Robinhood: Growth Amid a Slew of Regulatory Run-ins

- Team WhiteSight

- 2 mins read

- Digital Finance, Insights

Table of Contents

Robinhood: Growth Amid a Slew of Regulatory Run-insWhile Robinhood has seen phenomenal growth this year, the firm has faced several significant setbacks such as system outages during market swings that prevented customers from trading, the cancellation of its plans to expand to the U.K. and the most recent issue of restricting trading on a few volatile stocks. ♂️ Regulatory Pressure Mounts: In 2019-20, Robinhood faced a maximum number of regulatory scrutiny and sanctions which included regulators across the board including SEC, FINRA, Massachusetts securities regulators, etc. questioning its business model. 2021 seems to bring even more heat on its operating model. So far Robinhood has responded with hiring a bunch of lobbyists, increasing size of its customer service team, improving UX and adding more financial education materials✋ Friction Ain’t Always Bad: While removing friction has been one of the core motto of FinTechs across sectors, in capital markets this may expose customers to unprecedented risks that include getting access to leverage that they can’t afford or getting involved in financial instruments that they don’t understand. Gamification Grey Area: Marketing tactics to acquire GenZ & Millennial customers and gamification approach to engage with them on a frequent basis is a new […]

This post is only available to members.

document.addEventListener('DOMContentLoaded', function() {

console.log('social login script loaded');

// Use event delegation in case buttons are dynamically rendered

document.body.addEventListener('click', function(e) {

console.log('social login button clicked');

var btn = e.target.closest('.button-social-login');

if (btn) {

// e.preventDefault();

// Disable button to prevent multiple clicks

btn.style.pointerEvents = 'none';

btn.style.opacity = '0.6';

// Change button content to 'Please wait...' with a simple spinner

btn.innerHTML = ' Please wait...';

// Add spinner animation style if not already present

if (!document.getElementById('social-login-spinner-style')) {

var style = document.createElement('style');

style.id = 'social-login-spinner-style';

style.innerHTML = '@keyframes spin {0%{transform:rotate(0deg);}100%{transform:rotate(360deg);}}';

document.head.appendChild(style);

}

}

});

});

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

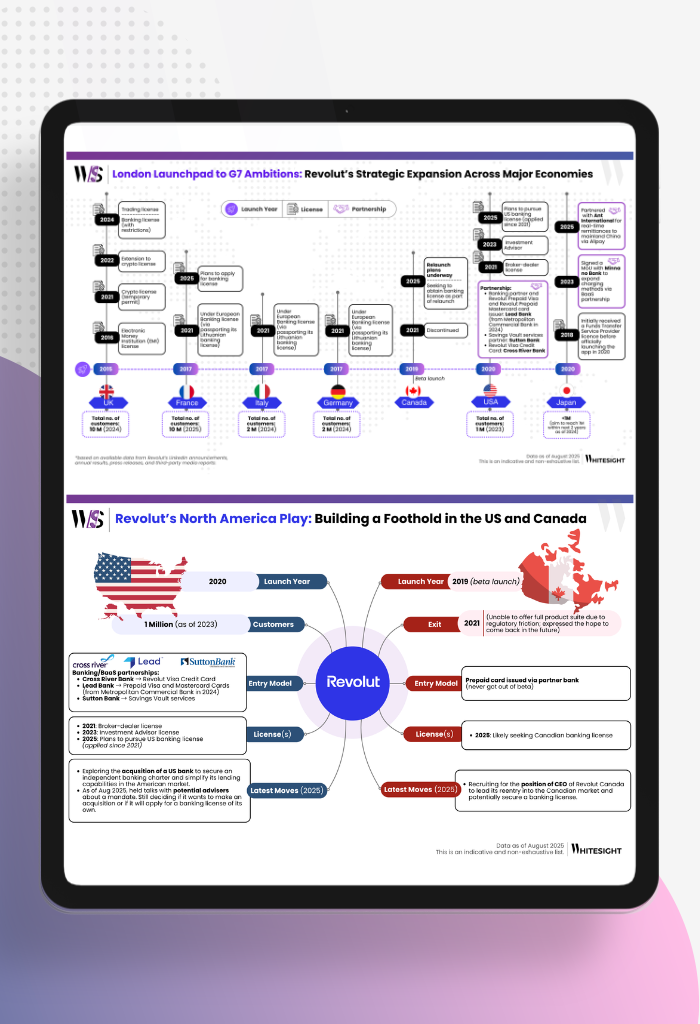

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty