Banking-as-a-Service in the US | SynapseFi Deep Dive

- Team WhiteSight

- 3 mins read

- Fintech Strategy, Insights

Table of Contents

Banking-as-a-Service (BaaS) is a key piece of the US fintech puzzle due to the lack of a regulatory framework for fintech-specific licenses. It also has the conventional upsides that come with the service offering – doing away with cumbersome licensing requirements, faster time to market & product development, ability to focus on customer servicing, and so on.Over the years, the most populated fintech ecosystem of the world has seen numerous BaaS providers coming into the picture, and they can be broadly categorized as follows: Regulated Banks like Cross River, Greendot utilise their licenses as well as modern tech stack to help fintech startups build on top of them.Middleware providers like Galileo & Treasury Prime facilitate the tech infrastructure that can act as a flexible intermediary to foster collaboration between banks and fintechs.Platform BaaS providers like Synapse & Unit provide an end-to-end offering that is ready to use for fintech startups.Primitives, a newly emerging BaaS model, like Moov offer granular control to developers designing financial products from the ground up.Each of these categories of BaaS players has a unique proposition towards a target market segment, which makes for plenty of room for them to coexist with some healthy competition.SynapseFi – All […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

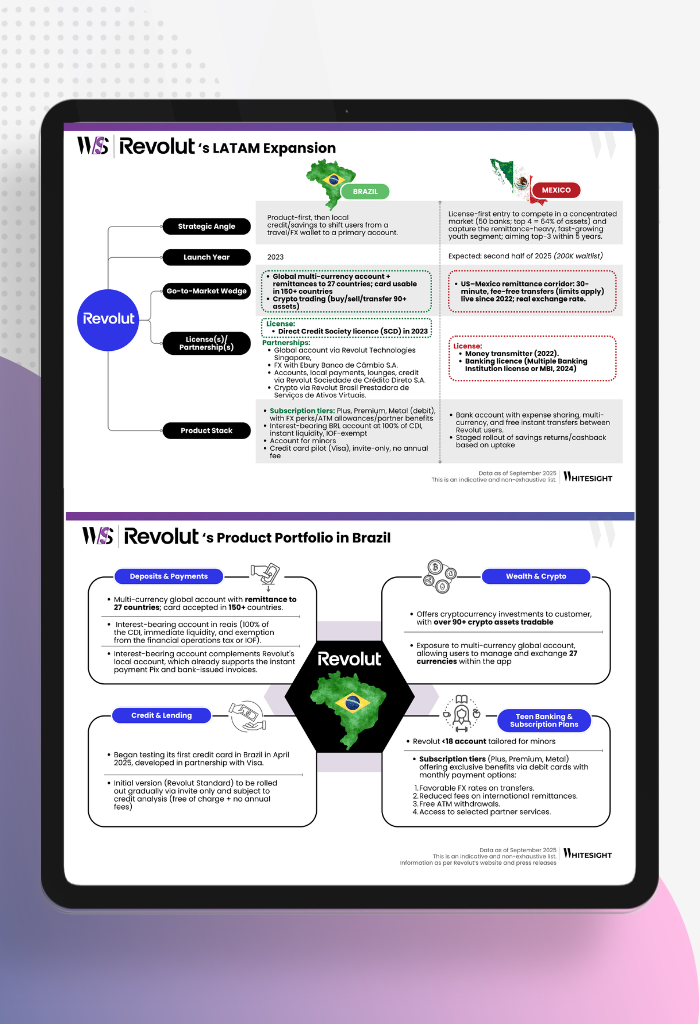

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...