Marcus: An Expedition from Wall Street to Main Street

- Sanjeev Kumar and Risav Chakraborty

- 5 mins read

- Digital Finance, Insights

Table of Contents

In 1869, a German immigrant named Marcus Goldman moved to New York City to launch a new business targeted at small businesses to help them secure short-term capital. Over the next few years, Marcus Goldman’s son, Henry Goldman, and son-in-law, Samuel Sachs, joined him, and the firm became a partnership with a new name: Goldman Sachs & Co.Over the next century and a half, the firm turned itself into a giant, announcing an annual revenue of $59.34B and annual net earnings of $21.64B in 2021. Approximately 98% of the annual revenues came from Investment Banking, Global Markets, Asset Management, and Wealth Management businesses.In this blog, we look at the digital bets Goldman has made on its diversification strategy towards building a consumer-centric digital finance business – Marcus by Goldman Sachs.Marcus, from the outside, may look like an innocuous neobank initiative aimed at unlocking retail banking opportunities for the global investment bank, but look deeper, and it seems like a riddle wrapped in a mystery inside an enigma.The firm’s evolutionary tale from ‘Goldman Sachs by Marcus’ to ‘Marcus by Goldman Sachs’ is an exciting one, especially given that the neobanking sector has faced a slew of failures and setbacks in recent […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

