The big picture of embedded finance and how it’s taking shape in Canada

- Afshan Dadan and Sanjeev Kumar

- 7 mins read

- Embedded Finance, Insights

Table of Contents

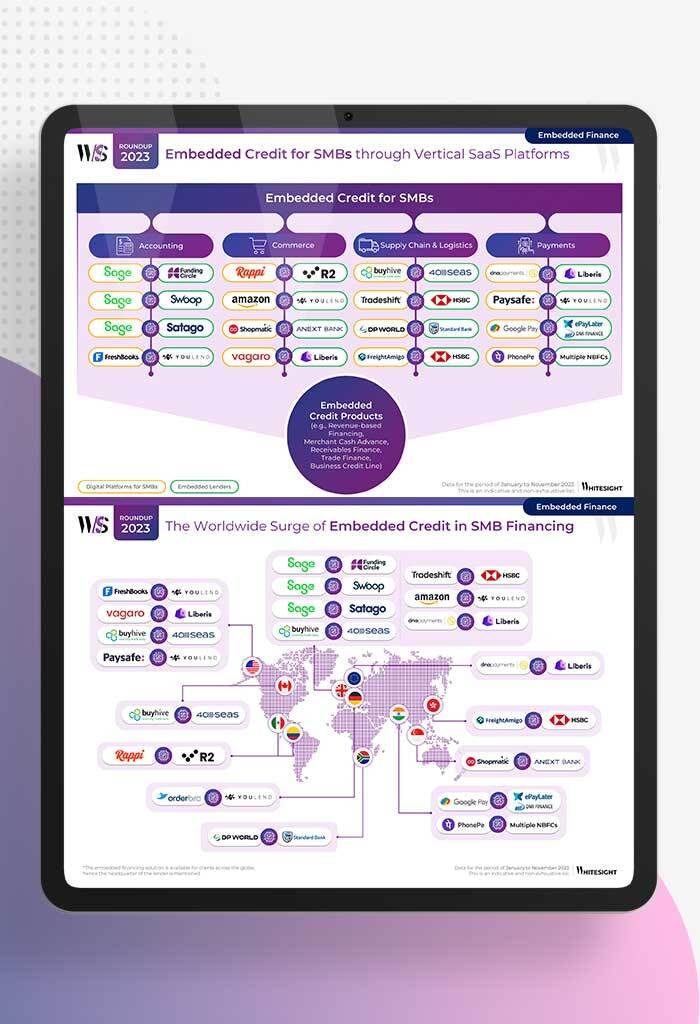

We’re going to go ahead and say it – 2023 is the year for embedded finance. This not-so-sneaky little trend has been gaining momentum not-so-quietly, and we’re quite enthusiastic about it. You’ve got brands from several sectors that you’d never associate with financial services, launching, well – you guessed it – financial services. 😮But what is just so fascinating about this trend? Is it the actual financial offerings? Not really. Is it the way that they’re embedding these offerings? Yes, somewhat. Is it the reason why they’re embedding these products? Big yes.Essentially, the integration of financial products into customer journeys on platforms, apps, and marketplaces that aren’t financially focused influences the way customers find, assess, and engage with these financial offerings. This is quite a transformation when you think of it. And this gives us a classical definition of embedded finance. Embedded finance primarily means offering seamless integration of financial services within non-financial platforms. It’s a game-changer, enabling these non-financial platforms to offer financial products directly to their customers – retail consumers, small and medium businesses, as well as enterprise customers. Non-financial platforms across industries, such as e-commerce, airlines, ride-hailing, food delivery, etc., are hopping on the bandwagon, aiming to wow customers, […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

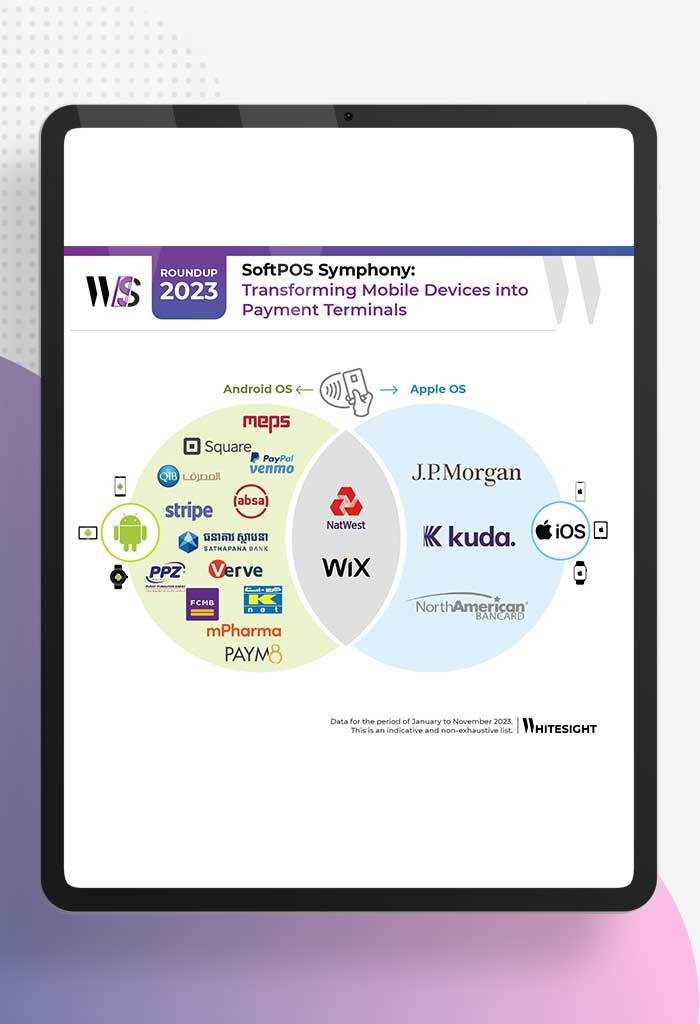

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

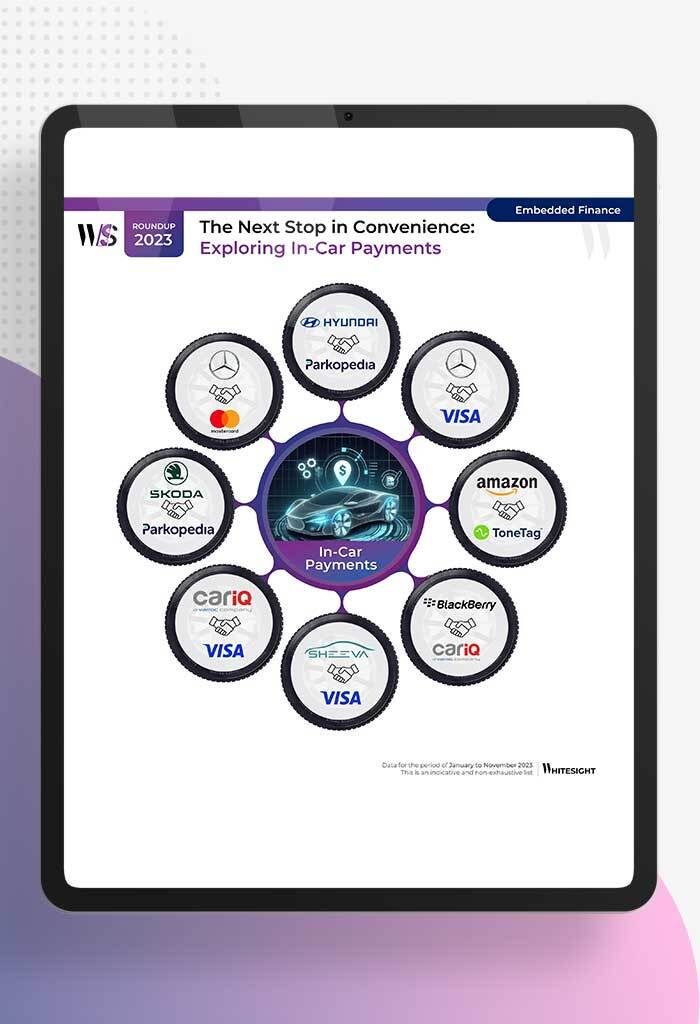

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

