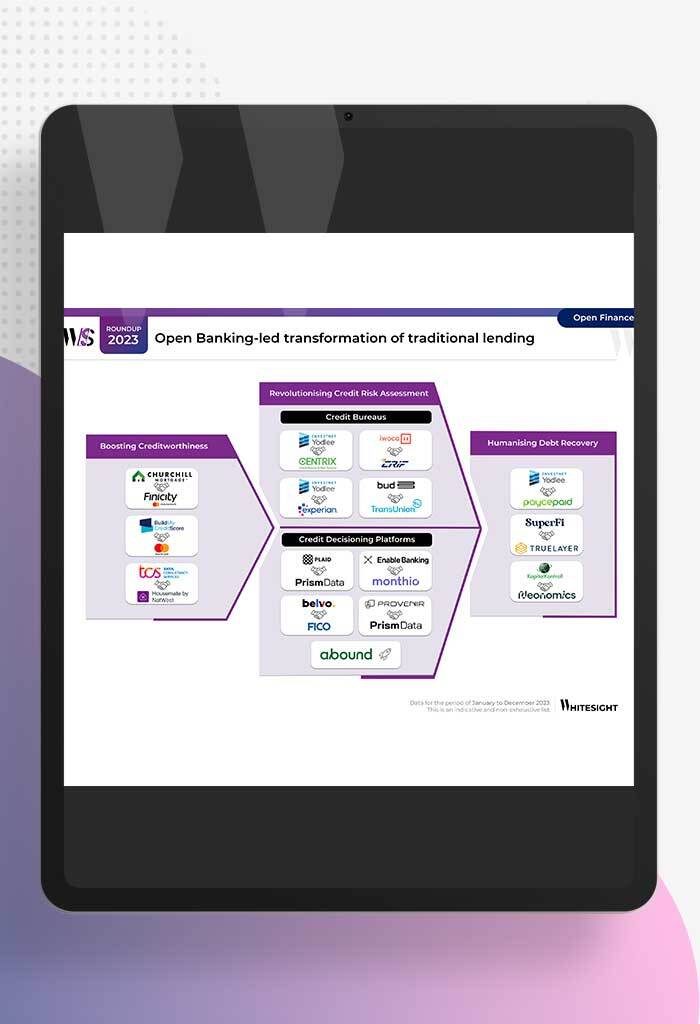

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

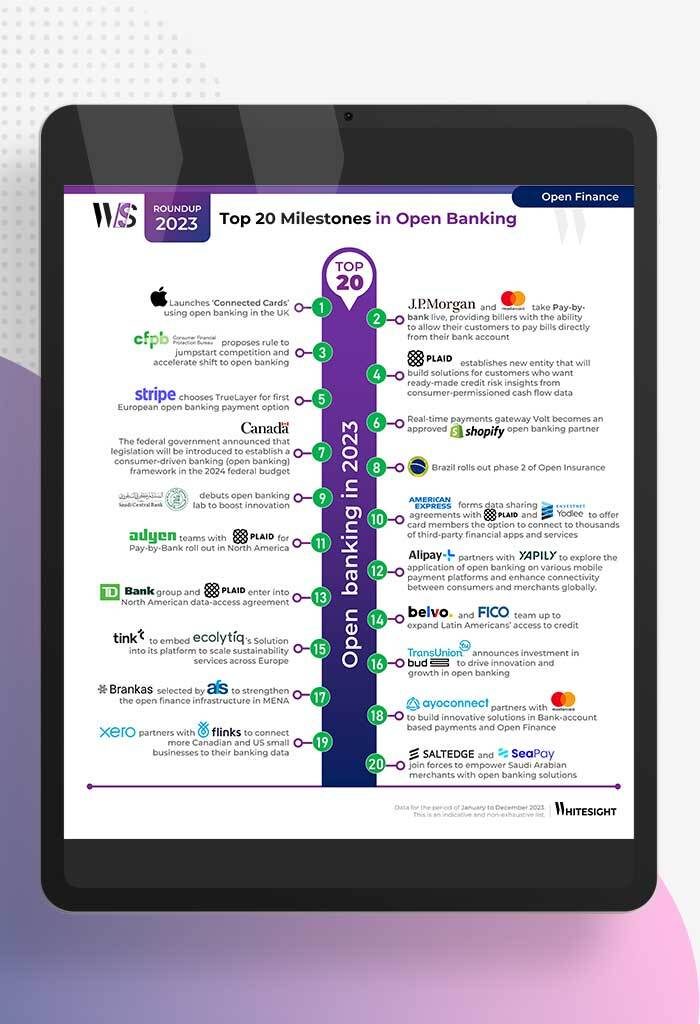

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...