2023 Roundup: SoftPOS Takes the Stage for a Swipe-Free Serenade

- Risav Chakraborty and Kshitija Kaur

- 4 mins read

- Embedded Finance, Insights

Table of Contents

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders before we do, it’s high time our payments caught up with the speed of our emoji replies. Imagine having to wait at the checkout, wallet MIA, and the cashier’s giving you the look that says, “Move faster; my lunch break is slipping away.”Fear not, for the fintech, banking, and commerce wizards have bestowed upon us the ‘Tap to Pay’ feature. The post-pandemic era saw contactless payments soar from a convenient option to the primary method of business. In response to the surging demand for more contactless solutions, a trend emerged in 2023 where key players across various industries introduced features like tap-to-pay and SoftPoS for consumers and merchants. Among the diverse approaches, Android and Apple devices stepped forward to make the payment acceptance process as easy as ordering pizza on a lazy Sunday.Let’s quickly bring you up to date with some of the tech lingo:Tap to Pay: Imagine you’re at a coffee shop, and instead of swiping your card or fumbling with cash, you just tap your smartphone or smartwatch on the card machine. That’s Tap to Pay. It’s like […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Samridhi Singh and Kshitija Kaur

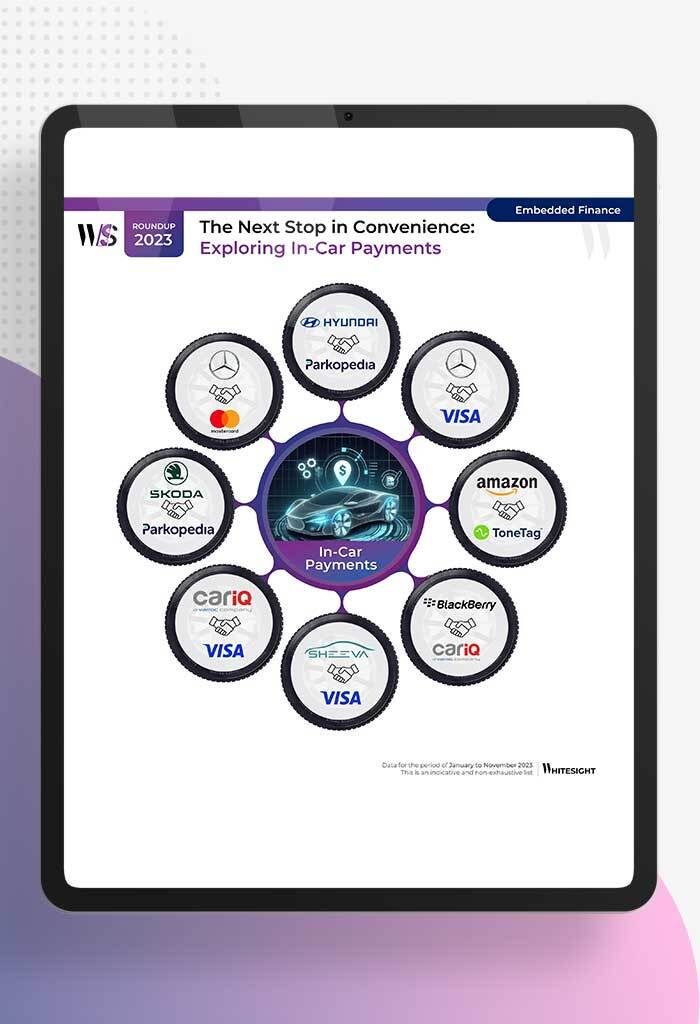

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

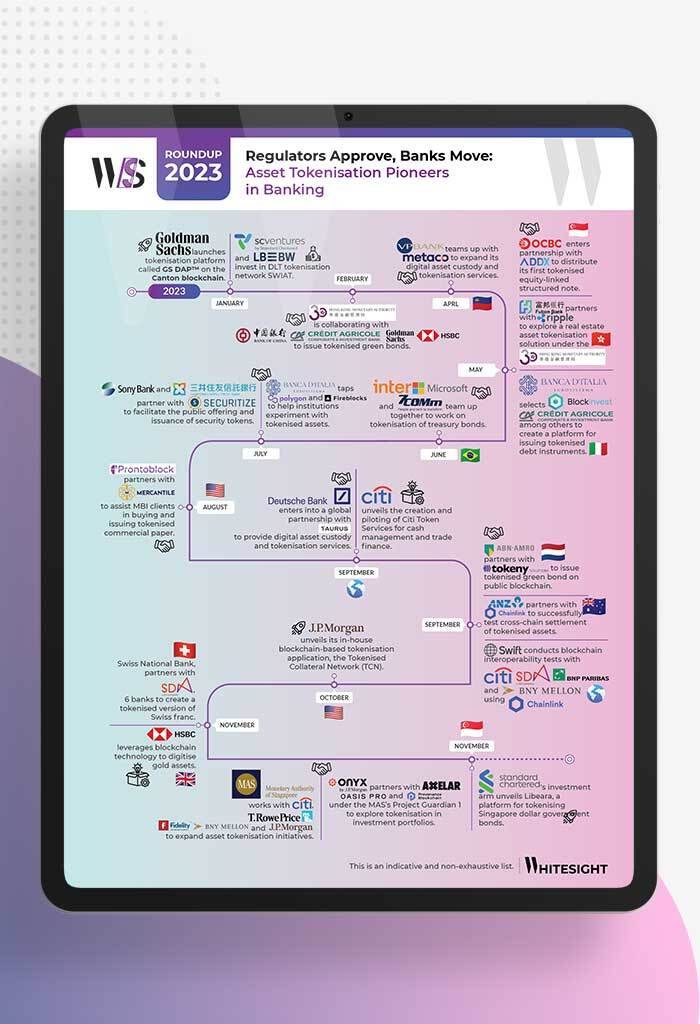

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

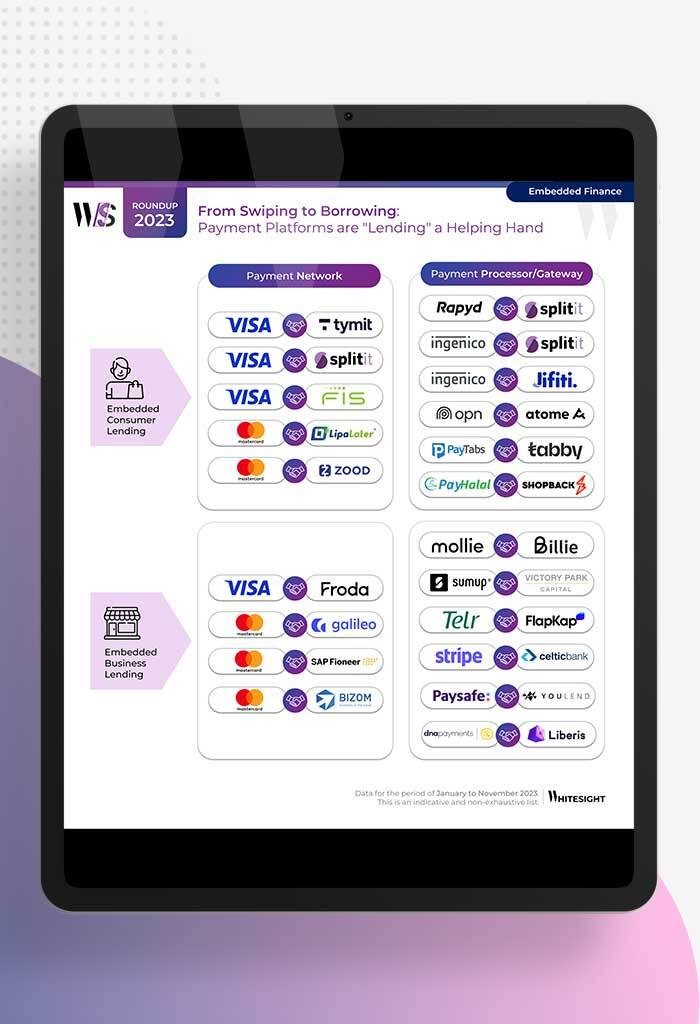

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

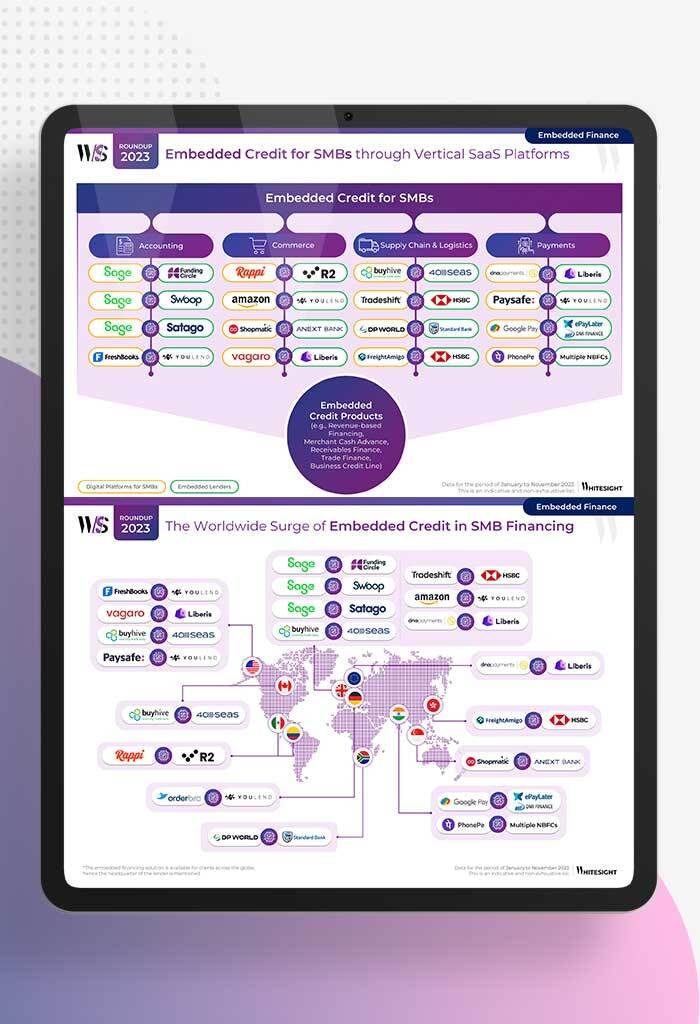

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...

- Samridhi Singh and Kshitija Kaur

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...