Fintech valuation dip – Correction or crash?

- Risav Chakraborty and Kshitija Kaur

- 3 mins read

- Insights, Market Trends

Table of Contents

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced venture capital investment, and falling valuations. Factors such as rising interest rates, rising inflation, and economic uncertainty have posed significant challenges for the sector. From Q3 to Q4 2022, fintech deals saw a sharp 52% drop, exceeding the overall 27% decrease in the venture market. With fintech valuations currently below their historical averages, a swift revival seems unlikely. In this blog, we expand upon our analysis from last year, which focused on public market fintechs, to encompass the noticeable downward trend that has now also permeated private markets. The great fintech adjustment The private market underwent significant upheaval in Q4 2022, and those ripples have definitely spilled into the early part of 2023. Prominent European fintech players, including Klarna, Checkout.com, and N26, witnessed drastic valuation reductions. Klarna, once Europe’s highest-valued startup, endured an 85% valuation drop, falling from $45B to a mere $6.7B in 2022. Similarly, Checkout.com underwent a 73% decrease, settling at an internal valuation of $11B by December 2022. Even N26, one of Europe’s celebrated fintech firms, faced a potential 67% markdown from its earlier $9.2B valuation as major […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

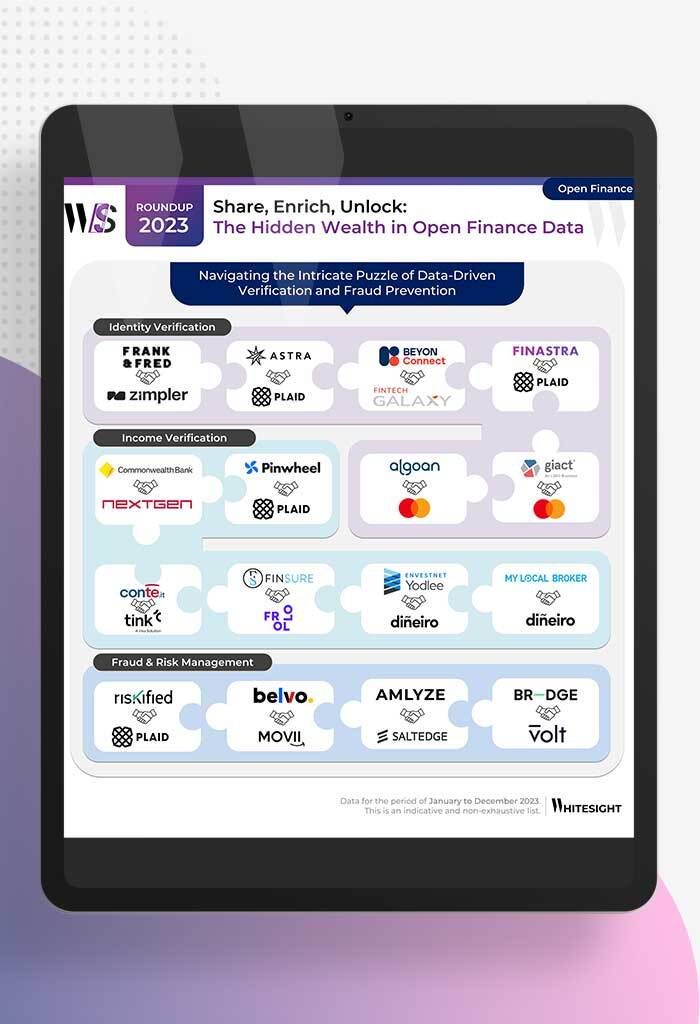

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

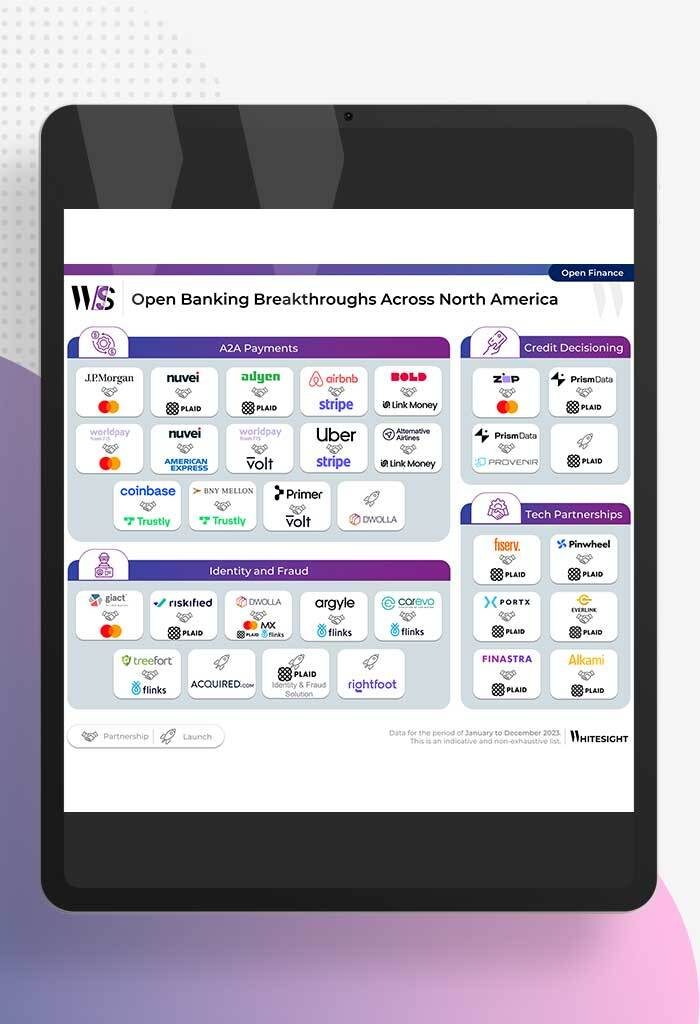

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

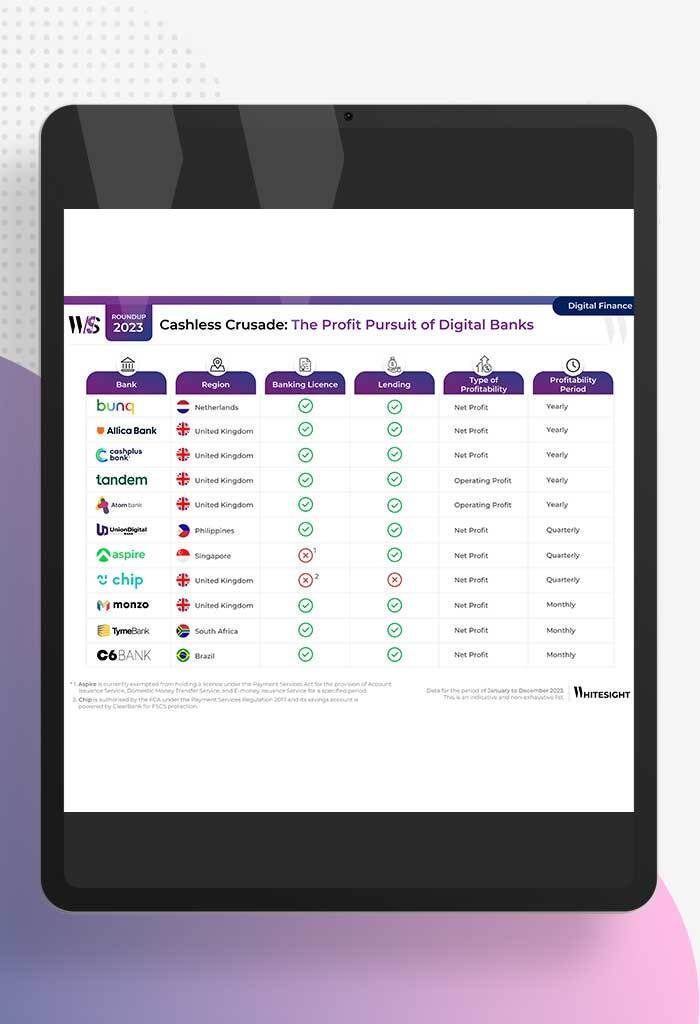

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

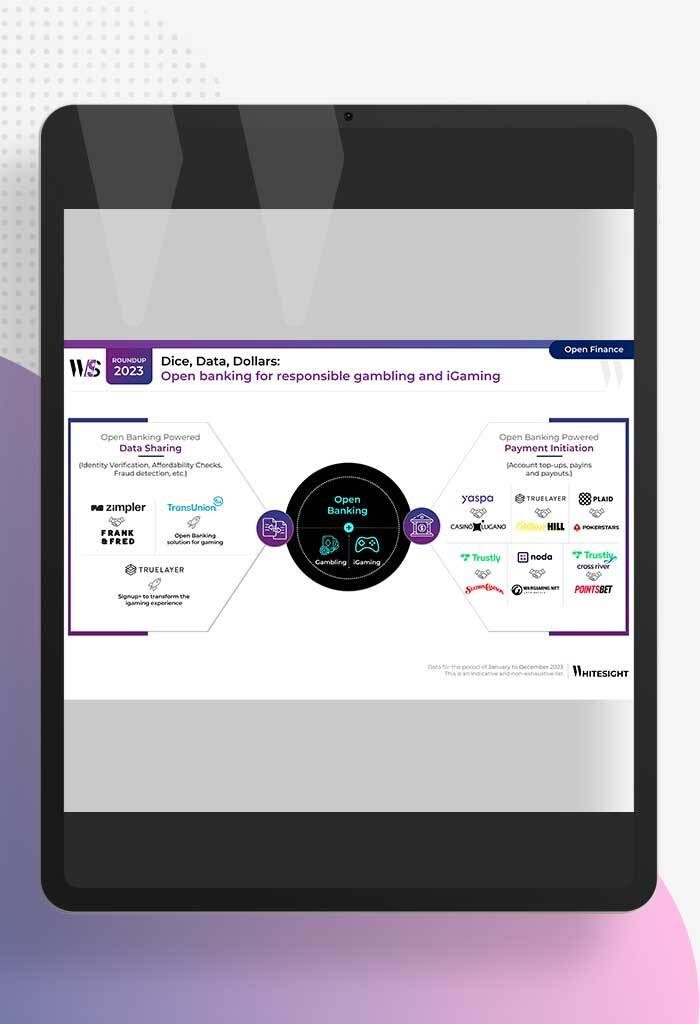

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

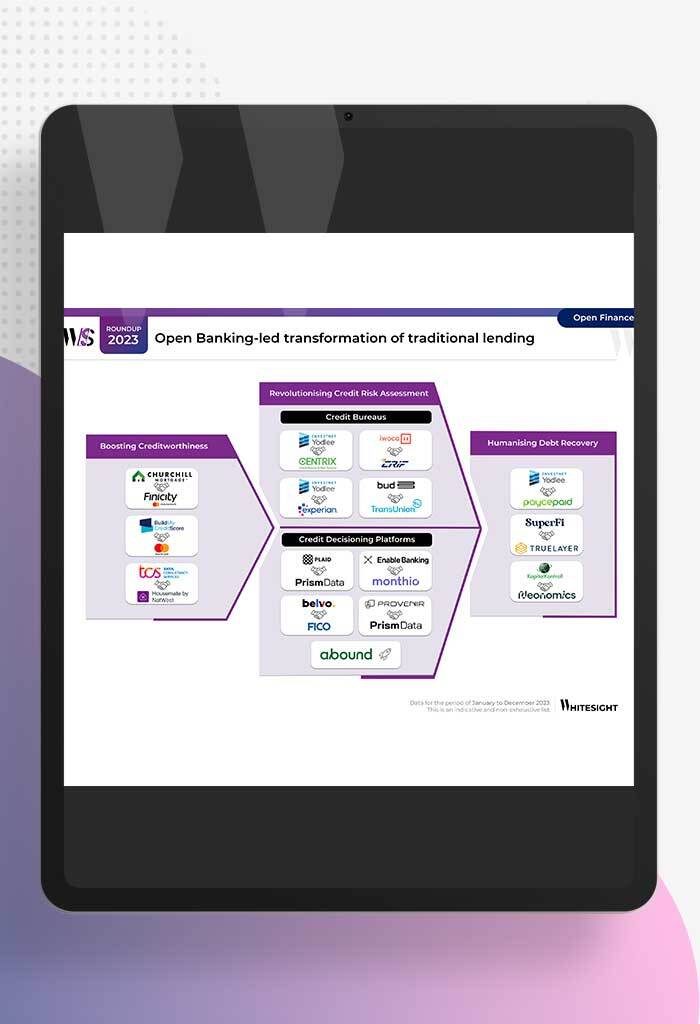

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

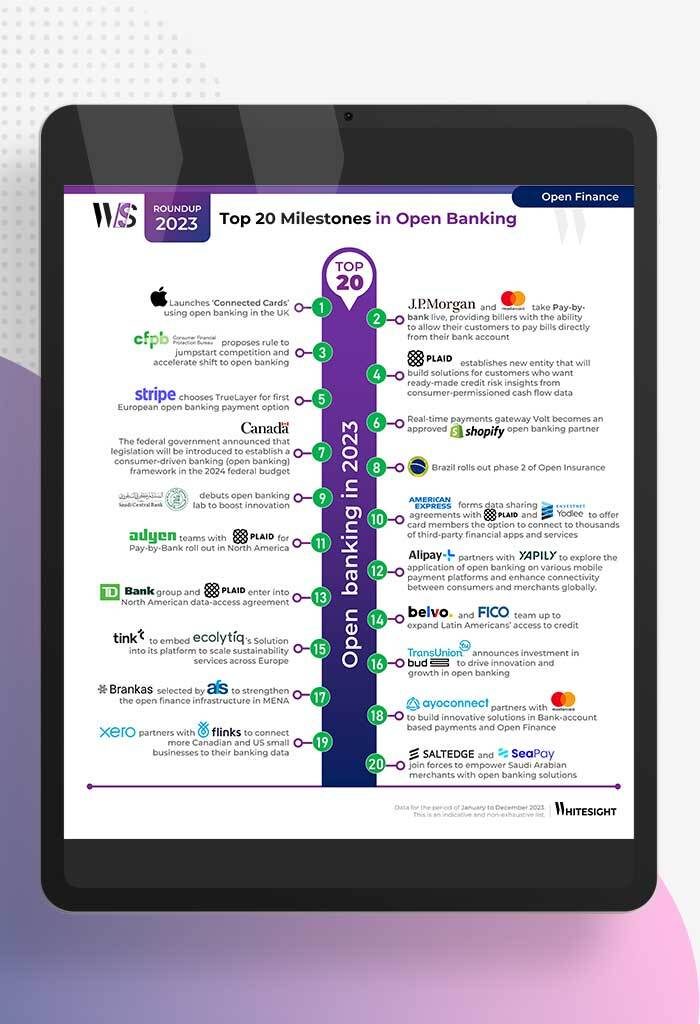

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...