Fintech Ecosystem Ripples: Analysing the Echoes of SVB’s Collapse

- Kshitija Kaur and Risav Chakraborty

- 6 mins read

- Bank-Fintech Collaboration, Insights

Table of Contents

The recent collapse of Silicon Valley Bank (SVB) has sent shockwaves across the global fintech industry, adding further challenges to an already tumultuous year. Our thoughts are with all those affected by the situation. While we will not delve into every intricate detail of SVB’s downfall, examining its history and extensive involvement in the fintech ecosystem can offer valuable insights for the industry, enabling us to learn from them as a community. Before we get into that, here’s a concise summary of the events that have transpired, charted out to set the context and bring you up to speed with the current state of affairs:Silicon Valley Bank has been a bank for startups since 1983, requiring them to pledge all their assets as collateral and maintain all their accounts and excess cash with it.Due to the pandemic, the US central bank lowered interest rates to nearly zero to encourage borrowing and spending, leading to growth in bank deposits from 2020 to 2022. Banks invested these deposits in government-backed securities while meeting regulatory requirements.Startups also benefited from this and attracted venture capital investment, leading Silicon Valley Bank to receive many of these deposits due to being a popular choice among startups.SVB’s deposits […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

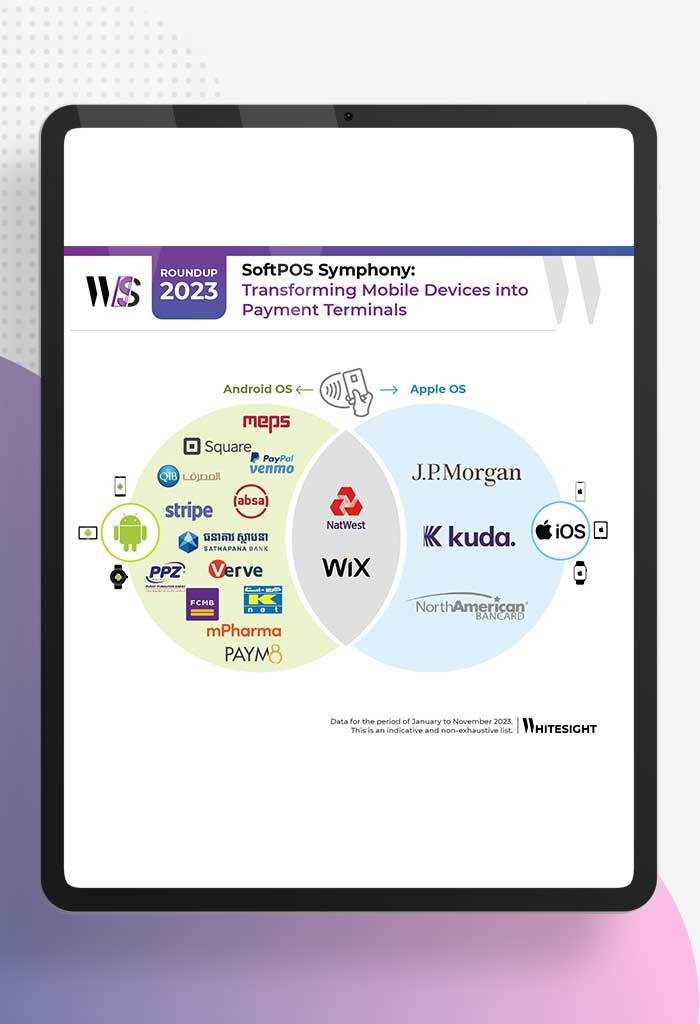

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

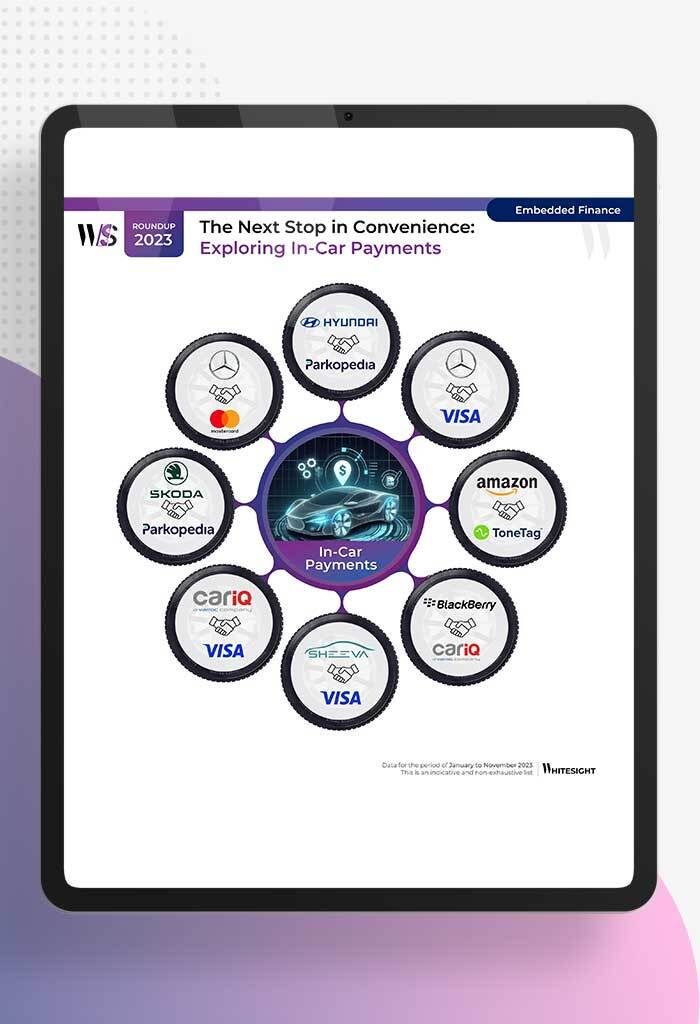

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

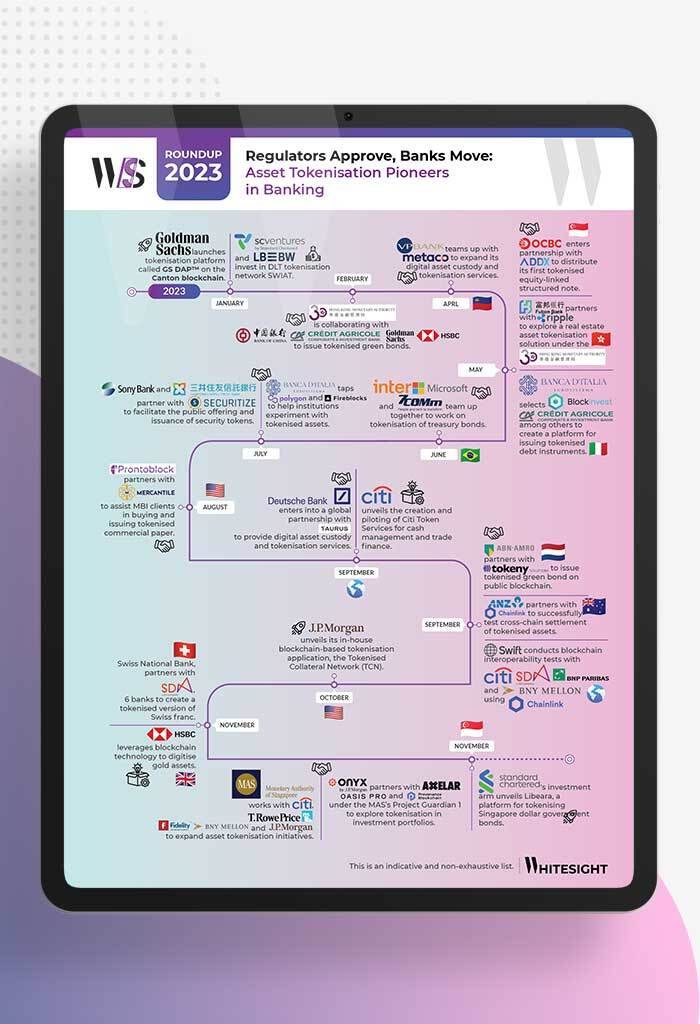

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

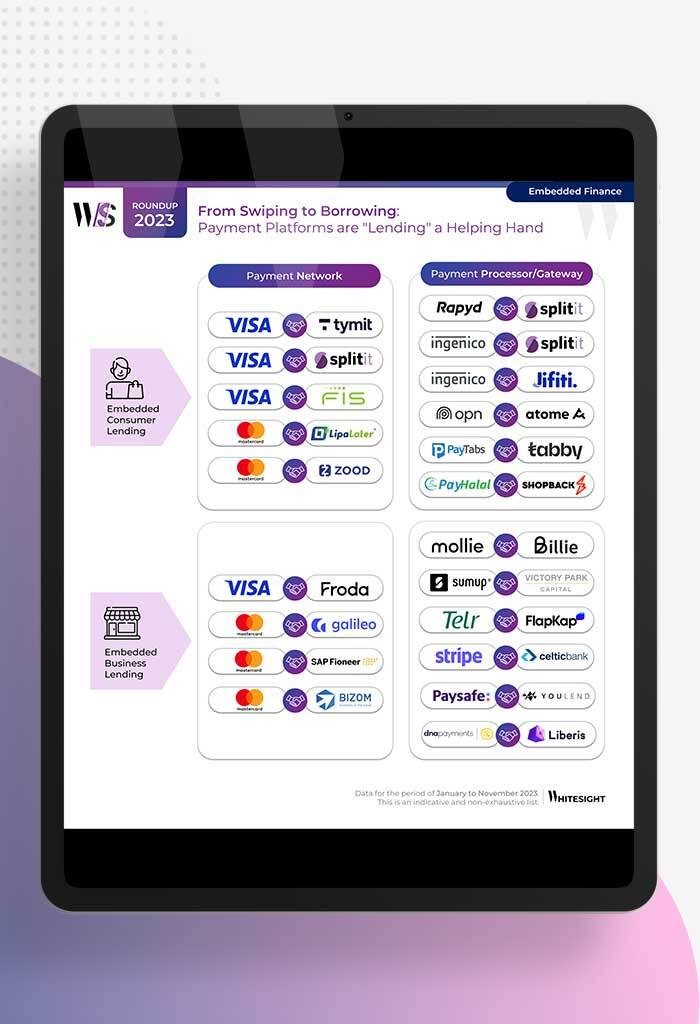

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...