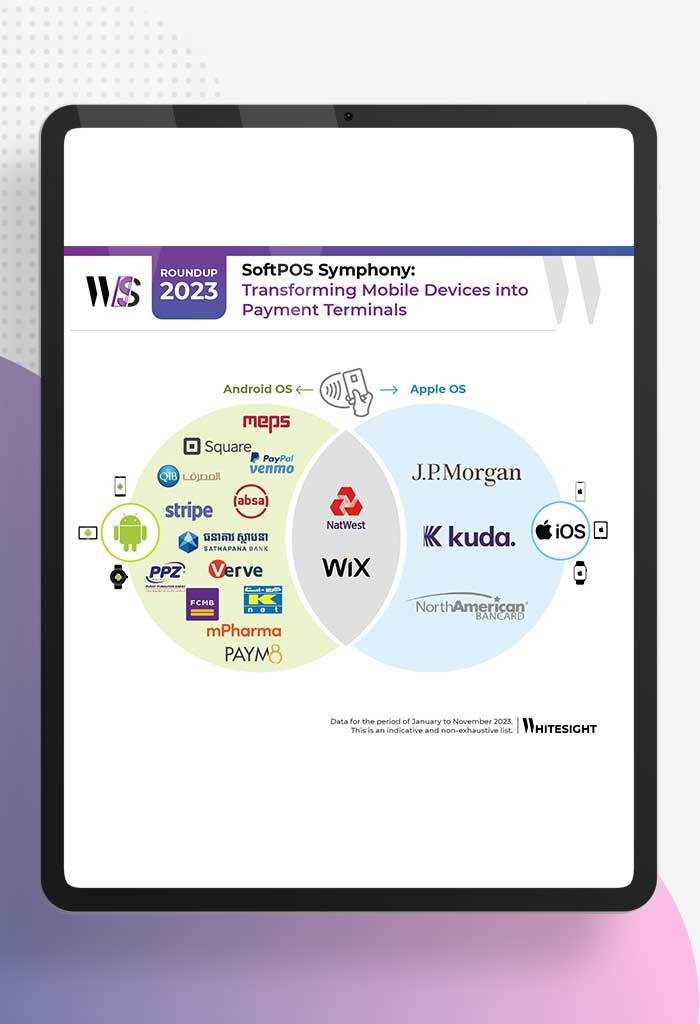

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

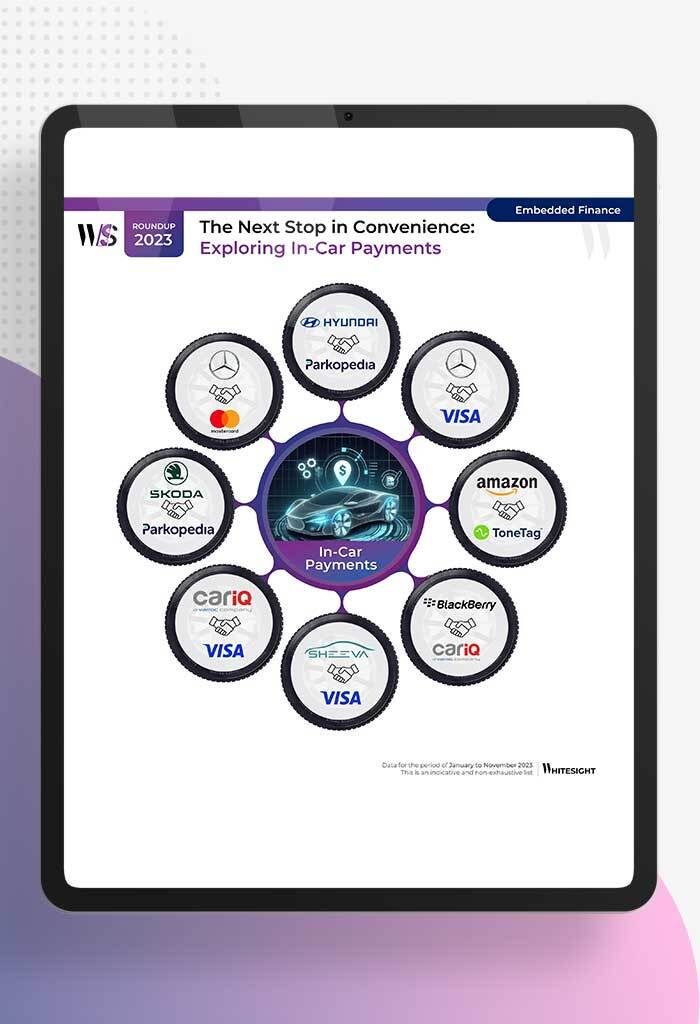

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

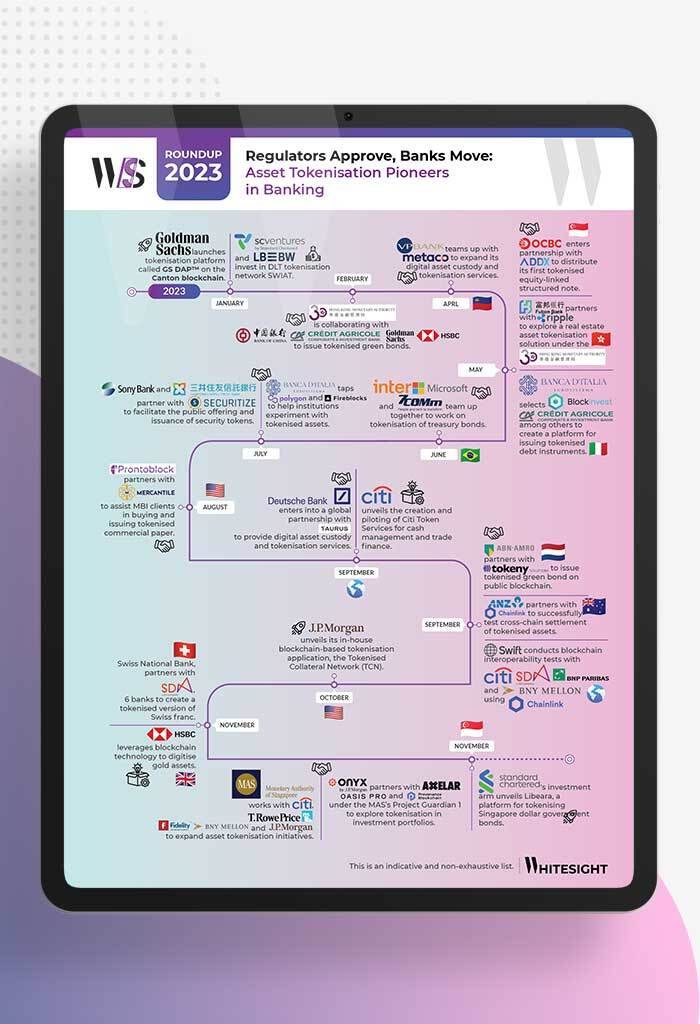

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

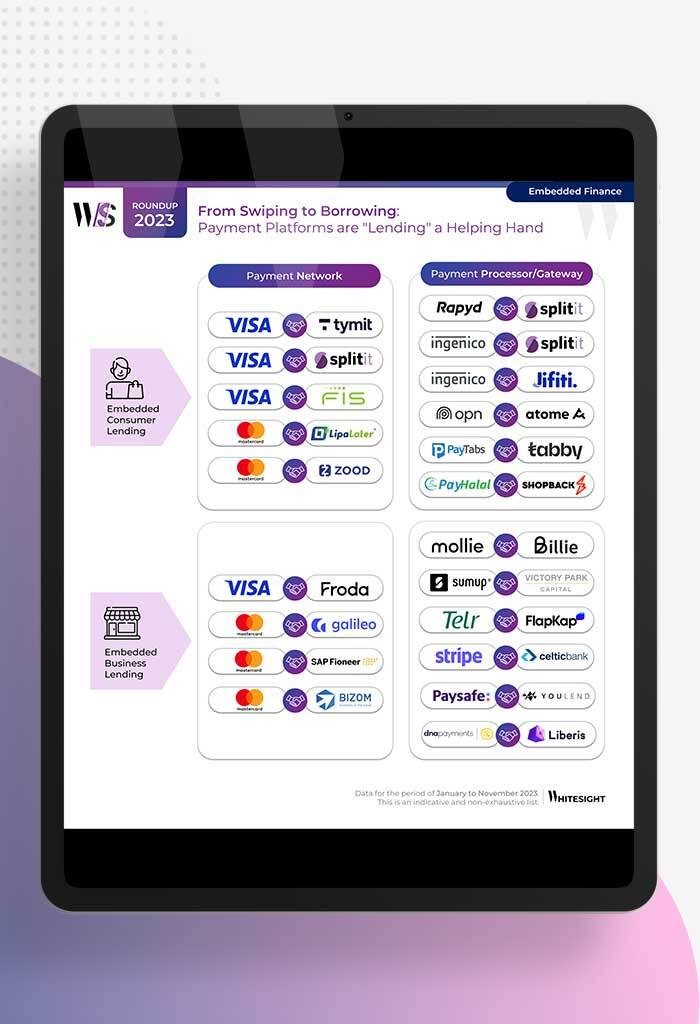

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...