JPMorgan’s BlockChase: Dallying On Blockchain And Web 3

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Digital Assets, Insights

Table of Contents

JPMorgan has always been on a quest to embrace disruptive trends as the traditional banking industry gets challenged with emerging technologies and evolving business models. Despite being an incumbent bank, the financial goliath has never shied away from diversification and experimenting with modern technology as is evident from their innovation and investment strategy. In 2015, the Wall Street Bank made its first attempt to foray into the blockchain industry, when it partnered with eight other banks including Barclays and BBVA to form a consortium led by R3. In our previous post, we explored the Goliath’s Resurgence by taking a look at its FinTech playbook. In this post, we add a crypto twist to this playbook by seeking the goliath’s tryst with the crypto phenomenon across the themes of blockchain, cryptocurrencies, NFTs, and the metaverse. 2015-2019: Betwixt and Between The Crypto CrazeJPMorgan’s association with blockchain can be traced back to Feb 2016 – when the bank began a trial test of the technology similar to one that underlies bitcoin – by tapping into Digital Asset Holdings. The following year, they launched their own blockchain, Quorum, hoping to explore potential ways the DLT might help accelerate the rate it transacts business. However, […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

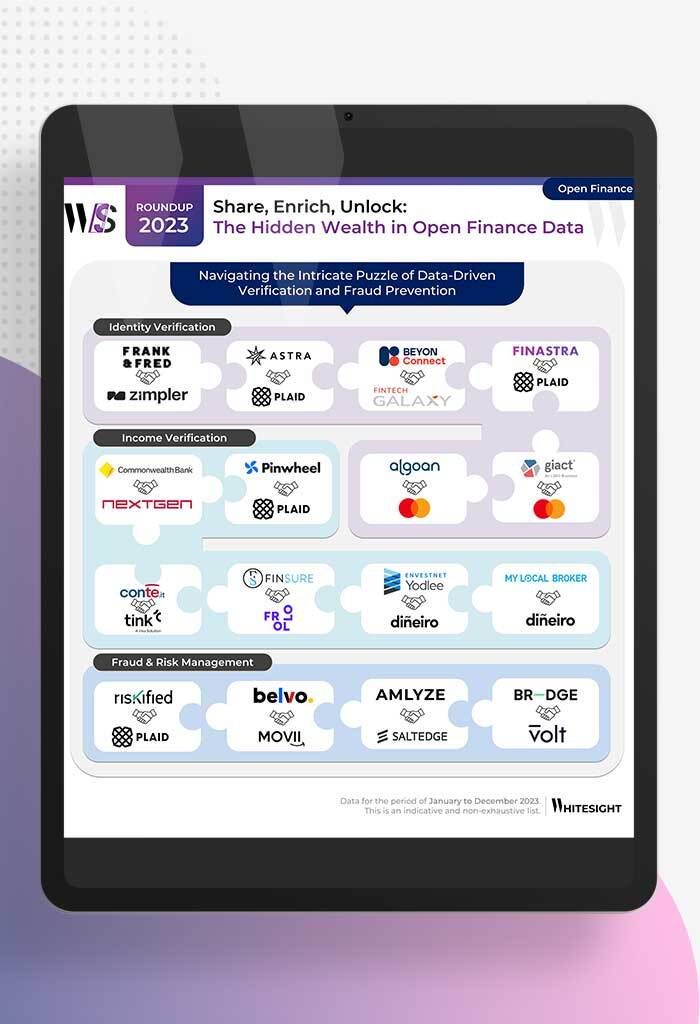

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

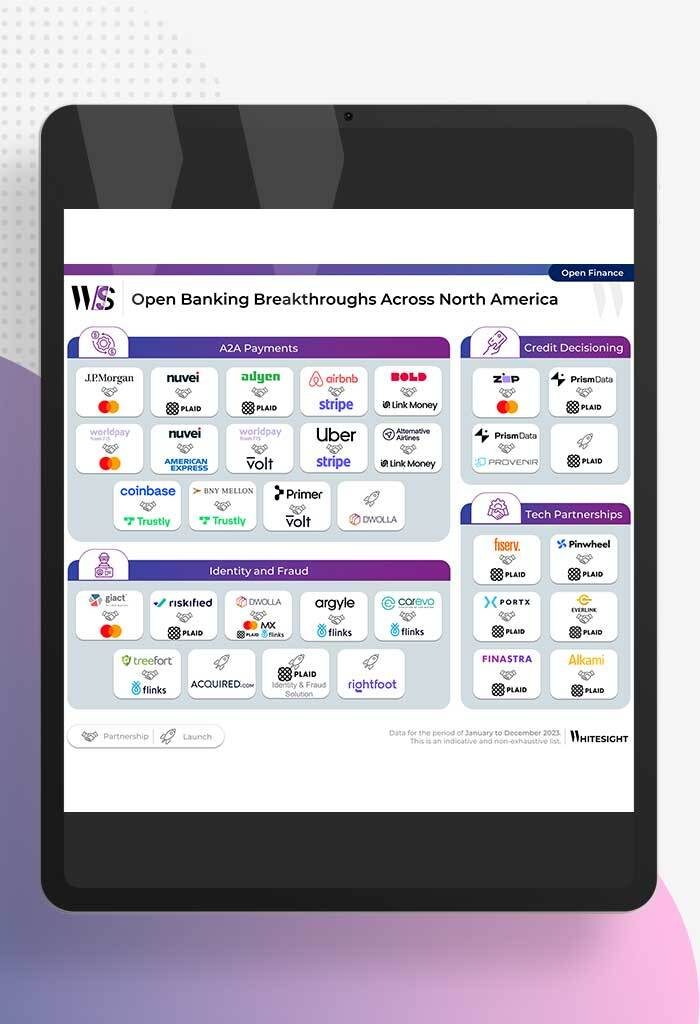

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

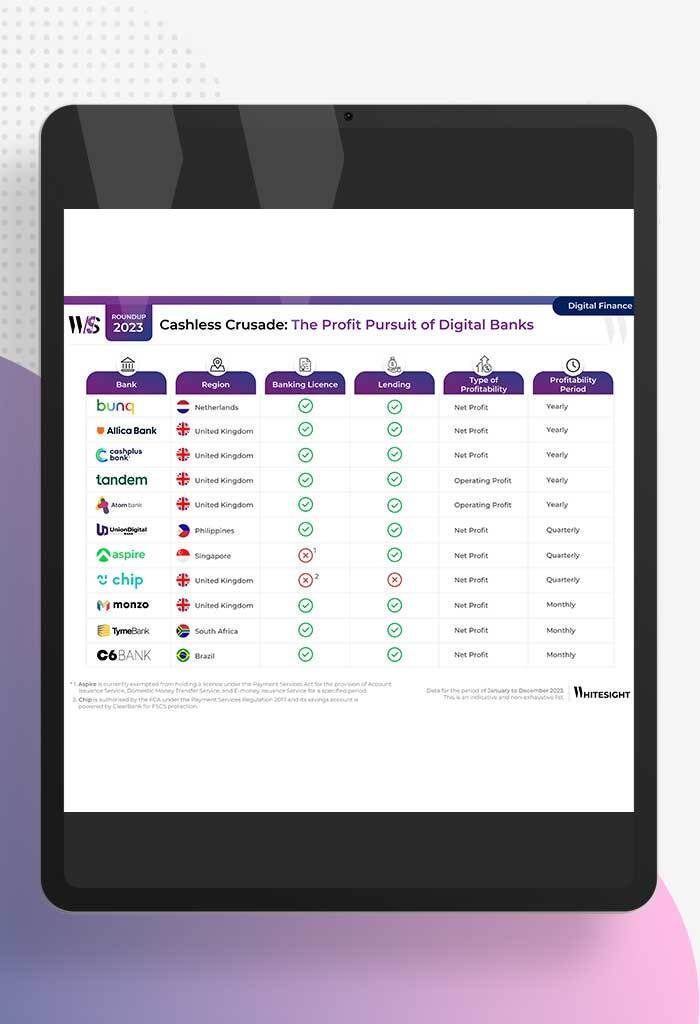

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

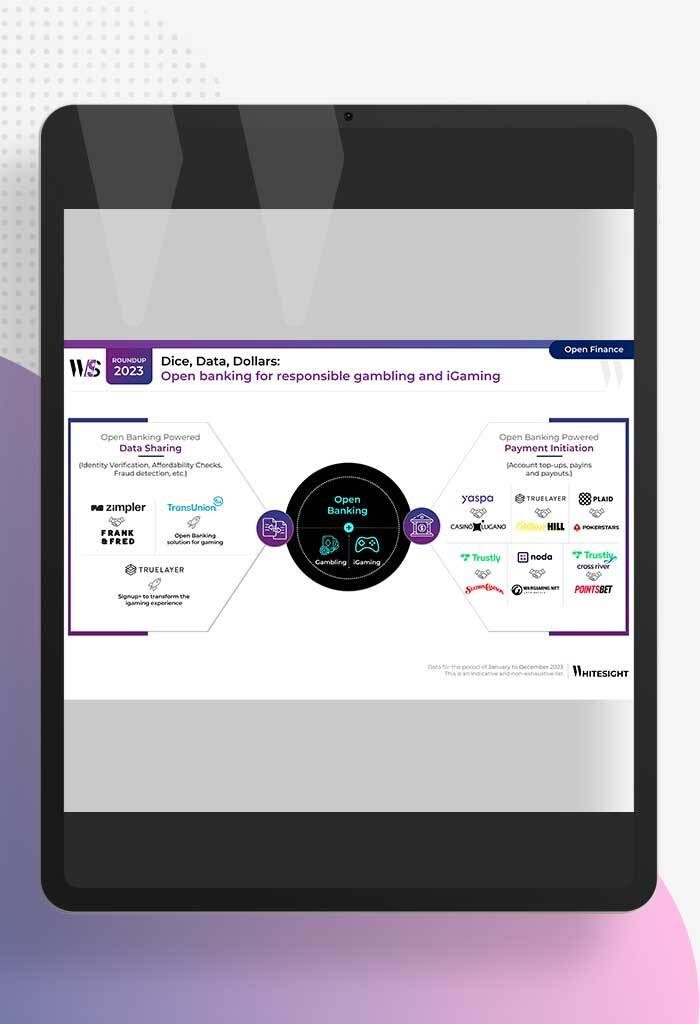

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

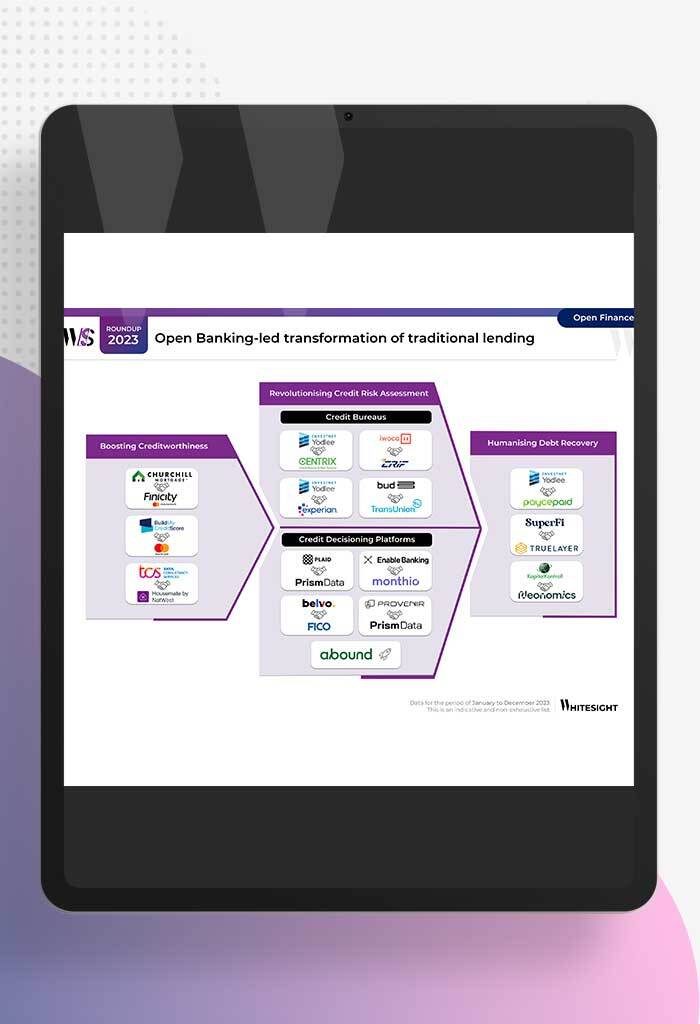

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

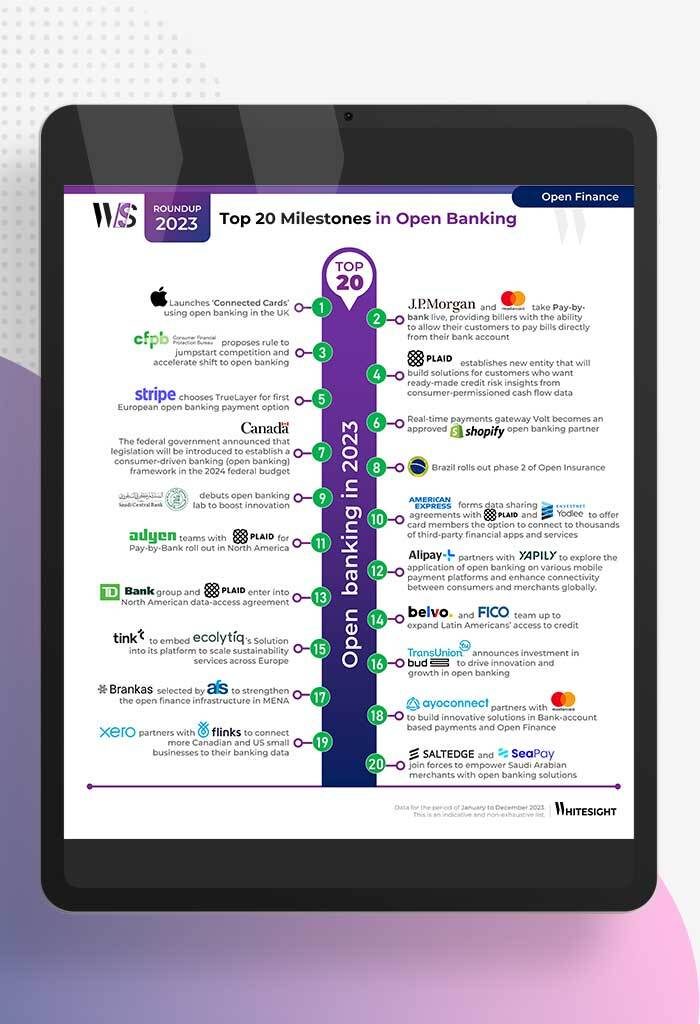

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...