Nice to “Meta” You: Brands Become Versed with Metaverse

- Afshan Dadan and Risav Chakraborty

- 4 mins read

- Digital Assets, Insights

Table of Contents

Nice to “Meta” You: Brands Become Versed with MetaverseThe idea of living through the eyes of one’s digital avatar may not be such a far-fetched notion for today’s digitized world. While Facebook (Meta) decided to dip into the immersive universe of Metaverse—a hybrid reality where the “physical” and the “digital” are said to collide—with much hype and fanfare recently, there have been multiple brands across industries who had already embarked on the journey to be a part of the Metaverse in various shapes and forms much before. We look at some of the key metaverse initiatives in this post. The concept of an interconnected and interoperable ecosystem isn’t entirely new. The theory stems as far back as 1992, where it was depicted more as a virtual gaming environment that people could interact with using virtual reality headsets, and has been in practice for gamers through examples like Second Life and Fortnite. Several other online gaming firms have since then built upon this design, with names such as Roblox and Epic Games at the forefront – creating virtual worlds that offer not only the possibility to socialize and host virtual events, but also participate in a digital economy. The Sandbox gaming […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

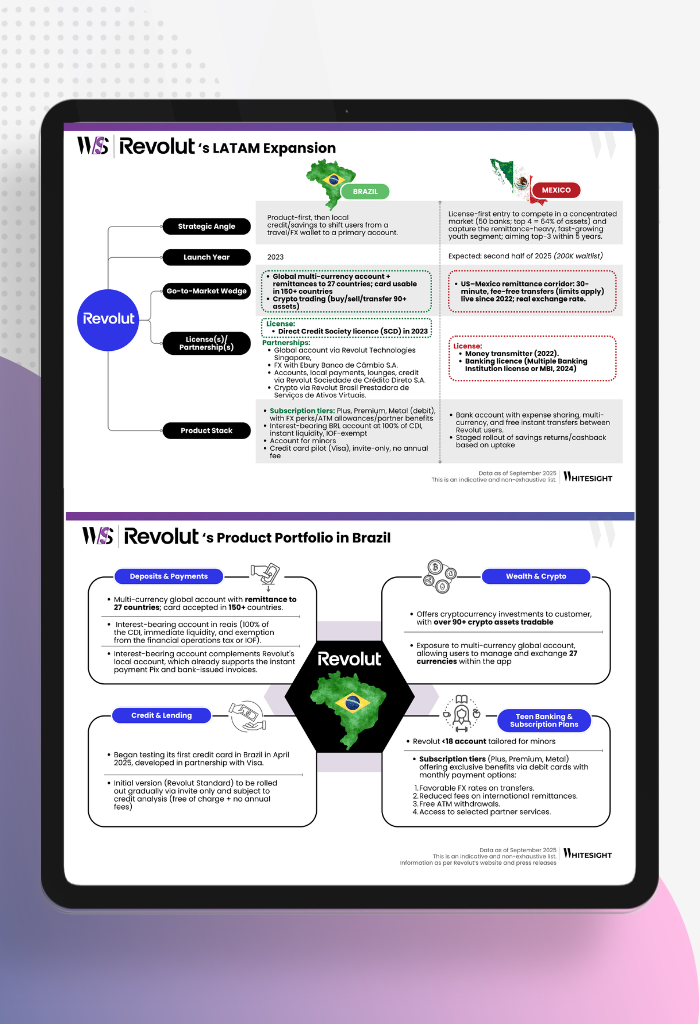

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

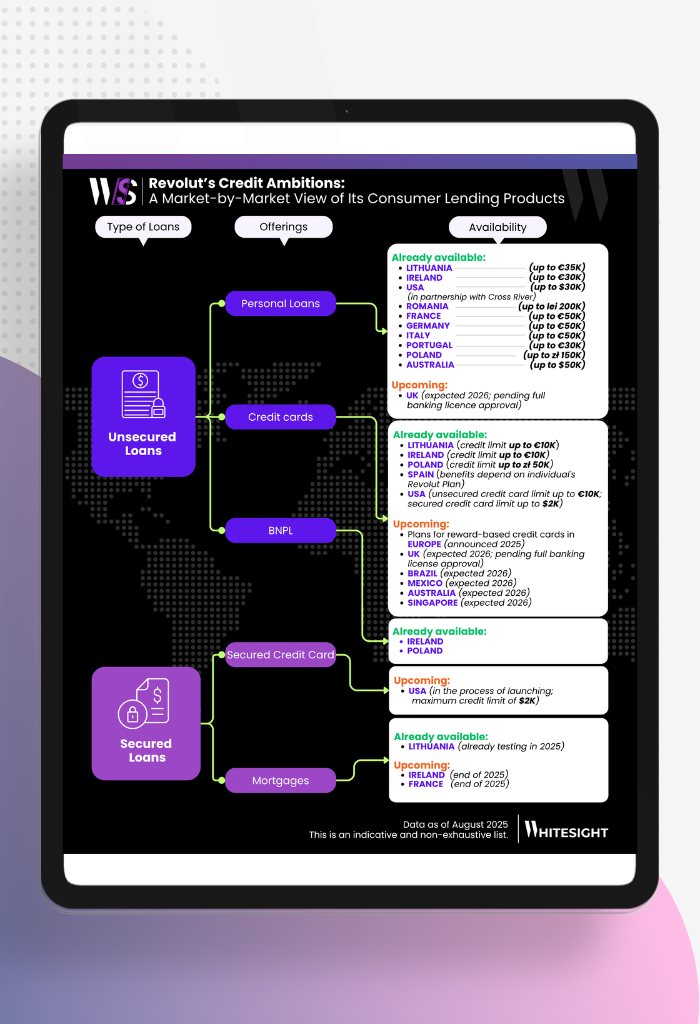

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

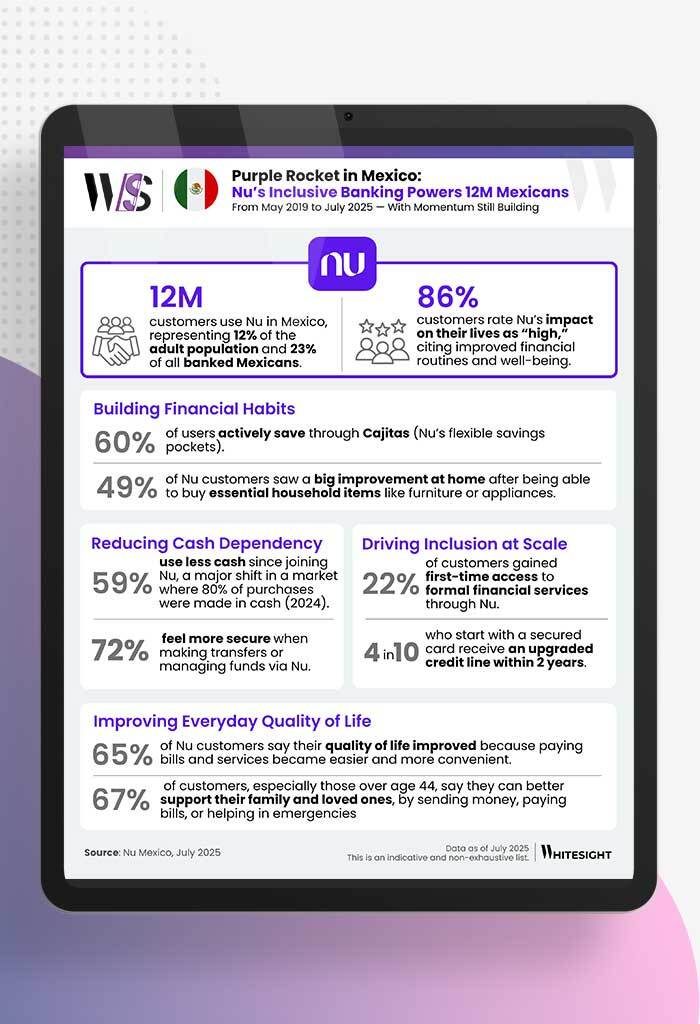

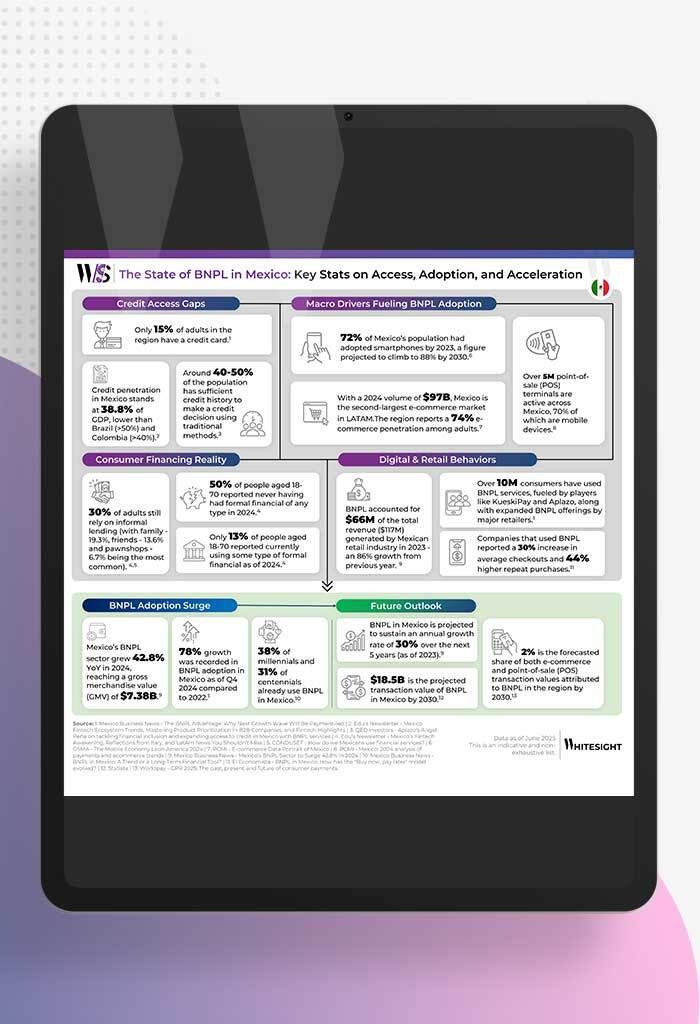

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar