The big picture of embedded finance and how it’s taking shape in Canada

- Afshan Dadan and Sanjeev Kumar

- 7 mins read

- Embedded Finance, Insights

Table of Contents

We’re going to go ahead and say it – 2023 is the year for embedded finance. This not-so-sneaky little trend has been gaining momentum not-so-quietly, and we’re quite enthusiastic about it. You’ve got brands from several sectors that you’d never associate with financial services, launching, well – you guessed it – financial services. 😮But what is just so fascinating about this trend? Is it the actual financial offerings? Not really. Is it the way that they’re embedding these offerings? Yes, somewhat. Is it the reason why they’re embedding these products? Big yes.Essentially, the integration of financial products into customer journeys on platforms, apps, and marketplaces that aren’t financially focused influences the way customers find, assess, and engage with these financial offerings. This is quite a transformation when you think of it. And this gives us a classical definition of embedded finance. Embedded finance primarily means offering seamless integration of financial services within non-financial platforms. It’s a game-changer, enabling these non-financial platforms to offer financial products directly to their customers – retail consumers, small and medium businesses, as well as enterprise customers. Non-financial platforms across industries, such as e-commerce, airlines, ride-hailing, food delivery, etc., are hopping on the bandwagon, aiming to wow customers, […]

This post is only available to members.

document.addEventListener('DOMContentLoaded', function() {

console.log('social login script loaded');

// Use event delegation in case buttons are dynamically rendered

document.body.addEventListener('click', function(e) {

console.log('social login button clicked');

var btn = e.target.closest('.button-social-login');

if (btn) {

// e.preventDefault();

// Disable button to prevent multiple clicks

btn.style.pointerEvents = 'none';

btn.style.opacity = '0.6';

// Change button content to 'Please wait...' with a simple spinner

btn.innerHTML = ' Please wait...';

// Add spinner animation style if not already present

if (!document.getElementById('social-login-spinner-style')) {

var style = document.createElement('style');

style.id = 'social-login-spinner-style';

style.innerHTML = '@keyframes spin {0%{transform:rotate(0deg);}100%{transform:rotate(360deg);}}';

document.head.appendChild(style);

}

}

});

});

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

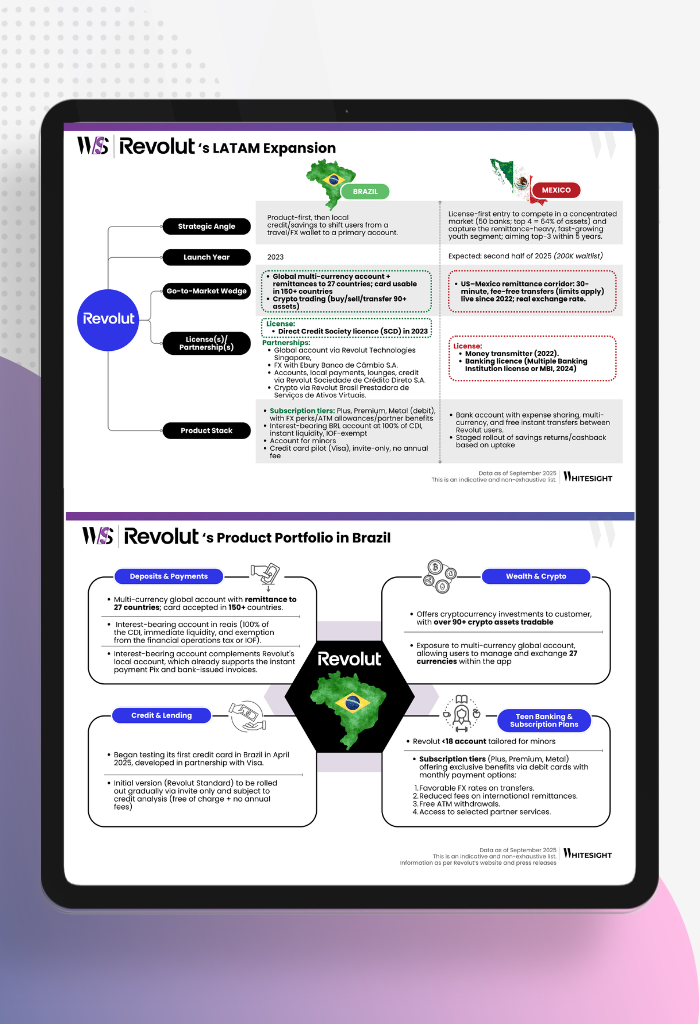

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

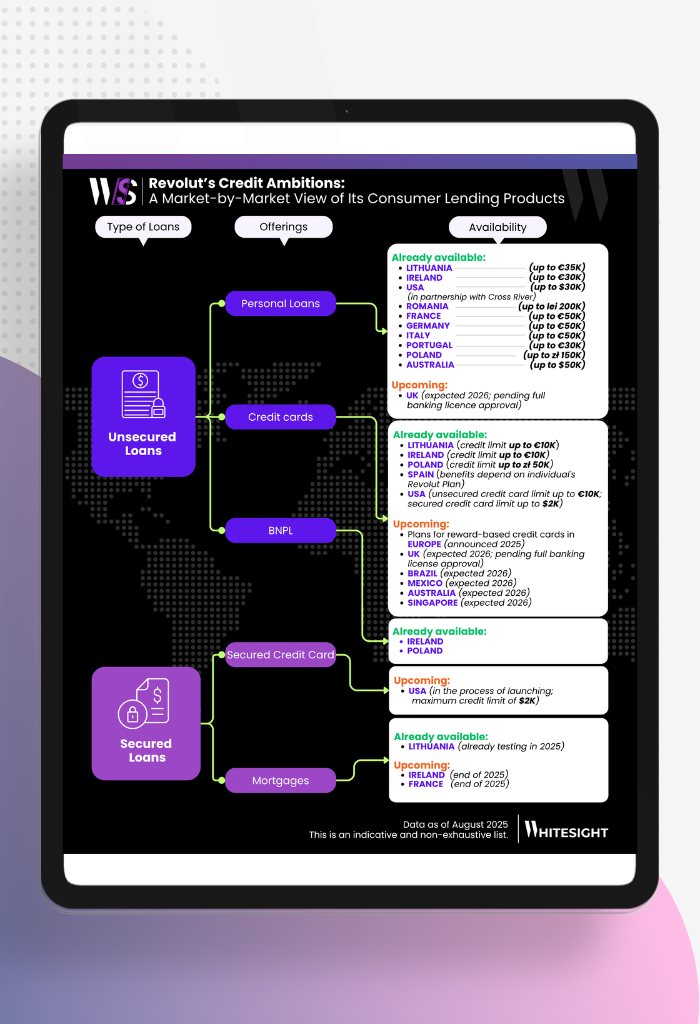

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

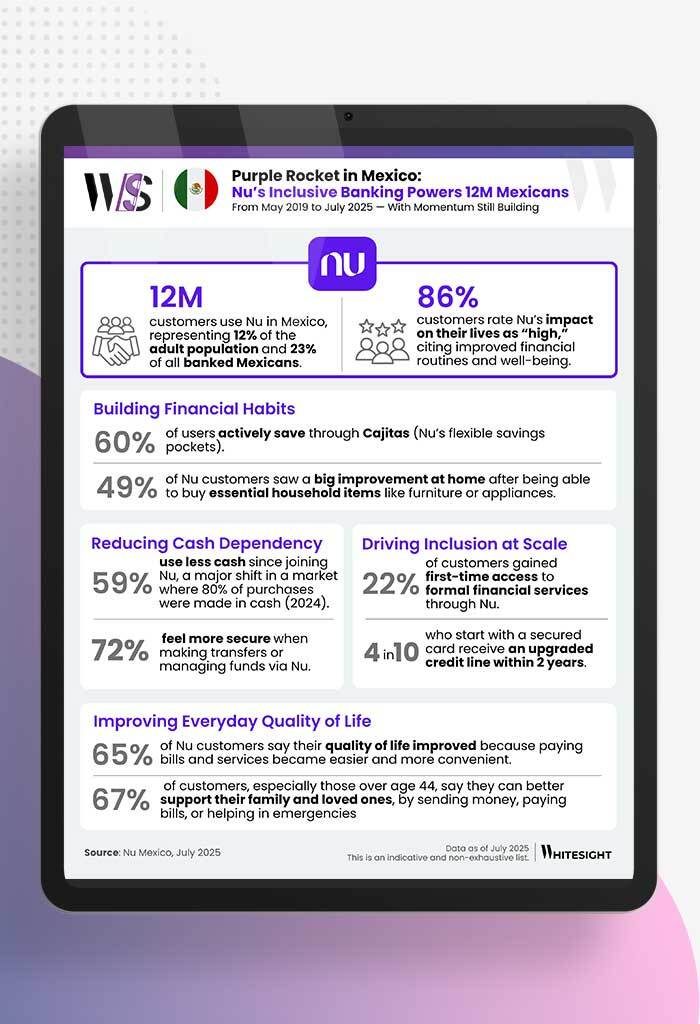

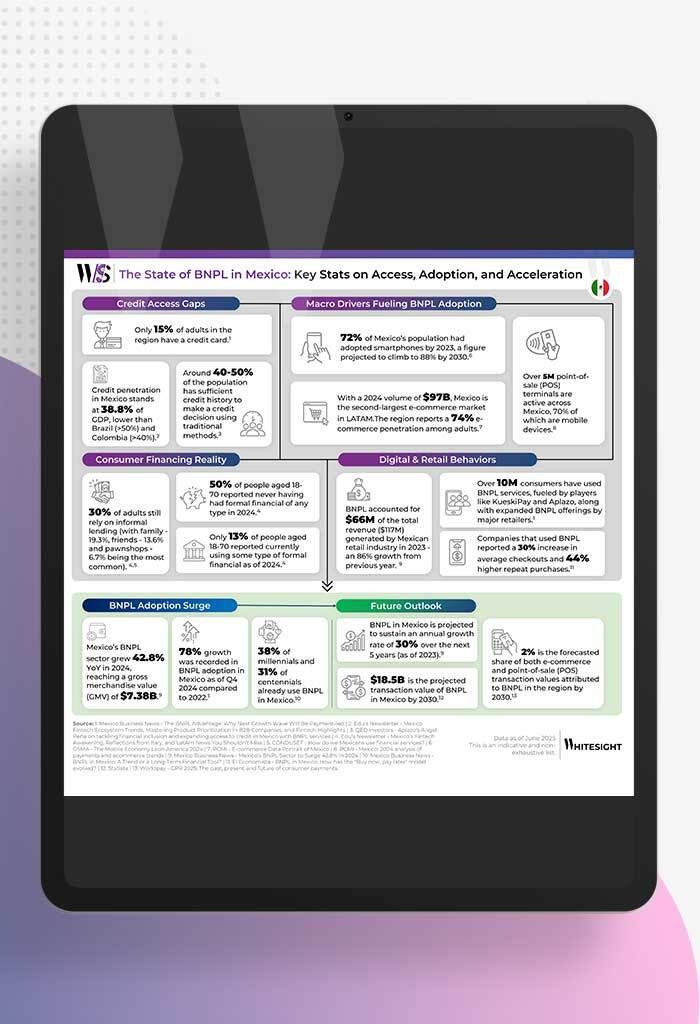

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar