Where’s The Exit? – 2021 FinTech Public Listing Trends

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

The past year was bigger, better and bolder for the fintech sector. Startups and firms at all levels observed remarkable growth across segments, geographies and business models. Several fintech behemoths went public in 2021 and an overwhelming majority of them chose to do so before turning profitable! With this momentum, choosing the most suitable exit strategy becomes the next task at hand. We looked at M&A as one of the exit strategies that was on full display in the FinTech sector — now, here’s a roundup of the exit strategy trends that we witnessed in 2021.The year 2021 saw the rise of many companies going public through listing methods—from Initial Public Offerings (IPO), Direct Listings, and the hot new trend of going public via Special Purpose Acquisition Companies (SPAC). However, profitability still eludes a majority of these FinTechs who chose to go public before achieving a positive bottom line. Public markets have been skeptical of their path to profitability due to the prevalent uncertainty surrounding it, which has correspondingly resulted in stock prices being in red for most of the year. With this blog, we look at the biggest FinTech public listing headlines of 2021 through three varied lenses that […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Samridhi Singh and Kshitija Kaur

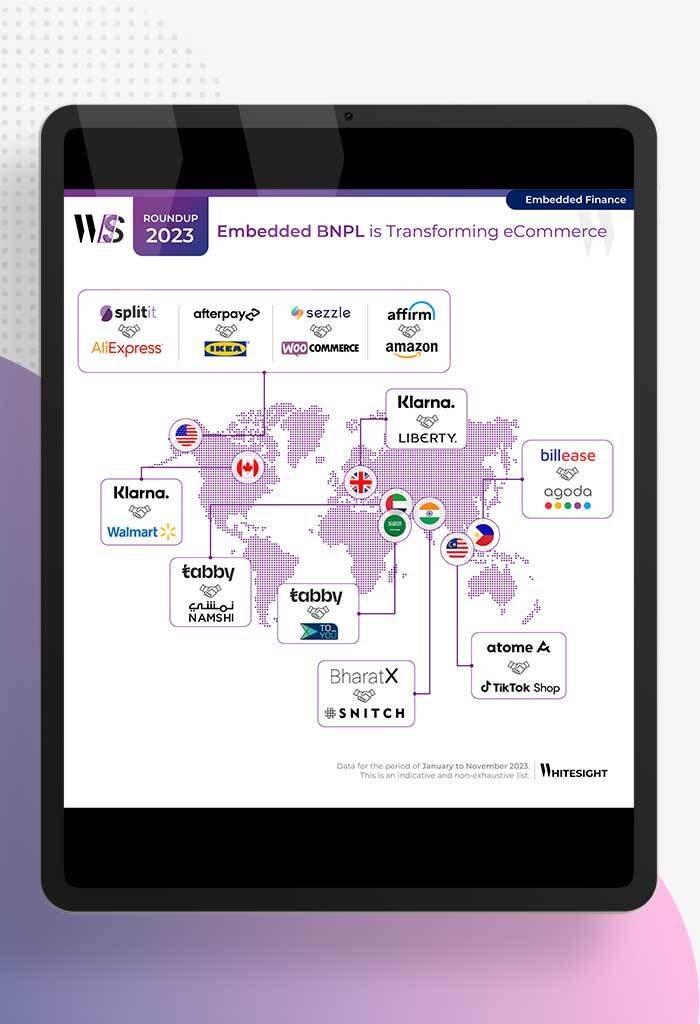

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...

