Embedded, Expanding, Evolving: BNPL’s Role in Mexico’s Financial Future

- Kshitija Kaur and Sanjeev Kumar

- 9 mins read

- Embedded Finance, Partnerships

Table of Contents

A New Chapter in Mexico’s Consumer Credit Story

Across Latin America, credit has long been a privilege unevenly distributed. In a region where large swathes of the population remain outside formal financial systems, access to credit is often gated by high interest rates, fragmented infrastructure, and a dependency on legacy banking models that haven’t kept pace with consumer needs. Even in high-growth fintech markets like Brazil or Colombia, meaningful inclusion remains patchy, marked by a growing appetite for digital services but constrained by uneven reach.

In the same way, Mexico isn’t new to credit. It just never had enough of it in the right places.

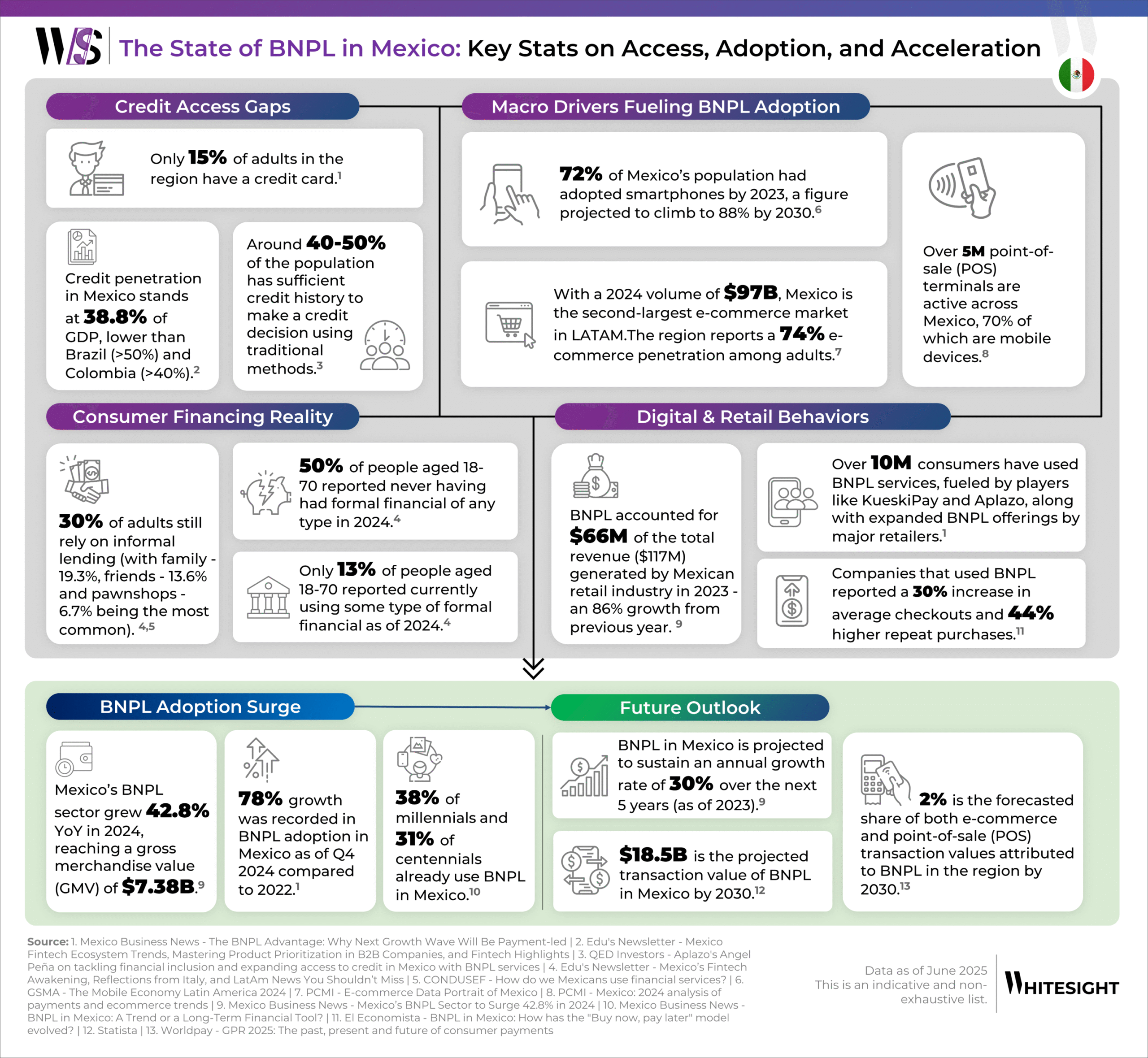

Despite being LATAM’s second-largest economy, most consumers still operate outside the boundaries of formal finance. As of 2024, only 15% of adults own a credit card, and nearly 50% of the population aged 18 to 70 has never accessed any formal financial service. A staggering 30% continue to rely on informal credit, often borrowing from family and friends or pawnshops to cover short-term needs.

It’s in this credit vacuum that buy now, pay later (BNPL) has carved a place for itself. What began as a checkout convenience is fast becoming one of the most accessible forms of credit in the country. In 2024 alone, BNPL usage grew by 78%, crossing 10 million users, and is projected to sustain 30% annual growth over the next five years.

BNPL’s growth in Mexico is a response to something much more foundational.

The most obvious driver is unmet demand. Traditional credit models rely on formal employment histories and high credit scores – criteria that exclude much of Mexico’s workforce. BNPL flips this equation by offering no-interest, installment-based lending with minimal friction, often requiring nothing more than a smartphone and a valid ID.

Second, the timing couldn’t be more ideal. Smartphone penetration hit 72% in 2023 and continues to climb. At the same time, digital transactions grew 30.5% year-over-year, and e-commerce is surging, with 74% of adults now shopping online. BNPL rides these rails seamlessly, especially among millennials (38%) and centennials (31%), who are already using BNPL services.

Lastly, the infrastructure is catching up. Real-time payments (like Cobro Digital or CoDi), partnerships with merchants, and embedded finance integrations are allowing BNPL to scale in ways traditional lenders can’t. And for retailers, the value is undeniable – higher average checkouts, repeat purchases, and lower cart abandonment rates. As per AMVO, retailers in the electronics and fashion sectors already reported up to 50% of online purchases through BNPL channels in 2024 during promotional periods like Hot Sale or El Buen Fin.

In this blog, we’re diving into what makes Mexico a compelling BNPL market today. Let’s explore who’s leading the charge, how business models are evolving, and why BNPL could become the financial backbone for Mexico’s underbanked future.

What the Numbers Tell Us About BNPL’s Rise in Mexico

The data on BNPL in Mexico paints a story that goes beyond growth curves or user counts. Beneath the numbers are patterns that signal how BNPL is evolving from a fringe payment option into a systemic response to financial exclusion and shifting digital behavior:

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

- BNPL is emerging as a parallel credit system, because the formal one didn’t scale: Mexico’s credit system is fundamentally exclusionary. With only 13% currently using any formal financial product, traditional lenders have effectively priced out the majority of the population. BNPL providers have stepped into this vacuum as the first meaningful point of entry to credit for millions. The model works precisely because it does not require a credit history, a formal job, or even a bank account in some cases.

- Usage patterns show a shift from ‘access’ to ‘intentional usage’: BNPL is being used repeatedly because it fits how people want to pay. High repeat usage metrics (like 44% in returning customers for BNPL-enabled merchants) indicate a behavioral shift: consumers aren’t testing the model, they’re adopting it as a planning tool. Mexican consumers are looking for control over their finances. Installments offer predictability. The rise of BNPL is as much about financial planning as it is about access.

- Consumer behavior is mobile-first, installment-friendly, and credit-starved: The rhythm of Mexico’s economy favors fortnightly liquidity. BNPL aligns almost intuitively with that cadence, offering short-term installment plans that mirror wage cycles, especially in the informal and gig economy. What’s also evident is the digital channel preference – more than 72% smartphone adoption and 40% of e-commerce transactions already processed via mobile wallets and alternative payment methods. The BNPL experience, embedded in apps, retail sites, or wallets, matches how people already browse, buy, and pay.

- BNPL is growing because it makes economic sense for both sides: Retailers adopting BNPL are also doing it for returns. With reported 30% increases in average checkouts, the business case is clear. Consumers convert faster, spend more, and come back more often when offered BNPL at checkout. For merchants operating in a low-credit environment, BNPL is proving to be an acquisition and retention engine.

Building for Scale Through Product and Compliance Depth

As BNPL grows in reach, it’s also growing in complexity. Players are building moats through deeper product stacks and divergent regulatory strategies. Two things stand out: what they’re building, and under what license.

How BNPL Players Are Deepening Product Relevance

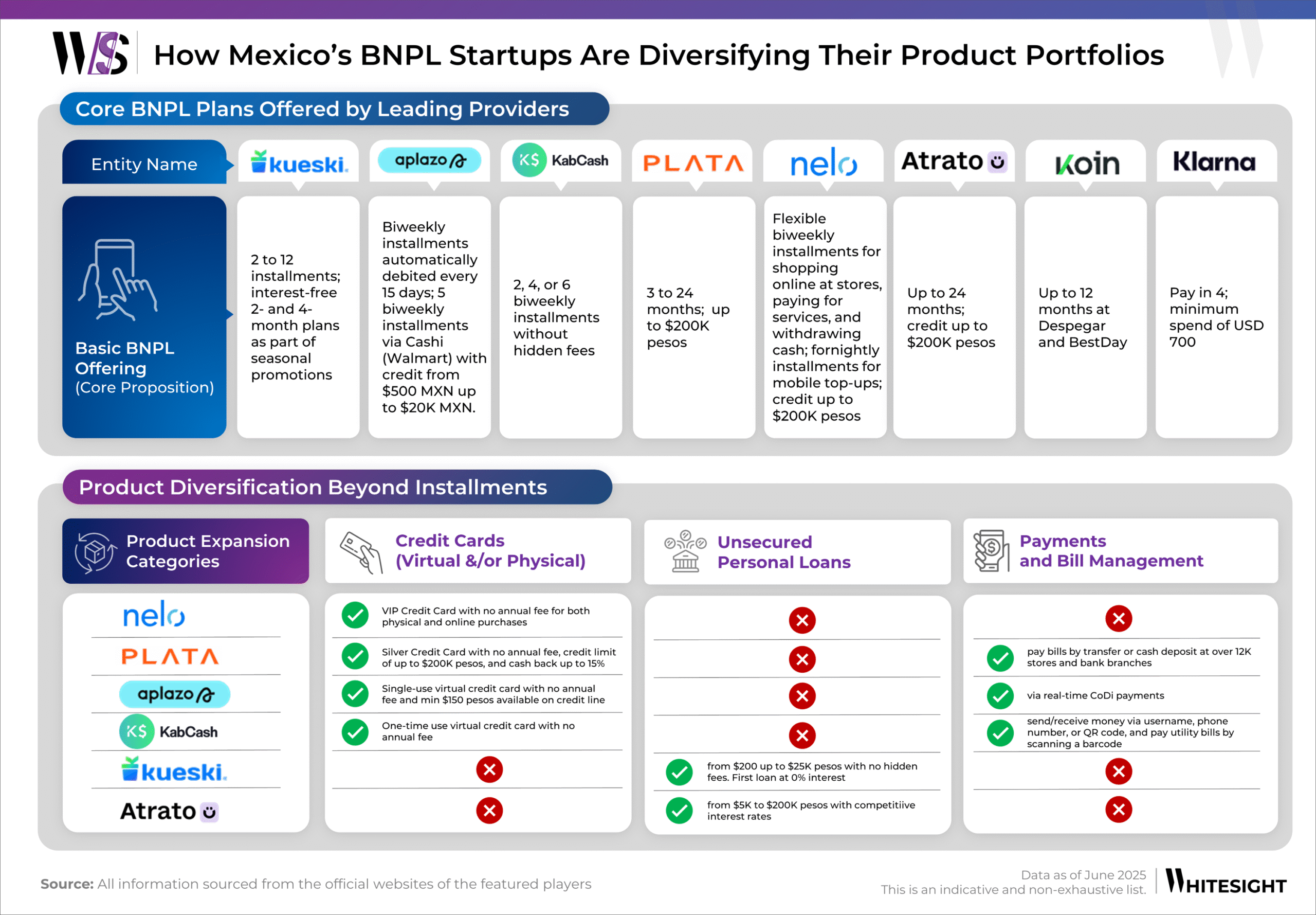

What began as a single checkout function – splitting a purchase into smaller payments – is now evolving into a multi-pronged product play. Today, BNPL providers in Mexico are stitching together ecosystems that extend far beyond pay-in-X offerings.

What we’re seeing is a deliberate expansion from checkout finance to full consumer engagement. The diversification across cards, credit, and payments reveals a clear logic: own more of the customer’s spending behavior. For instance, Nelo and KabCash are layering virtual cards onto their credit lines, enabling users to transact more broadly across online and offline channels. Plata is fusing cashback with installment options, creating a value-added experience. These represent a shift in positioning – from “deferred checkout” to day-to-day liquidity tools.

At the same time, BNPL in Mexico is evolving into a hybrid of embedded finance and micro-credit. Players like Kueski and Atrato Pago are stretching into personal loans, bringing short-term, non-collateralized lending into the same user flow. Others like Aplazo are embedding themselves into routine financial flows – bill payments, merchants’ payment portals (via Walmart’s Cashi), and even real-time CoDi integrations. The common thread: BNPL providers are embedding themselves into multiple moments of consumer financial decision-making. Each additional feature, be it a card, a credit line, or a utility bill payment, expands surface area, deepens stickiness, and extends monetization opportunities.

Beyond this, merchant offerings are the second engine. Kueski’s merchant stack (zero commissions for first-time sellers, automated integrations, chargeback protection) mirrors models from Klarna and Afterpay. Koin is bundling anti-fraud tools and business portals, anchoring BNPL as part of the retail infrastructure, not just an add-on.

Navigating the Regulatory Grey

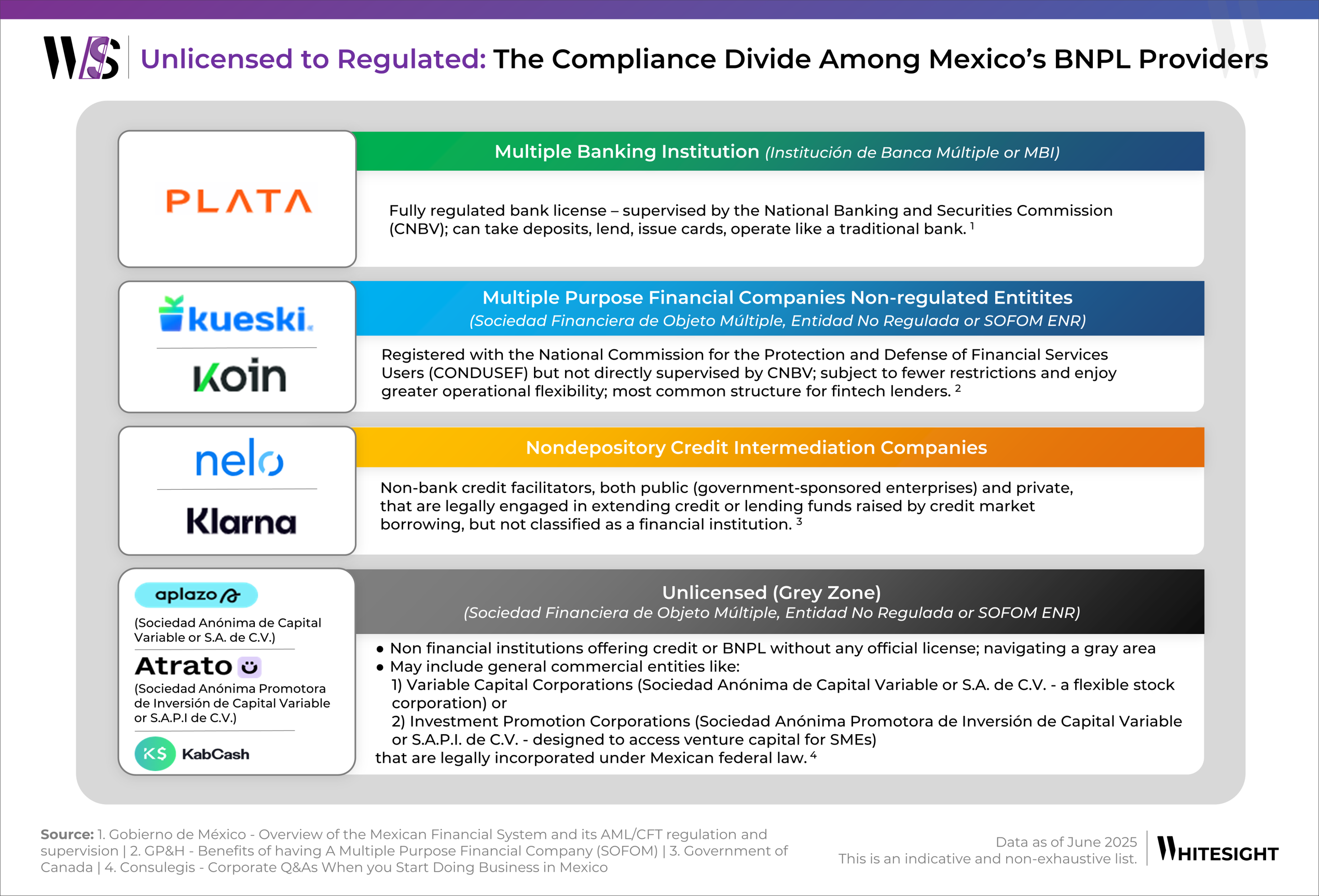

As product strategies diverge, so do licensing choices. If product breadth defines a BNPL player’s ambition, the license they operate under defines how fast (and how credibly) they can pursue it.

- Unlicensed Corporate Entities: As of mid-2025, BNPL is not formally classified under any specific lending regulation, leaving most players outside the purview of CNBV or even fintech-specific oversight. This has allowed a cohort of players like KabCash, Aplazo, and Atrato Pago to scale under general corporate structures. Aplazo, for instance, is incorporated as a Variable Capital Corporation or Sociedad Anónima de Capital Variable (S.A. de C.V.). Meanwhile, Atrato Pago operates as an Investment Promotion Corporation or Sociedad Anónima Promotora de Inversión (S.A.P.I. de C.V.). These entities are recognized under Mexican corporate law and can be fully foreign-owned. They offer limited liability and operational flexibility, particularly around venture capital participation (in the case of S.A.P.I.), but they are not authorized financial institutions.

- Non-depository Credit Intermediation Companies (e.g., Nelo, Klarna): These players are legally permitted to extend credit through instruments like installment loans or financing agreements, but they are not authorized to hold deposits or offer traditional banking products. Their role is essentially that of credit facilitators: issuing digital cards, processing short-term loans, or offering sales financing. These entities are regulated more like specialized consumer lenders, but without the protections or structure of a financial institution.

- Sociedad Financiera de Objeto Múltiple, Entidad No Regulada (SOFOM ENR): The SOFOM ENR license allows fintech lenders. like Kueski and Koin, to issue loans, leases, and credit products, and to operate with significant autonomy. They are registered with the National Commission for the Protection and Defense of Users of Financial Services (CONDUSEF), ensuring some consumer transparency, but are not supervised by the National Banking and Securities Commission (CNBV). This structure gives them a critical balance: the ability to operate like a lender, but with fewer compliance hurdles than a bank. In Mexico’s fintech ecosystem, SOFOM ENR has become the license of choice for serious digital lenders—lean, legal, and scalable.

- Multiple Banking Institution (Institución de Banca Múltiple or MBI): Here we have Plata, the outlier with a full MBI license. MBIs can offer checking and savings accounts, issue credit cards, and lend using deposit-backed funds. Getting an MBI license involves a multi-stage approval from CNBV and comes with full prudential supervision. Plata’s license allows it to operate like a digital bank. In a market dominated by regulatory lightweights, this positioning provides both long-term defensibility and institutional-grade trust.

The CNBV is reportedly working on new guidelines, expected by late 2025, that would bring BNPL under a formal regulatory umbrella. Once enforced, this would bring players like Aplazo and Atrato under more direct scrutiny and could nudge them toward acquiring SOFOM or similar licenses if they want to retain lending as a core service. Until then, these players operate at scale, but in ambiguity.

Embedded BNPL Partnerships as the Distribution Engine

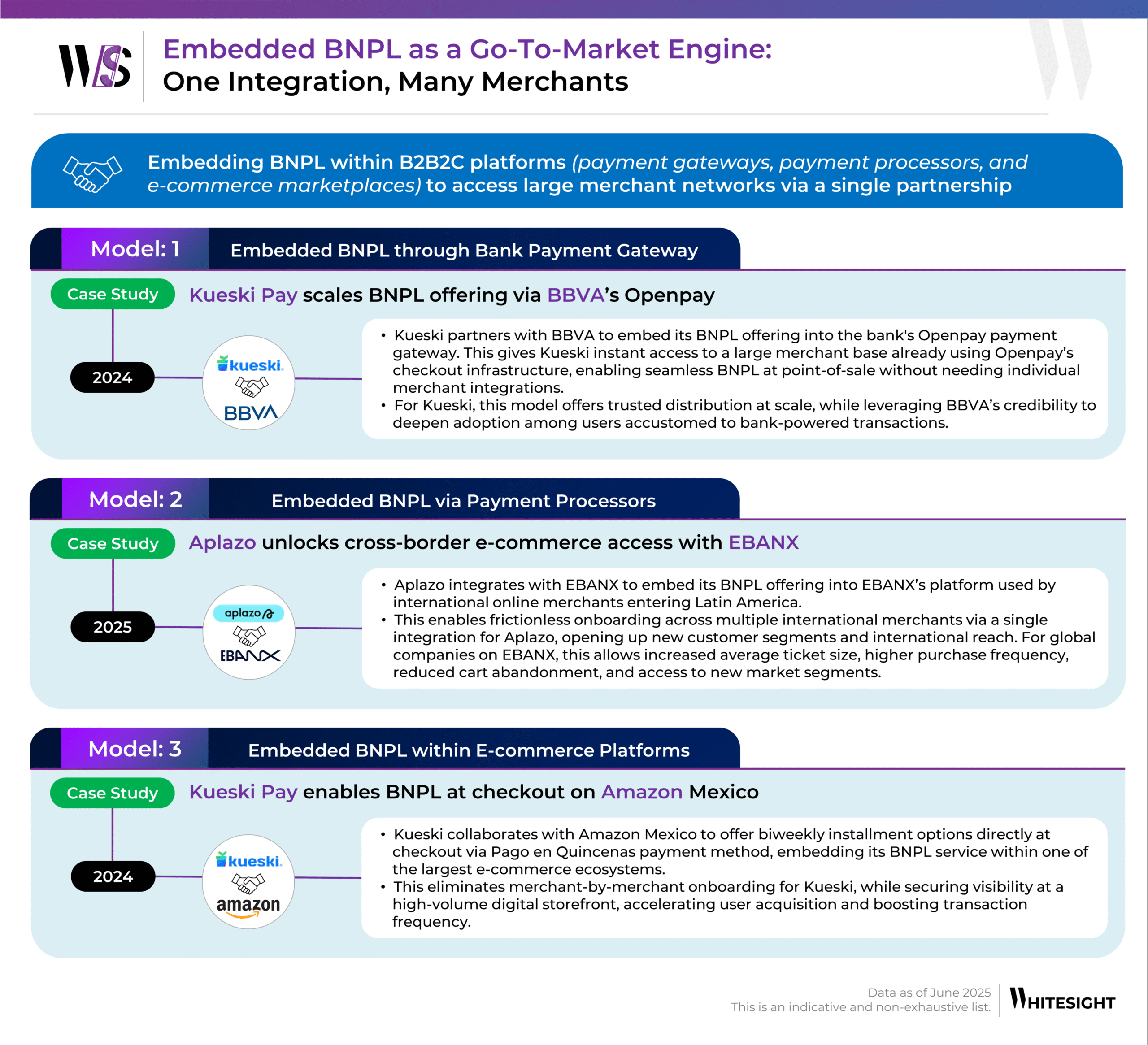

As BNPL grows beyond its early adopter segment, Mexican players are rethinking distribution. Many are embedding their services where demand and a wide merchant network already exist: at payment gateways of banks, vertical SaaS platforms, and payment processors.

- Kueski Pay’s 2024 partnership with BBVA is a case in point. By integrating Kueski’s BNPL offering into BBVA’s Openpay gateway, the service becomes instantly available to thousands of merchants, and by extension, to millions of consumers who now get access to deferred payments without needing credit cards. This model allows BNPL to skip the trust-building cycle and piggyback off the brand equity of established institutions.

- But partnerships aren’t just about scale, they’re about positioning. Kueski Pay’s tie-up with Amazon Mexico repositions BNPL as a mainstream checkout option. With users able to choose between 4 to 12 biweekly payments right at checkout, Amazon leverages BNPL as a conversion tool, while Kueski benefits from behavioral data at high-value purchase moments.

- And the benefits extend across borders. Aplazo’s partnership with EBANX allows BNPL to be embedded into a processor that already handles global payment preferences, FX reconciliation, and compliance. International retailers now attract Mexican consumers who couldn’t previously transact online due to a lack of cards, while Aplazo gains a foothold in segments where underwriting was once a bottleneck.

For BNPL providers, these partnerships compress go-to-market timelines, offer instant merchant distribution, and remove the friction of cold onboarding. They also offer borrowed credibility. In a market where many BNPLs operate without a formal license, partnering with an incumbent bank or enterprise platform provides a halo of legitimacy, particularly with users making their first credit transaction online. For banks and payment processors like BBVA or EBANX, they open up new monetization pathways, capturing transaction-based revenue from users that were previously cash-only or underbanked.

From Installments to Inclusion: What Comes Next for BNPL

While BNPL in Mexico is still in its early innings, the momentum is undeniable. Transaction values are projected to triple from $6.1B in 2025 to over $18.5B by 2030, with 50% annual growth expected in transaction volumes. BNPL is forecasted to capture 2% each of the e-commerce and POS transaction value by 2030 – small shares, but indicative of a market with massive headroom.

The Mexican BNPL space is also attracting global attention. Entrants like Klarna and Sezzle, and regional names like Brazil’s Koin are setting up shop, betting on Mexico’s digital appetite and its unmet credit needs. At the same time, homegrown players are raising the bar on intelligence. Kueski is showcasing how AI can bridge financial gaps. By using machine learning to assess alternative data for credit scoring, it’s opening up credit access for those outside the formal system. AI-powered chatbots handle customer service at scale, while real-time fraud detection systems enhance security, building both trust and efficiency into the user experience. Plata, too, is leveraging an AI-powered platform to scale smarter credit operations.

With regulation expected by late 2025, the sector may soon have its first formal rulebook. If that framework strikes the right balance between consumer protection and operational freedom, BNPL could evolve into something far more foundational: a core layer of Mexico’s financial inclusion strategy. A bridge for the underbanked. A system where trust is built, not presumed.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

Authors

Head of Growth

Kshitija is a senior branding associate at WhiteSight, crafting branding strategies and fintech content. When she's not conjuring up new ideas for the company, you can find her dabbling in new hobbies and documenting her experiences through writing and short films.

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty