2023 Roundup: The Surge of Card Issuing Innovations by Payment Processors

- Risav Chakraborty and Sanjeev Kumar

- 3 mins read

- Embedded Finance, Insights

Table of Contents

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank? It’s like asking your GPS for directions and ending up in Narnia—confusing, time-consuming, and being unsure on how you got there. Merchants, big and small, have found themselves in a similar situation, desperately wanting a simple way to provide cards to their employees, suppliers, and consumers without navigating through the labyrinthine bureaucracy of conventional banks. In 2023, payment service providers (PSPs) donned the cape of card issuance superheroes, giving businesses the power to issue customised virtual and physical cards. In the ongoing evolution of the payment and banking sector, the payment card has emerged as the crucial connection to the ultimate consumer. Inflexible legacy technology has meant that various integrations, extensive regulatory compliance demands, and operational inefficiencies have hindered businesses from getting a share of the interchange fees. According to Allied Market Research, the global cards market was valued at $524.9B in 2022 and is projected to reach $1.2T by 2032, growing at a CAGR of 8.8% from 2023 to 2032. Swipe into the Future: PSPs’ Cardistry Mastery In 2023, PSPs played a pivotal role in transforming the landscape by providing […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

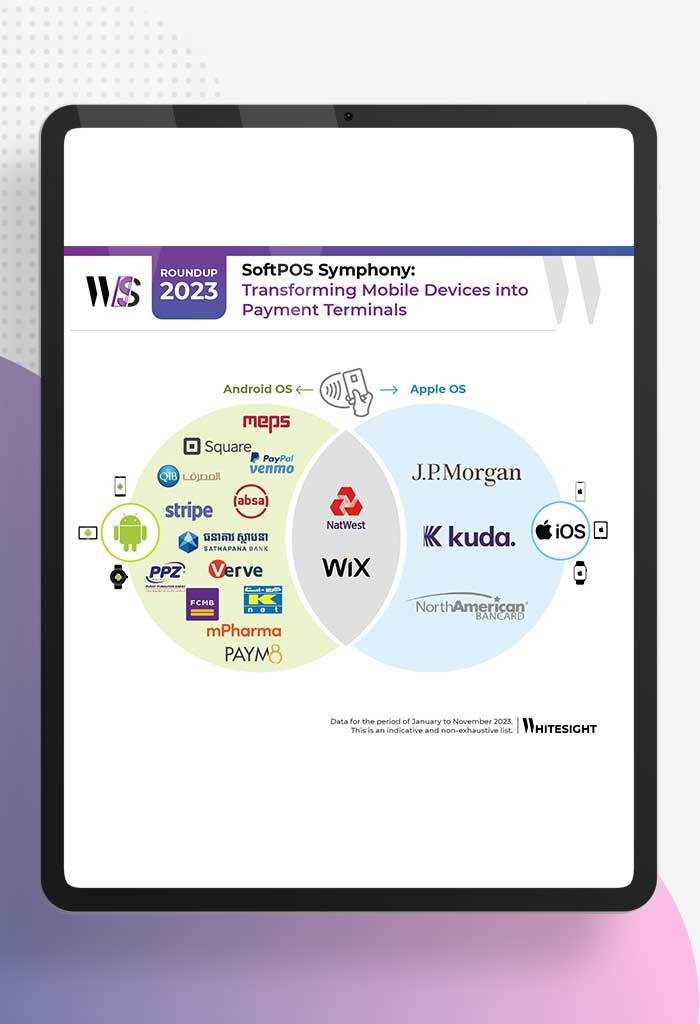

- Risav Chakraborty and Kshitija Kaur

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

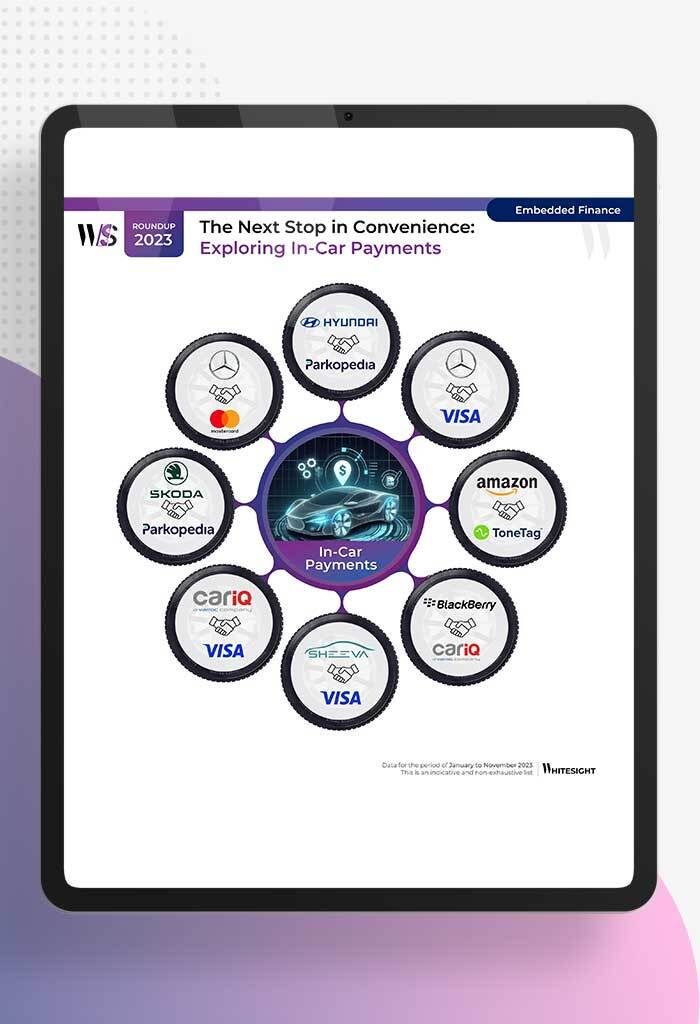

- Samridhi Singh and Kshitija Kaur

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

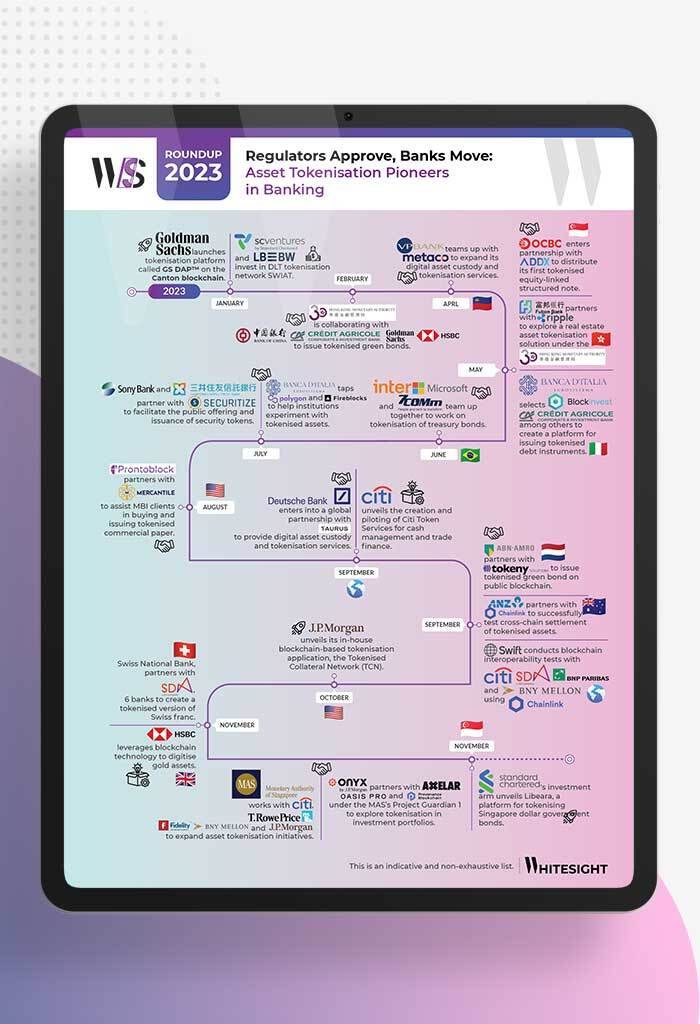

- Samridhi Singh and Sanjeev Kumar

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

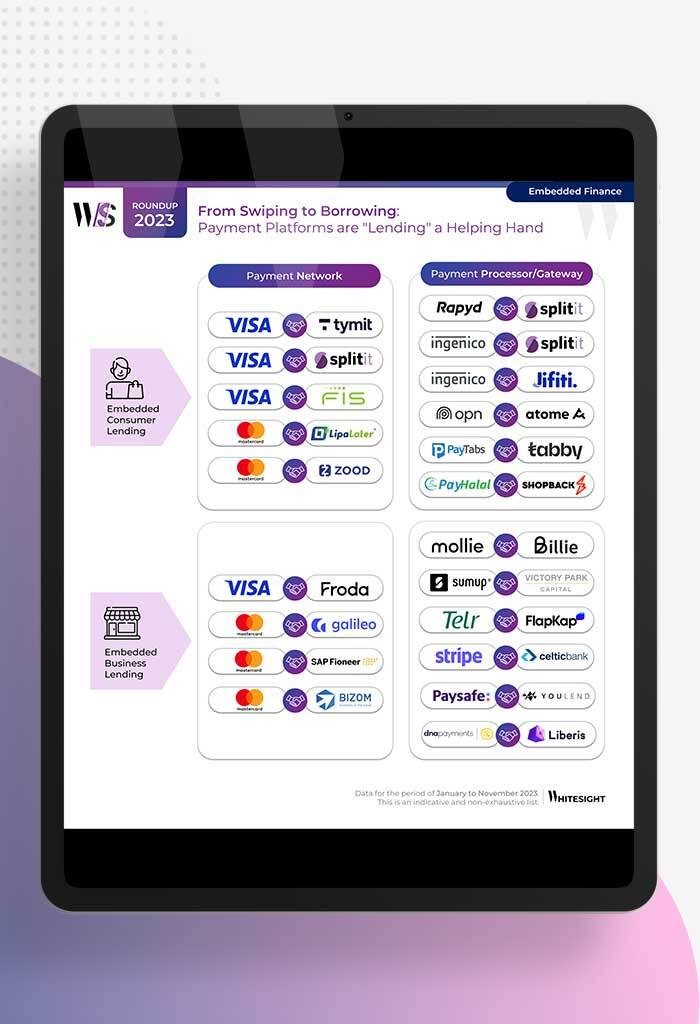

- Kshitija Kaur and Risav Chakraborty

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

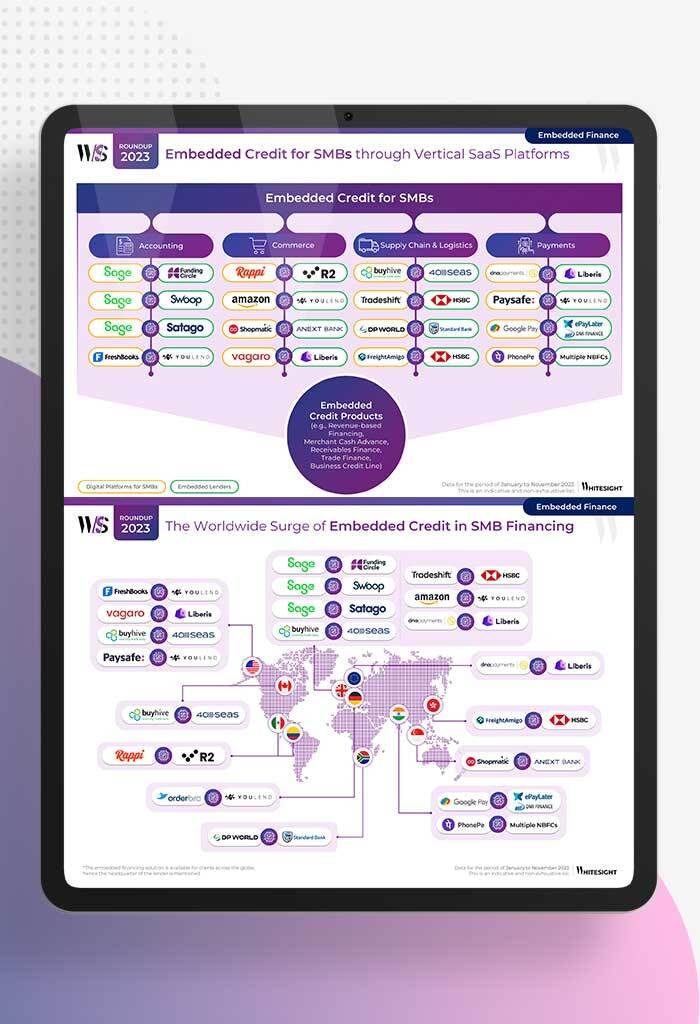

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...

- Samridhi Singh and Kshitija Kaur

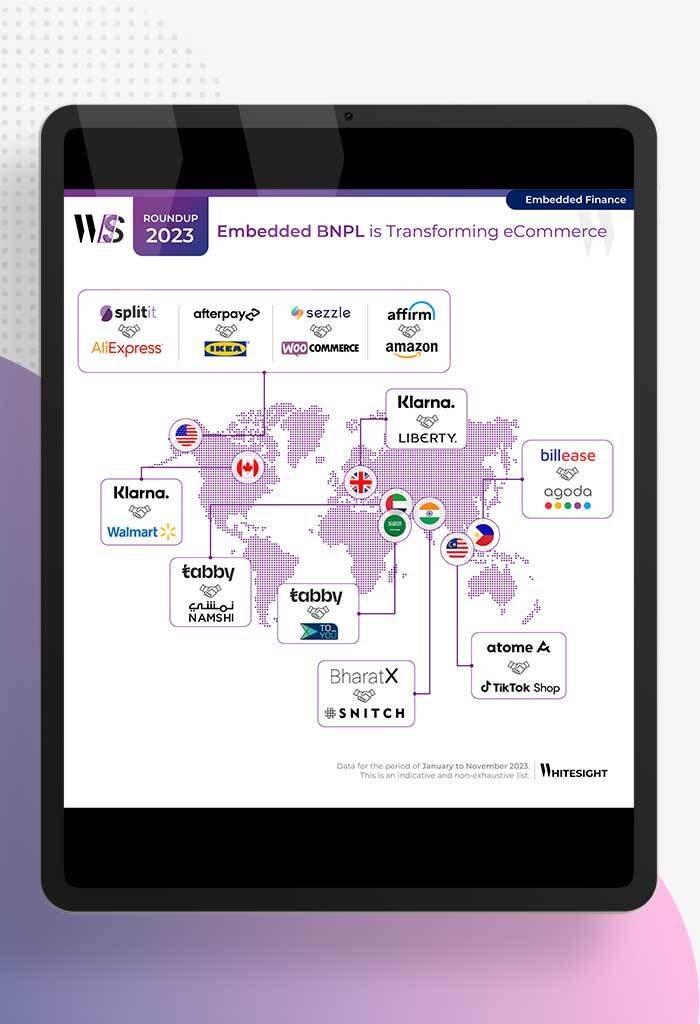

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...