Apple Pay Later: From Solo Act to Strategic Symphony

- Sanjeev Kumar

- 3 mins read

- Embedded Finance, Insights

Table of Contents

Apple’s Strategic Shift in BNPL This is a quick look at Apple’s strategic shift from building its own BNPL solution to joining forces with established players. For the full analysis on how this collaborative ecosystem is rewriting Apple’s BNPL strategy, head over to the full breakdown at Fintersections! Unpack Apple’s Strategic Pivot Here! Apple Pay Later burst onto the scene in 2023, offering a convenient way to split purchases into manageable instalments. However, in a recent move, Apple announced it would be shutting down its own BNPL service in the US. Instead, they’re shifting gears and pursuing a partnership-based approach.Apple is embracing a collaborative ecosystem model, moving away from a traditional vertically integrated approach. This strategic realignment is designed to harness the strengths of partnerships with banks, technology firms, and other BNPL providers, which are crucial for expanding market reach and enhancing operational efficiency. On the flip side, there are key inhibitors like Regulatory Complexity and Operational Overhead, which posed significant challenges in the vertically integrated model. Let’s dive deep into the intricacies to unpack the inhibitors of the vertically integrated model and the drivers for the collaborative ecosystem model shaping Apple’s BNPL strategy.. Shifting Gears: Why Did Apple Shut […]

This post is only available to members.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

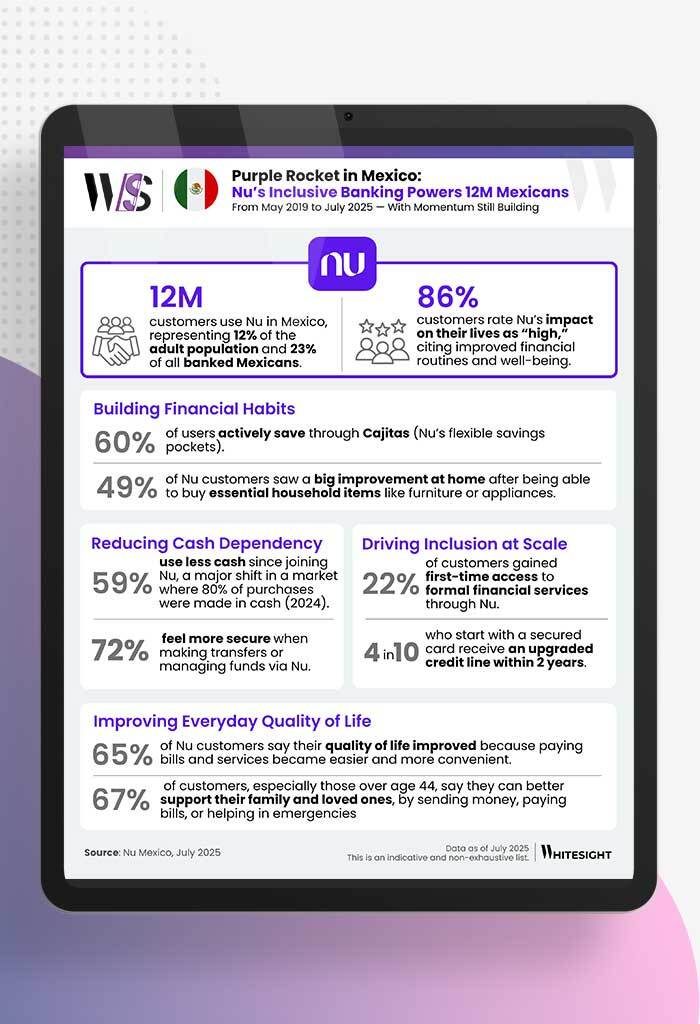

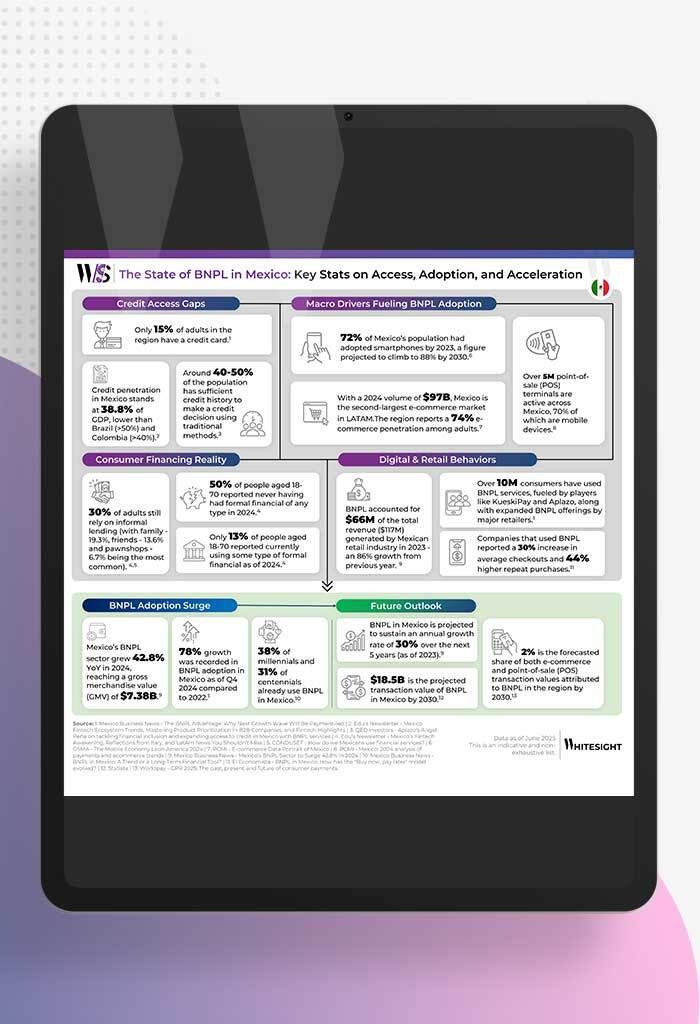

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar