Breaking the Fintech Iceberg: Contactless Payments

Payment Plunge: Beneath the Surface of Tap-and-Go

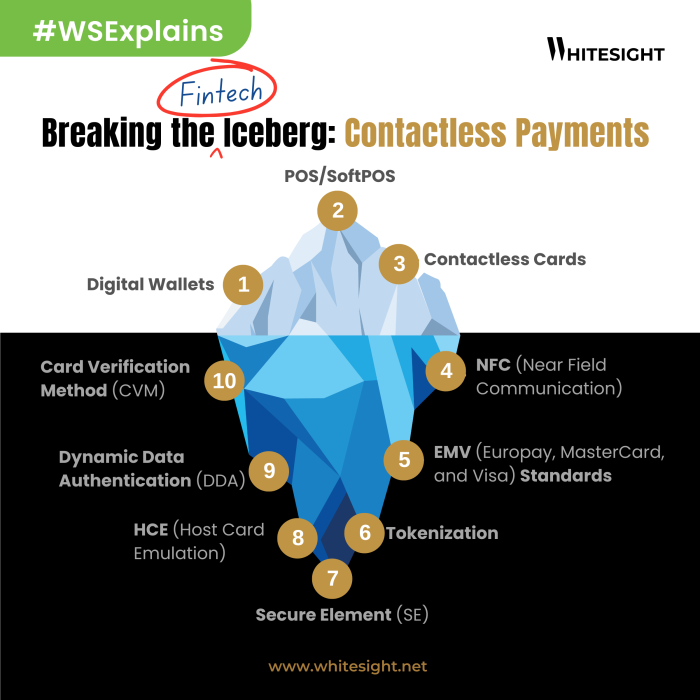

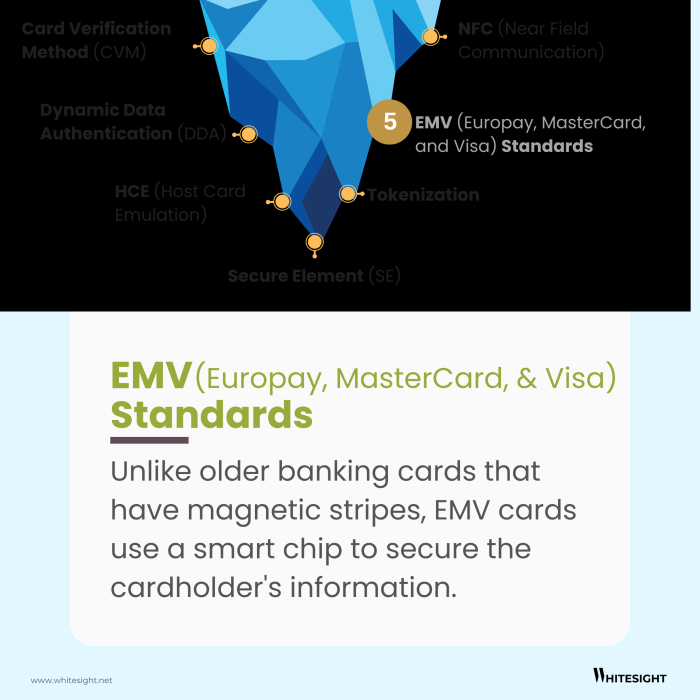

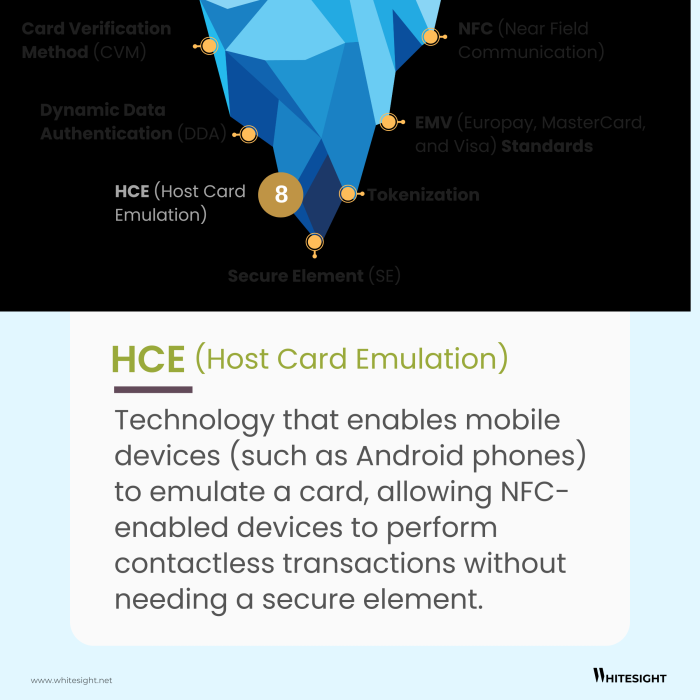

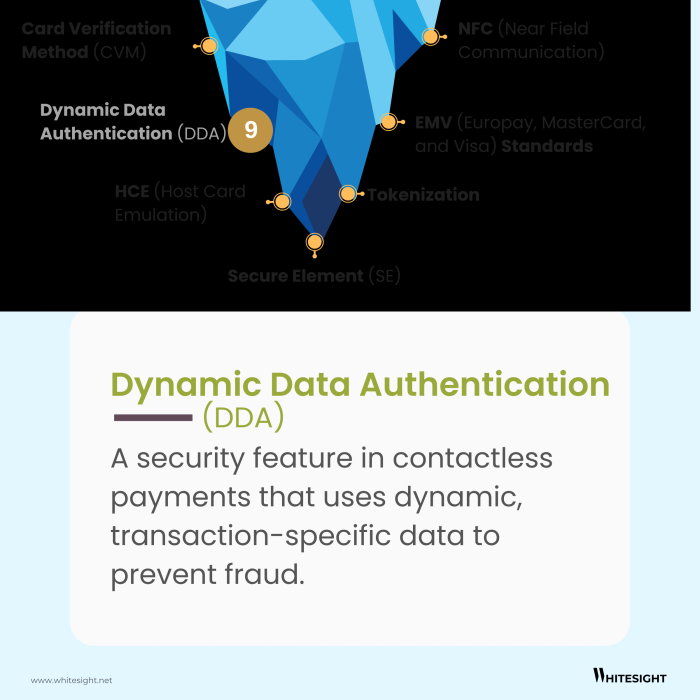

The surge in contactless payments represents a fundamental shift in how financial transactions are evolving. With NFC technology at its core, the ability to make secure, tap-to-pay purchases through cards, smartphones, and wearables is redefining consumer behavior and business models. In this detailed explainer post, we break down the 10 key elements powering this revolution—from NFC technology to tokenization and mobile wallets—offering a comprehensive look at how these components work together to create a seamless, secure, and efficient payment experience.

Contactless payments, driven by NFC technology and digital wallets like Apple Pay and Samsung Pay, are reshaping the payment landscape. The rise in SoftPOS solutions—allowing smartphones to act as contactless terminals—is particularly transforming small and medium businesses, enabling them to accept payments without expensive hardware. Security innovations like tokenization and dynamic data authentication protect against fraud by replacing sensitive data with tokens and generating unique transaction codes. For businesses, this means faster checkout experiences, reduced costs, and enhanced security, driving customer loyalty and operational efficiency.

Subscribe yourself to interrupted fintech intel with WhiteSight Radar. 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies that propels your business to the forefront of fintech.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Fintech's future on your radar 🚀

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

For fintech companies, this signals a shift towards more user-friendly, security-enhanced payment solutions. Businesses embracing contactless technology can enhance the customer experience by offering frictionless, convenient payment options, which are particularly appealing in today’s fast-paced, hygiene-conscious world.

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts