BaaS Backlash: The Great Unbundling Under Scrutiny

- Risav Chakraborty and Sanjeev Kumar

- 6 mins read

- Embedded Finance, Insights

Table of Contents

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming, “Software is eating the world.” Over the next decade, this prediction manifested in the banking sector through Banking-as-a-Service (BaaS). Fast forward a decade, and that bite took a particularly significant chunk from the financial industry, as highlighted in our 2022 BaaS Roundup and 2023 roundup on The State of Embedded Finance.BaaS shifted the spotlight onto on-demand, modular, and cost-effective banking services accessible even to non-banks and unlicensed fintechs. This shift initiated a widespread surge of new entrants – from those providing and enabling BaaS to those leveraging BaaS to launch personalised financial products for underserved segments. This wasn’t just a shift – it was a revolution. A Cambrian explosion of players rose, each wielding BaaS to reimagine what banking could be. From sponsor banks offering their charters like an appetiser to venture-backed middleware platforms cooking up compliance and operations as side dishes, the feast was full of surprising flavours. KYC, risk monitoring, reporting, core banking, loan underwriting – everything became bite-sized and served a la carte. Non-banks and nimble fintechs swarmed, feasting on a modular, on-demand buffet of banking capabilities. Armed with […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

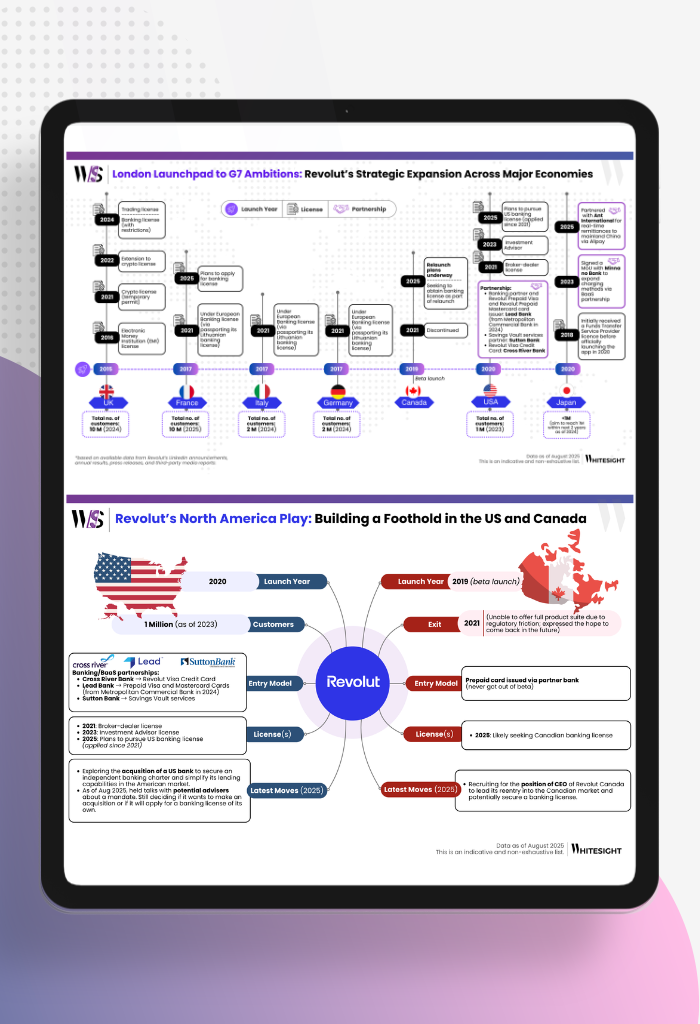

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

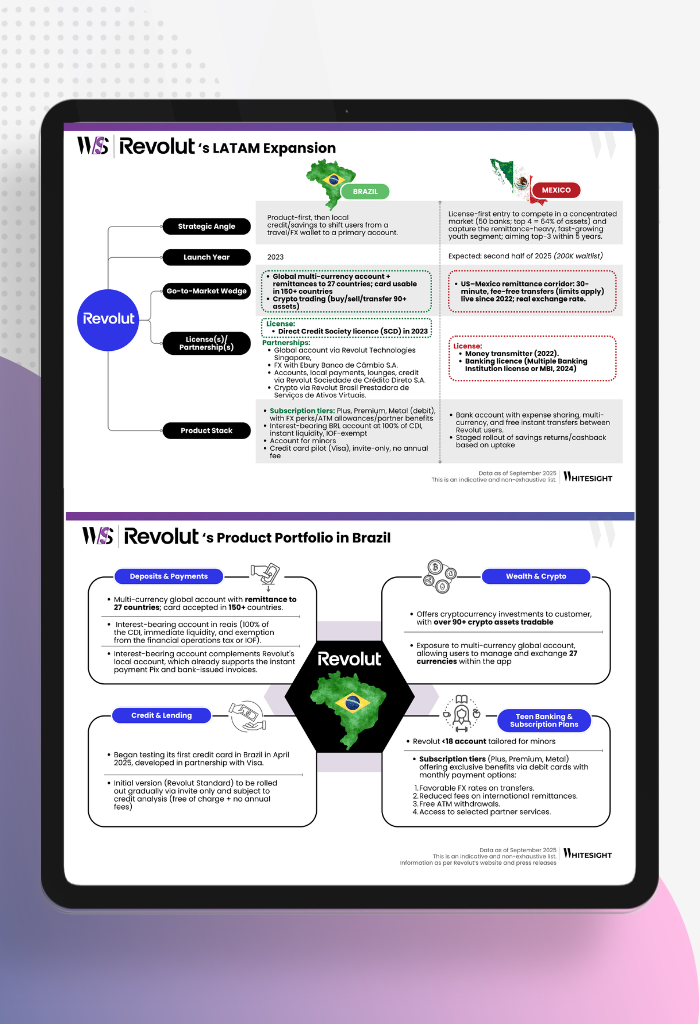

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

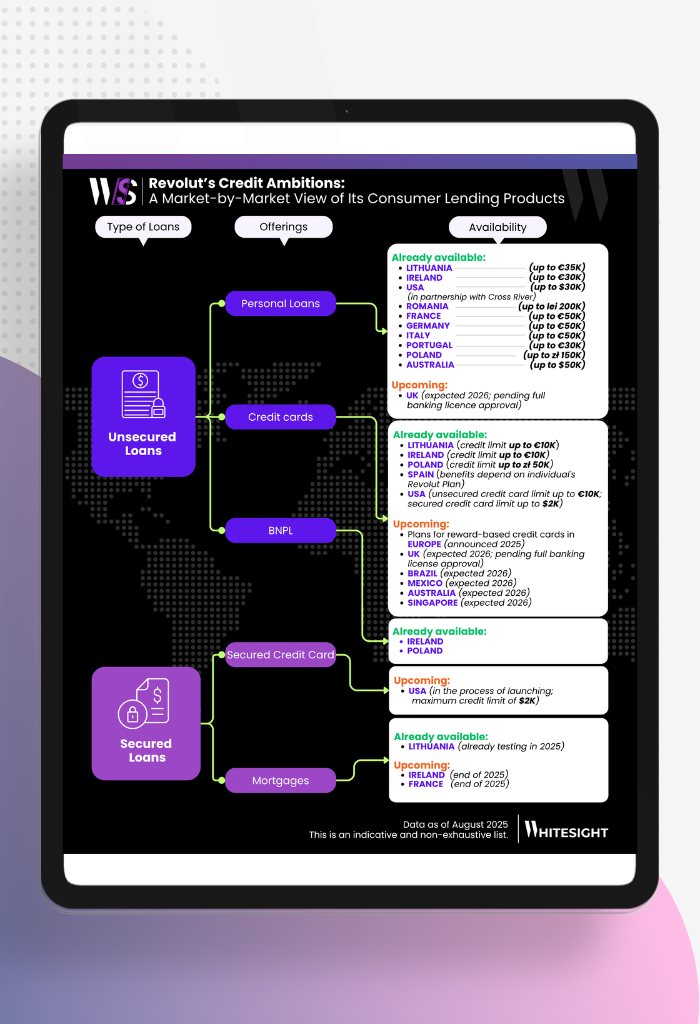

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...