Trusting The Trustless: 2022 Crypto Shutdown & Hacks

- Sanjeev Kumar and Anjali Singh

- 3 mins read

- Digital Assets, Insights

Table of Contents

2021 was a year where the sun shined brightly upon crypto investors. By November 2021, Bitcoin had reached an all-time high of $69,000, breezing through with a market cap of $3T. Few could have imagined what was in store for Crypto and DeFi in 2022.It was not long before things turned from bolt to blue, with the crypto market plummeting below , $2T in January 2022 following interest rate revisions by the Federal Reserve. It was only an unfortunate downward spiral thereupon. Currently, the crypto ecosystem is tied up by a string of hacks and swindlers – causing investors to second-guess its “trustless” foundation.Market experts call this period of market-freezing conditions ㅡ “crypto winter”, and in this post, we’ll explore what caused the polar vortex in the crypto ecosystem.How Did The Crypto Winter Set In? Cryptocurrency prices are prone to wild volatility. It has always been a market that’s hot today, cool tomorrow. The year’s crypto ecosystem collapse has largely been caused by the failure of crypto “banks”, crypto exchanges, and crypto hedge funds.Exhibit 1 shows how crypto companies ultimately went from high-flyers to skydivers in 2022.The world of crypto went into a tailspin when TerraUSD and its sister coin […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

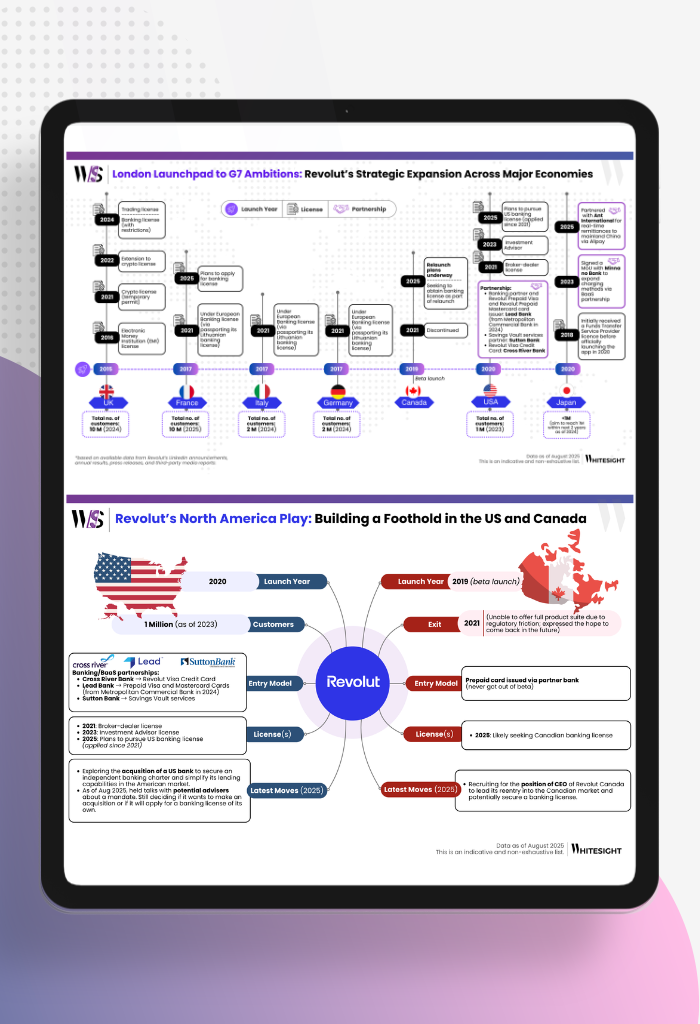

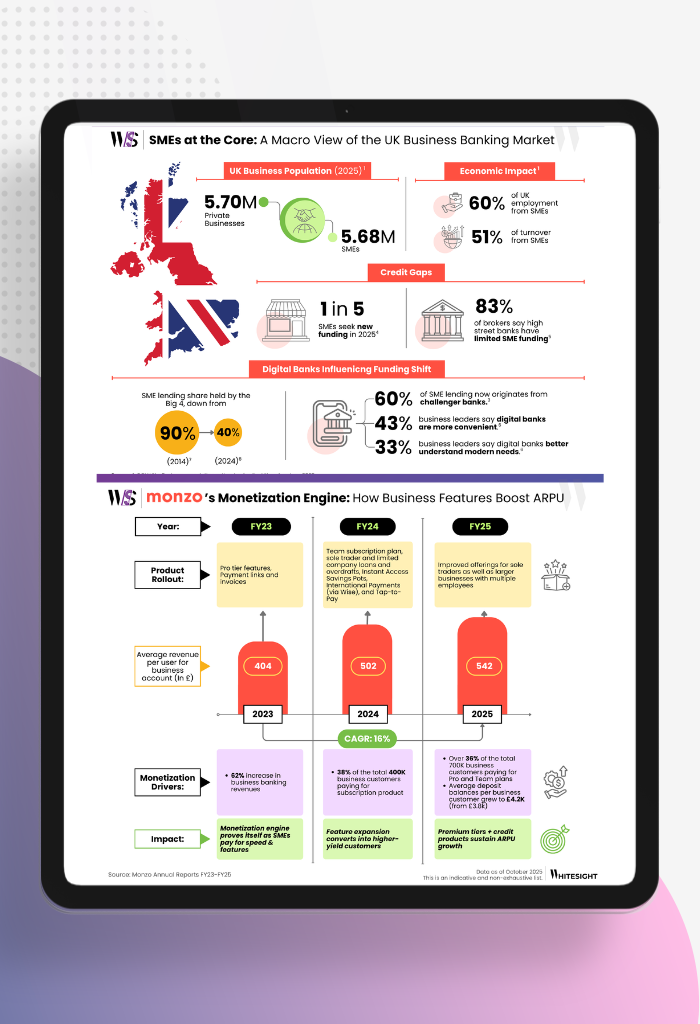

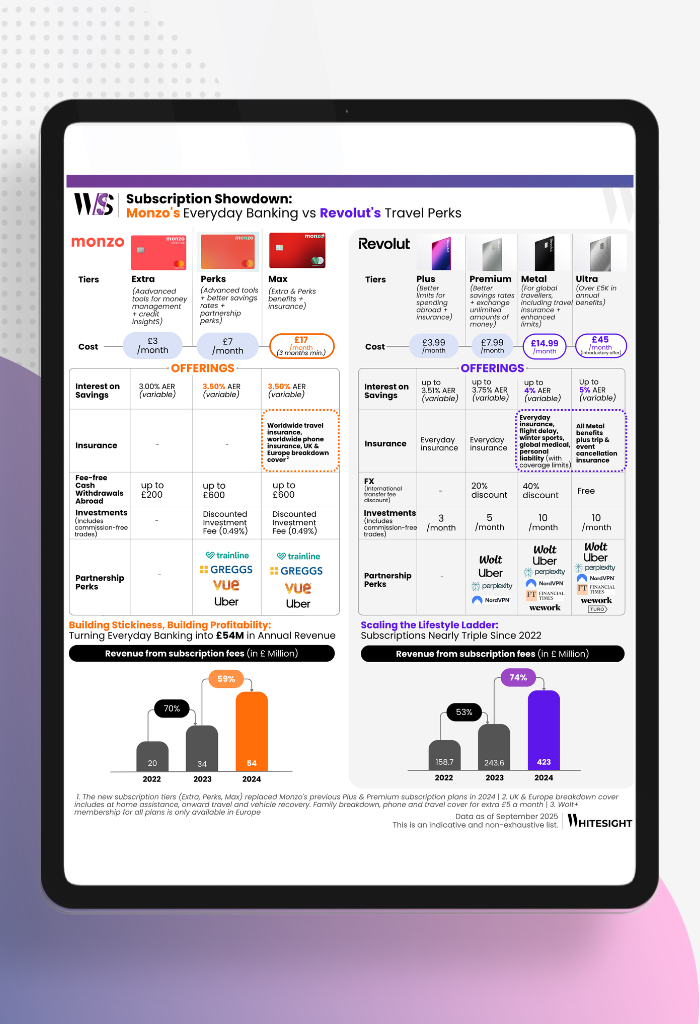

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

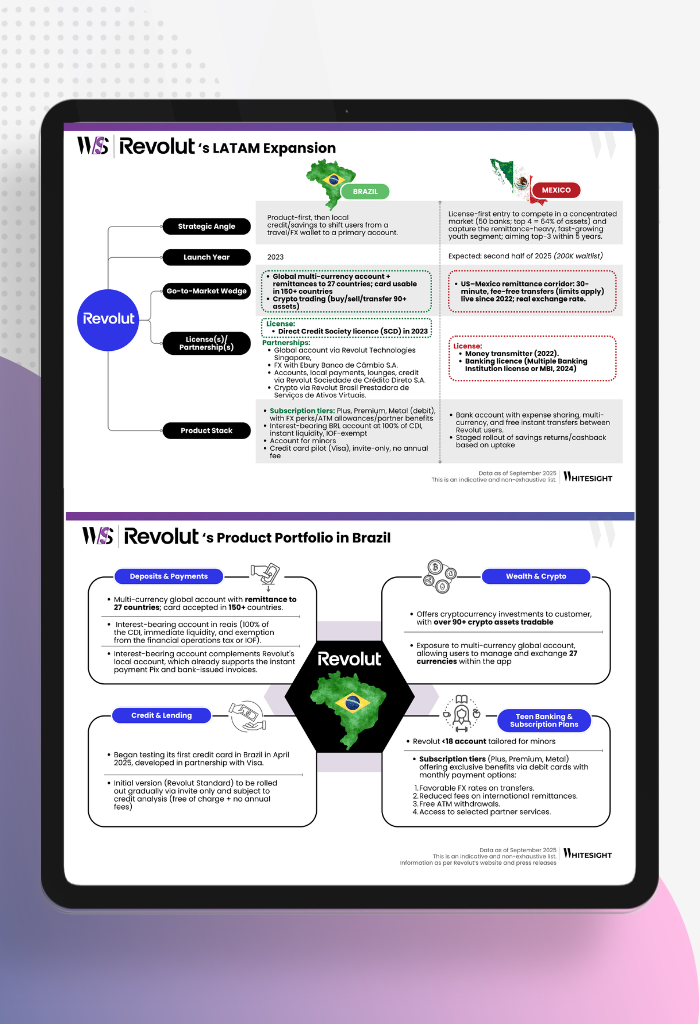

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

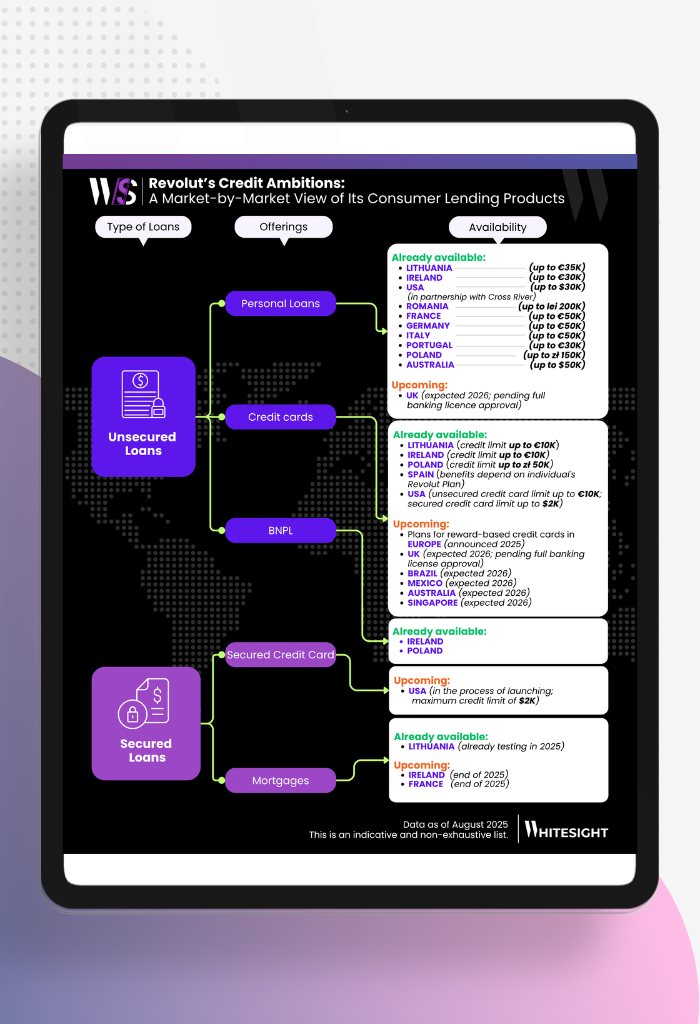

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...