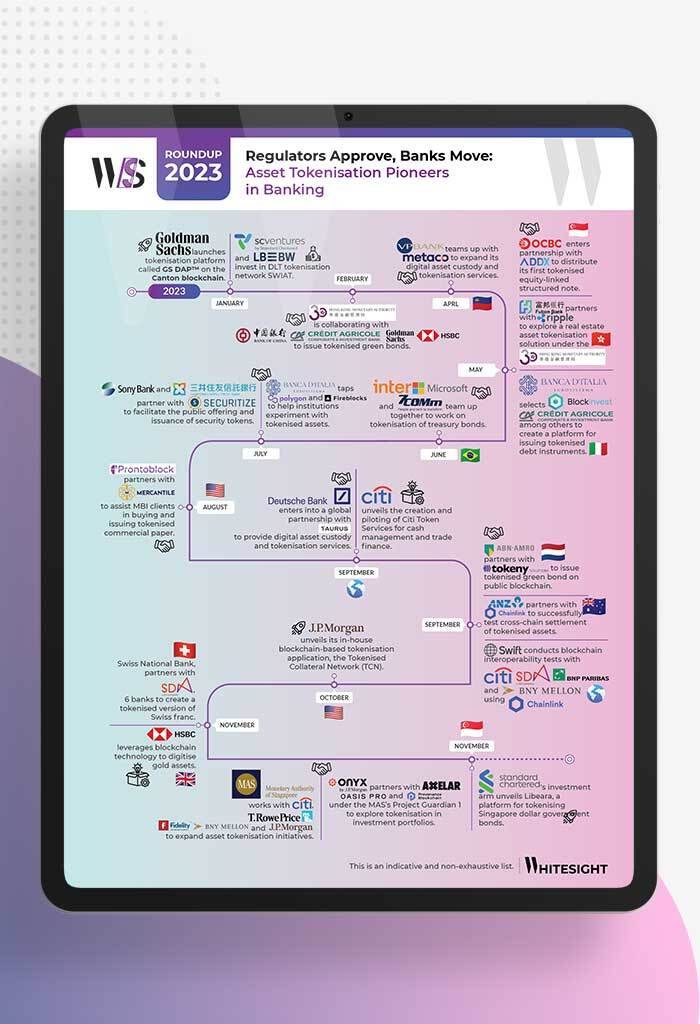

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

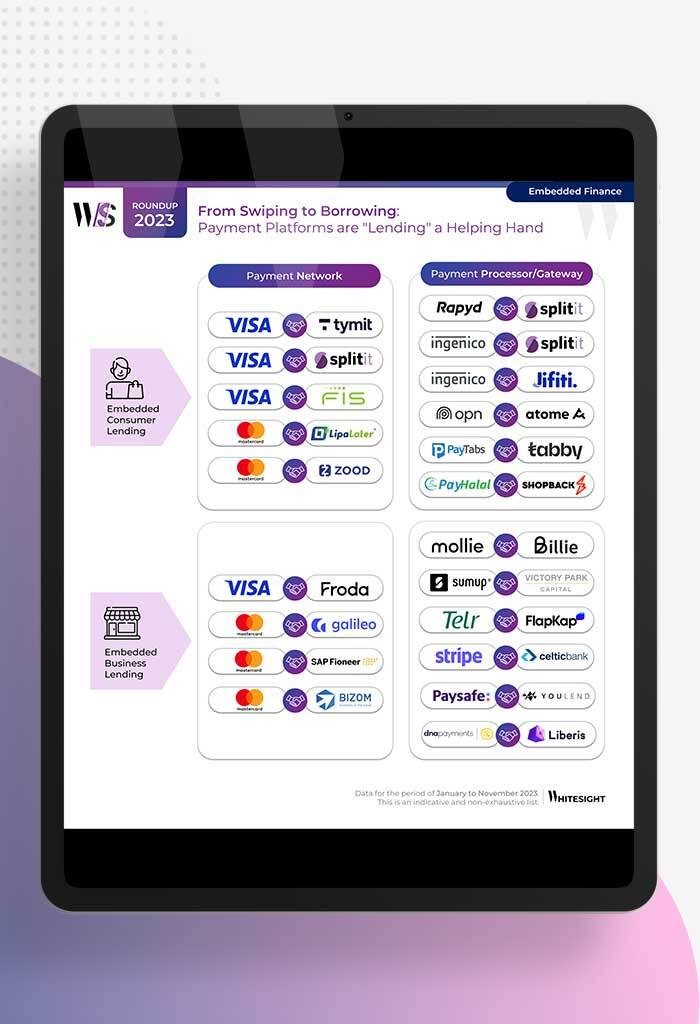

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...