Revolut-ionary Leaders: Navigating Global Aspirations

- Risav Chakraborty and Anjali Singh

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

In its seven years of existence, Revolut has swiftly made its way from a multi-currency payments startup in the UK to a digital bank scaleup in Europe, and now marching towards becoming a global financial super-app. Unravelling the story so far, we’ve looked at their product evolution (the What) and their expansion strategy through licencing (the How) across different geographies (the Where). Now it’s time to explore the Who ㅡ the people leading the meteoric rise of the FinTech poster child.Faces Behind The Revolution: Leaders From Around The GlobeTo build a global financial super-app, mapping out a cohesive international leadership team and tapping into the right top management talent pool is one of the key steps in achieving the vision. Like many disruptive innovation stories, it all began with one man’s frustration over the traditional banking system. Nikolay Storonsky – the man behind it all – bid on the market opportunity presented by the high costs and frustrating customer experiences involved in forex transactions. Along with Vladyslav Yatsenko, Revolut was built to provide forex at market rate for ex-pats and international travellers. What started as a company premised at Level39 FinTech incubator at London’s Canary Wharf is now a decacorn […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

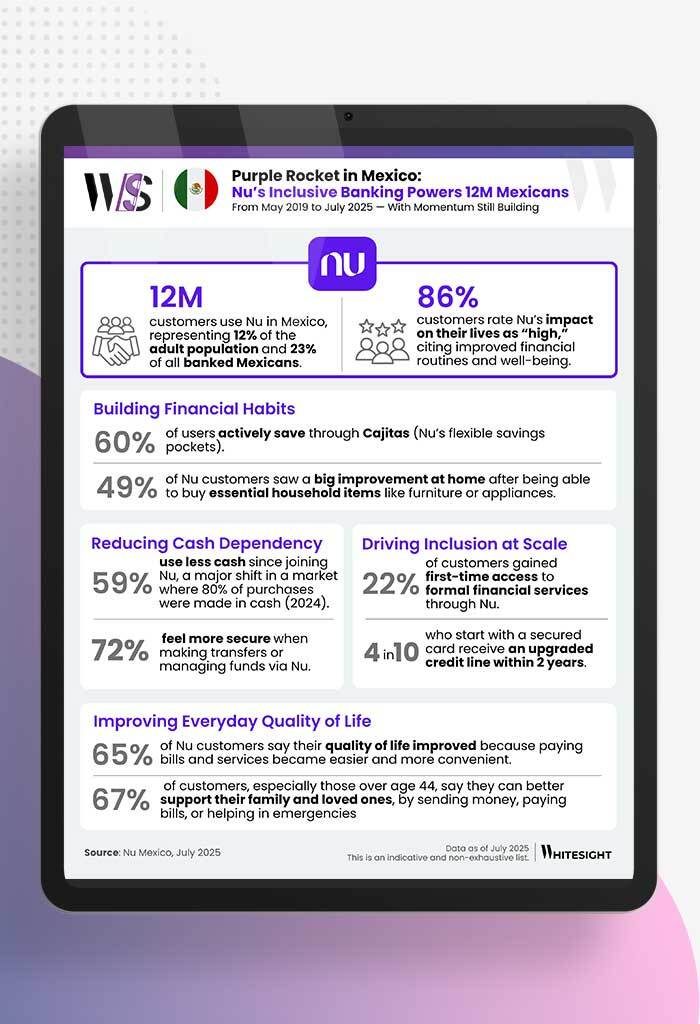

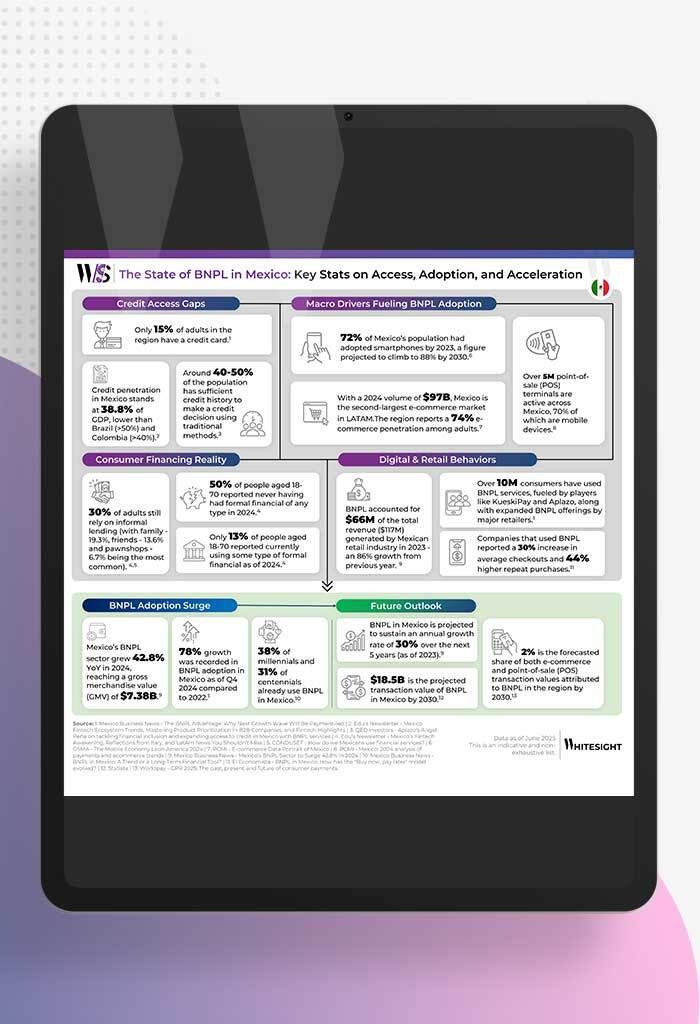

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar