African Neobanking: A Stellar And Steady Rise

- Kshitija Kaur

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

The banking sphere around the world has evolved tremendously in response to the consumers’ tastes shifting to more digital-first offerings. Be it digital banking, open banking, digital payments, the many delicate threads of such innovations have come together to collectively sew the fabric of neobanking.The first-generation neobanks have grown leaps and bounds in markets such as the UK, the US, and Brazil, gaining multi-billion dollar valuations and serving hundreds of millions of customers. The neobanking wave is now sweeping other emerging markets such as the Middle East, Southeast Asia, and Africa.In this post, we look at the intriguing landscape of African neobanks. Africa holds over 20% of the Earth’s land area more than China, Canada, and the US combined, and is home to about 16% of the world’s population. A majority of the African population is still unbanked and underbanked presenting a breeding ground for neobanks to emerge and flourish. Emerging Embroidery: The PreambleAs an emerging contender in the game of rising economies and financial breakthroughs, Africa has gained steady momentum despite its historical past. With challenges such as limited economic resources and an overall inadequacy in the region’s infrastructure, the gap between insubstantial capital and financial inclusion seems to […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Kshitija Kaur

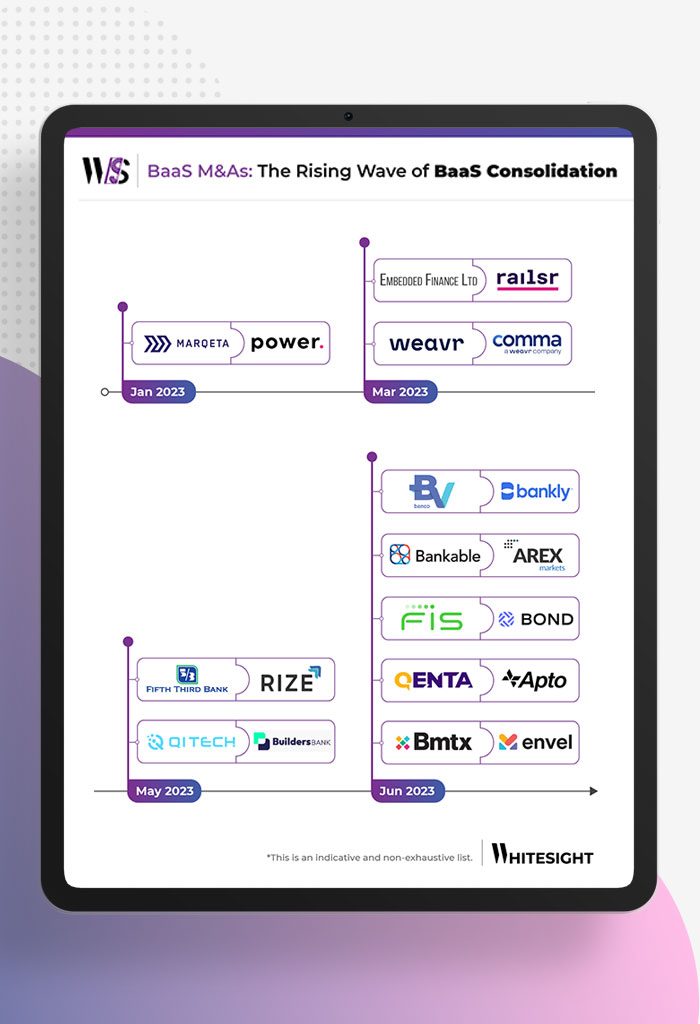

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...

- Risav Chakraborty and Kshitija Kaur

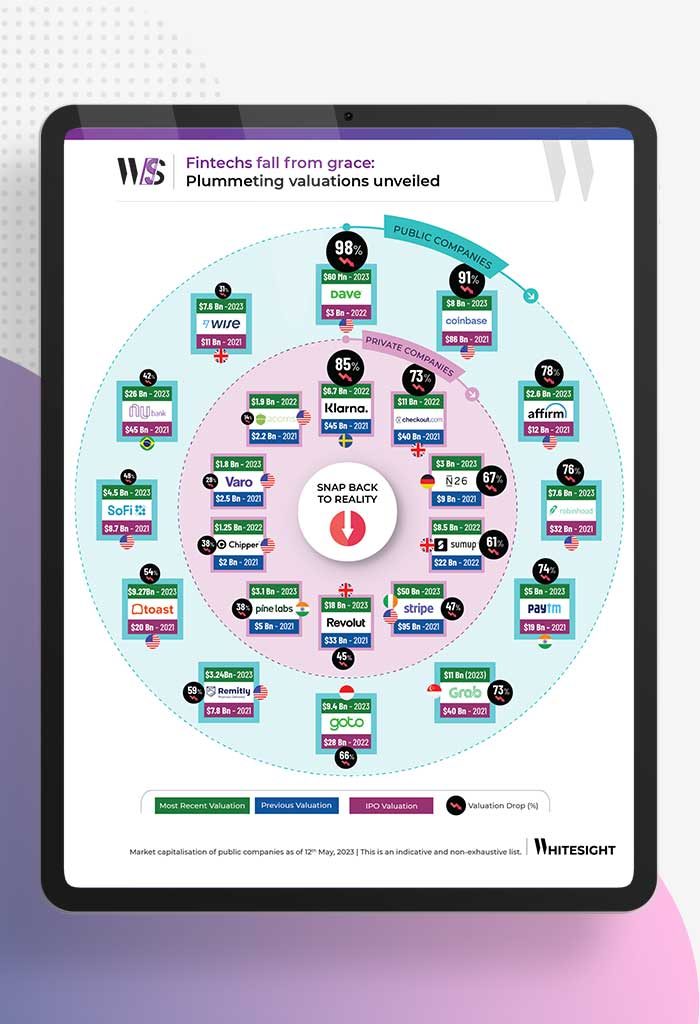

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced...

- Risav Chakraborty and Sanjeev Kumar

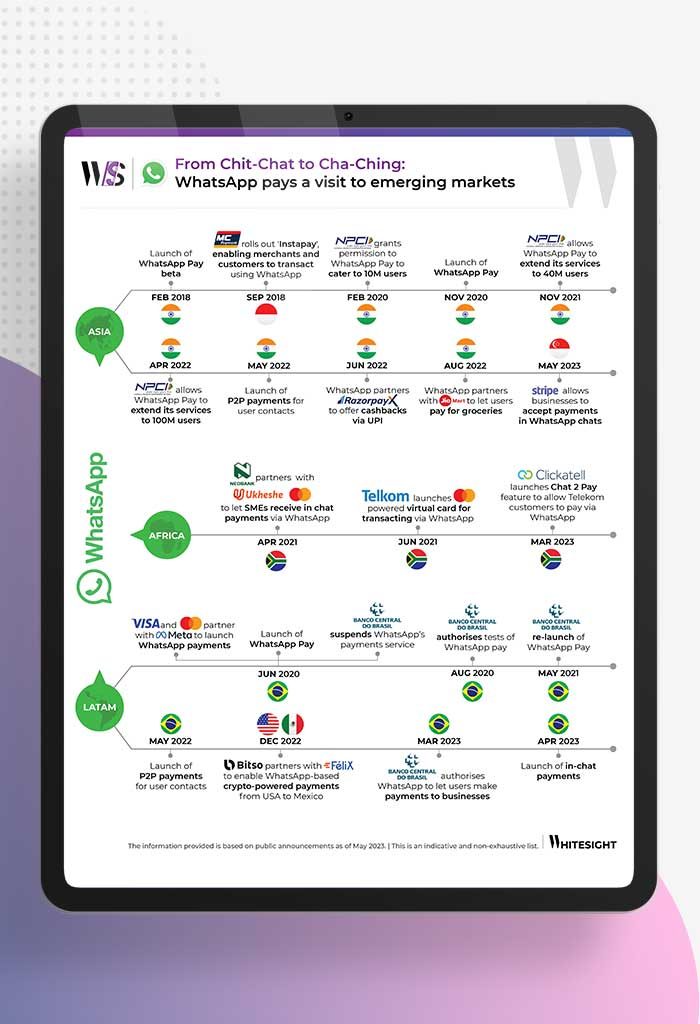

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to...

- Sanjeev Kumar and Samridhi Singh

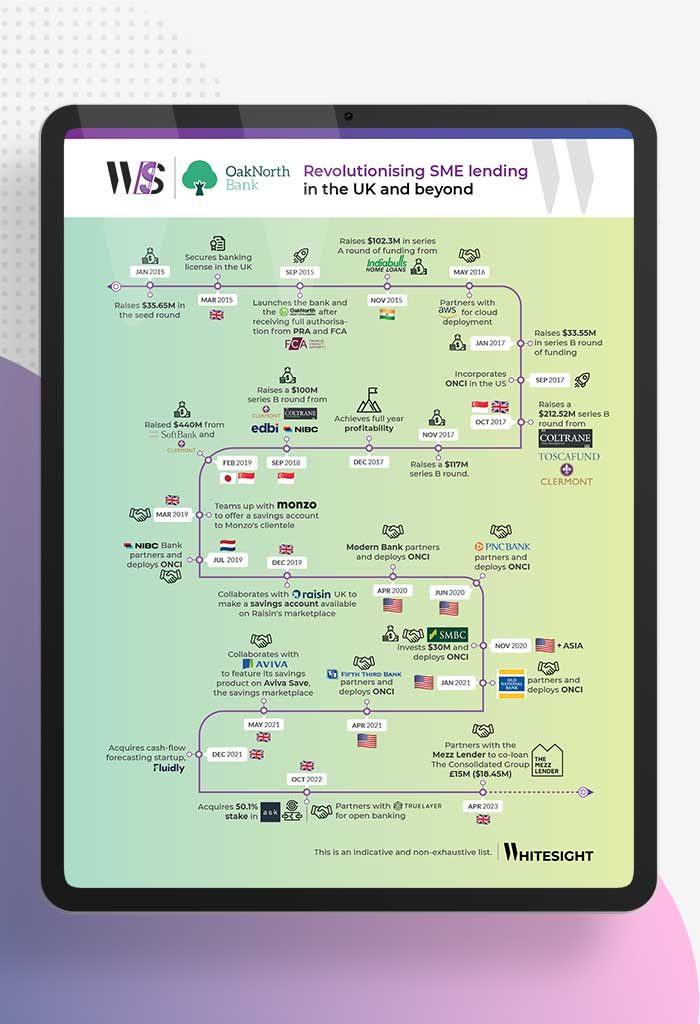

OakNorth has emerged as a standout in the fintech realm thanks to its exceptional business model that not only ensures...

- Sanjeev Kumar and Risav Chakraborty

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind....

- Afshan Dadan and Ananya Shetty

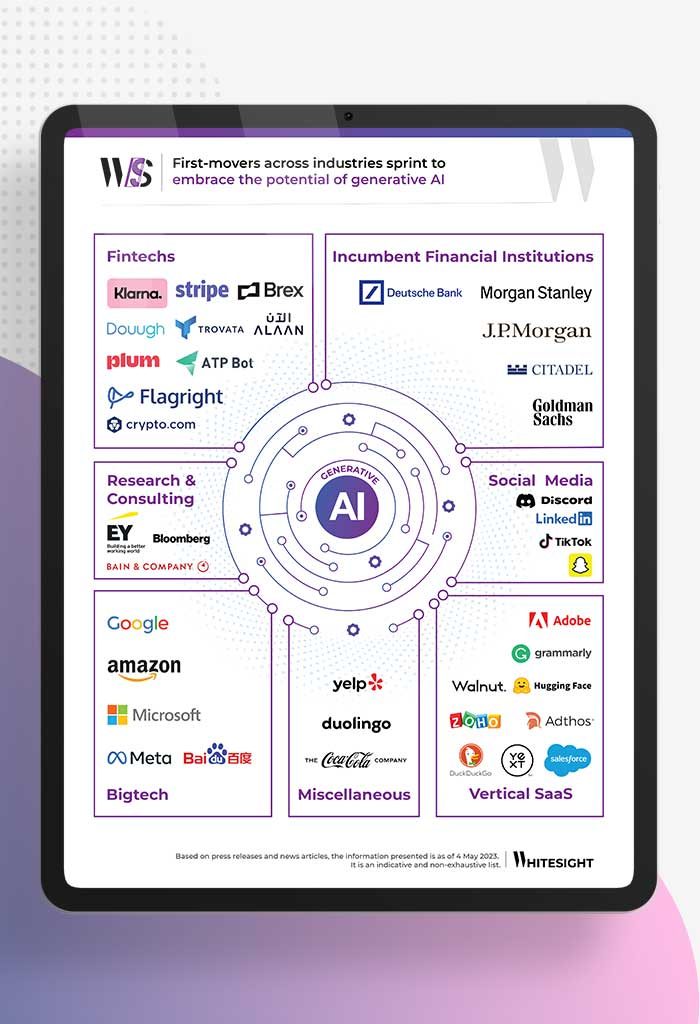

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT by Open AI, StyleGAN by NVDIA, DeepDream by Google) that can...