The US Fintech Domino: Bank M&As and SMB Neobanks

- Team WhiteSight

- 6 mins read

- Digital Finance, Insights

Table of Contents

As the world slowly recovers from the pandemic and fintech startups ready themselves for the new normal, their operating models are facing a new and significant challenge in the wake of the recent mergers and acquisitions from the banking sector.Based on our ongoing analysis of the neo-banking & digital challenger banking space, we believe that neobanks who cater to small and mid-size businesses (SMBs), will emerge as significant players in the fintech ecosystem in the coming years.In this article, we analyse the way SMB neobanks operate in the US and the challenges and opportunities that they face in the wake of the recent banks’ M&As.SMB Neobanks: Overview & Customer Segment FocusSMBs are usually the backbone of a country’s economy in terms of generating significant employment opportunities and contributing massively to international trade. However, the segment itself is extremely fragmented in terms of size, life stage and nature of individual firms who operate in it. Owing to this fragmentation, SMBs are often overlooked by the megabanks and do not have comprehensive access to personalised and contextual banking services. Even FinTechs that earlier concentrated on SMBs, focused only on specific point solutions such as card acquiring, lending, accounting etc. and did not […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

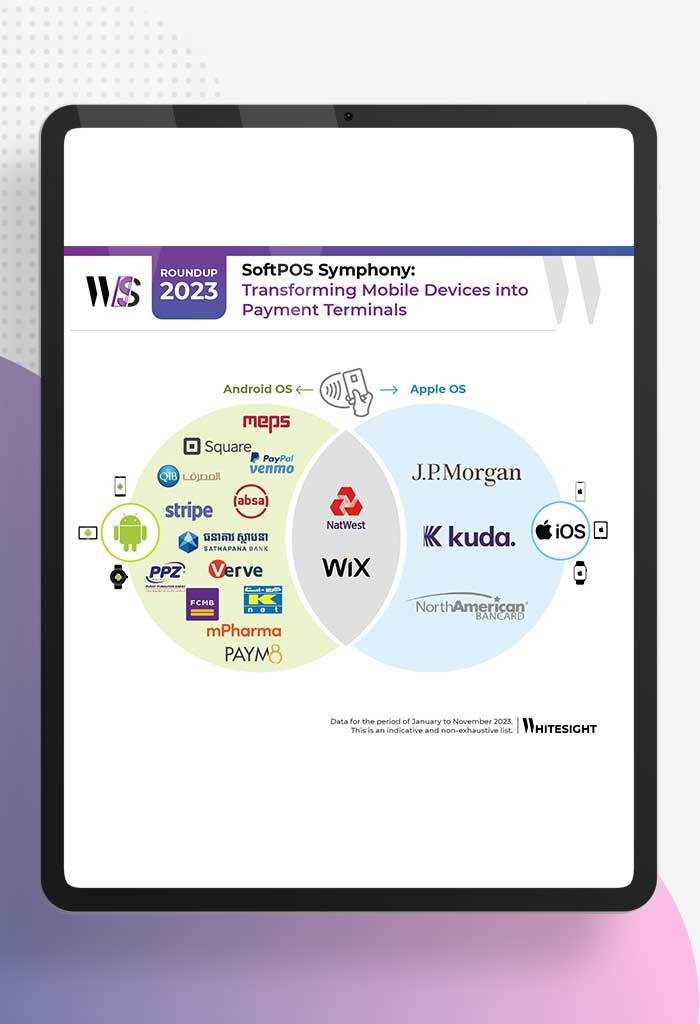

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

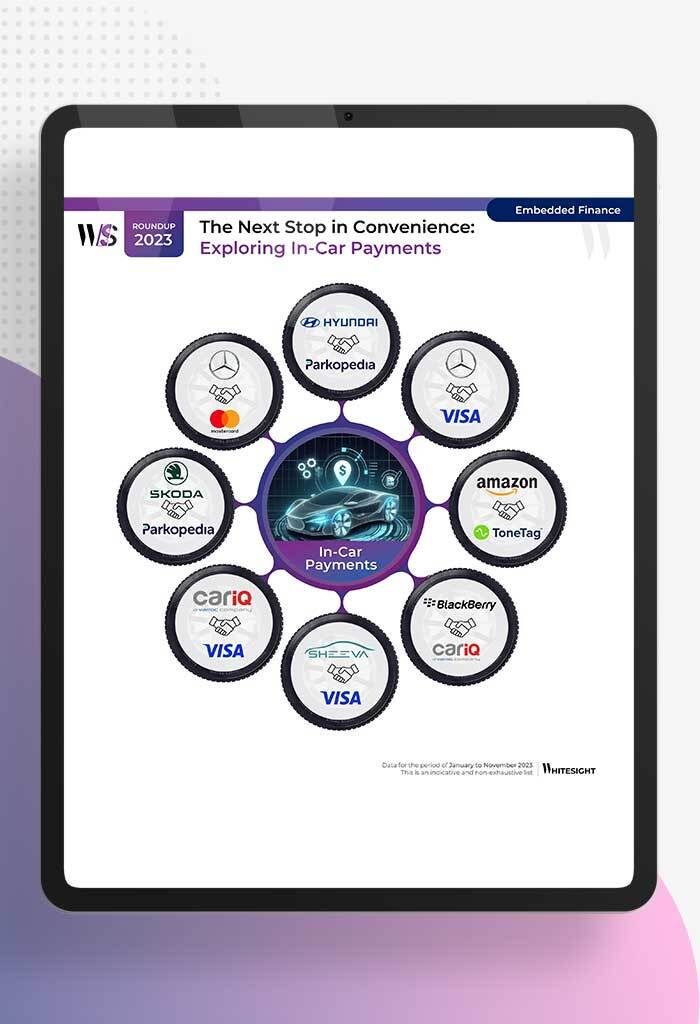

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

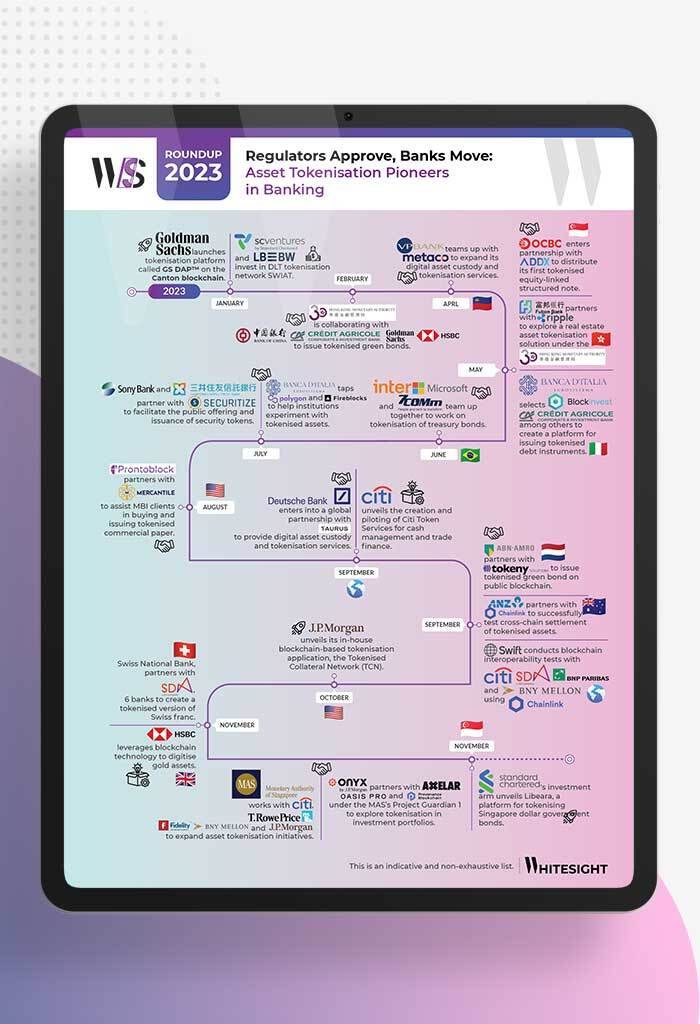

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

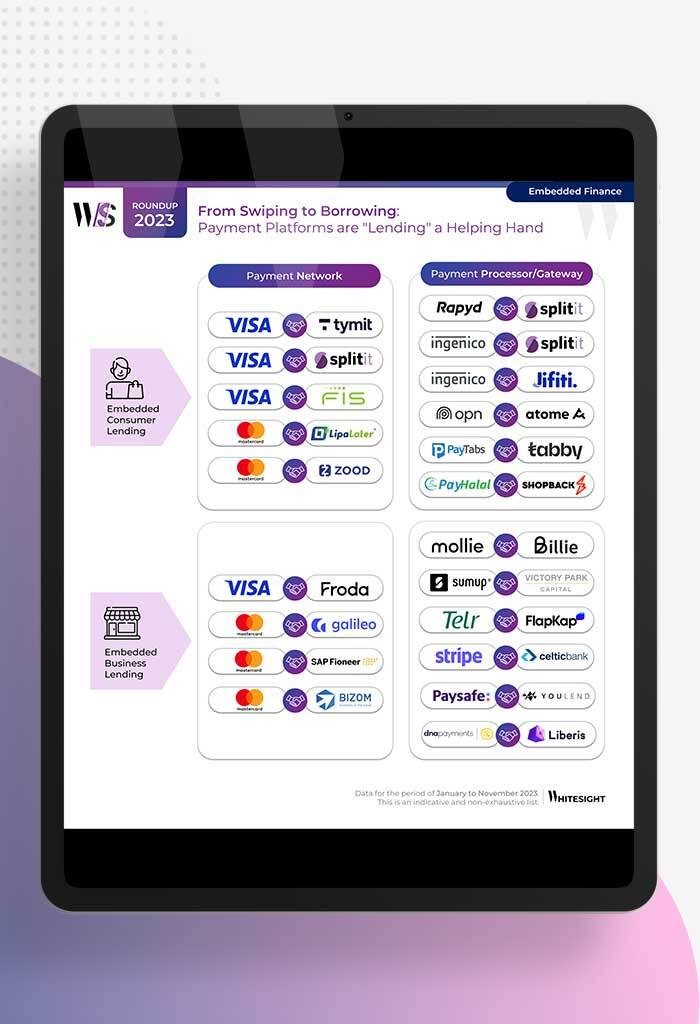

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...