Roundup 2024: How Open Banking Empowers Credit Decisioning

- Kshitija Kaur and Sanjeev Kumar

- 5 mins read

- Insights, Open Finance

Table of Contents

The Impact of Open Banking on Credit Decisioning Welcome to the 2024 edition of WhiteSight’s annual roundups – a deep dive into the most significant fintech trends making waves! As we gear up for another series of insightful annual roundups, we kick off by examining a game-changing shift in the credit landscape: open banking-powered credit decisioning. We previously explored how Open Banking is Flipping the Traditional Lending Game, enabling lenders to dive into a more accurate picture of consumers’ financial situation to offer loans that truly fit their ability to pay.With an estimated 82% of lenders believing that the cost-of-living crisis makes affordability checks more important than ever, and 77% acknowledging the need to improve their risk decisioning models for a more accurate view of people’s finances, it is evident that the momentum has continued into this year, positioning open banking-powered credit decisioning as a transformative force in lending. From enabling non-banks to rethink BNPL (buy-now-pay-later) strategies to supporting the ‘credit invisible’ through cash flow analysis, open banking is reshaping credit assessments across markets. This year has seen notable collaborations and launches from industry players, all integrating consumer-permissioned data for better risk profiling and affordability insights. Join us as we… […]

This post is only available to members.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

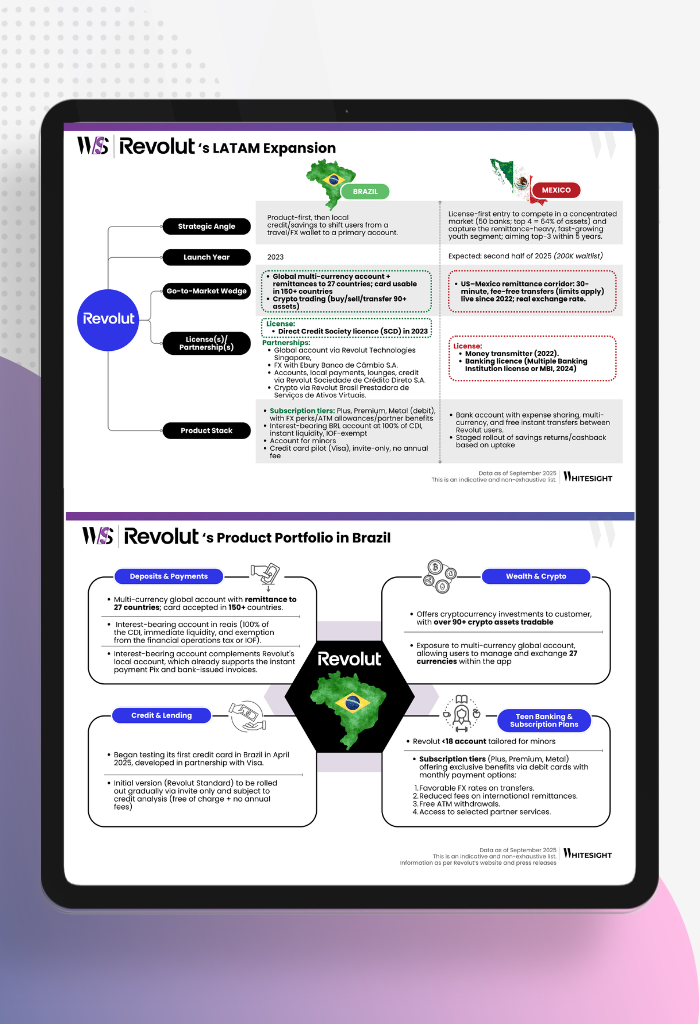

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...