Adaptable Platforms, Strong Alliances: BaaS consolidation in action

- Sanjeev Kumar and Kshitija Kaur

- 3 mins read

- Insights

Table of Contents

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm.It’s no surprise, really. The demand for agile and expandable infrastructures is at an all-time high in the fintech sector. And with technology evolving at warp speed, financial institutions are being pushed to think on their feet and embrace change. That’s where BaaS swoops in to save the day – offering a shortcut by providing off-the-shelf, adaptable, and secure platforms that can be swiftly deployed to unlock new revenue streams and customer experiences. Whether it’s about reaching greater heights economically or seizing opportunities to boost one’s market position, the trend of consolidation is undeniably upon us. The first half of 2023 is in full swing, with over ten strategic BaaS acquisitions already in the bag. We uncover the three key aspects shaping the BaaS consolidation wave and reveal the fascinating patterns emerging from this frenzy. 1. Catalysts of the BaaS consolidation movement The BaaS integration movement is being supercharged through strategic power plays as follows: Velocity and versatility: In the race for survival, FIs and tech platforms recognize the need for speed and adaptability to satisfy customers and outpace the competition. By acquiring BaaS […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

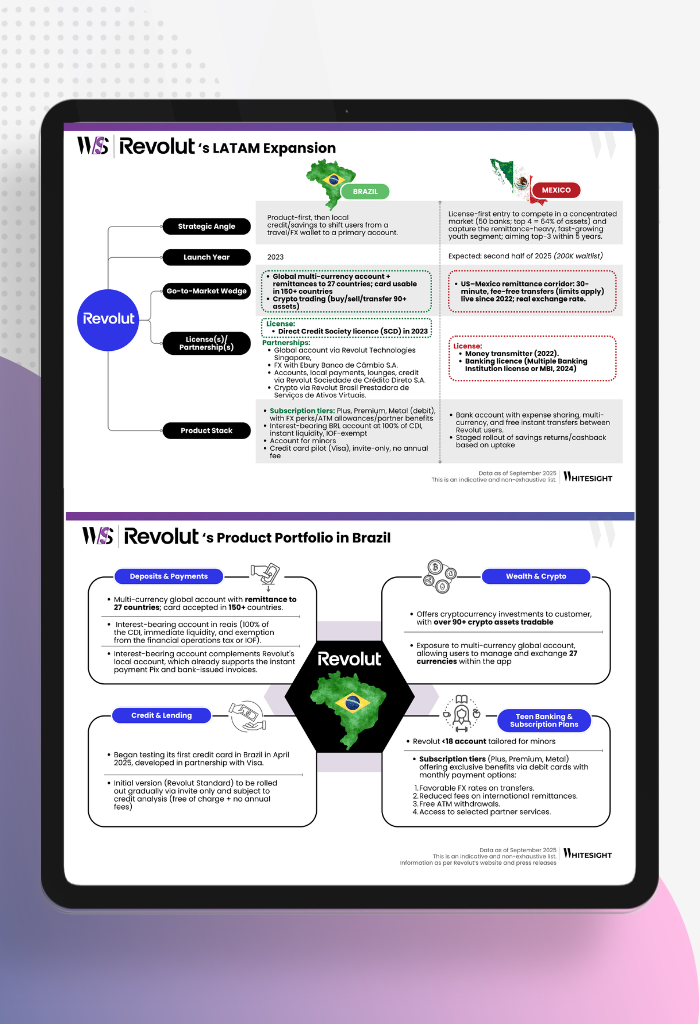

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

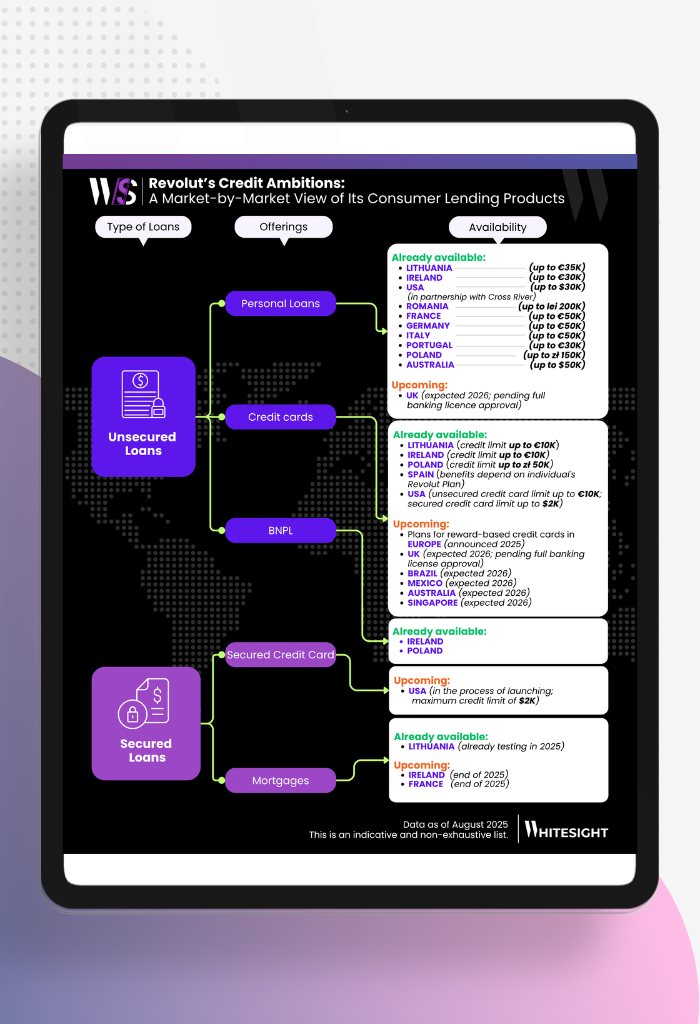

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...