From iPhone to iBank: Analysing Apple’s Embedded Finance Adventures

- Sanjeev Kumar and Risav Chakraborty

- 8 mins read

- Fintech Strategy, Insights

Table of Contents

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind. What makes these brands global phenomenons? Their products, for starters, but more importantly, their loyal user base. Loyalty can make or break a brand. And when you’re loyal to a brand, you are loyal. So think of a scenario where a brand you love has introduced something new. Your automatic reaction is, “This is so cool, sign me up!”. Hook, line, and sinker.Apple started with the desktop computers – pretty cool, shattered the ceiling with the iPod – so cool, took it to the next level with the MacBook – super cool, stepped up its game again with the iPhone – super duper cool, then came the iPad, the Apple Watch, the AirPods, and so much more in between – cool cool cool. If you’re one of the 1.8 billion active device users of Apple, you’re most probably a fan of one product or the other.With so many products across different categories, the main question for Apple is – how do we increase user loyalty/stickiness/engagement? Well, you make products that are a class apart, and you also keep improving and introducing […]

This post is only available to members.

document.addEventListener('DOMContentLoaded', function() {

console.log('social login script loaded');

// Use event delegation in case buttons are dynamically rendered

document.body.addEventListener('click', function(e) {

console.log('social login button clicked');

var btn = e.target.closest('.button-social-login');

if (btn) {

// e.preventDefault();

// Disable button to prevent multiple clicks

btn.style.pointerEvents = 'none';

btn.style.opacity = '0.6';

// Change button content to 'Please wait...' with a simple spinner

btn.innerHTML = ' Please wait...';

// Add spinner animation style if not already present

if (!document.getElementById('social-login-spinner-style')) {

var style = document.createElement('style');

style.id = 'social-login-spinner-style';

style.innerHTML = '@keyframes spin {0%{transform:rotate(0deg);}100%{transform:rotate(360deg);}}';

document.head.appendChild(style);

}

}

});

});

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

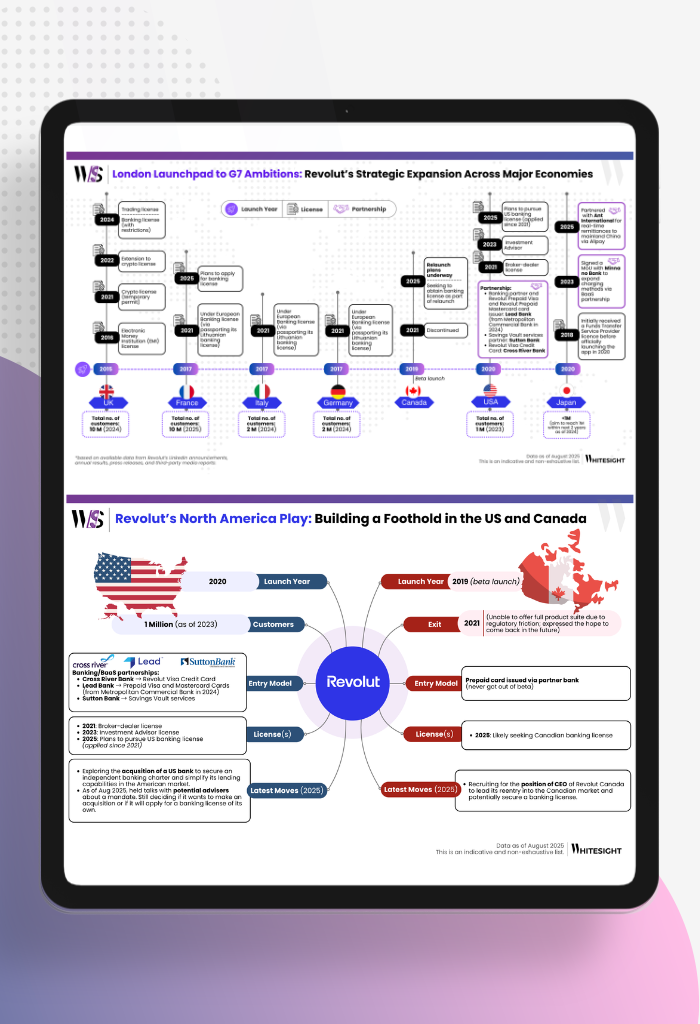

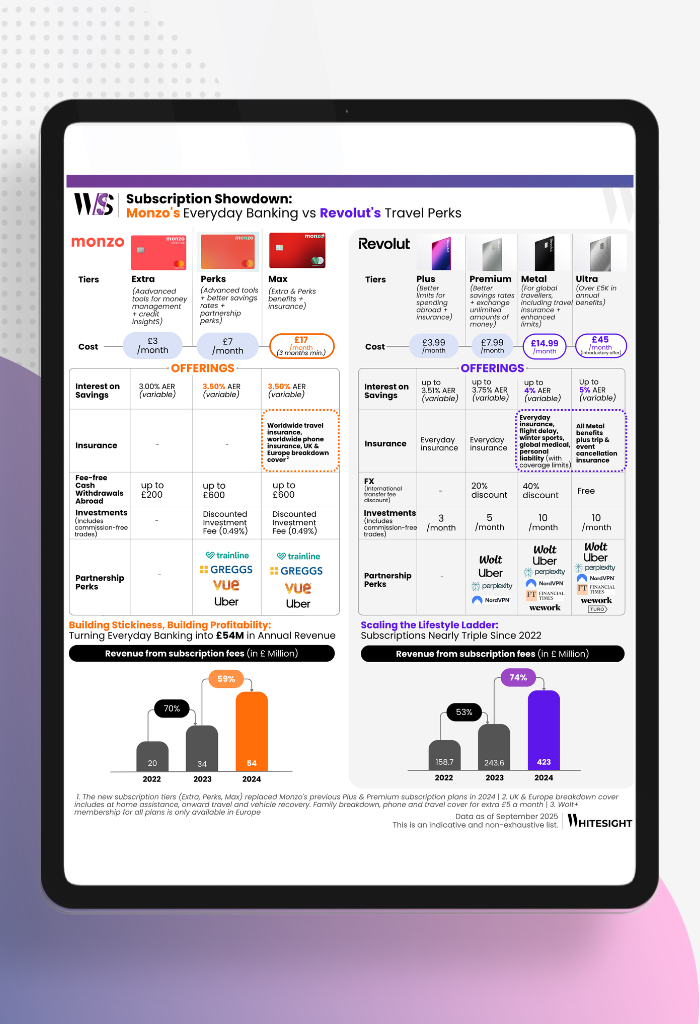

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty