2022 BNPL Roundup: Turmoil or Transition?

- Sanjeev Kumar and Kshitija Kaur

- 7 mins read

- Embedded Finance, Insights

Table of Contents

Money and credit go back almost as far as one can remember – it’s inherent in our financial systems. When one’s purchasing power is lower than their expenses, personal loans are usually the best option for most people who qualify. However, these are too large and come with high-interest rates, a ton of credit checks and documentation, and additional fees. The next best option? Credit cards. At the same time, not everyone qualifies for a credit card, and even if they do, not everyone applies. Enter Buy Now, Pay Later (BNPL) as a medium to extend instant, unsecured, interest-free, short-term, low-ticket, and embedded credit in customer journeys to enable convenient shopping experiences and more business for merchants.Although the notion finds its roots back in the 19th century, the last decade is where BNPL has truly flexed its muscle. By allowing an interest-free, alternate financing option to consumers for their purchasing journeys, the BNPL sector promised to build a fertile ground for payment-related experiences to breed on. Estimated to reach $680B in transaction volume worldwide by 2025, the segment has accelerated point-of-sale financing through the various discoverable platforms and card-linked installment offerings.We have cautiously and comprehensively tracked the rumblings and roars […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

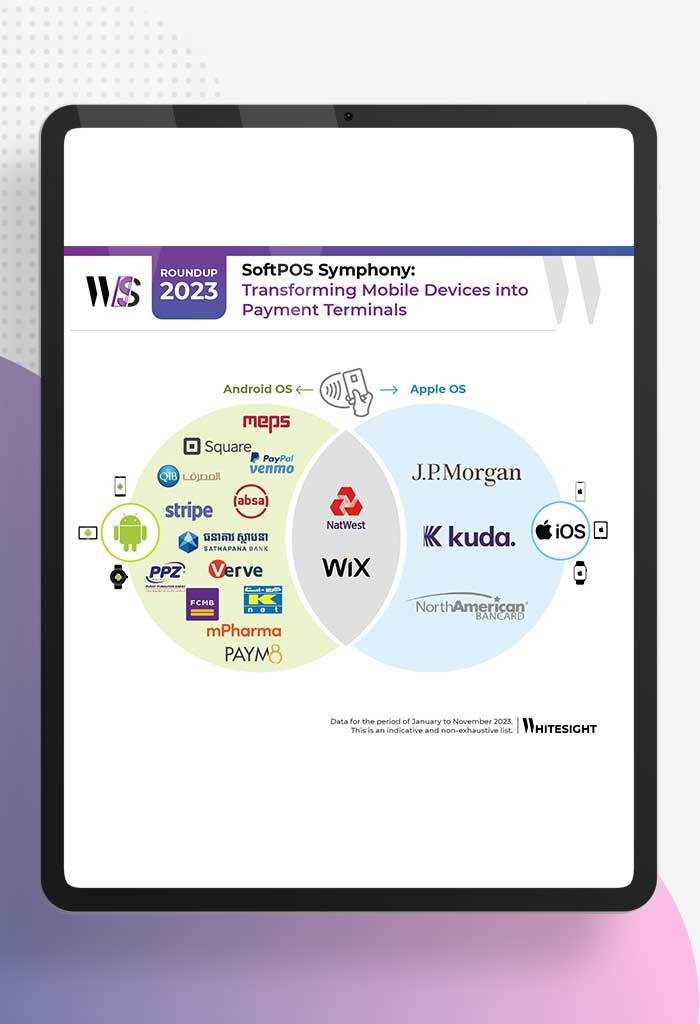

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

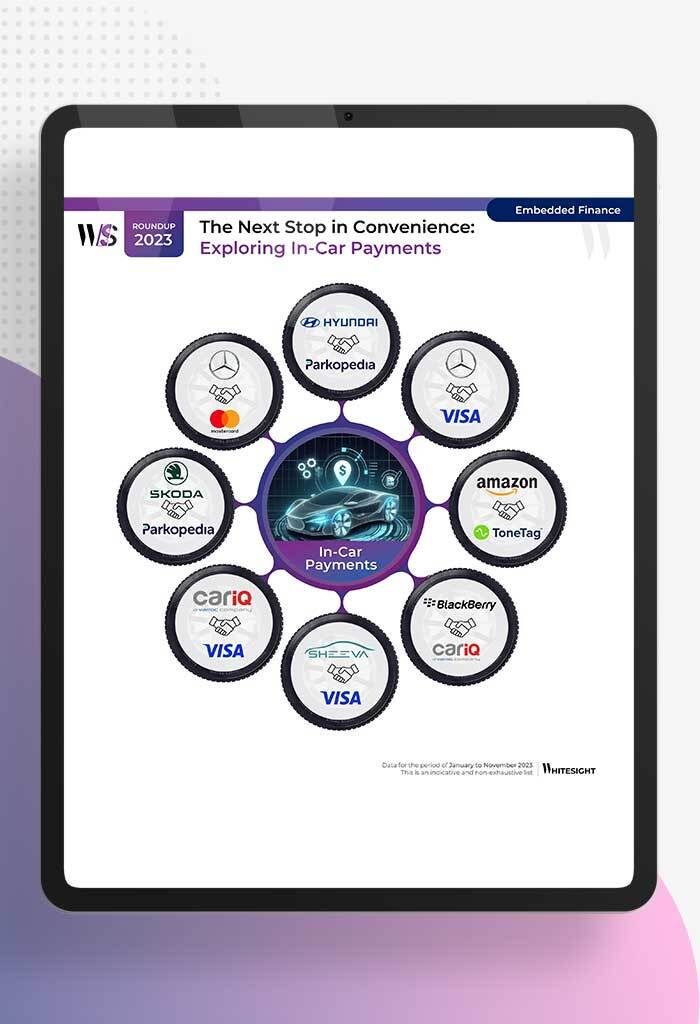

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

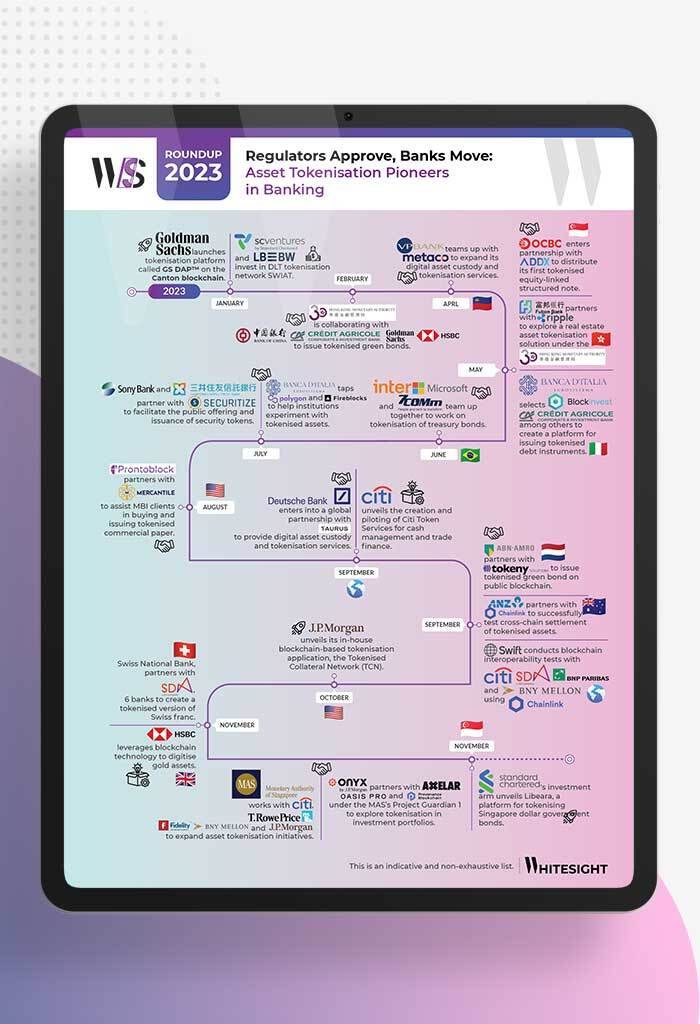

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

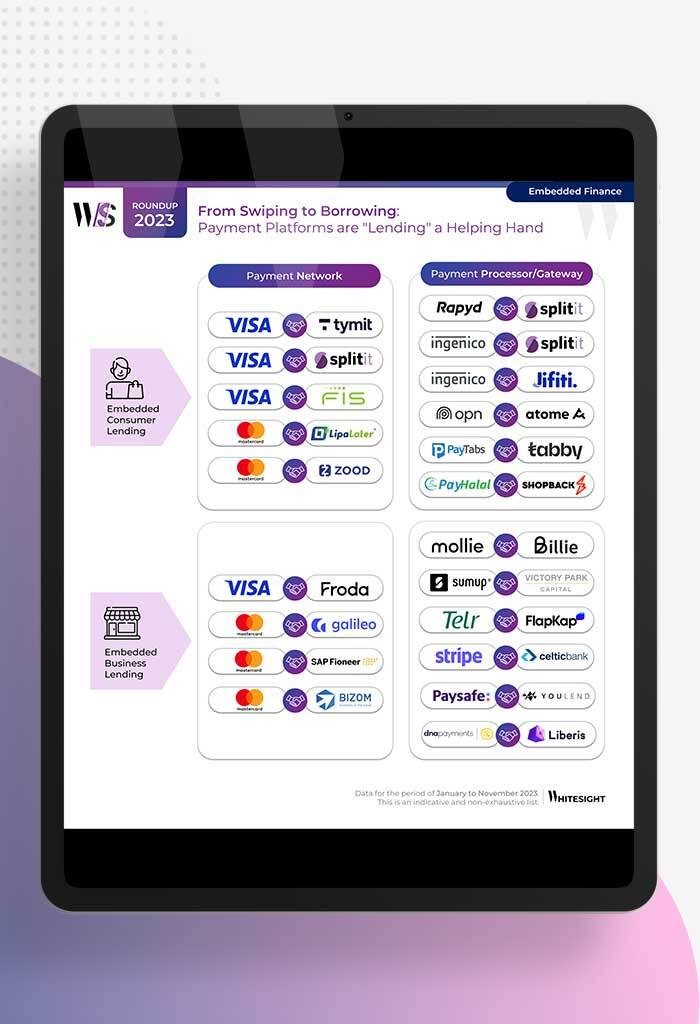

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...