2023 Roundup: The Twists and Turns of Embedded Insurance in Travel

- Risav Chakraborty and Kshitija Kaur

- 3 mins read

- Embedded Finance, Insights

Table of Contents

Drive Safe, Fly Secure: Embedded Insurance Escapade The travel and mobility sectors are roaring back to life now that the pandemic is in the rearview mirror. In the ever-evolving world of travel and mobility—a sector where getting from point A to B isn’t just about the ride—it’s about the experience, safety, and, yes, peace of mind. In 2023, travel wasn’t just about moving around—it was about the freedom to explore without the baggage of worry, thanks to embedded insurance fitting snugly into our plans. And mobility? Think of it as all the cool ways we zip around locally – cars, scooters, or those nifty e-bikes. Capgemini forecasts a surge in the global mobility insurance market, projecting its value to double from $0.65T in 2023 to $1.38T in 2030. Unlike traditional insurance policies, embedded insurance offers a personalised and real-time approach to coverage, addressing the diverse and complex risks that exist in the sector. For consumers, this means an improved buying experience, tailored solutions, convenience, and accessibility. Travel and mobility platforms have been greatly benefiting by teaming up with insurance providers. They can share platform data for tasks like underwriting, risk analysis, pricing, and managing exposure. The collaboration not only opens […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Samridhi Singh and Kshitija Kaur

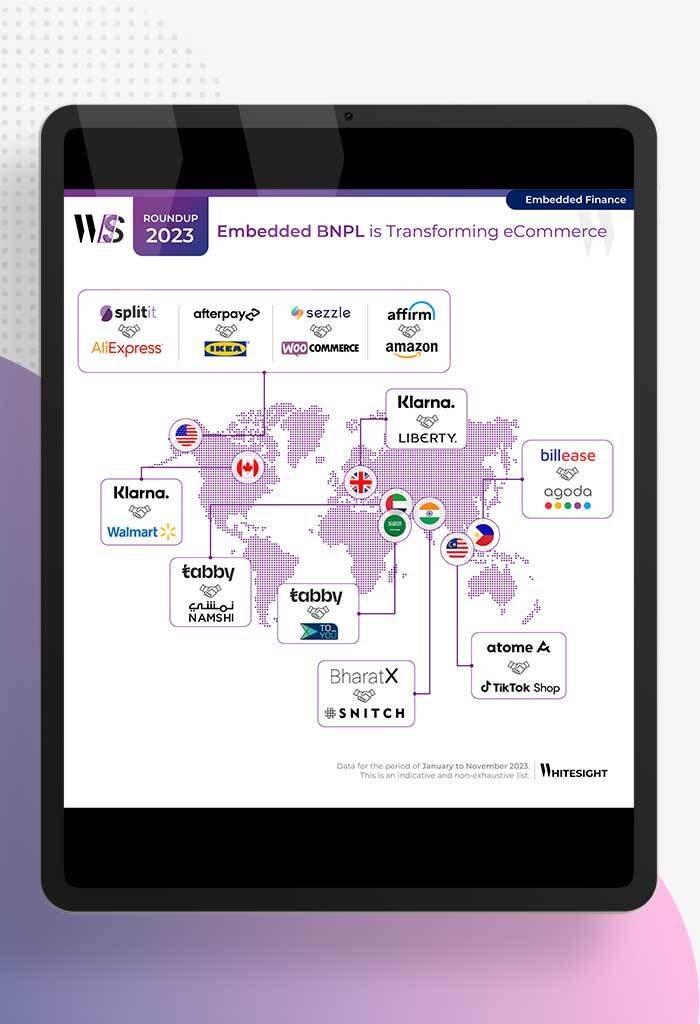

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...

- Kshitija Kaur and Risav Chakraborty

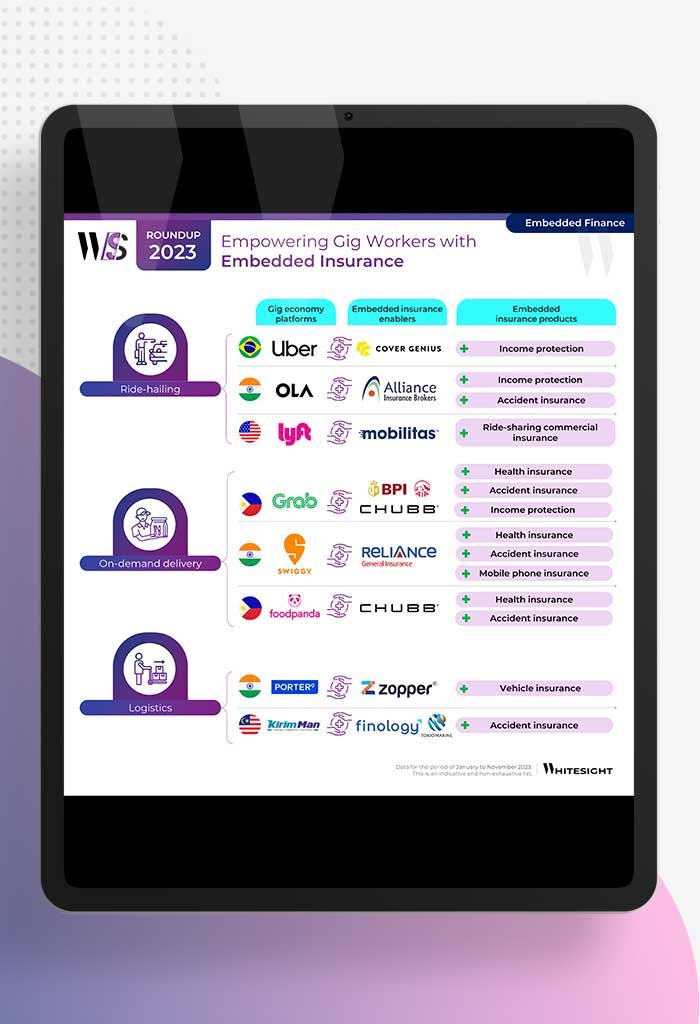

Insurtechs: The New Guardians of the Gigaxy? Life in the gig lane is a rollercoaster, isn’t it? You’ve got the...

- Afshan Dadan and Sanjeev Kumar

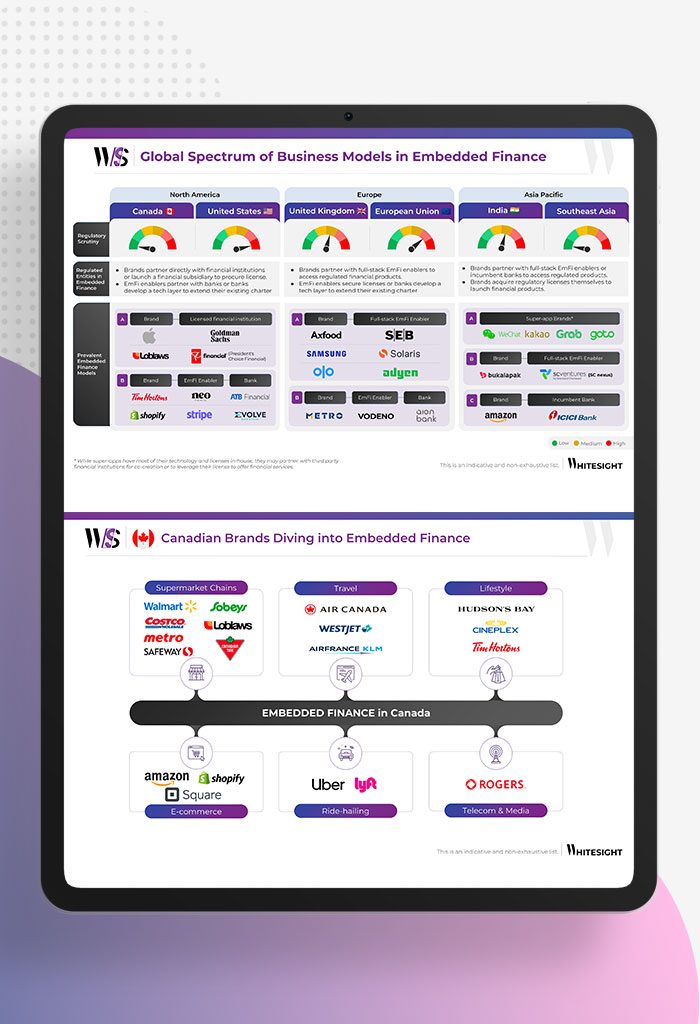

We’re going to go ahead and say it – 2023 is the year for embedded finance. This not-so-sneaky little trend...

- Sanjeev Kumar and Afshan Dadan

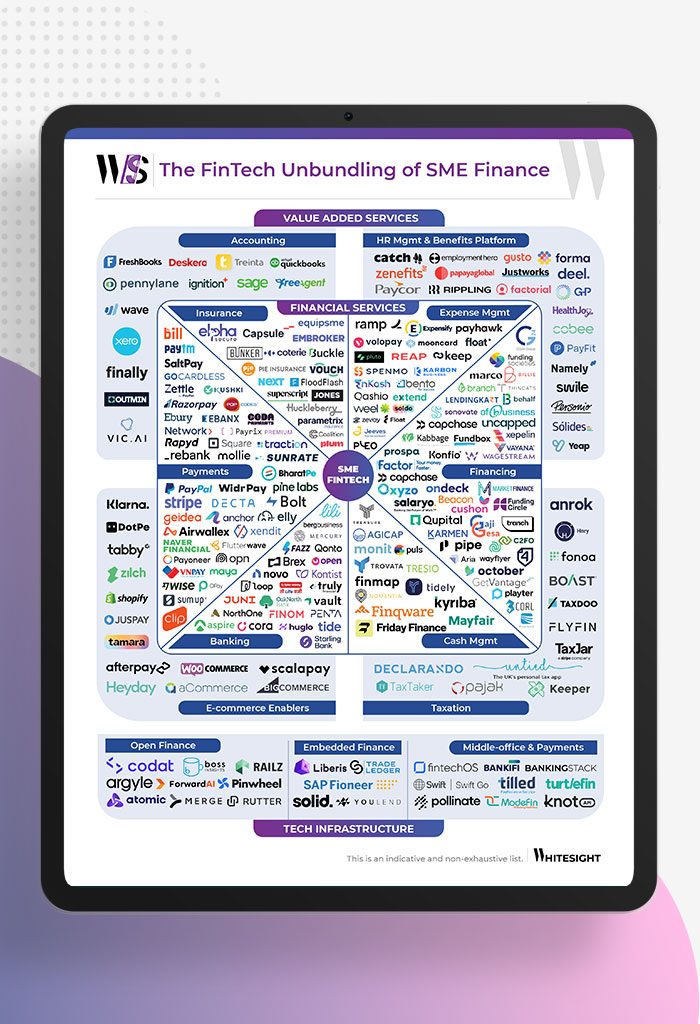

In the ever-evolving world of finance, fintech has emerged as a game-changer, particularly for small and medium enterprises (SMEs). As...

- Kshitija Kaur and Sanjeev Kumar

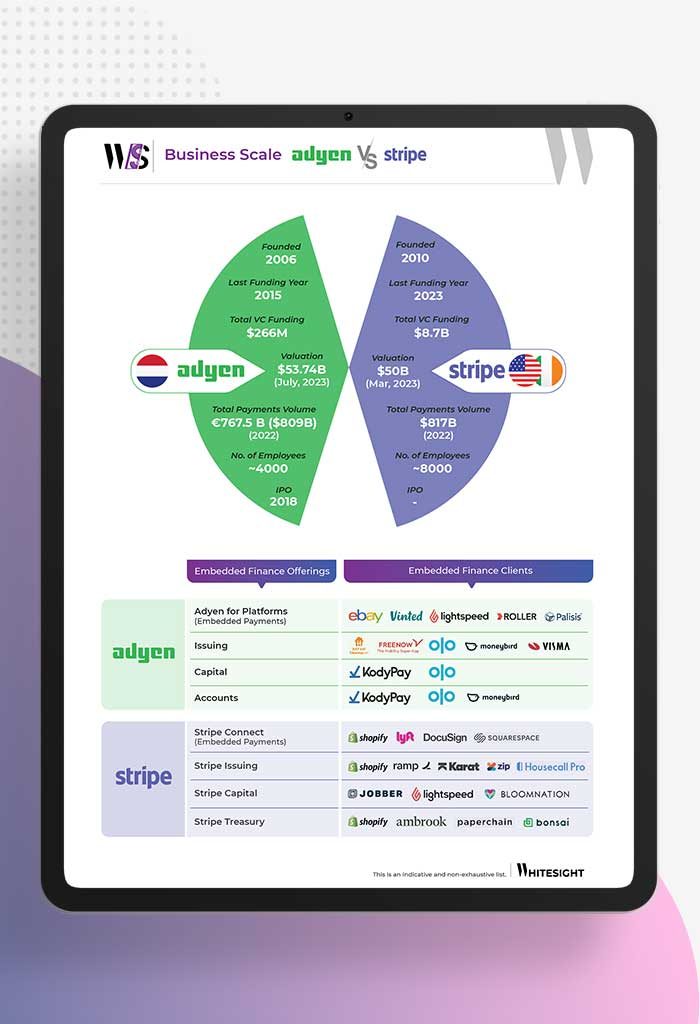

Payment processors had an incredible run during the pandemic, riding the wave of increased adoption of digital payments among merchants...

- Sanjeev Kumar and Kshitija Kaur

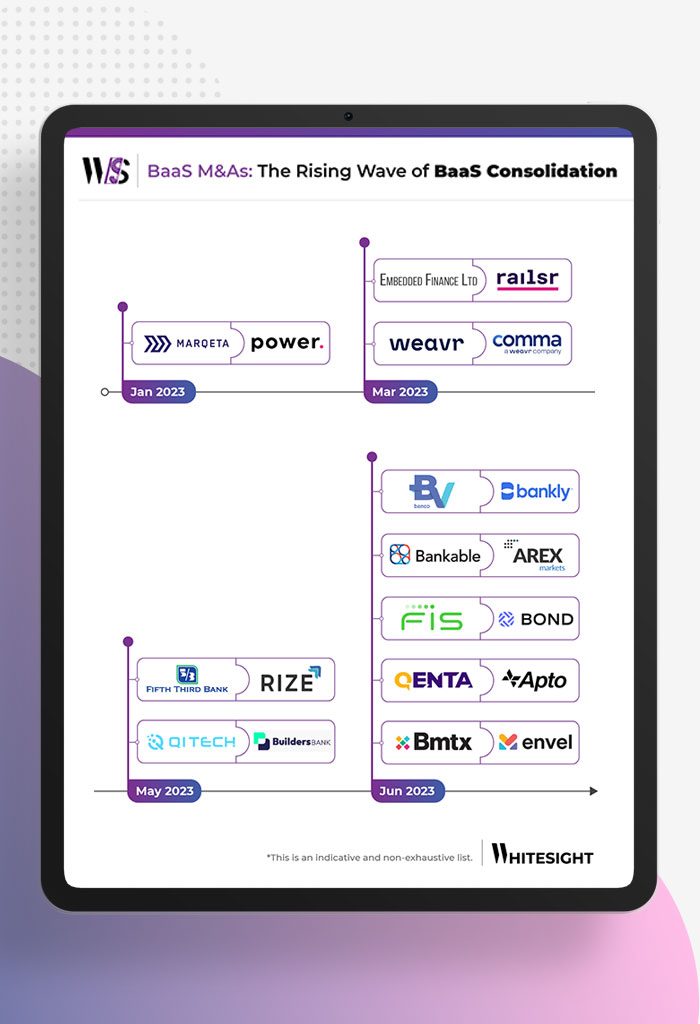

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...