Adaptable Platforms, Strong Alliances: BaaS consolidation in action

- Sanjeev Kumar and Kshitija Kaur

- 3 mins read

- Insights

Table of Contents

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm.It’s no surprise, really. The demand for agile and expandable infrastructures is at an all-time high in the fintech sector. And with technology evolving at warp speed, financial institutions are being pushed to think on their feet and embrace change. That’s where BaaS swoops in to save the day – offering a shortcut by providing off-the-shelf, adaptable, and secure platforms that can be swiftly deployed to unlock new revenue streams and customer experiences. Whether it’s about reaching greater heights economically or seizing opportunities to boost one’s market position, the trend of consolidation is undeniably upon us. The first half of 2023 is in full swing, with over ten strategic BaaS acquisitions already in the bag. We uncover the three key aspects shaping the BaaS consolidation wave and reveal the fascinating patterns emerging from this frenzy. 1. Catalysts of the BaaS consolidation movement The BaaS integration movement is being supercharged through strategic power plays as follows: Velocity and versatility: In the race for survival, FIs and tech platforms recognize the need for speed and adaptability to satisfy customers and outpace the competition. By acquiring BaaS […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

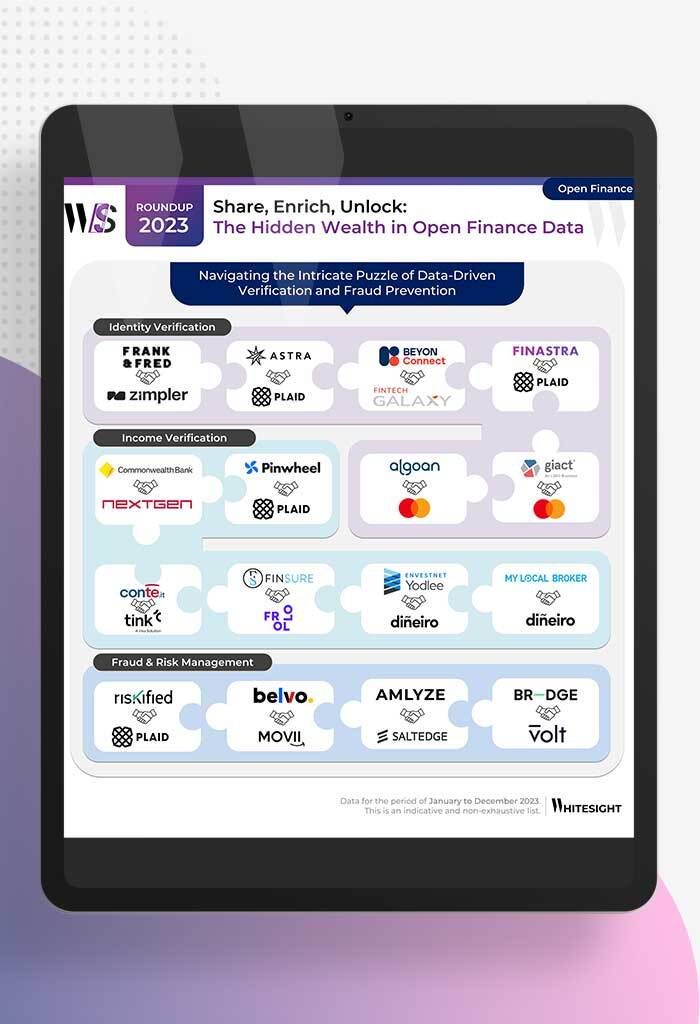

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

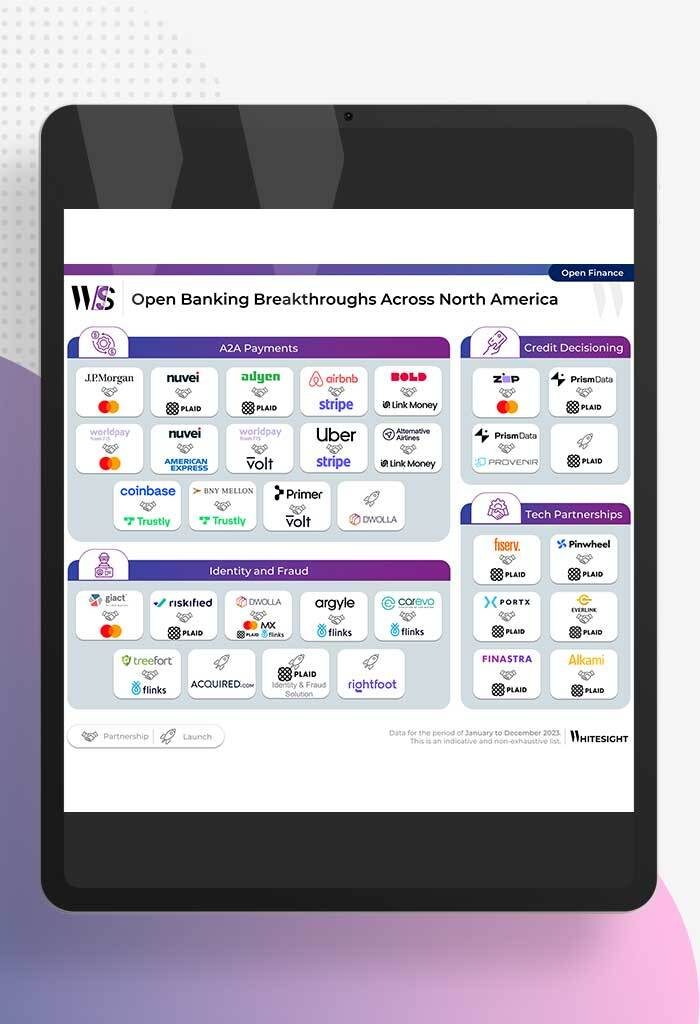

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

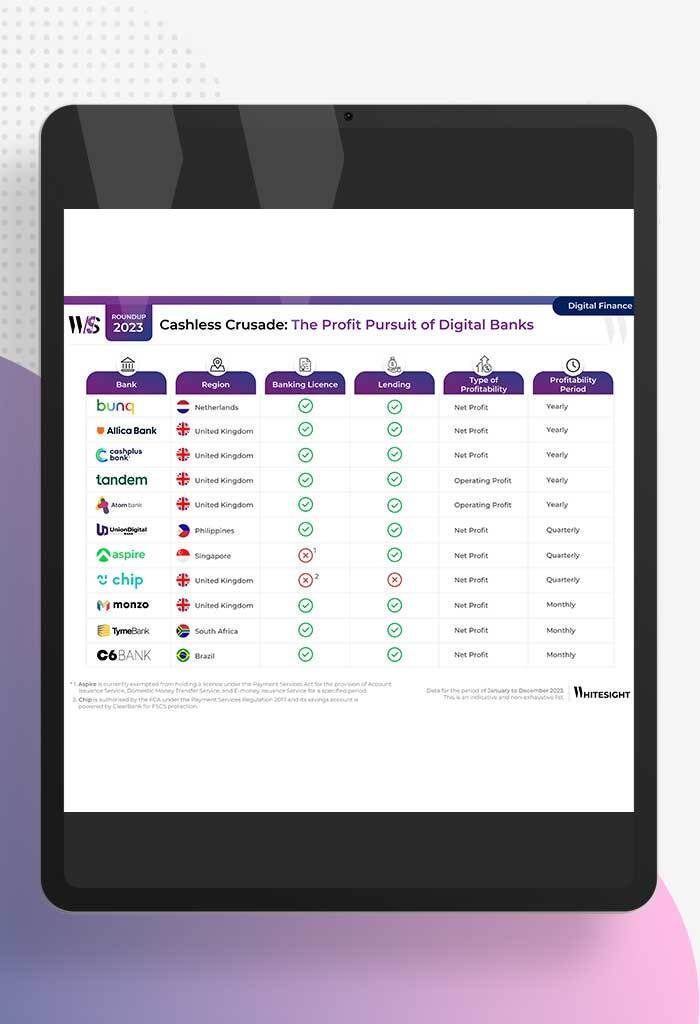

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

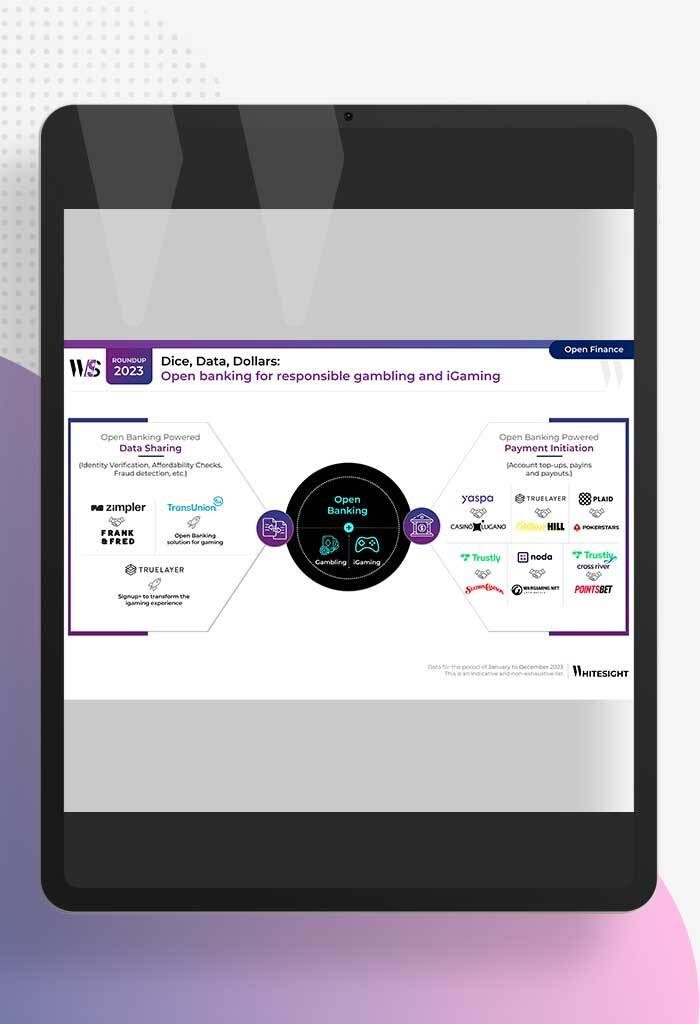

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

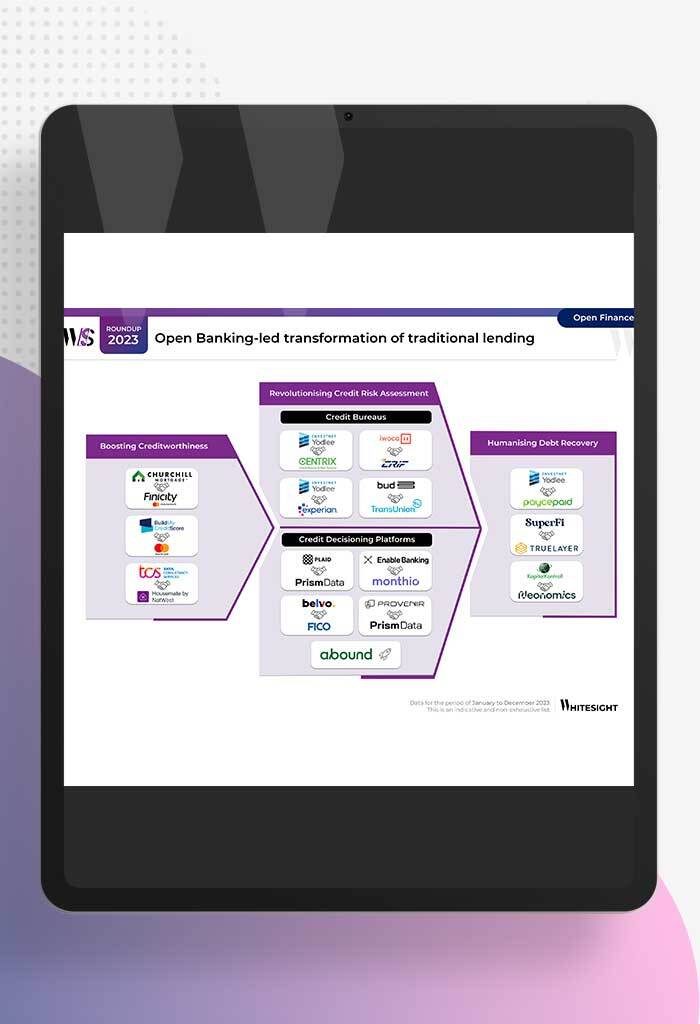

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

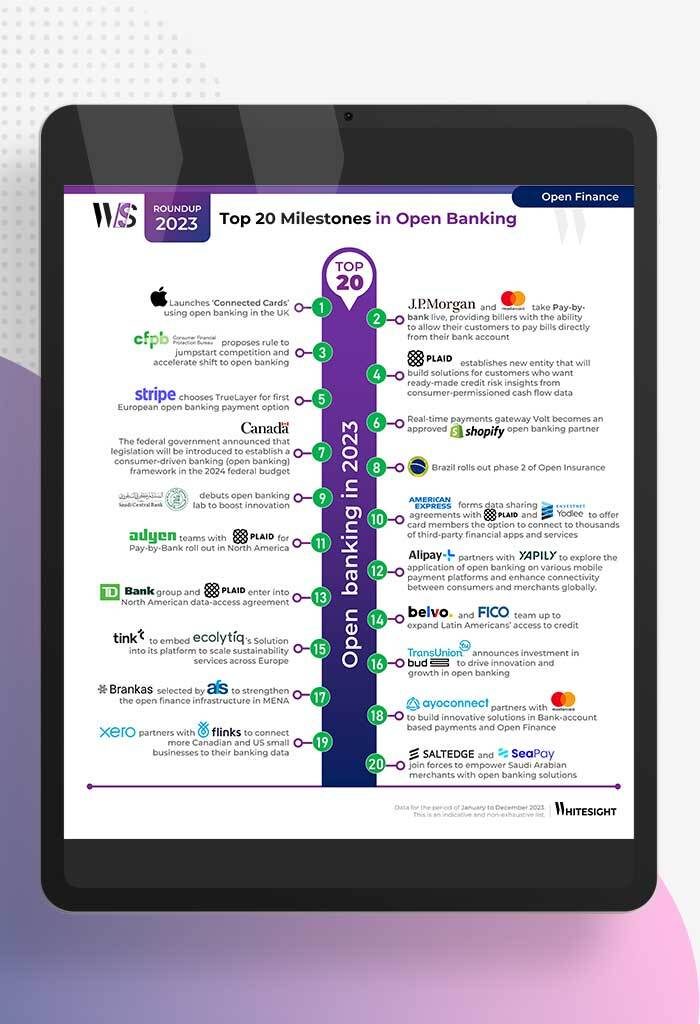

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...