- Risav Chakraborty and Kshitija Kaur

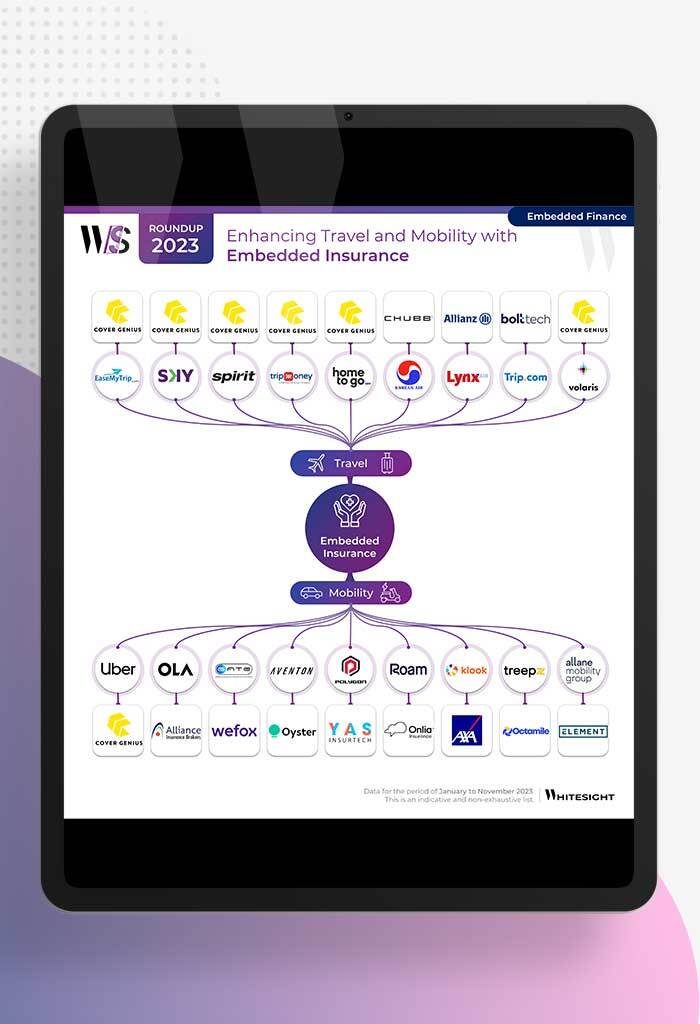

Drive Safe, Fly Secure: Embedded Insurance Escapade The travel and mobility sectors are roaring back to life now that the...

- Kshitija Kaur and Risav Chakraborty

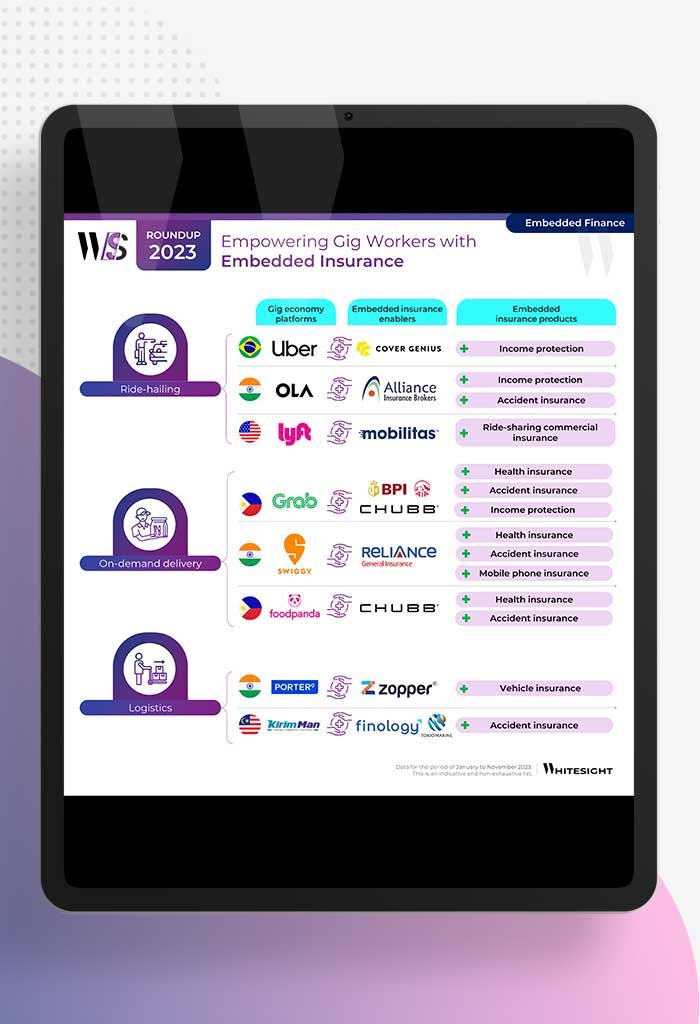

Insurtechs: The New Guardians of the Gigaxy? Life in the gig lane is a rollercoaster, isn’t it? You’ve got the...

- Afshan Dadan and Sanjeev Kumar

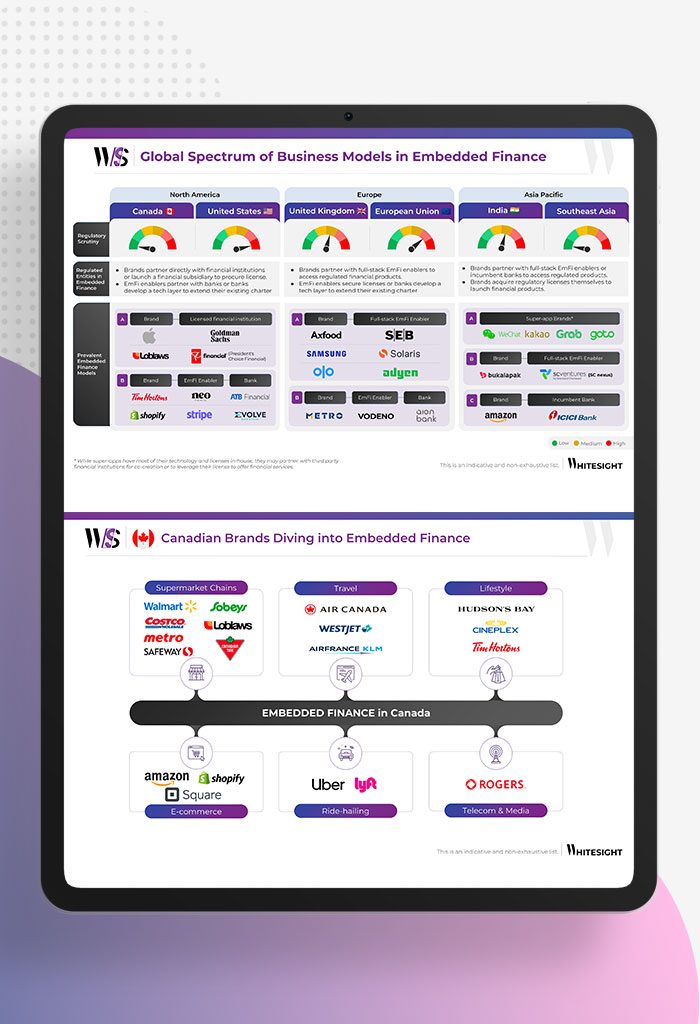

We’re going to go ahead and say it – 2023 is the year for embedded finance. This not-so-sneaky little trend...

- Sanjeev Kumar and Afshan Dadan

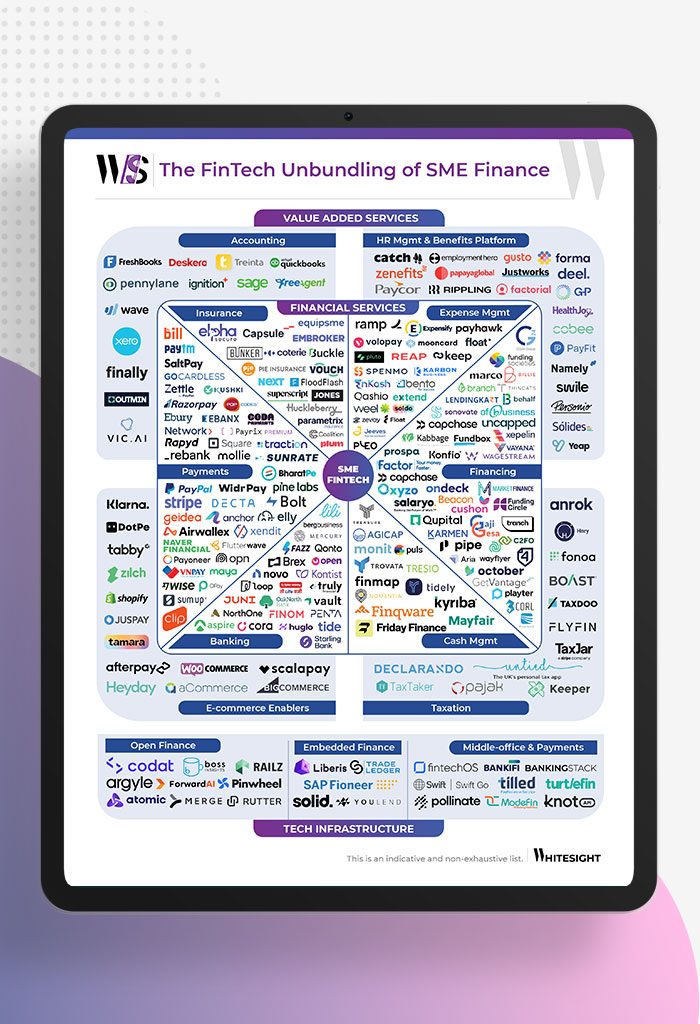

In the ever-evolving world of finance, fintech has emerged as a game-changer, particularly for small and medium enterprises (SMEs). As...

- Kshitija Kaur and Sanjeev Kumar

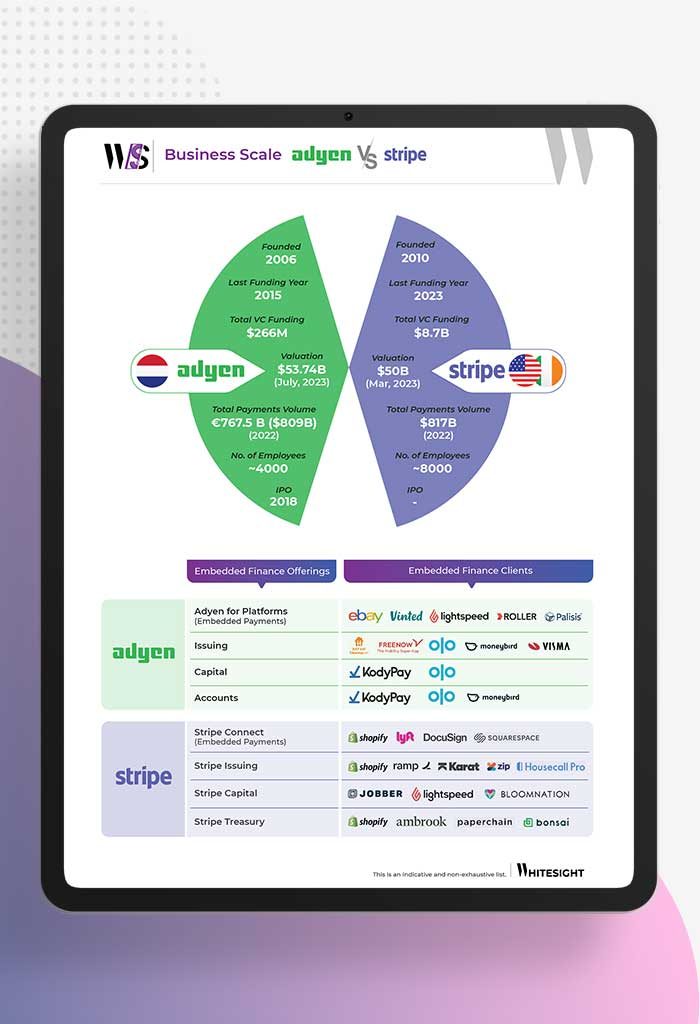

Payment processors had an incredible run during the pandemic, riding the wave of increased adoption of digital payments among merchants...