The US Fintech Domino: Bank M&As and SMB Neobanks

- Team WhiteSight

- 6 mins read

- Digital Finance, Insights

Table of Contents

As the world slowly recovers from the pandemic and fintech startups ready themselves for the new normal, their operating models are facing a new and significant challenge in the wake of the recent mergers and acquisitions from the banking sector.Based on our ongoing analysis of the neo-banking & digital challenger banking space, we believe that neobanks who cater to small and mid-size businesses (SMBs), will emerge as significant players in the fintech ecosystem in the coming years.In this article, we analyse the way SMB neobanks operate in the US and the challenges and opportunities that they face in the wake of the recent banks’ M&As.SMB Neobanks: Overview & Customer Segment FocusSMBs are usually the backbone of a country’s economy in terms of generating significant employment opportunities and contributing massively to international trade. However, the segment itself is extremely fragmented in terms of size, life stage and nature of individual firms who operate in it. Owing to this fragmentation, SMBs are often overlooked by the megabanks and do not have comprehensive access to personalised and contextual banking services. Even FinTechs that earlier concentrated on SMBs, focused only on specific point solutions such as card acquiring, lending, accounting etc. and did not […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

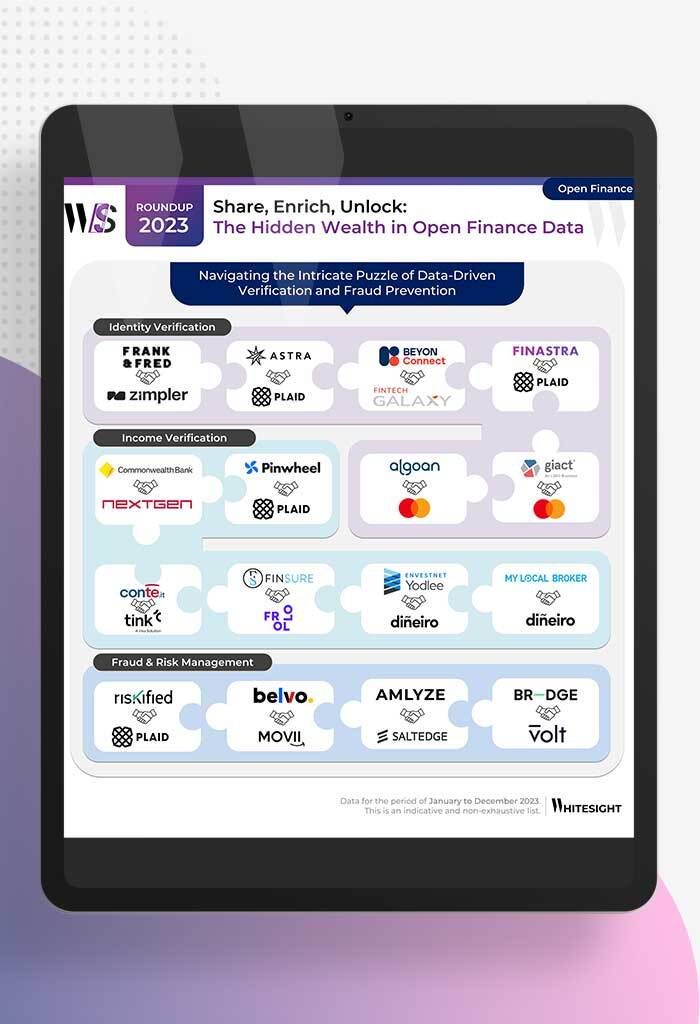

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

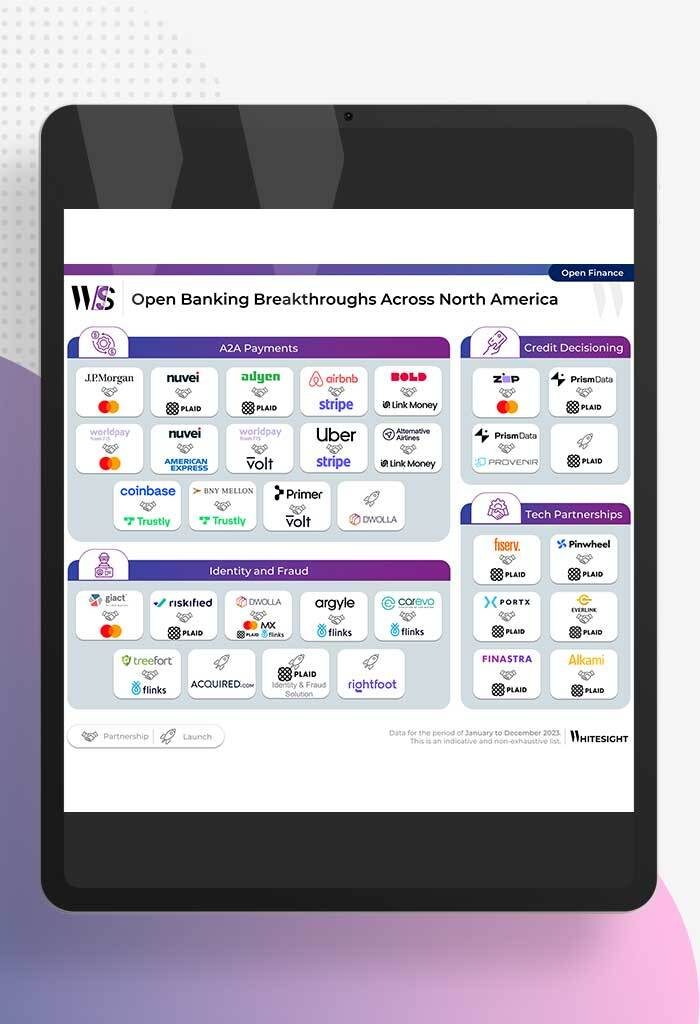

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

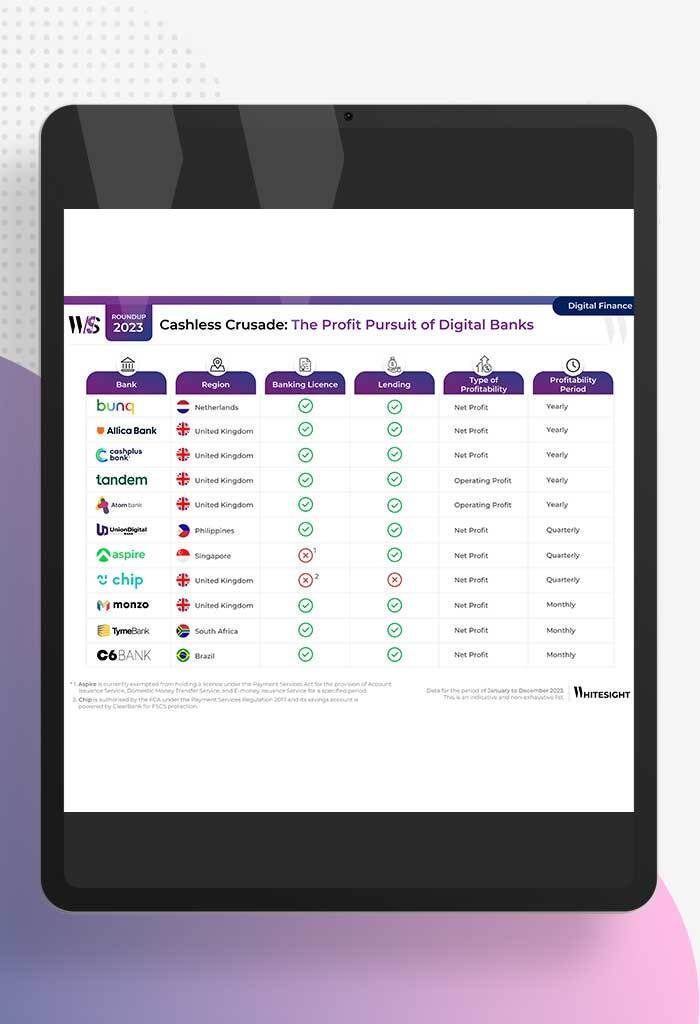

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

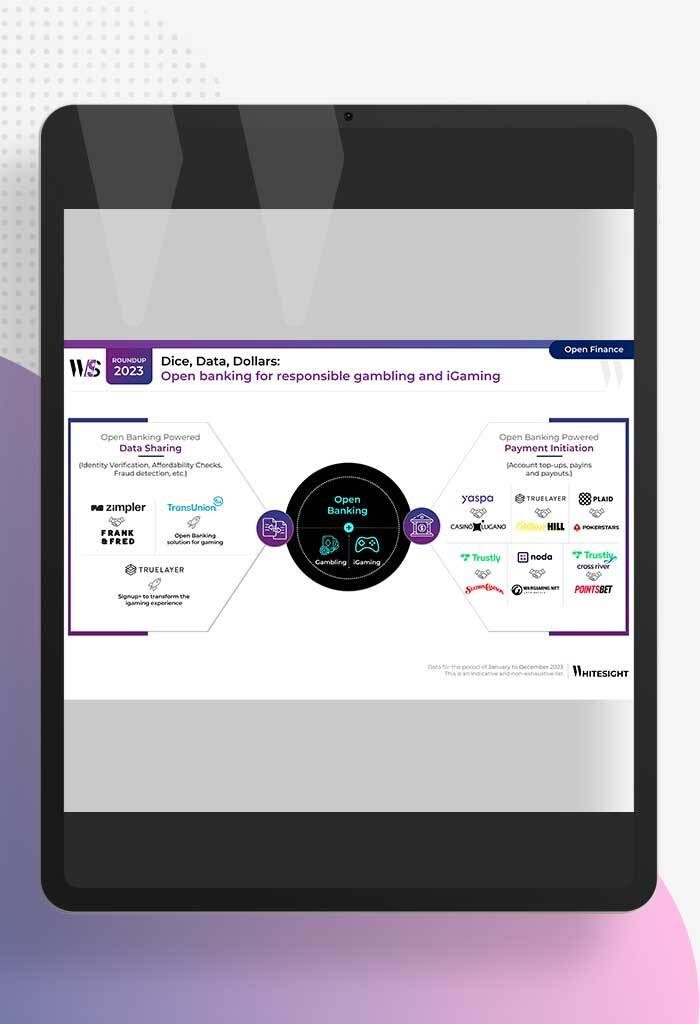

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

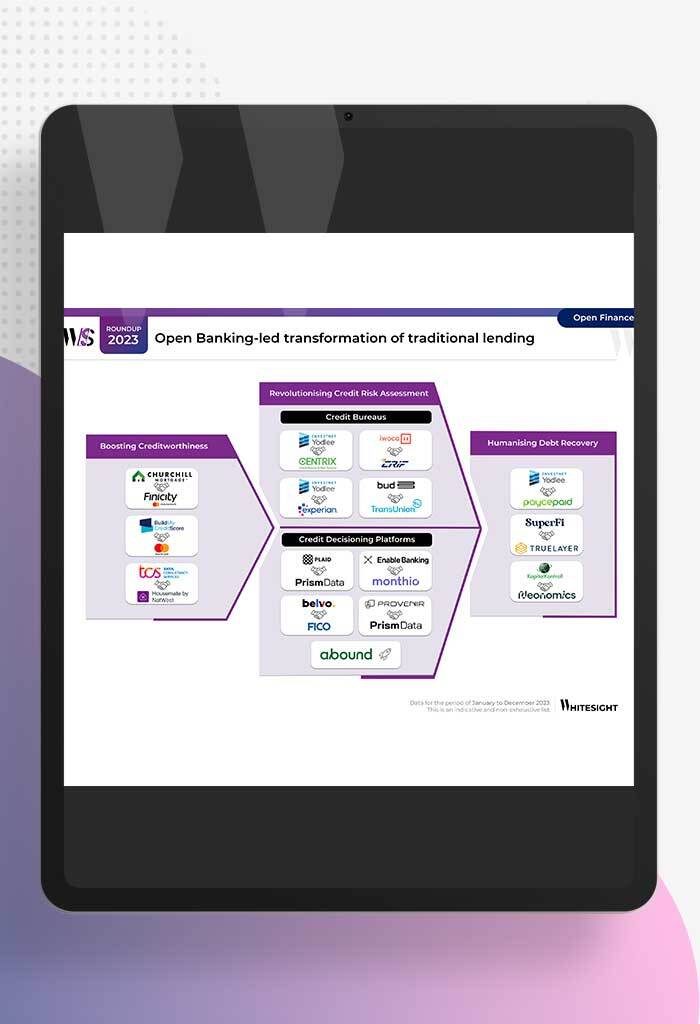

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

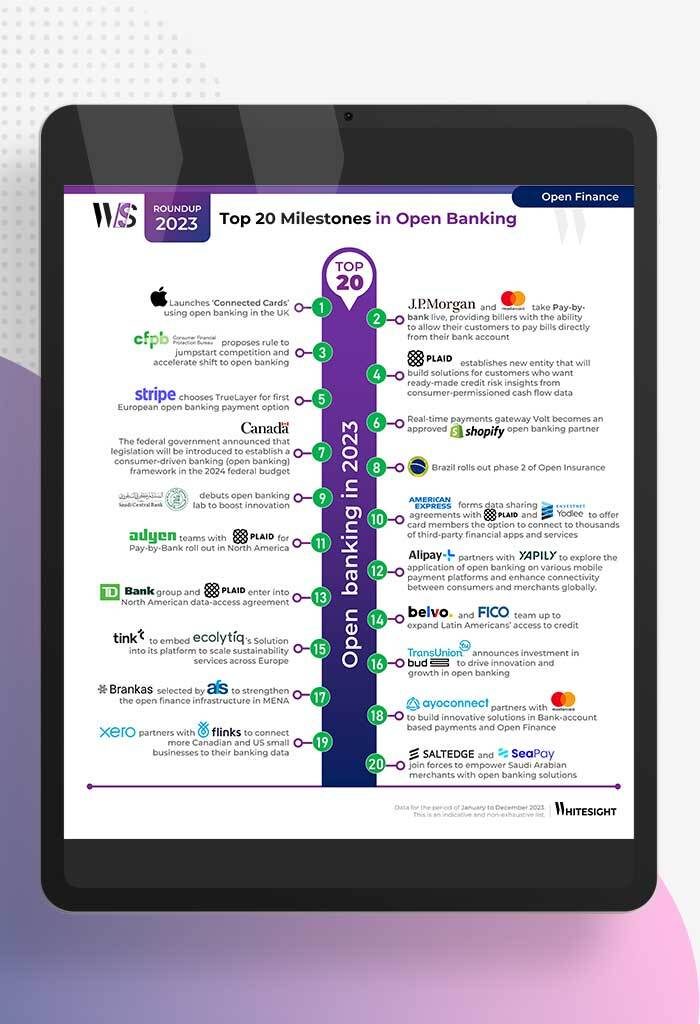

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...