J.P. Morgan’s Fintech Frontier: Collaboration, Diversification, and Innovation

- Kshitija Kaur and Risav Chakraborty

- 5 mins read

- Bank-Fintech Collaboration, Insights

Table of Contents

The fintech movement has emerged as a vast and varied landscape of financial services that spans everything from lending and credit to wealth management, brokerage, payments, and beyond. With its disruptive nature, it is rapidly infiltrating the traditional banking system, venturing into the uncharted territories of blockchain, neobanks, and even mortgages.With the advent of digital natives in banking, traditional financial institutions face the tough challenge to keep up with the latest products and services, leaving consumers spoilt for choice. Although traditional banks still enjoy consumers’ trust and hold most of their accounts, they are losing out to their digital-first rivals in terms of customer experience.This is where one bank is stepping up to bridge the gap – by embracing collaboration over competition, J.P. Morgan is leading the charge by betting big on its fintech strategy, diversifying its offerings and providing customers with a seamless banking experience that combines the best of both worlds. Today, the strategy stretches far beyond its home market – the US – and involves building, buying, investing, and forging alliances worldwide to explore new business models.Even as digital banking has become mainstream, the bank is leveraging its reputation for reliability and security to differentiate itself in […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

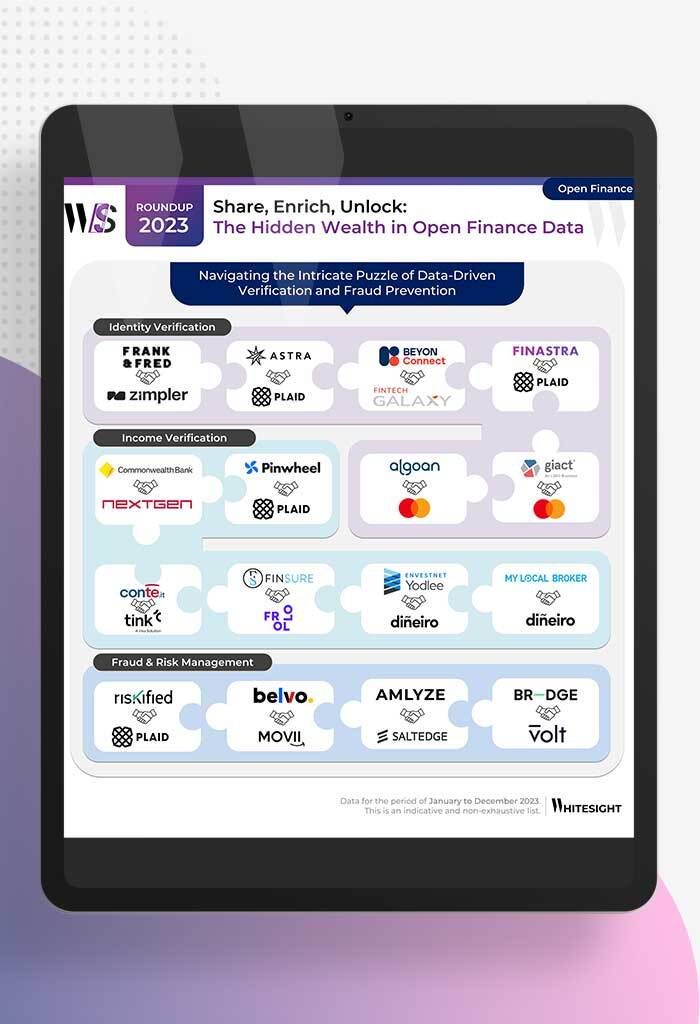

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

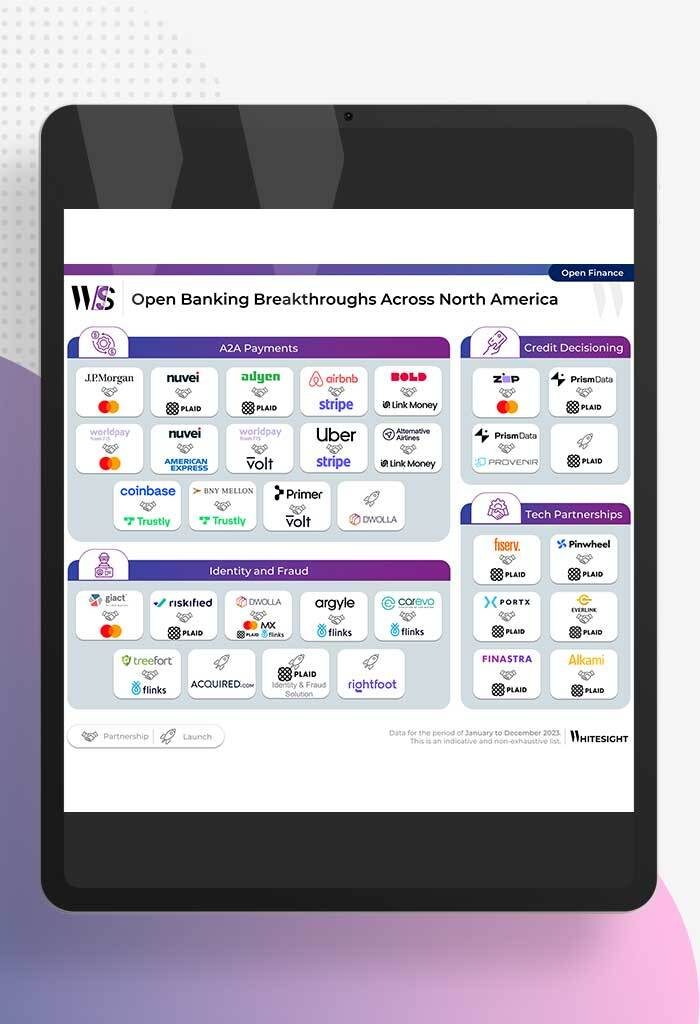

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

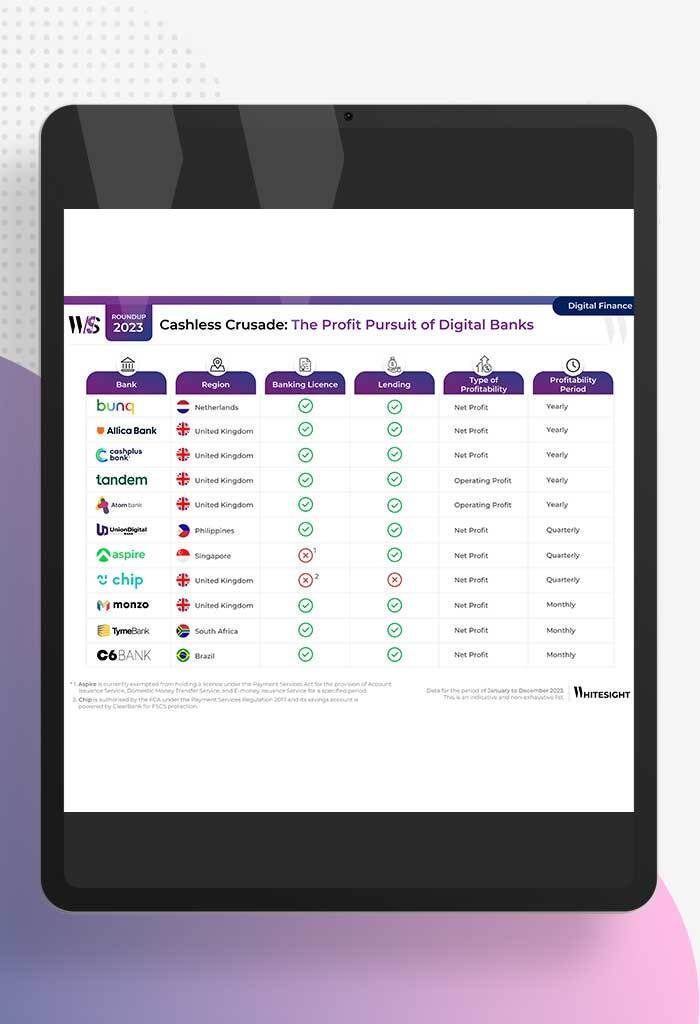

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

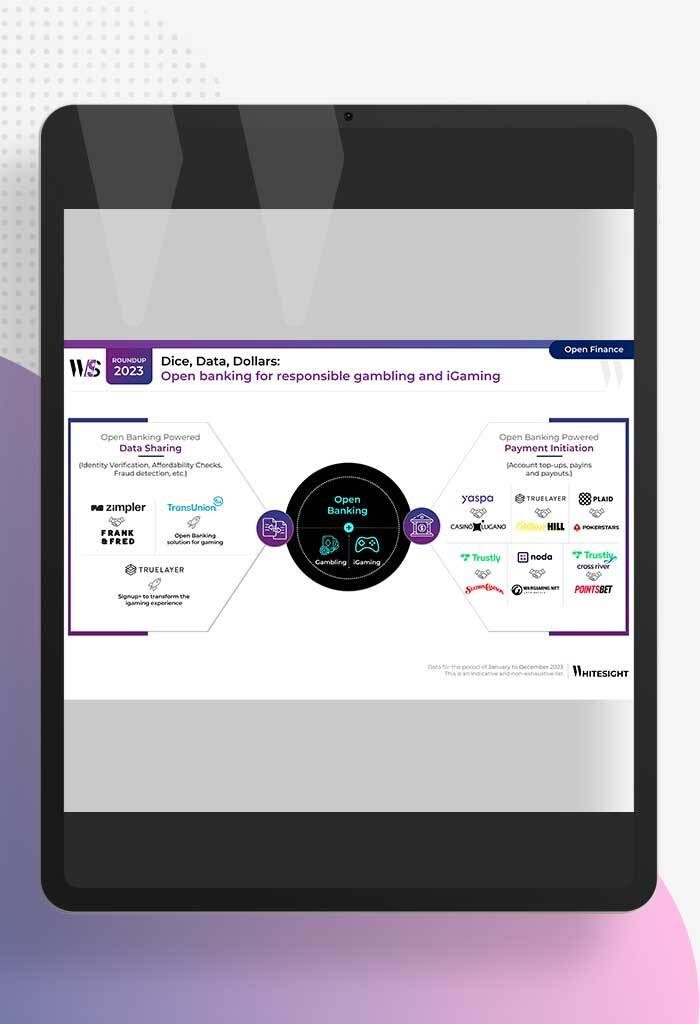

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

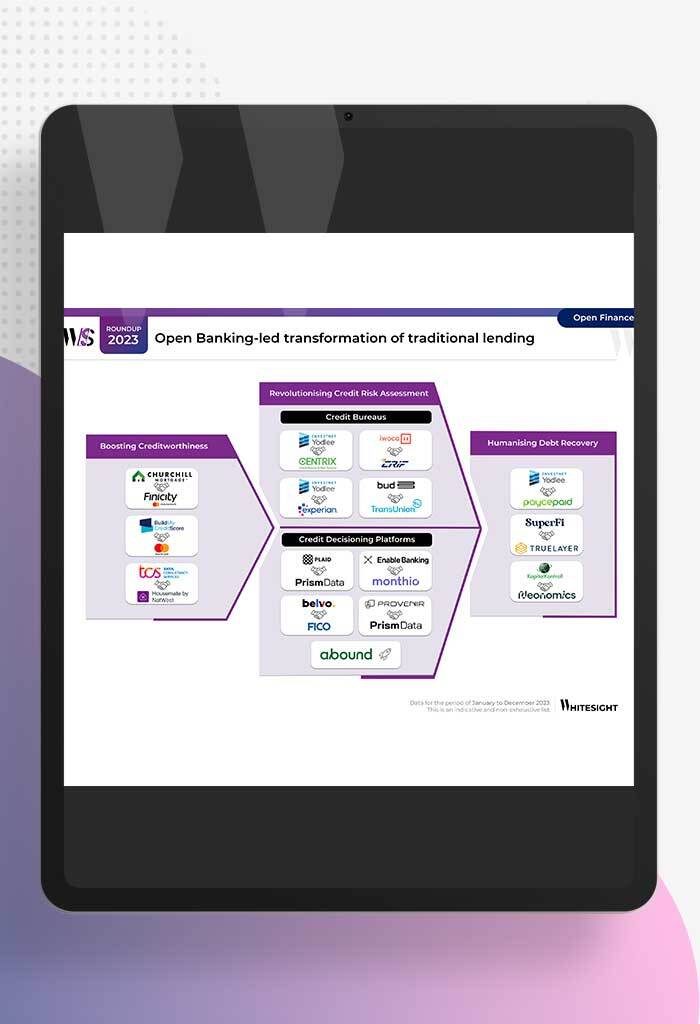

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

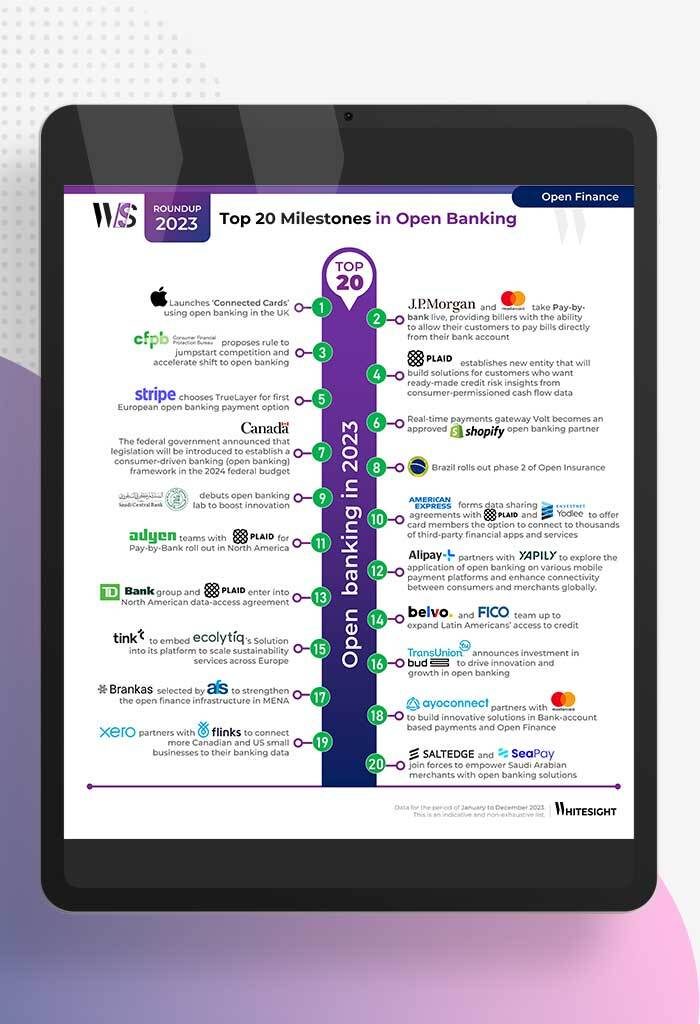

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...