WhatsApp says hello to the banking & payments world in emerging markets

- Risav Chakraborty and Sanjeev Kumar

- 3 mins read

- Embedded Finance, Insights

Table of Contents

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to fill gaps left by traditional banks. With 2 billion users, WhatsApp’s nifty setup enables instant and convenient peer-to-peer and peer-to-merchant transactions, reshaping money handling in the internet economy.We have explored Meta’s forays into fintech and crypto earlier. In this article, we’ll decode how WhatsApp is championing digital commerce and financial inclusion in emerging markets. Driving digital payments in Asia WhatsApp Pay is making some serious moves in Asia, especially in India, Indonesia, and Singapore. WhatsApp Pay joined the Indian digital payments revolution in 2018, launching under India’s National Payments Corporation (NPCI). It saw 0.31 million UPI payments in its first month, and by April 2023, transaction value hit a hefty $160M. To further accelerate customer adoption, they’ve got a cashback deal with RazorpayX, and a cool tie-up with JioMart for easy grocery payments.WhatsApp is also putting its best foot forward in other Asian countries such as Indonesia and Singapore. In Indonesia, they’re buddying up with MC Payments, and in Singapore, they’ve got a thing going with Stripe. This makes it a breeze for businesses to accept payments directly through WhatsApp […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

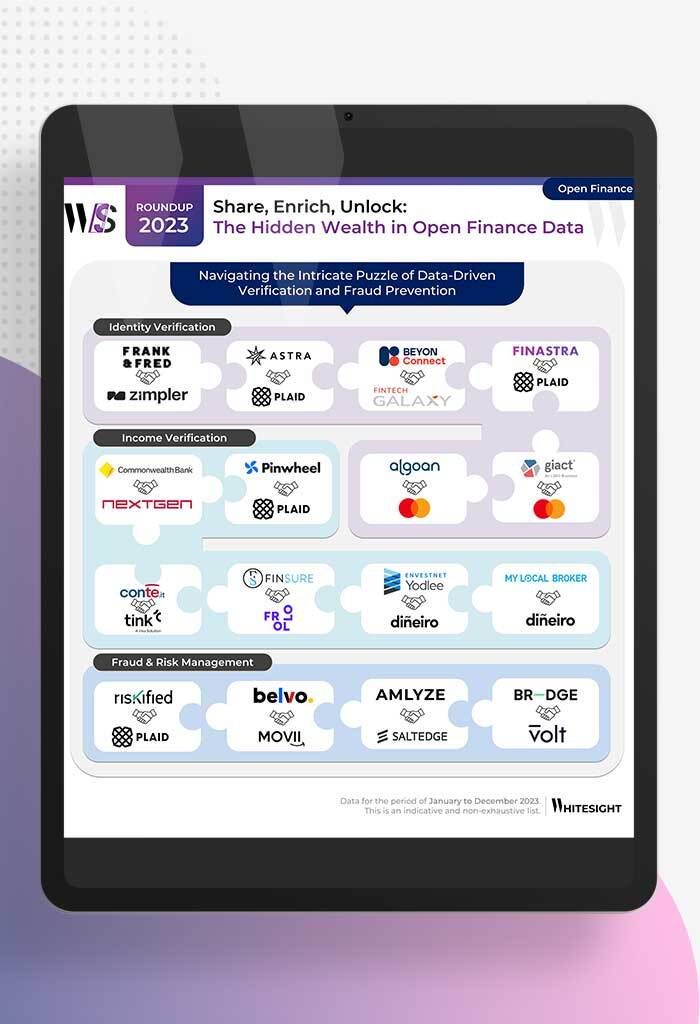

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

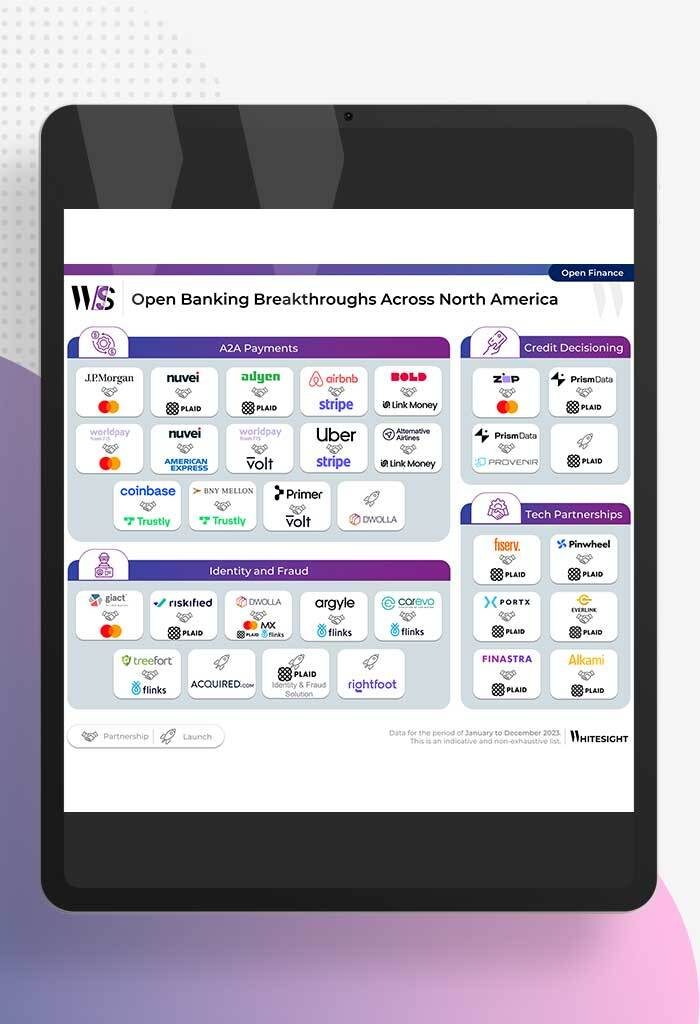

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

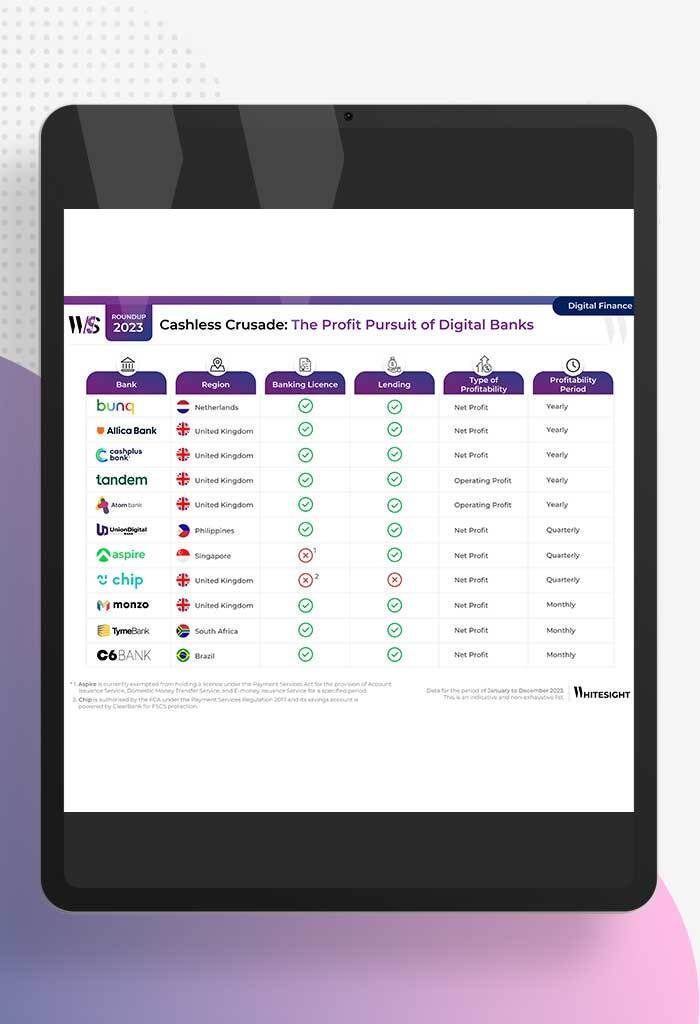

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

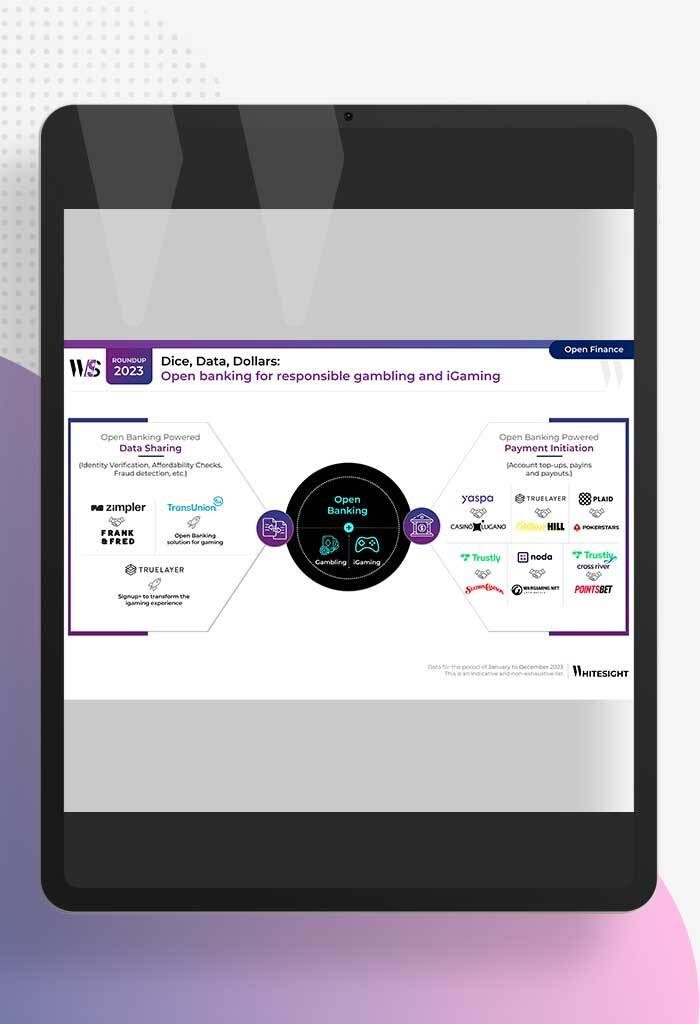

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

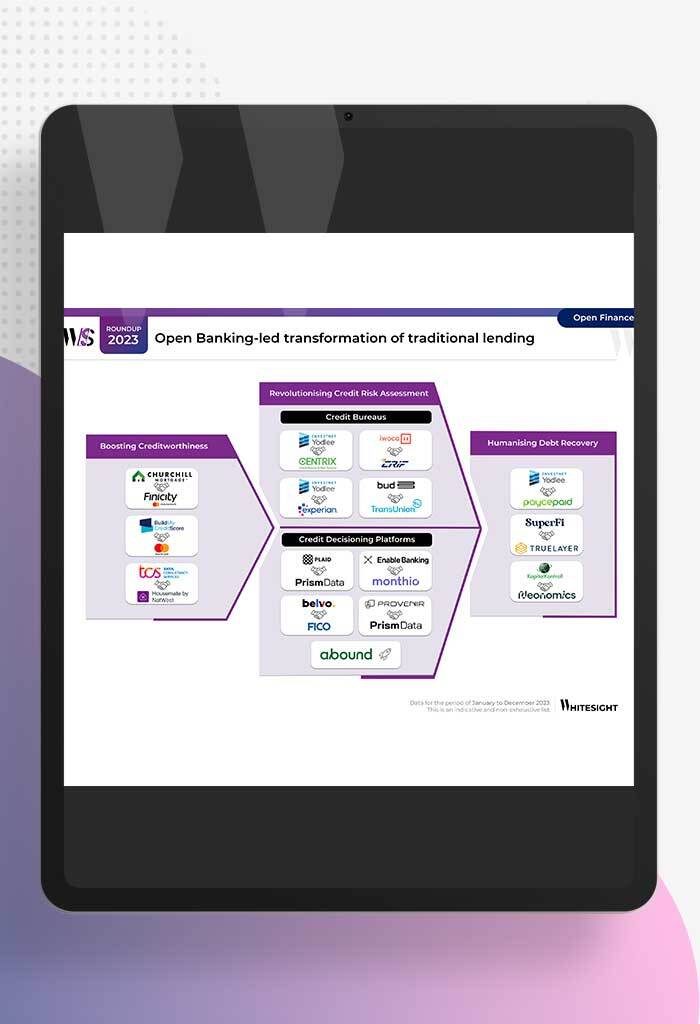

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

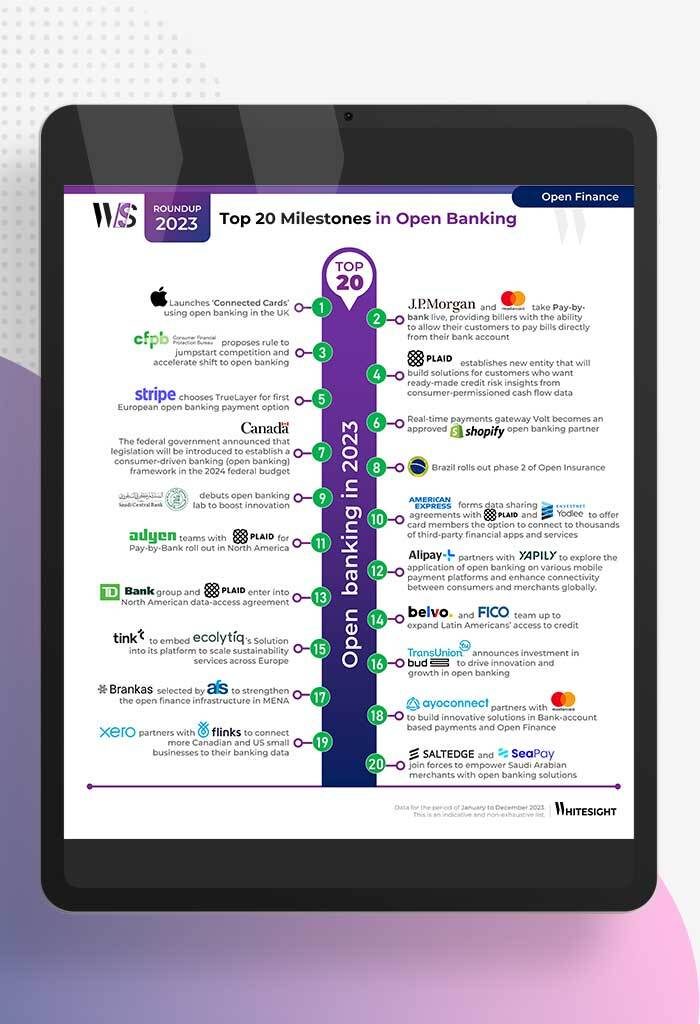

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...