Banking on the Future: DeFi-nitive Steps to Embrace Crypto and Blockchain

- Sanjeev Kumar and Kshitija Kaur

- 4 mins read

- Digital Assets, Insights

Table of Contents

The world has been quick to realize the avant-garde and empowering potential of digital currencies and assets in the last few years, and correspondingly made moves to adopt it as a tool towards financial freedom and unprecedented transparency. As FinTechs, venture capital funds, investors, and even the general public at large are showing keen interest in crypto, financial institutions can no longer afford to overlook the efficiency and potential of crypto assets; one that comes with a widely held commitment and belief that cryptocurrencies will be an important block in building the future of money.While financial institutions have been swinging hot and cold on crypto offerings, keeping in line with the uncertain regulatory stance, not much can stop them from experimenting and implementing these technologies in their operational models or investing in startups that are doing so. With this piece, we take a look at what some of the financial services big-shots are doing when it comes to crypto, and how committed they really are to the cause. Ingenious InvestmentsEven though the notion of banks becoming crypto-curious stems as far back as 2012, it’s only recently that financial institutions have begun to build around the decentralized ecosystem. Many of the […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

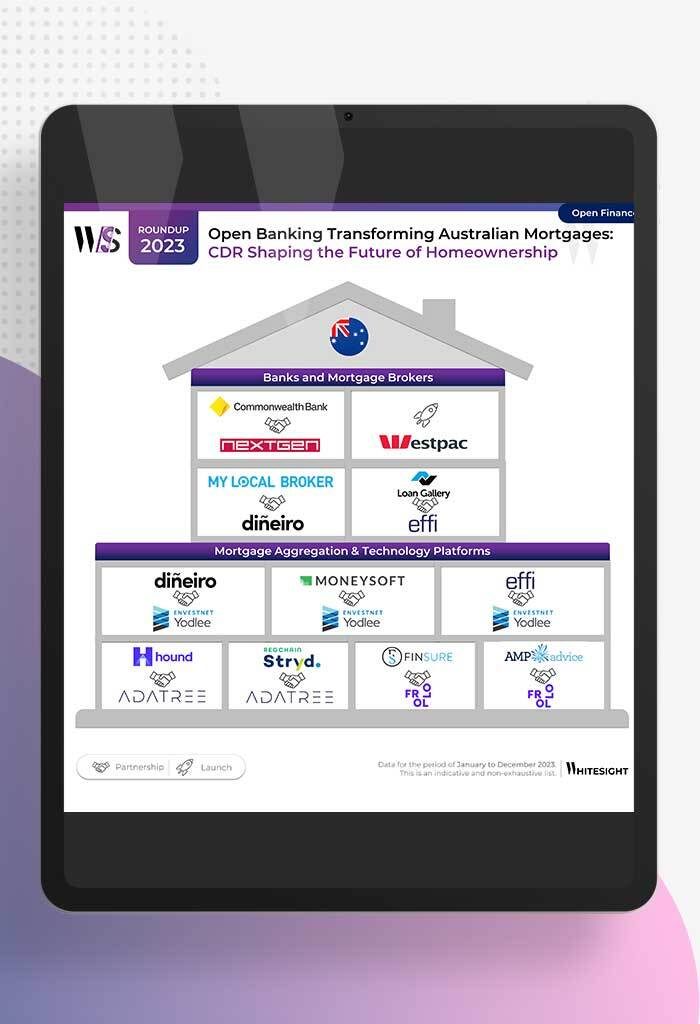

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

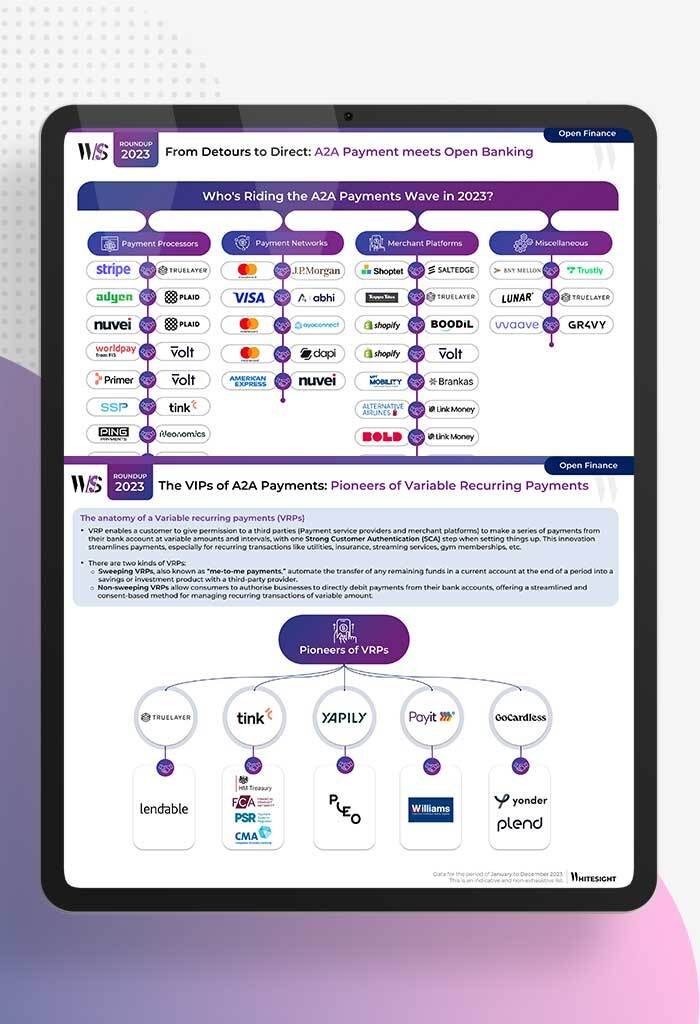

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

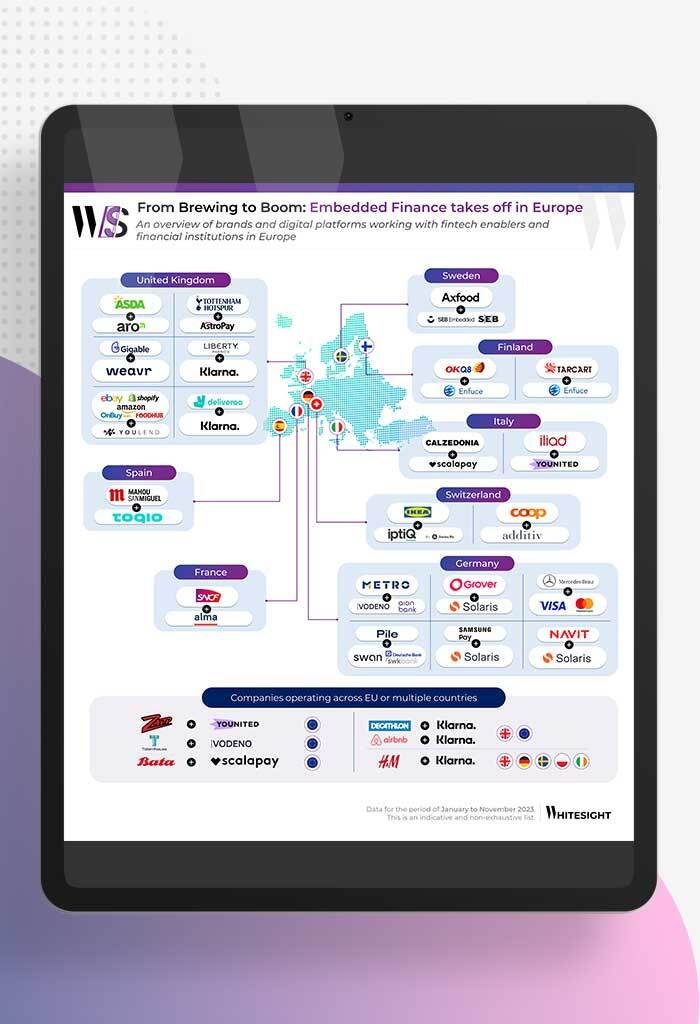

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

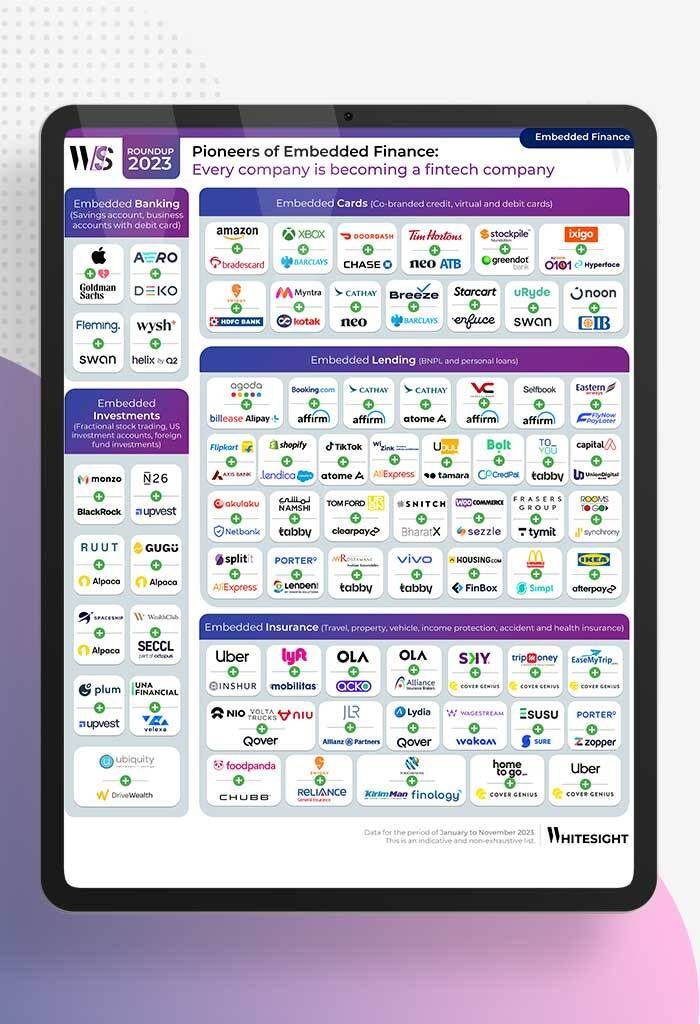

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...