Asset Tokenisation: The Next Frontier for Partnerships in Banking

- Sanjeev Kumar and Animesh Kaushik

- 3 mins read

- Digital Assets, Insights

Table of Contents

The blockchain and crypto industries have been weathering the difficult ‘crypto winter’, with decreased activity and market value presenting barriers for companies when it comes to continuing operations. While the use of blockchain and distributed ledger technologies (DLT) is still in its early stages, the industry has been exploring various use cases and tapping into investment opportunities.One trend that is attracting industry attention is the tokenisation of assets, enabling the creation of digital tokens on a blockchain that represents ownership of real-world assets. By unlocking the potential for fractional ownership of tangible and intangible assets, asset tokenisation is allowing investors to access a diversified range of asset choices for their portfolios.According to a BCG report, the total size of illiquid asset tokenisation alone would be $16T globally by 2030. Considering the huge market potential, many banks and financial institutions are dipping their toes in the asset tokenisation domain in different ways, with engagement in strategic partnerships becoming ever so crucial for adopting promising tokenisation solutions. In this blog, we take a look at how the banking ecosystem is leveraging collaborative tokenisation capabilities to trigger more transparency, cost advantages, and enhanced liquidity.To foray into this ambitious market, many banks have partnered […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

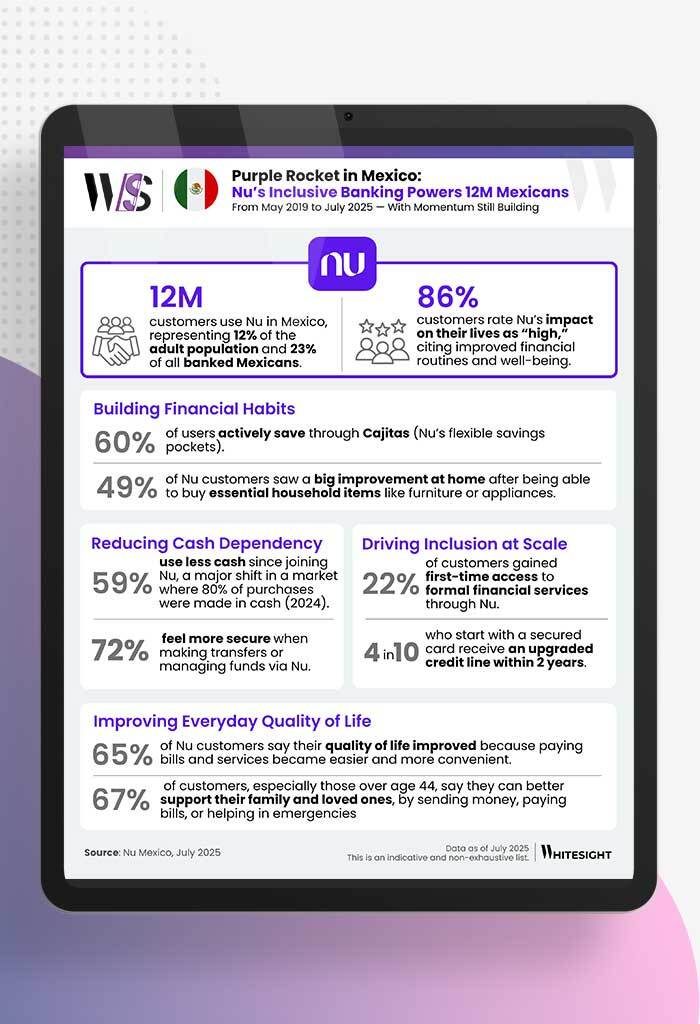

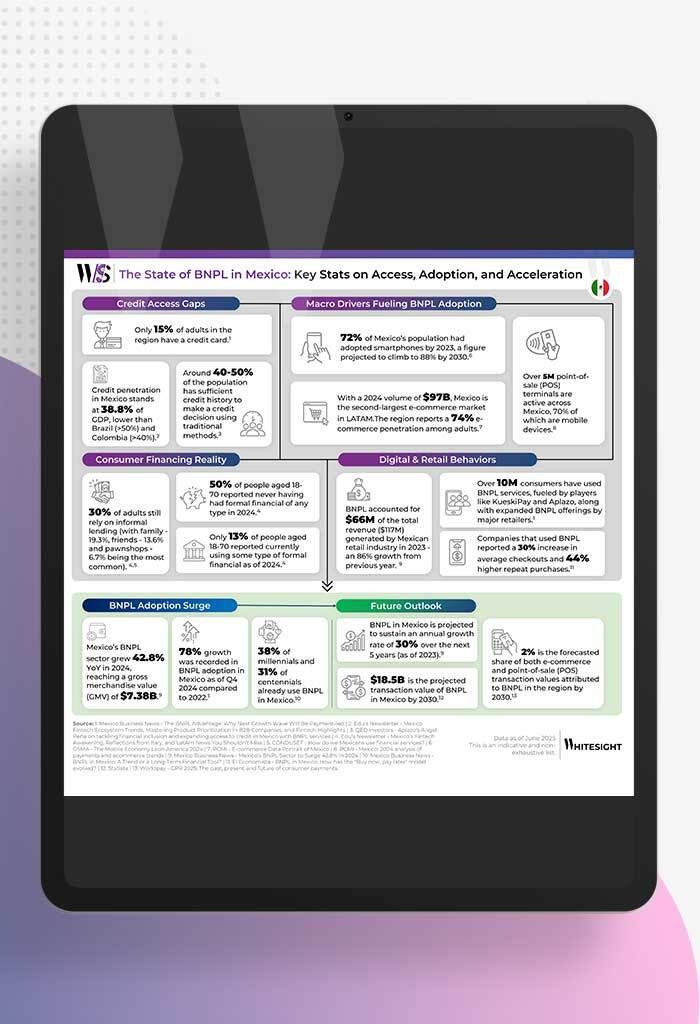

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar